by Glen | Apr 14, 2025 | 2025 mortgage rates, 2025 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, Georgia hard money, Government Bailout, hard money, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, private lender, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, recession, recession impact on real estate

Are the bulls running or are the bears coming? Any business media you pick up is harping on the idea of a “recession watch” and the economy is basically coming to an end! On the flip side my proprietary lending data is giving me a radically different answer. What...

by Glen | Jul 22, 2024 | 2024 election real estate impacts, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Commercial Lending, mortgage rates, Property Valuation, Real Estate economic trends, Real Estate Trends, Real estate Valuation, recession impact on real estate

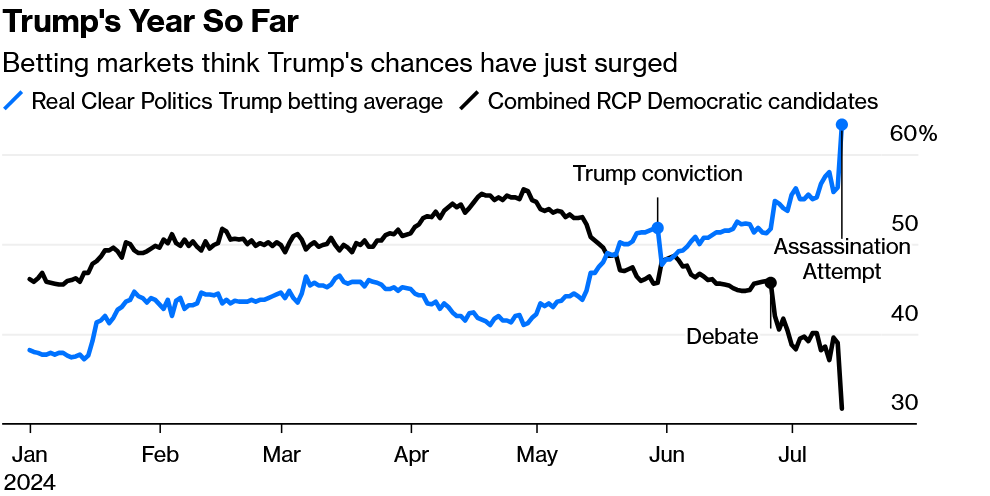

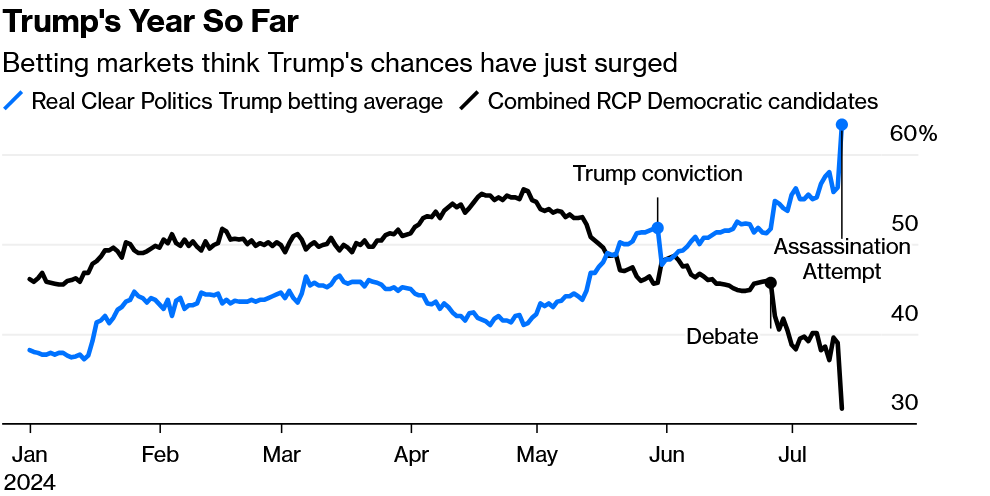

Wow, it is amazing how quickly tides have changed. Look at the chart above of the betting market on the next presidential election right after the assassination attempt. Fast forward and another twist happened over the weekend with President Biden stepping...

by Glen | Oct 23, 2023 | 2023 real estate predictions, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation, recession, recession impact on real estate

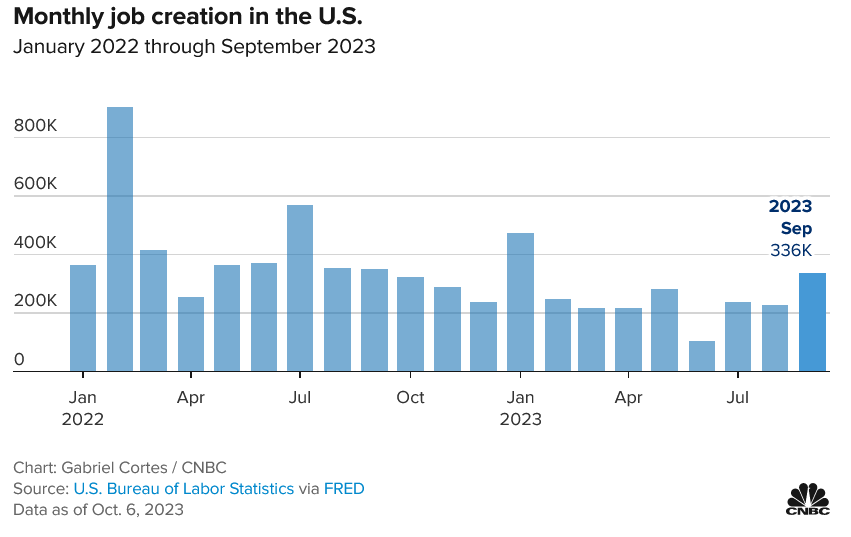

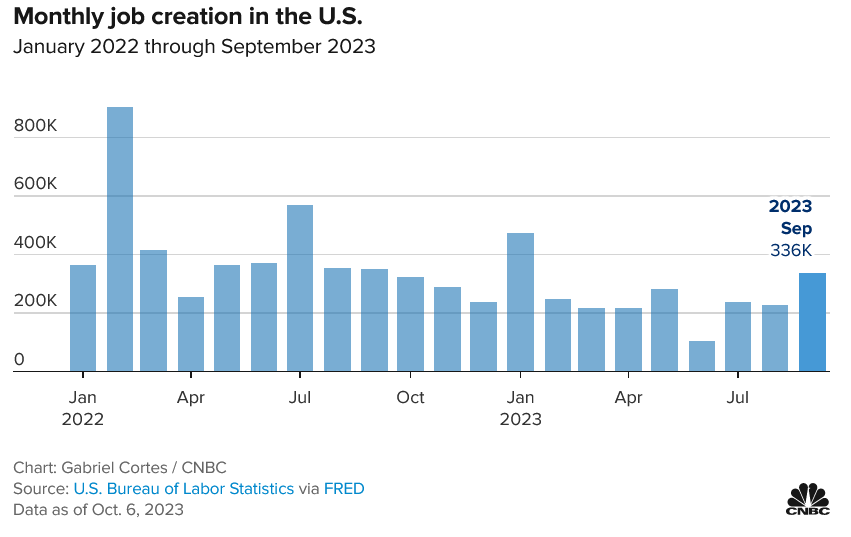

The economists forecasting the jobs data missed big time, with the recent jobs report almost double their predictions. Why is job growth still surging while interest rates hit 20 year highs. What does this mean for future interest rate increases? Does this change...

by Glen | Sep 25, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, Private Lending, Real Estate economic trends, real estate investing, Real Estate Trends, recession, recession impact on real estate, student loan impact on real estate

As part of a debt-ceiling agreement forged by President Joe Biden and House Speaker Kevin McCarthy, monthly student loan bills will resume September first. What does the restarting of student loans mean for real estate, interest rates, and the overall economy? How...

by Glen | Mar 6, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation, Realtor, recession, recession impact on real estate

In only a couple of months, the world has changed substantially. In December, inflation was supposedly decreasing rapidly and the odds of a soft landing were non existent. Fast forward a few months and inflation is running hot, consumers are spending like crazy,...

by Glen | Feb 27, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, commercial hard money, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, Private Lending, real estate investing, real estate taxes, Real Estate Trends, Real estate Valuation, recession impact on real estate, Residential hard money

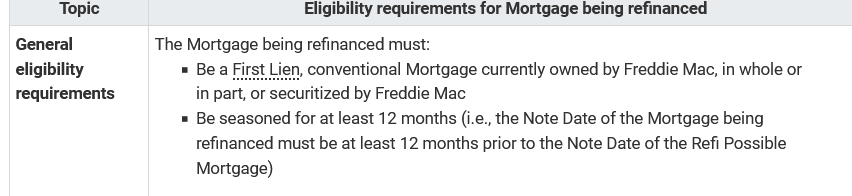

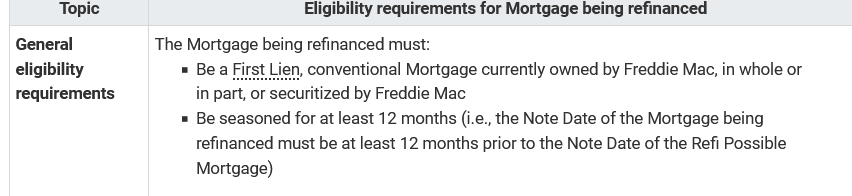

Beginning in March of 2023, Freddie Mac, the largest buyer of mortgages is drastically changing the seasoning requirements for any loans it purchases which basically means any new conventional conforming loan will have to follow the new rules. What big changes are...