by Glen | Jan 26, 2022 | Closing, commercial hard money, General real estate financing information, hard money, interest rates, mortgage rates, Property Valuation, Real Estate economic trends, Real Estate Trends, Real estate Valuation, residential lending valuation, Small Balance Commercial Lending, Underwriting/Valuation

New York City’s housing market is undergoing a powerful rebound, fueled by New Yorkers trading up, out-of-staters moving in, and others looking beyond the pandemic’s aftershocks to make a long-term bet on the city. On the flip side, Boise prices are up 25% year over...

by Glen | Jan 12, 2022 | interest rates, mortgage rates, Private Lending, Property Valuation, Real Estate economic trends, Real Estate Trends, Real estate Valuation, residential lending valuation, Underwriting/Valuation

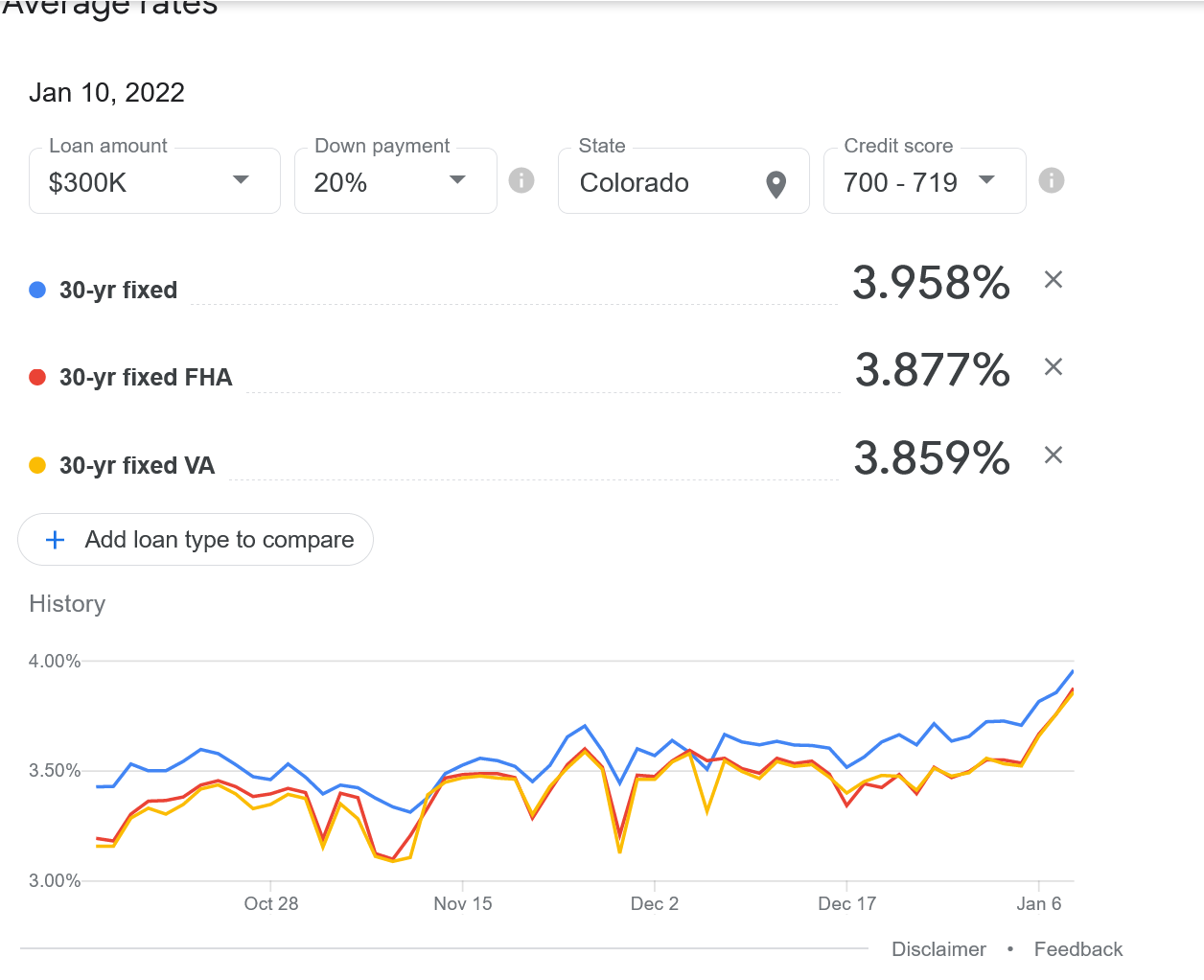

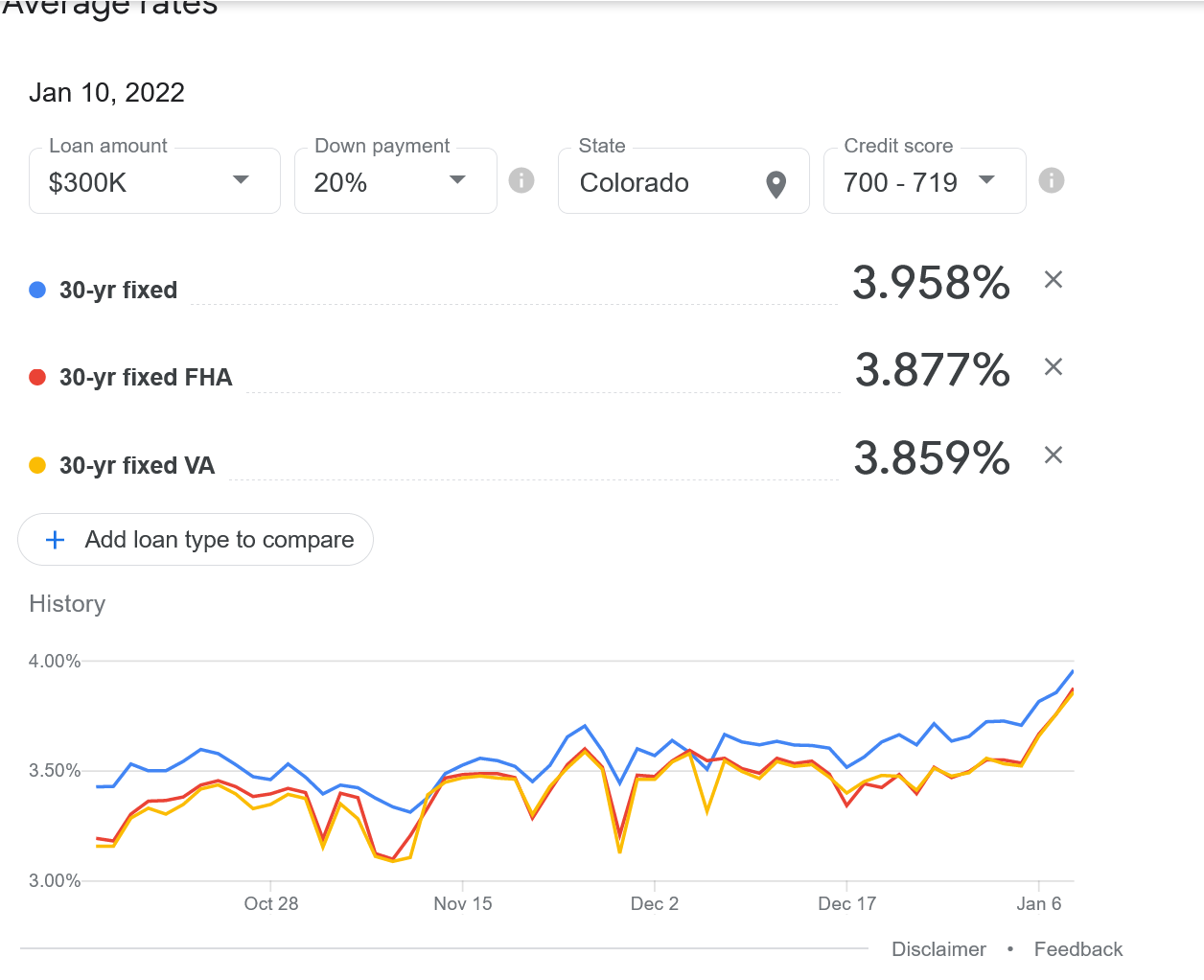

Inflation plowed ahead at its fastest 12-month pace in nearly 40 years during December, according to a closely watched gauge the Labor Department released Wednesday. The stock and bond markets are suddenly awake, with mortgage rates skyrocketing almost 4% from a low...

by Glen | Jan 5, 2022 | Colorado Hard Money, Denver Hard Money, Georgia hard money, Hard Money Commercial Lending, Hard Money Lending, Housing Price Trends / Information, Real Estate economic trends, real estate ibuyers, real estate investing, Real Estate Trends, Real estate Valuation, Realtor, Residential hard money, residential lending valuation

The National Association of Realtors just released their 2022 housing market report. What are their predictions on mortgage rates, appreciation rates, rental rates, and location of purchases? There are a couple of surprises in the data that could radically alter...

by Glen | Dec 22, 2021 | Atlanta Hard Money, Atlanta Private Lending, Denver Hard Money, Denver private Lending, Hard Money Lending, Housing Price Trends / Information, interest rates, mortgage rates, private lender, Private Lending, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation, Underwriting/Valuation

I hope everyone is having a happy holiday season. Before getting into my predictions for next year, there are three crucial factors to discuss that will shape the real estate market in 2022 and beyond. Interest rates, inflation, and where the pandemic goes from here....

by Glen | Nov 30, 2021 | Atlanta real estate trends, Colorado Hard Money, Commercial Lending valuation, coronavirus 2021 real estate impacts, Denver Hard Money, Georgia hard money, Hard Money Lending, interest rates, mortgage rates, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation

What a week it has been a new Covid variant has emerged while at the same time, the federal reserve announced they are retiring the word “transitory”. The stock market dropped and treasury yields increased. What does all the recent news mean for real estate? Will...

by Glen | Nov 11, 2021 | Hard Money Lending, Housing Price Trends / Information, Private Lending, Property Valuation, real estate ibuyers, real estate investing, Real Estate Trends, Real estate Valuation, Realtor, Residential hard money, residential lending valuation

Real-estate firm Zillow Group Inc. is exiting from the home-flipping business, saying Tuesday that its algorithmic+ model to buy and sell homes rapidly doesn’t work as planned. Zillow has about 18 thousand houses it will be looking to sell. What does this mean for...