by Glen | Apr 28, 2025 | Atlanta Hard Money, Atlanta real estate trends, Brokering Loans to Fairview, Closing, Colorado Hard Money, Denver Hard Money, Georgia hard money, Hard Money Commercial Lending, Homeless impact on real estate, Other Questions, Process/Loan Submittal, Program Details, Questions Regarding Fairview, Realtor, Underwriting/Valuation

This newest property tax measure that passed has been deemed the most controversial in the US. What was in the new measure? What state (hint it wasn’t a far right or left state)passed a controversial law to protect private property rights...

by Glen | Feb 24, 2025 | 2025 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Brokering Loans to Fairview, Closing, CO hard money, Colorado Hard Money, Denver Hard Money, Denver private Lending, Georgia hard money, Other Questions, Process/Loan Submittal, Program Details, Questions Regarding Fairview, Real Estate economic trends, Realtor, Underwriting/Valuation

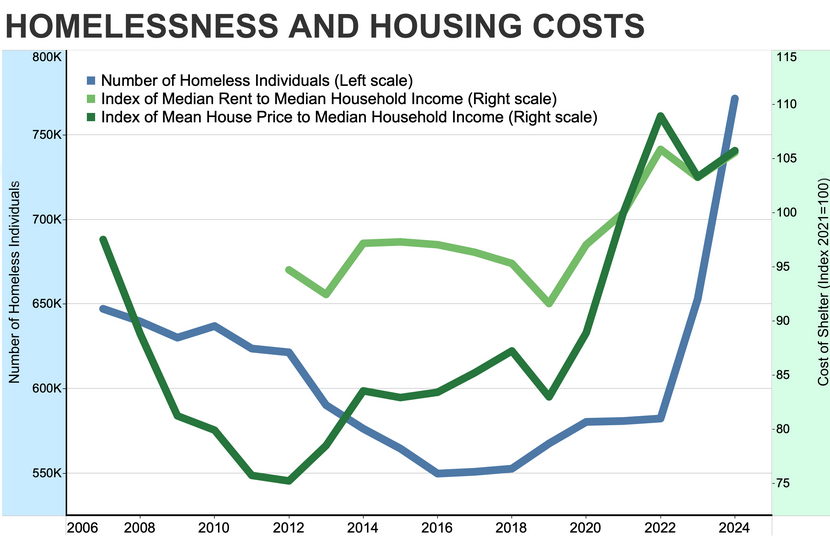

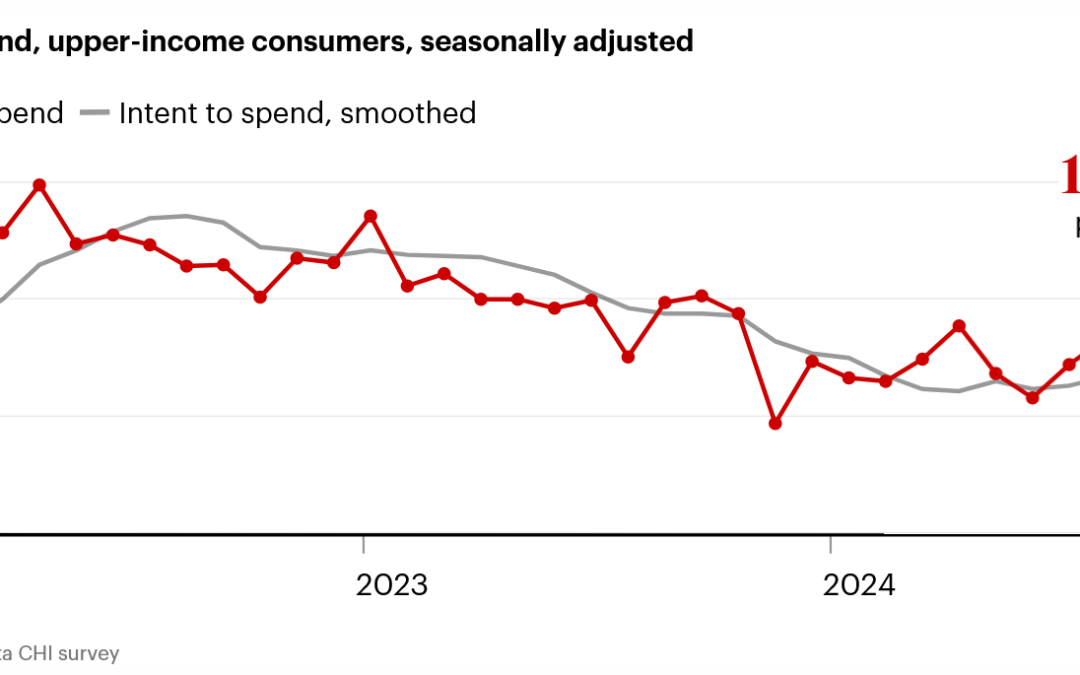

Higher income consumers are showing signs of stress. Look at the chart above, from the peak in 2022 higher end consumers intent to spend has dropped almost 25%. What does the chart mean for real estate and the general economy? Why focus on higher end consumers?...

by Glen | Feb 17, 2025 | Atlanta Hard Money, Brokering Loans to Fairview, Closing, Colorado Hard Money, commercial hard money, commercial private lending, commercial property trends, Denver Hard Money, Georgia hard money, Other Questions, Process/Loan Submittal, Program Details, Questions Regarding Fairview, Realtor, Underwriting/Valuation

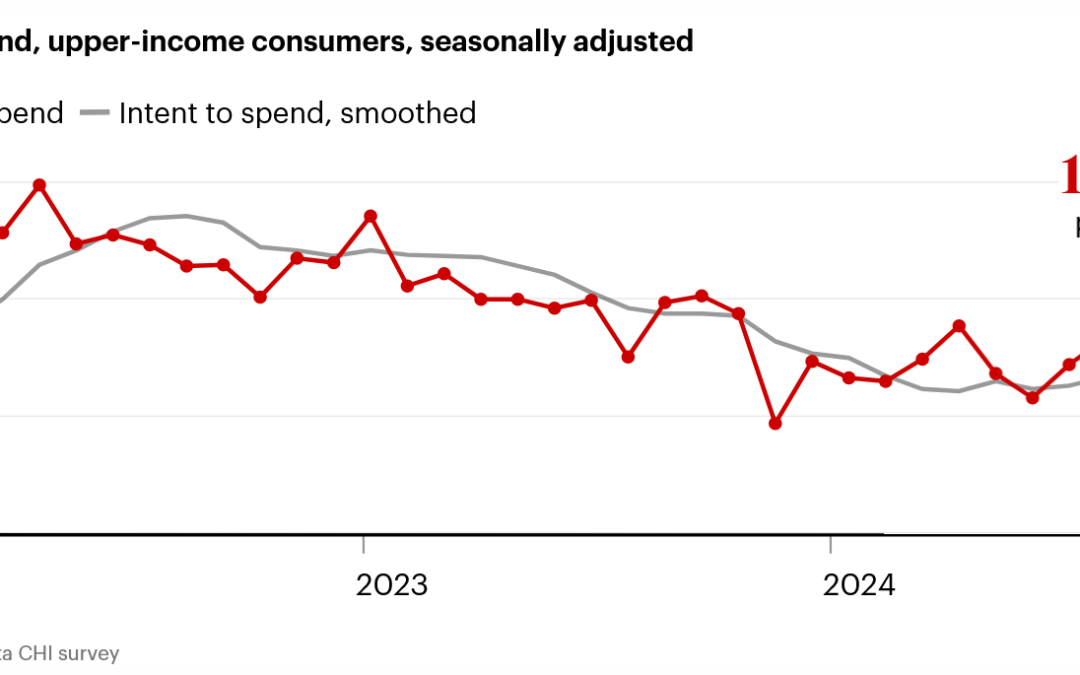

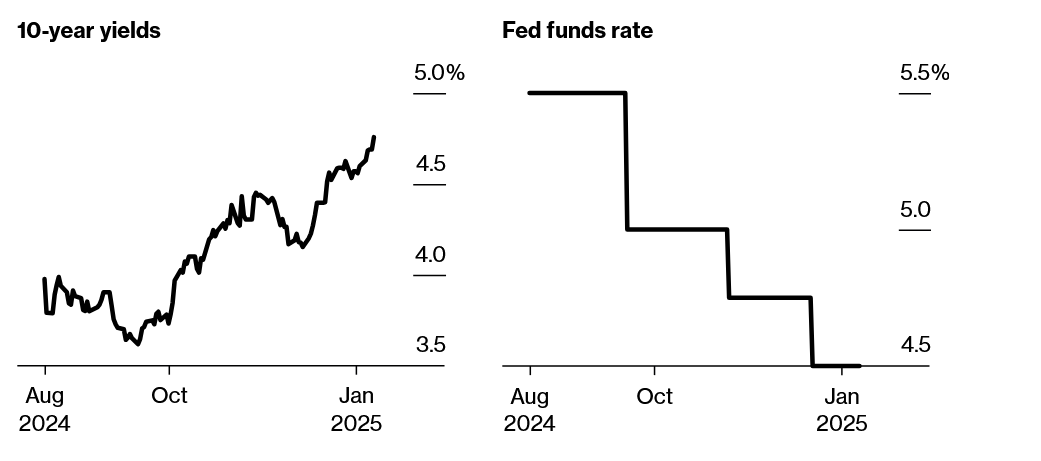

The bank mantra over the last 3 years has been survive until 2025. 2025 is when bankers were predicting a sharp decline in rates that would ultimately bail out the beleaguered commercial property market. Here we are at the dawn of 2025 and 10 year treasuries and...

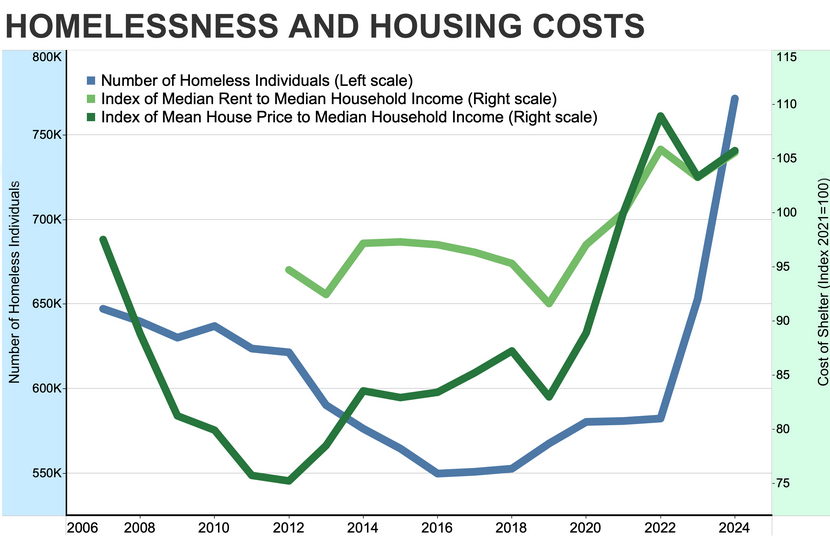

by Glen | Feb 10, 2025 | Atlanta Hard Money, Atlanta Private Lending, Brokering Loans to Fairview, Closing, Colorado Hard Money, Colorado private lender, Denver private Lending, Georgia hard money, Government Bailout, Housing Price Trends / Information, Housing shortage, Other Questions, Process/Loan Submittal, Program Details, Property Insurance, property taxes, Property Valuation, Questions Regarding Fairview, Underwriting/Valuation

I took the pic above of a house after a small fire in CO. I’m amazed the house had made it. Unfortunately thousands of property owners in LA are not as lucky. The recent fires in LA are estimated to cost upwards of 50 billion making it one of the costliest...

by Glen | Feb 3, 2025 | 2024 mortgage rates, 2025 mortgage rates, 2025 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Other Questions, Process/Loan Submittal, Program Details, Questions Regarding Fairview, Realtor, Underwriting/Valuation

Wow, 2024 was definitely a surprise, at the beginning of the year, there were huge predictions of a rapid decline in rates, fast forward to 2025 and now rates are actually rapidly increasing even after the federal reserve cut short term rates. Why are rates...

by Glen | Jan 20, 2025 | 2025 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Brokering Loans to Fairview, Closing, Colorado Hard Money, Colorado private lender, Colorado ski real estate, Denver Hard Money, Georgia hard money, interest rates, mortgage rates, Other Questions, private lender, Process/Loan Submittal, Program Details, Questions Regarding Fairview, real estate investing, Real Estate Trends, Realtor, Underwriting/Valuation, will house prices continue to increase

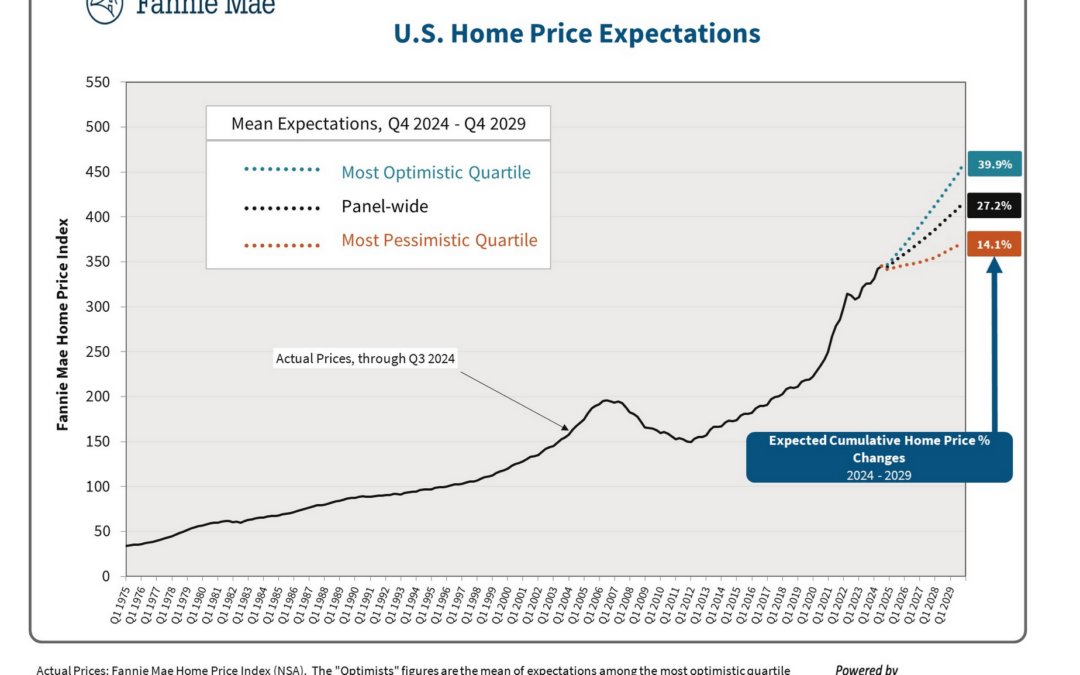

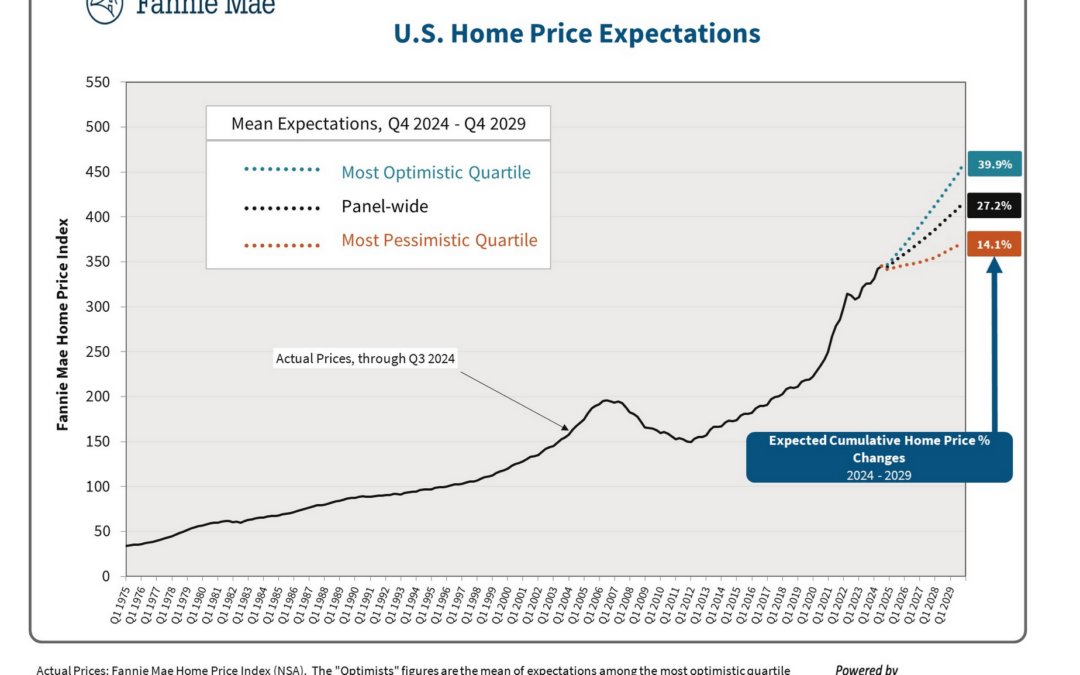

Fannie Mae, one of the largest buyers of residential mortgages has some profound predictions. Will house prices continue their upward trend through 2030? How accurate are the predictions below? How can house prices continue in such a linear fashion? Will...