by Glen | Apr 7, 2025 | Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, Denver Hard Money, Georgia hard money, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Realtor, Residential hard money

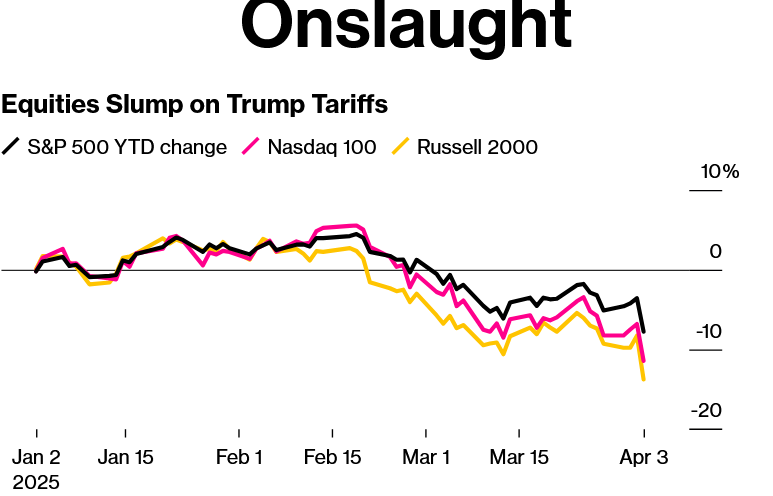

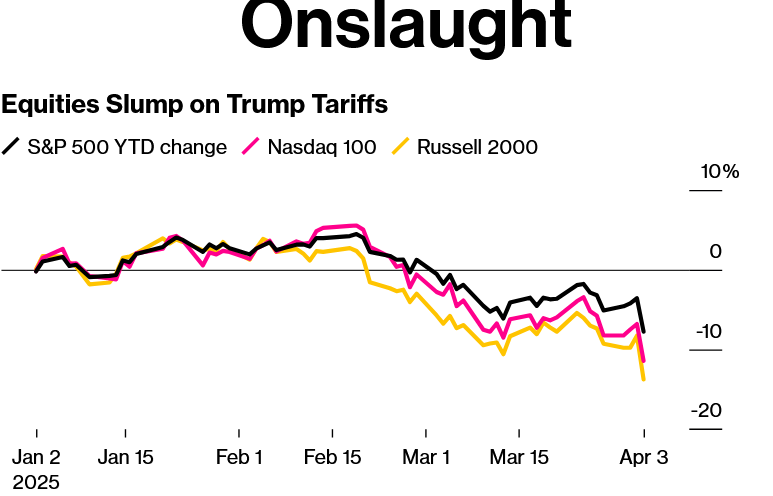

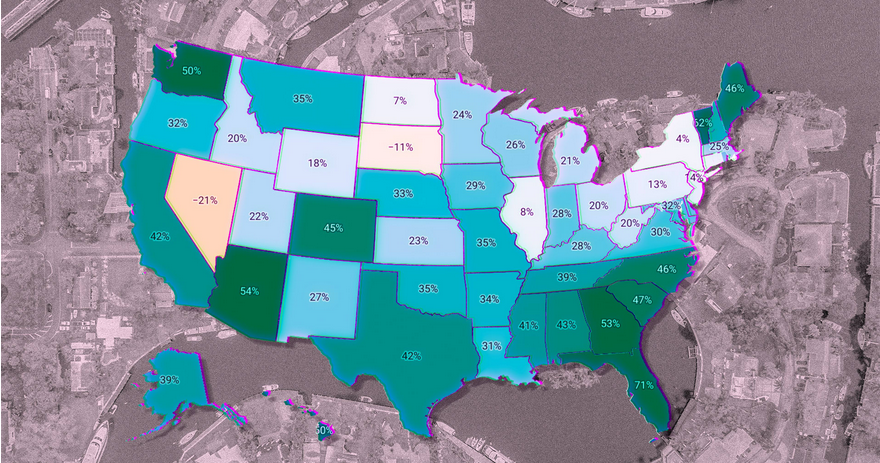

For years, myself, and many others have thought that interest rates were the predictor of housing prices. Fast forward to post COVID where interest rates have doubled and yet housing prices remain high and are still trending higher in many markets. What other...

by Glen | Nov 4, 2024 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, hard money loans, private lender, Real estate Valuation, Residential hard money

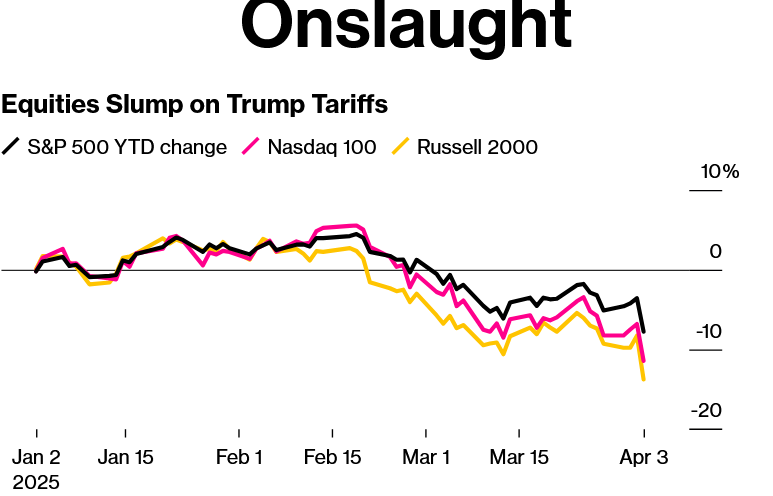

Even with falling interest rates, inventory has quickly increased. We have gone from a supposed shortage of housing to an inventory surplus in many hot markets. Home sales in July were at the lowest recorded level. What is driving the increase in inventory? Will...

by Glen | Feb 27, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, commercial hard money, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, Private Lending, real estate investing, real estate taxes, Real Estate Trends, Real estate Valuation, recession impact on real estate, Residential hard money

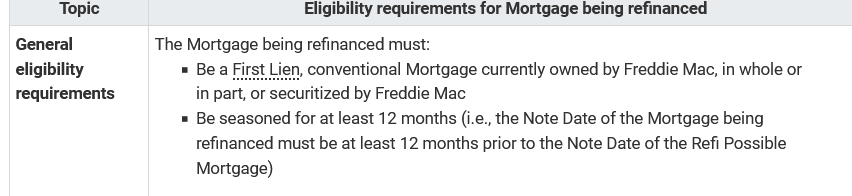

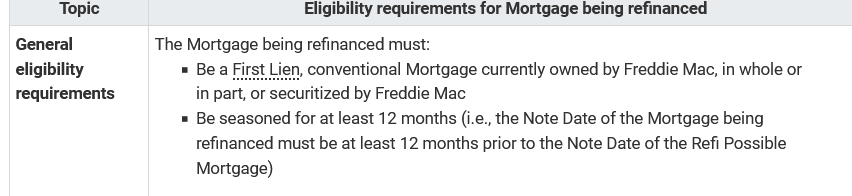

Beginning in March of 2023, Freddie Mac, the largest buyer of mortgages is drastically changing the seasoning requirements for any loans it purchases which basically means any new conventional conforming loan will have to follow the new rules. What big changes are...

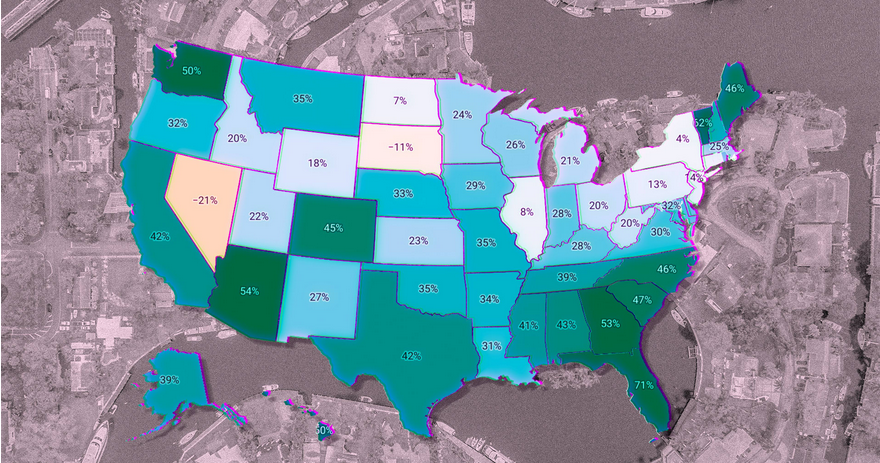

by Glen | Dec 5, 2022 | 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, recession, recession impact on real estate, Residential hard money, Underwriting/Valuation, what does this real estate recession look like

Since Covid it seems like traditional patterns have been broken. I hear time and time again that X or Y is different and there have been fundamental changes. Is this true, is everything “radically” different now? Is a bear walking around in the snow a sign (zoom in...

by Glen | Nov 21, 2022 | 2023 real estate prediction, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Commercial Lending valuation, credit scoring, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, real estate investing, Real Estate Trends, Residential hard money, residential lending valuation

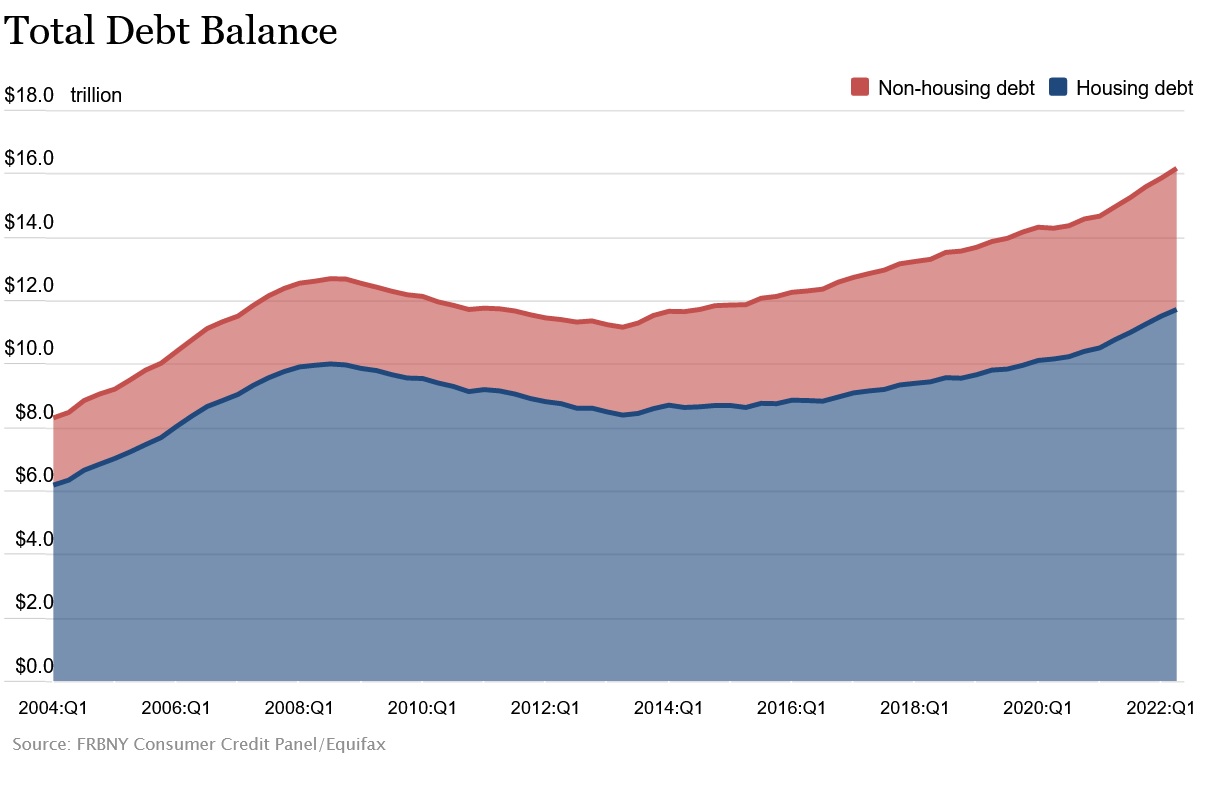

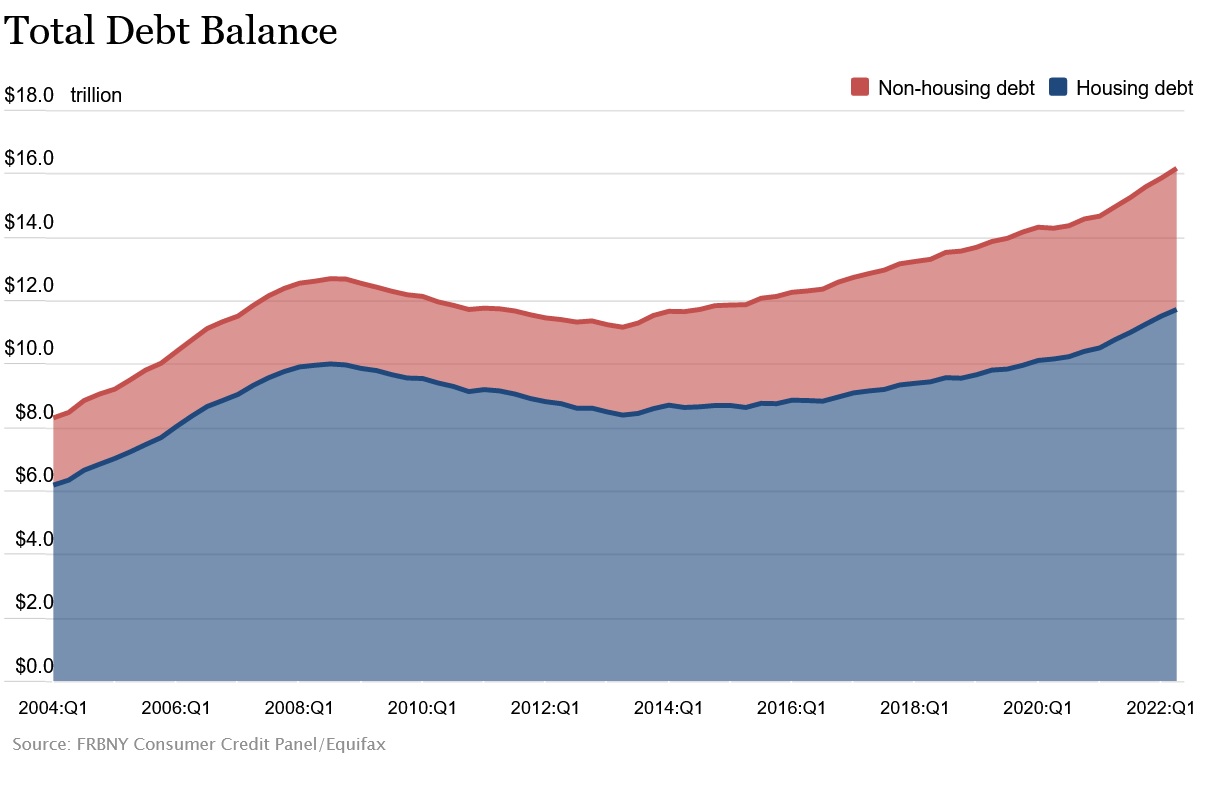

The federal reserve bank of NY recently published a report showing consumer debt jumping to the highest levels ever recorded with every category growing from mortgages, autos, credit cards, lines of credit, etc… Is some consumer debt better/worse than others for the...

by Glen | Nov 7, 2022 | 2023 real estate prediction, Colorado Hard Money, commercial hard money, Real Estate economic trends, Residential hard money, Underwriting/Valuation, what does this real estate recession look like

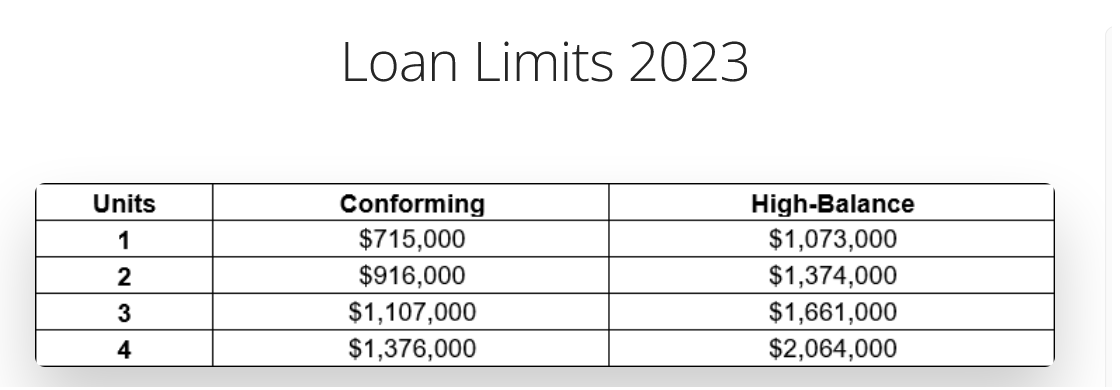

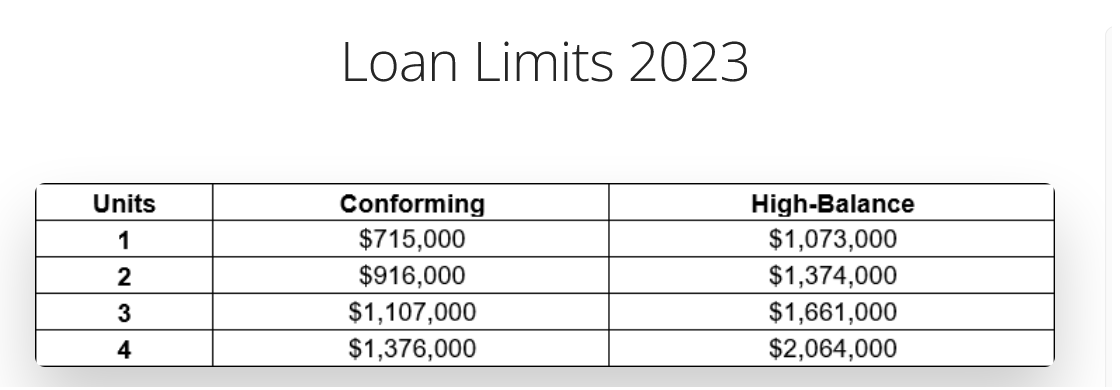

The federal government is about to back mortgages over one million for the first time. The maximum size of home-mortgage loans eligible for backing by Fannie Mae and Freddie Mac is expected to jump sharply in 2023, a reflection of the rapid appreciation in home prices...