by Glen | Feb 25, 2022 | Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates, Private Lending, Real Estate economic trends, Real Estate Trends, Real estate Valuation

Initially when Ukraine was invaded the stock market dropped precipitously over 800 points during the day only to make a huge rebound into positive territory. What does this volatility mean for interest rates and in turn real estate? Does the invasion change the path...

by Glen | Feb 10, 2022 | 2022 real estate predictions, Atlanta Hard Money, Colorado Hard Money, Denver Hard Money, Georgia hard money, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation, residential lending valuation, Small Balance Commercial Lending, Underwriting/Valuation, what happens to real estate in a correction

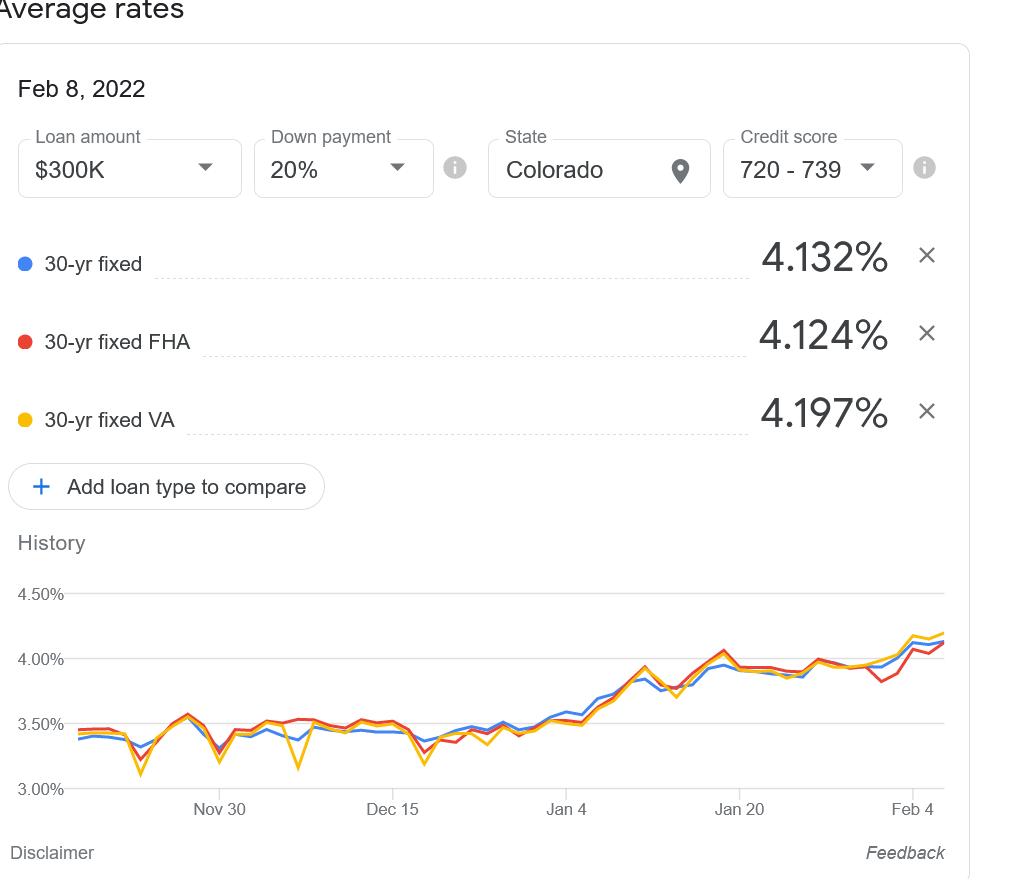

Inflation plowed ahead at its fastest 12-month pace in nearly 40 years during January and substantially higher than any estimates according to a closely watched gauge the Labor Department released Thursday (CPI). The stock and bond markets are continuing to awaken,...

by Glen | Jan 26, 2022 | Closing, commercial hard money, General real estate financing information, hard money, interest rates, mortgage rates, Property Valuation, Real Estate economic trends, Real Estate Trends, Real estate Valuation, residential lending valuation, Small Balance Commercial Lending, Underwriting/Valuation

New York City’s housing market is undergoing a powerful rebound, fueled by New Yorkers trading up, out-of-staters moving in, and others looking beyond the pandemic’s aftershocks to make a long-term bet on the city. On the flip side, Boise prices are up 25% year over...

by Glen | Jan 24, 2022 | 2022 stock market correction, hard money loans, private lender, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Realtor, Residential hard money, Small Balance Commercial Lending, Uncategorized

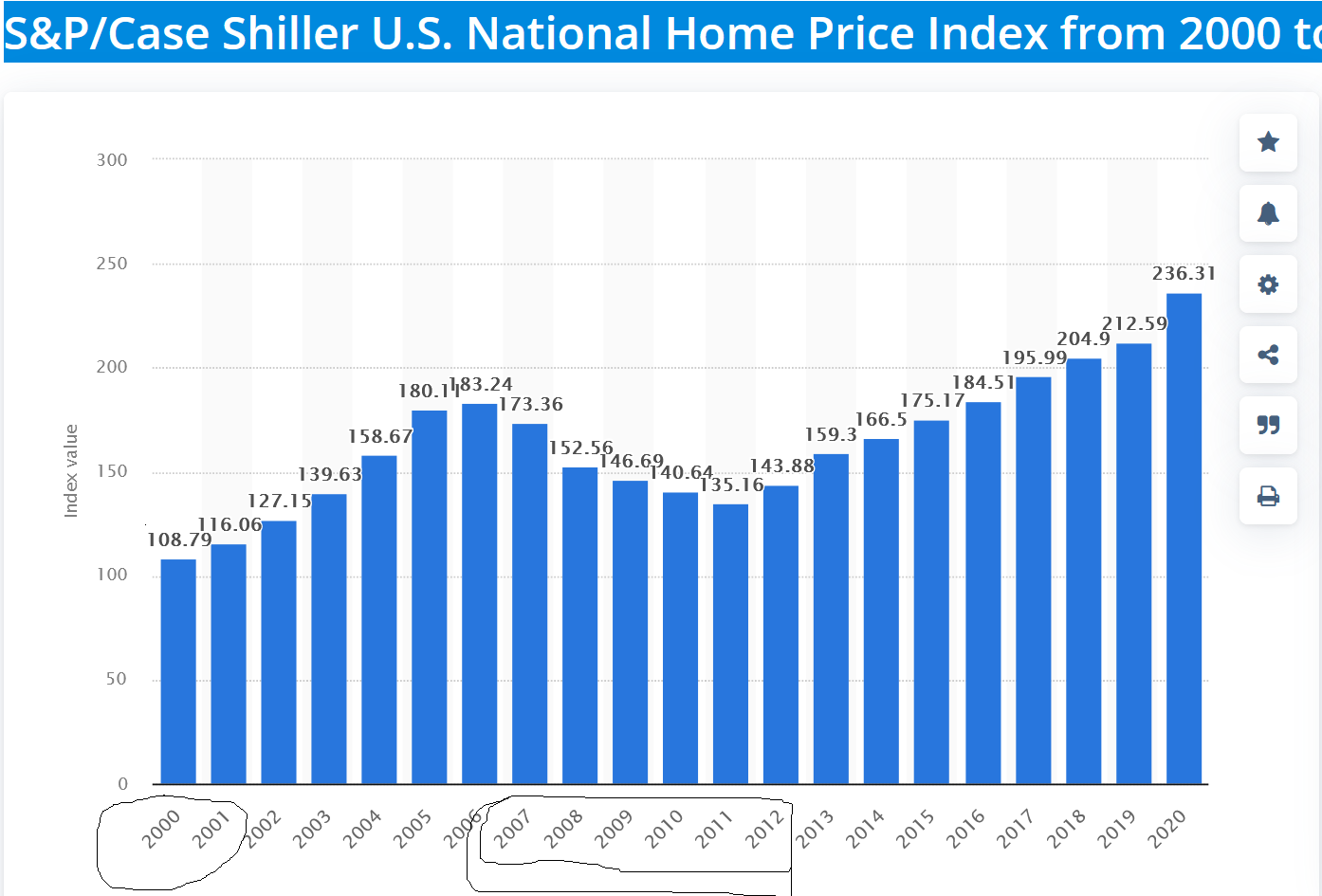

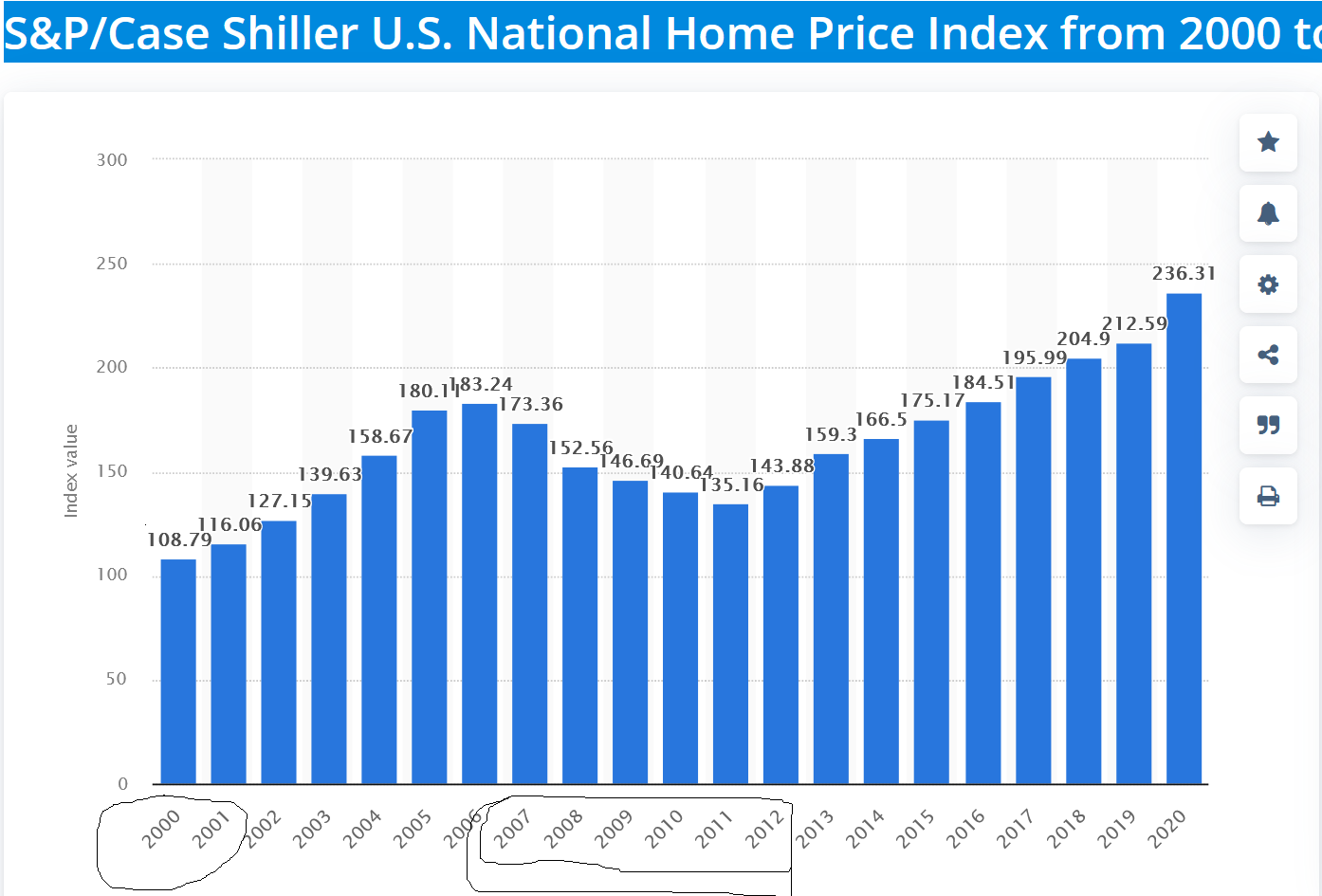

It has been quite the year for the stock market. As I am writing this blog, the market has already plunged 10% to kick off the year. Morgan Stanley just warned that stocks are more overvalued than the tech bubble. How will this impact real estate? What happened...

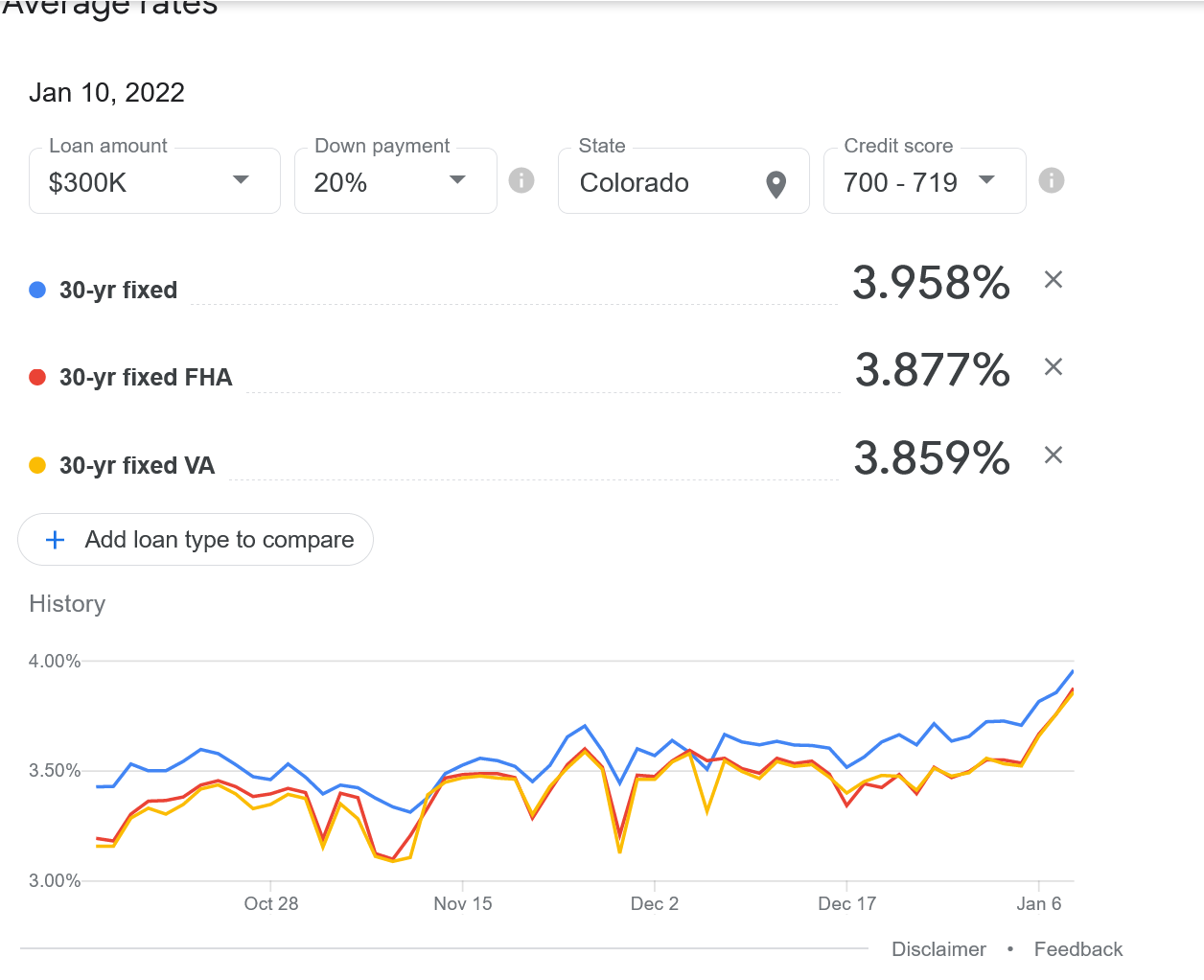

by Glen | Jan 12, 2022 | interest rates, mortgage rates, Private Lending, Property Valuation, Real Estate economic trends, Real Estate Trends, Real estate Valuation, residential lending valuation, Underwriting/Valuation

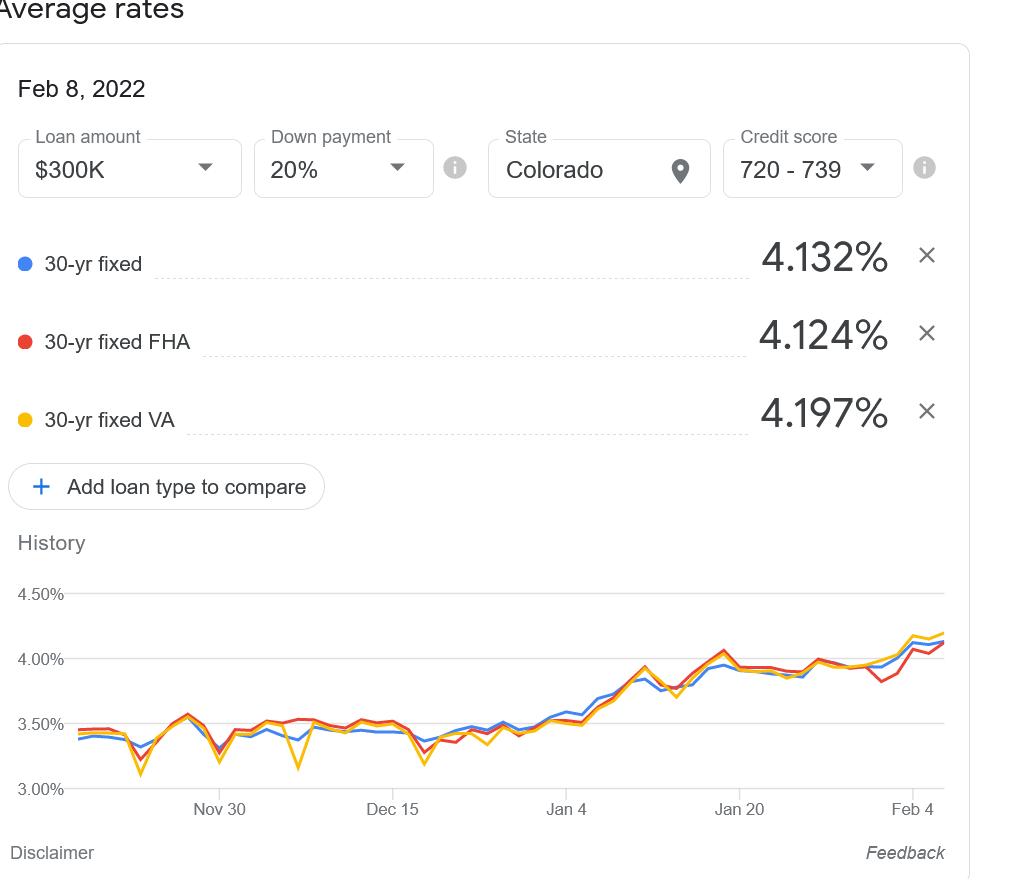

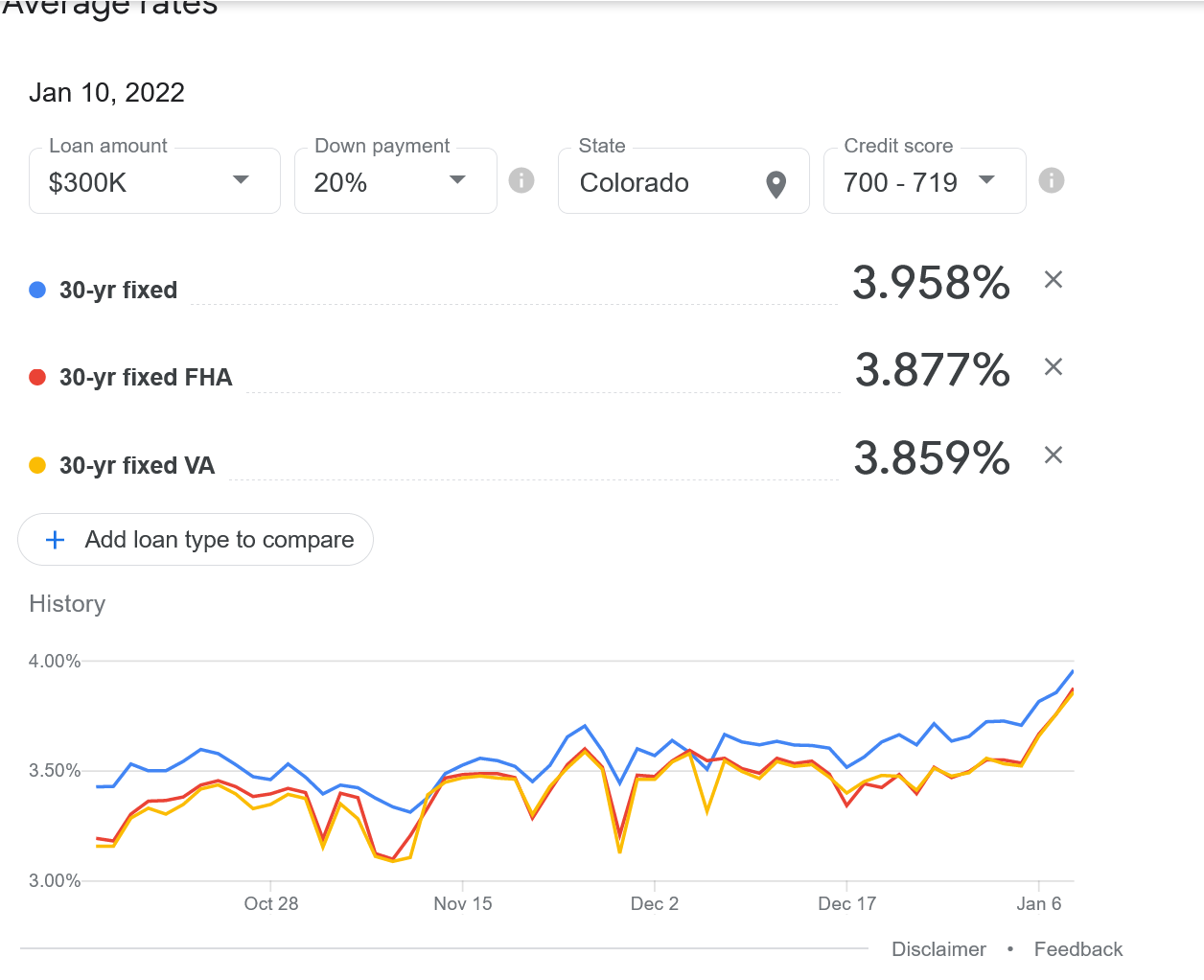

Inflation plowed ahead at its fastest 12-month pace in nearly 40 years during December, according to a closely watched gauge the Labor Department released Wednesday. The stock and bond markets are suddenly awake, with mortgage rates skyrocketing almost 4% from a low...

by Glen | Jan 5, 2022 | Colorado Hard Money, Denver Hard Money, Georgia hard money, Hard Money Commercial Lending, Hard Money Lending, Housing Price Trends / Information, Real Estate economic trends, real estate ibuyers, real estate investing, Real Estate Trends, Real estate Valuation, Realtor, Residential hard money, residential lending valuation

The National Association of Realtors just released their 2022 housing market report. What are their predictions on mortgage rates, appreciation rates, rental rates, and location of purchases? There are a couple of surprises in the data that could radically alter...