US commercial real estate prices have plunged 13% from a peak this year, the biggest drop since the global financial crisis of 2008. What is causing the decline in commercial property prices. Is this a blip or will the slide in commercial property prices worsen in 2023? What commercial property is my favorite even in times of declining prices.

What was in the data on commercial property prices

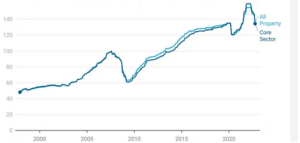

US commercial real estate prices have plunged 13% from a peak this year, the biggest drop since the global financial crisis, as rising interest rates cut into property values.

Shopping malls have taken the biggest hit, with prices sliding 23% from their recent peak, according to Green Street’s October price index. Apartments and warehouses followed, each tumbling 17%. Office prices are down 14%.

For all commercial-property types, the decline was the biggest since the 2008 financial crisis, when prices plummeted about 35%, according to Peter Rothemund, a researcher at the real estate analytics firm. In October alone, prices fell 7%.

Why are commercial property prices falling faster than residential properties?

Commercial properties are more sensitive to interest rates than residential properties. The overwhelming majority of commercial mortgages are variable rates where the rate is fixed for 1-7 years and then adjusts after that which means the cash flow of commercial properties will be impacted much sooner than on a residential property that could have a 30 year fixed mortgage.

Furthermore, the primary method to value a commercial property is the income approach Net Operating income/Cap rate (rate of return). As cap rates rise due to higher treasury rates, property values fall (more on this below)

Will commercial property prices fall further?

Yes, we are just at the beginning of the readjustment in the commercial property market. Below are 4 reasons that prices will continue to fall heading into 2023

- Variable rate mortgages: With the majority of commercial loans based on variable rates, the more interest rates increase and/or stay at lofty levels, the lower the value of the property will be. Property owners cannot raise rents high enough to offset the huge jump in debt service. For example, last year an apartment could get a loan of 3%, now that same loan is around 5%, when the loan rolls over to the variable rate, cash flow will be impacted.

- Treasury yields are higher than cap rates: Treasuries are seen as the “risk free” base return and investor requires. As Treasury yields rise, the yields on alternative investments will also need to rise in order to compensate for the risk. For example, if the 10 year treasury is at 5%, most investors would want a return on a safe commercial asset greater than that rate. Remember the higher the cap rate the lower the value of the property so as cap rates increase due to treasuries increasing, commercial property values will fall.

- Lots of excess supply currently: There is currently allot of excess supply especially in office and large industrial. The market will need to reset to the new paradigm of demand which will eventually increase inventory especially in the office sector

- More on the way: it is impossible to accurately time the markets so inevitably you have increased inventory of new properties coming on the market as the market is turning. There are millions of square feet of office, retail, industrial, etc… that were begun before the real estate market turned. These properties will come on the market just as demand wanes.

What property type typically does better in a declining market

Under 10k light industrial/industrial condos is my favorite go to in commercial. Even in a downturn there is typically demand for smaller spaces for the plumbers, granite installers, car detailers, etc… that are able to hang on during the recession. Furthermore, in most markets there is not a plethora of small industrial spaces which keeps this sector from facing the same reset as some of the larger industrial or office properties.

Summary

Unfortunately the “party” is just getting started in commercial real estate. After years of rock bottom rates there is a reckoning occurring. As rates have risen sharply, cap rates have risen leading to a showdown between buyers and sellers as properties are “repriced” to the new paradigm. Buyers are looking for deals, but sellers are not ready to throw in the towel. They would prefer to wait the market out. Eventually the two sides will collide and the answer will be lower prices. How much lower is the million dollar question that will be driven by how high and long the federal reserve has to raise rates. Until we get a more definitive answer, prices will continue drifting lower as demand and supply remain constrained.

Additional reading/resources

- https://www.bloomberg.com/news/articles/2022-11-04/us-commercial-property-prices-slide-13-from-peak-as-rates-jump

- https://www.bisnow.com/atlanta/news/capital-markets/slowdown-in-cre-sales-gives-all-cash-buyers-opportunities-116708?

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender