by Glen | Aug 5, 2024 | Uncategorized

Wow, the last several days have been brutal in the stock market. At the same time interest rates have started to come down and yet sales are still down substantially from last year. For years, myself, and many others have thought that interest rates were the...

by Glen | Feb 5, 2024 | Uncategorized

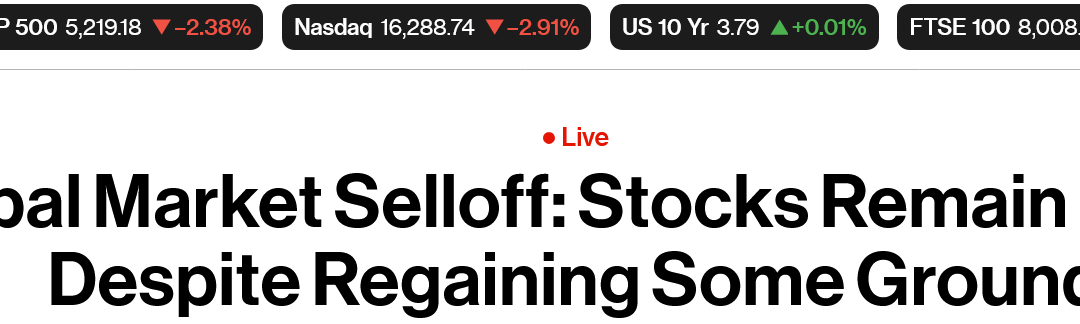

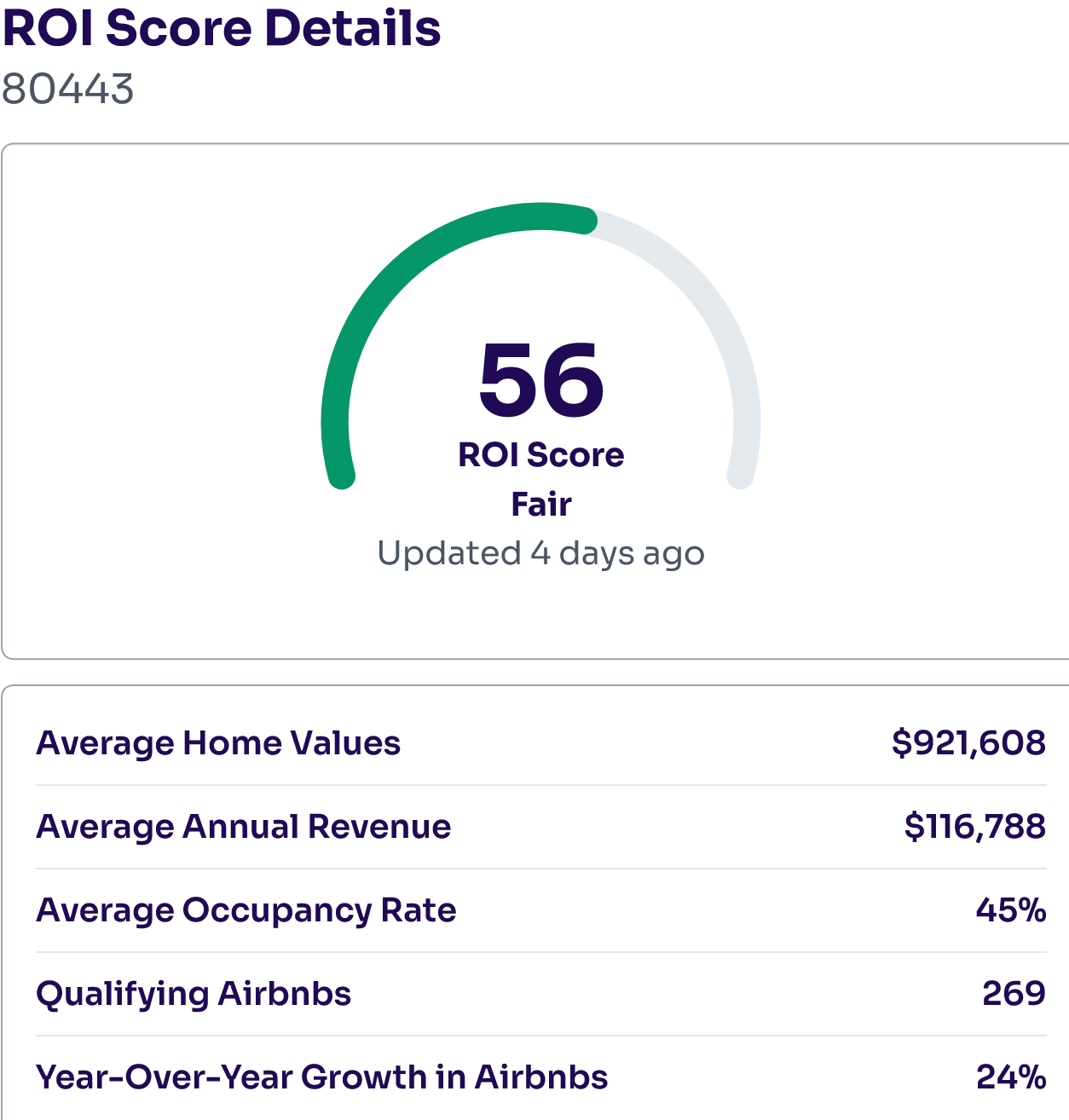

Is there a new subprime crisis lurking? 10 years ago nightly rentals were a novel concept, fast forward to 2024 and the number of nightly rentals have surged 40%. What does this huge increase in nightly rentals mean for real estate values? Has the market...

by Glen | Sep 11, 2023 | Uncategorized

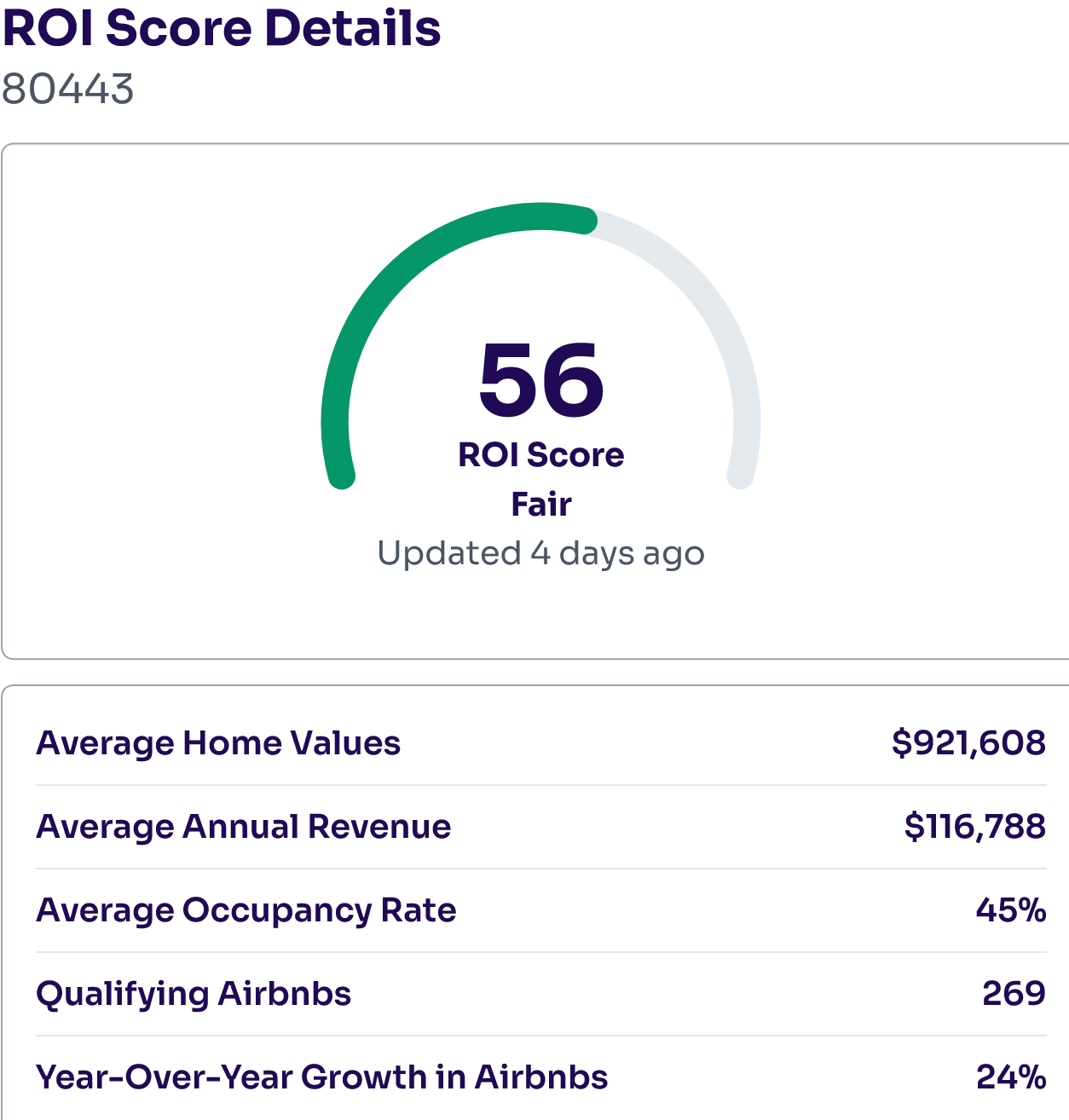

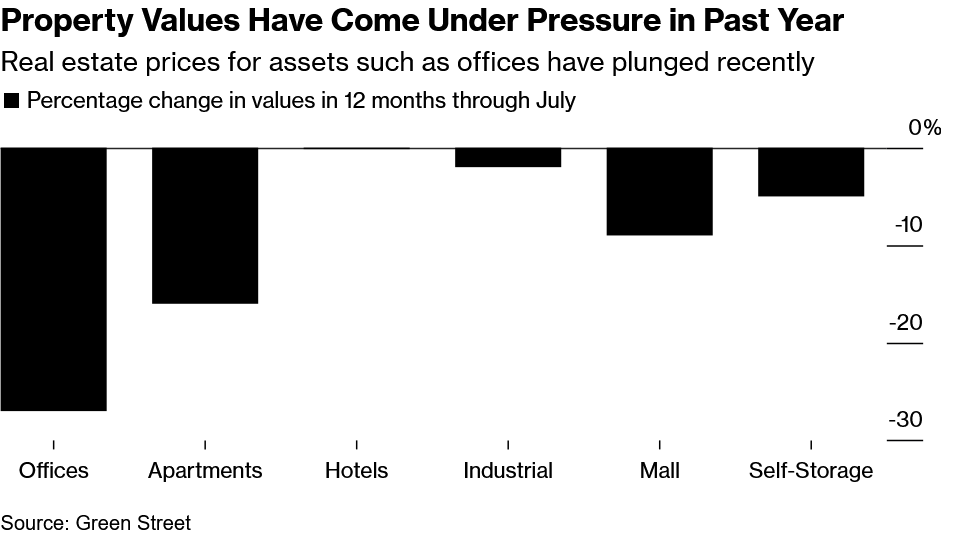

I continue to hear discussions about the huge plunge in office values while little attention has been given to other commercial property sectors like apartments. Apartment buildings, long considered a real-estate haven, are emerging as the next major trouble spot in...

by Glen | May 9, 2022 | Uncategorized

Fannie Mae, the largest buyer of mortgages in the US, just made some bold predictions about not only housing, but an upcoming recession. Their new predictions are a rapid departure from just a few months ago. What does Fannie Mae predict for the economy and housing?...

by Glen | Jan 24, 2022 | 2022 stock market correction, hard money loans, private lender, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Realtor, Residential hard money, Small Balance Commercial Lending, Uncategorized

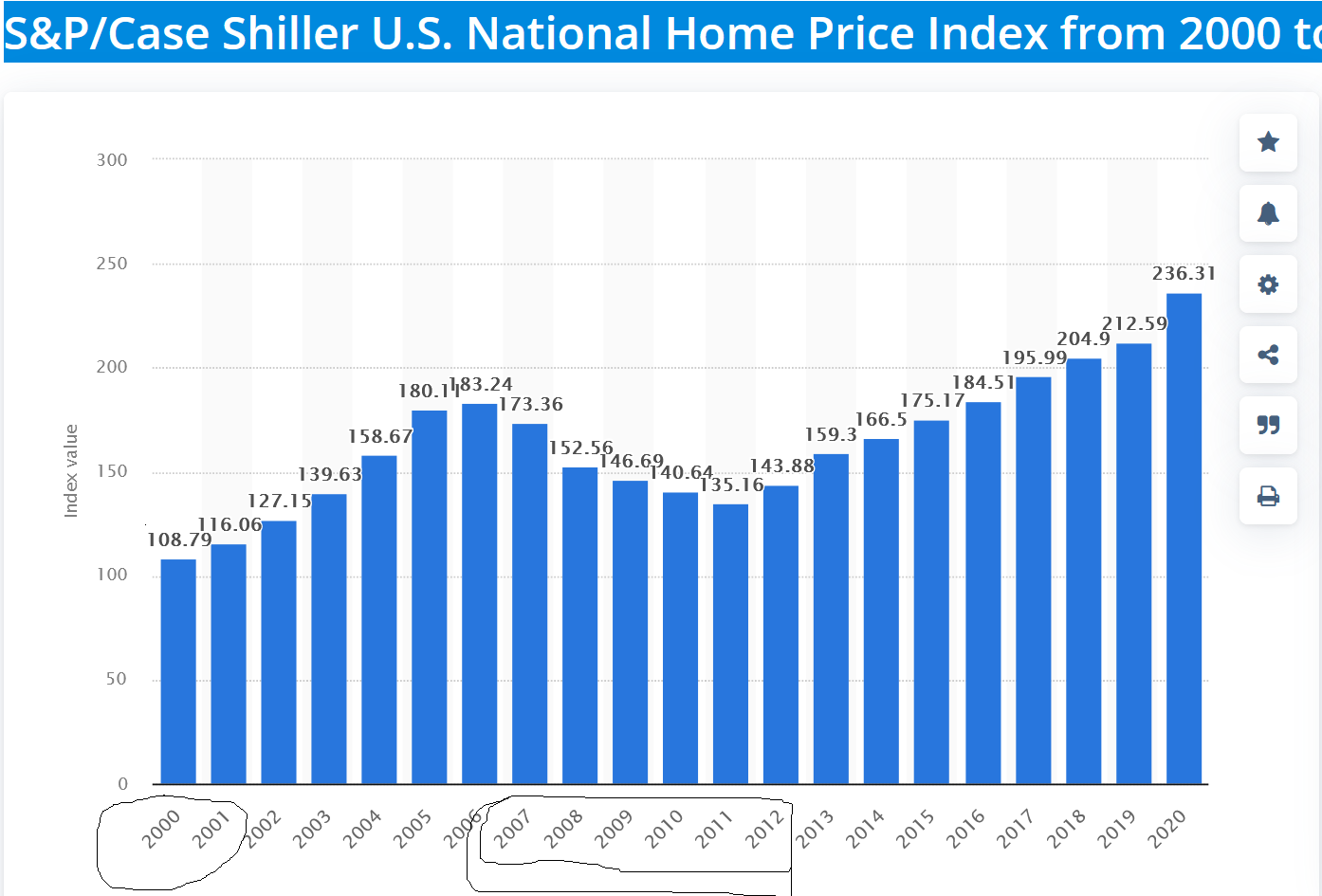

It has been quite the year for the stock market. As I am writing this blog, the market has already plunged 10% to kick off the year. Morgan Stanley just warned that stocks are more overvalued than the tech bubble. How will this impact real estate? What happened...

by Glen | May 5, 2021 | commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Real Estate economic trends, real estate investing, real estate taxes, Real Estate Trends, Real estate Valuation, residential lending valuation, Uncategorized

President Biden has proposed an increase in long term capital gains from their current 15-20% to 43% for the wealthiest. This would be the highest tax paid on income. What is in the new proposal? What does this proposal mean for real estate? How will the 1031...