by Glen | Dec 5, 2022 | 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, recession, recession impact on real estate, Residential hard money, Underwriting/Valuation, what does this real estate recession look like

Since Covid it seems like traditional patterns have been broken. I hear time and time again that X or Y is different and there have been fundamental changes. Is this true, is everything “radically” different now? Is a bear walking around in the snow a sign (zoom in...

by Glen | Nov 21, 2022 | 2023 real estate prediction, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Commercial Lending valuation, credit scoring, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, real estate investing, Real Estate Trends, Residential hard money, residential lending valuation

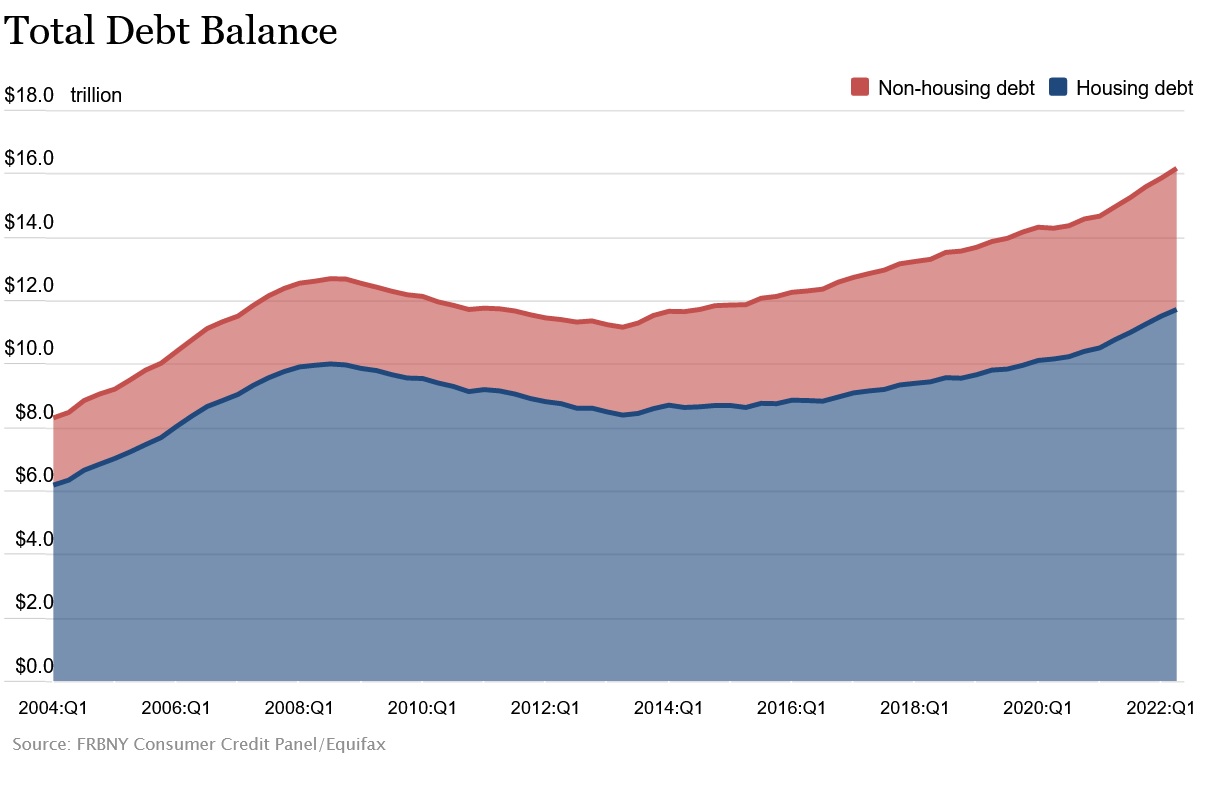

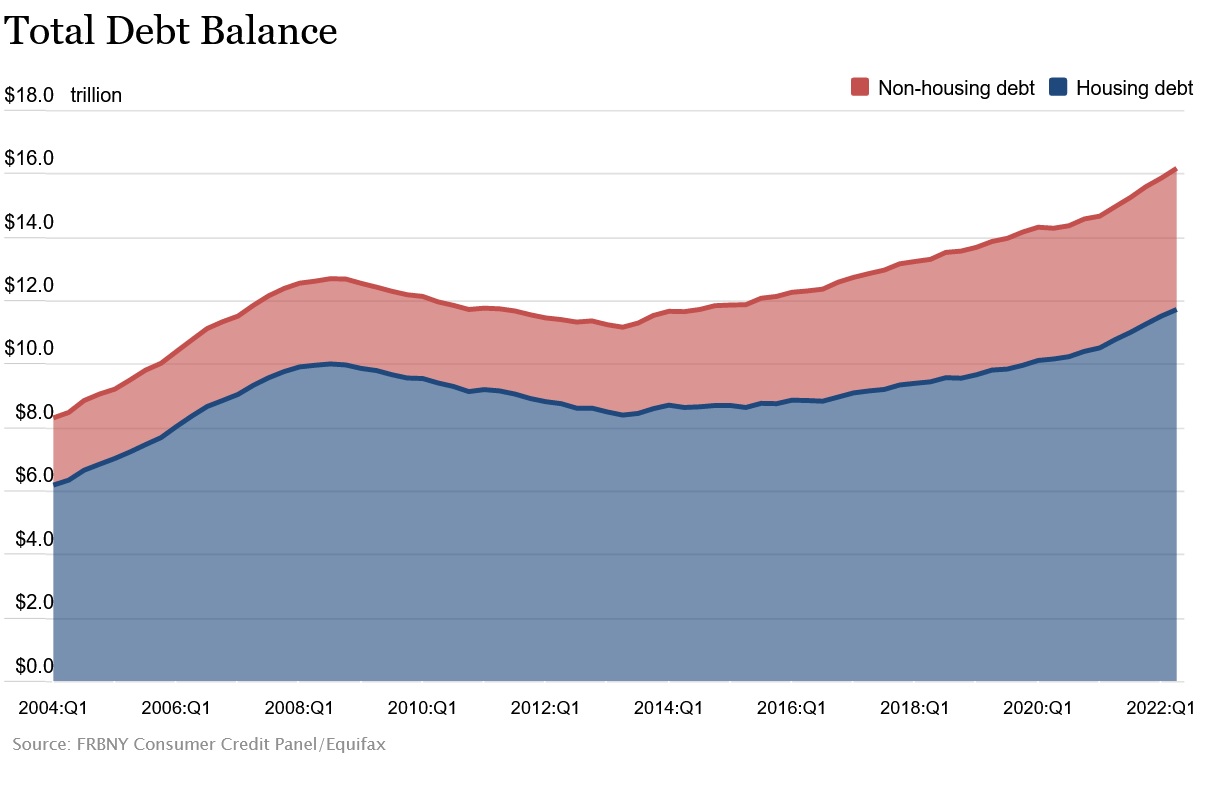

The federal reserve bank of NY recently published a report showing consumer debt jumping to the highest levels ever recorded with every category growing from mortgages, autos, credit cards, lines of credit, etc… Is some consumer debt better/worse than others for the...

by Glen | Oct 10, 2022 | 2022 real estate predictions, 2022 stock market correction impact on real estate prices, 2023 real estate prediction, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending, Hard Money in the News, Hard Money Lending, hard money loans, Housing Price Trends / Information, interest rates, mortgage rates, Property Valuation, Real Estate Trends, Real estate Valuation

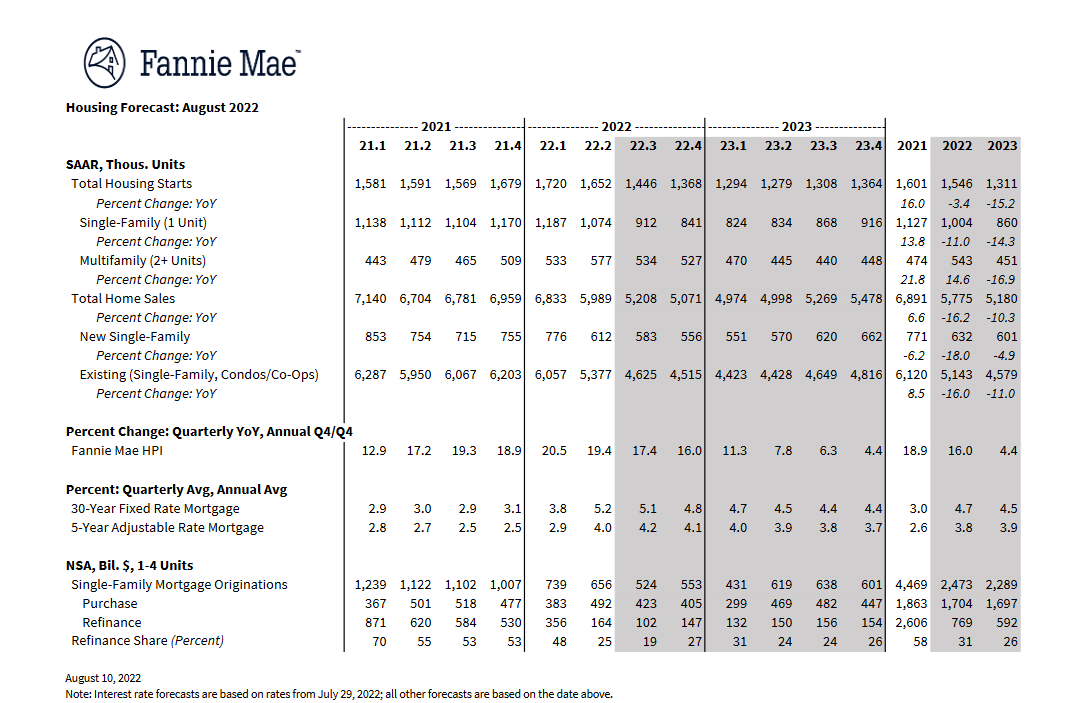

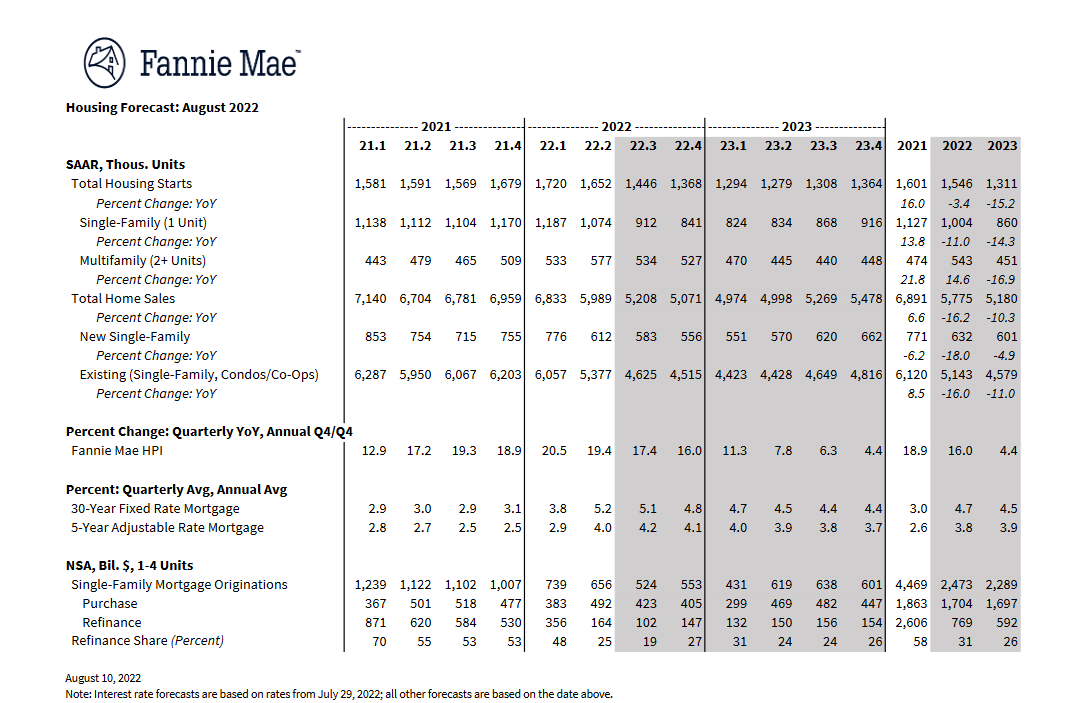

It will get much worse for the housing market and the mortgage industry. That’s the takeaway from a group of economists at Fannie Mae who slashed their forecast for 2022 home sales this week. Federal Reserve chairman Powell recently threw even more cold water on their...

by Glen | Sep 26, 2022 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, Private Lending, Property Valuation, Real Estate Trends, Real estate Valuation

First, the pic above was the leading picture for a listing I looked at. I guess they were stressing the work from home conveniences in the office Unfortunately this could lead to some “interesting” conversations with coworkers. With the back to office trend in full...

by Glen | Jul 25, 2022 | 2022 real estate predictions, 2022 stock market correction, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, Property Valuation, real estate investing, Real Estate Trends, Real estate Valuation, recession, recession impact on real estate, Residential hard money, residential lending valuation

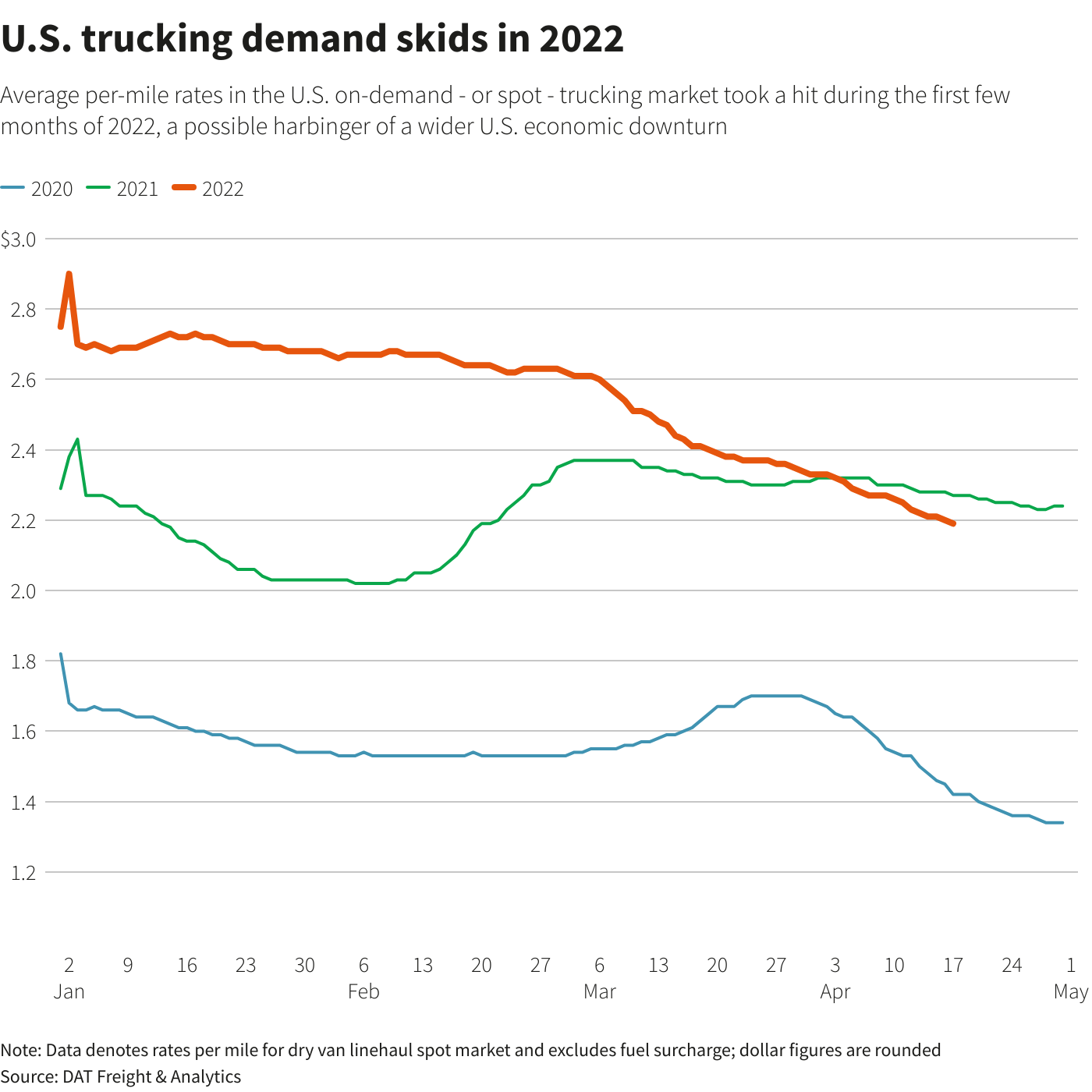

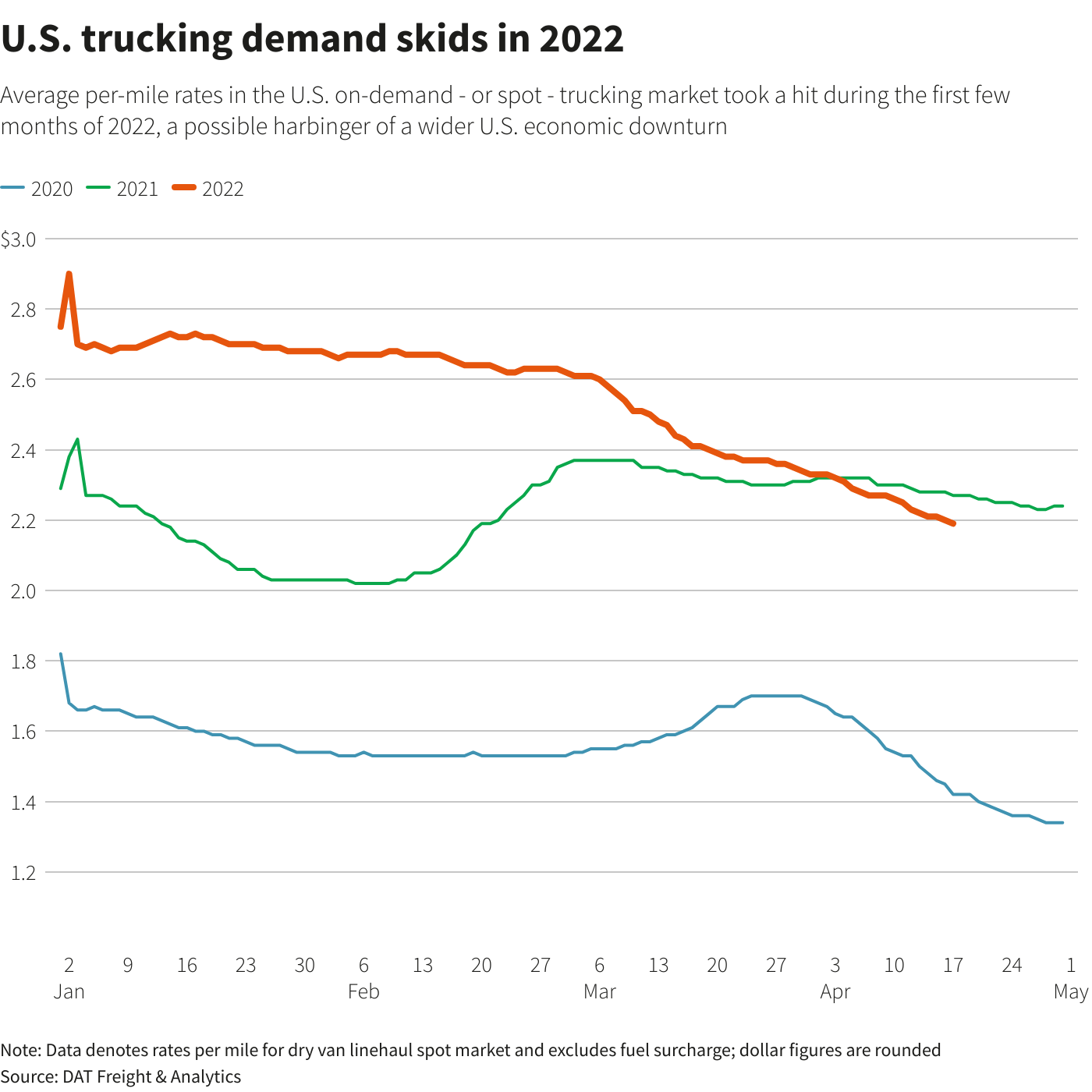

There has been an unexpectedly sharp downturn in demand to truck everything from food to furniture since the beginning of March and rates in the overheated segment that deals in on-demand trucking jobs – known as the spot market – are skidding. Why are...

by Glen | Jul 11, 2022 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Realtor

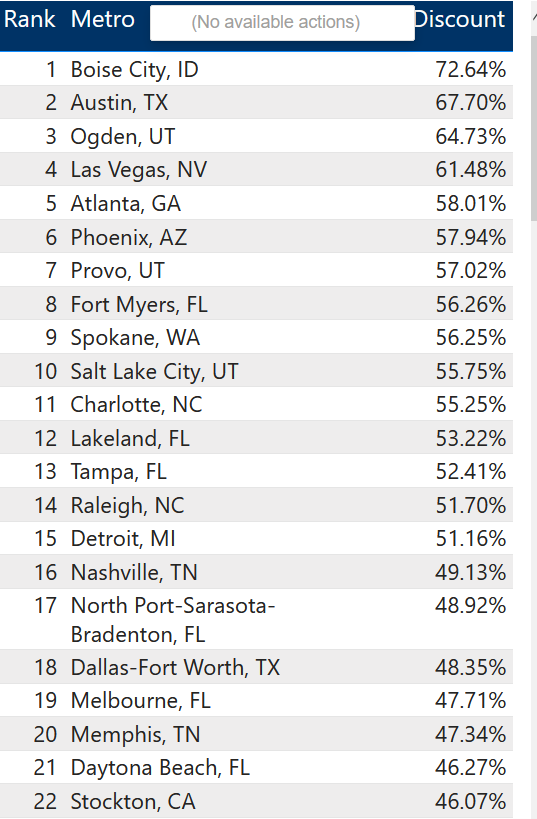

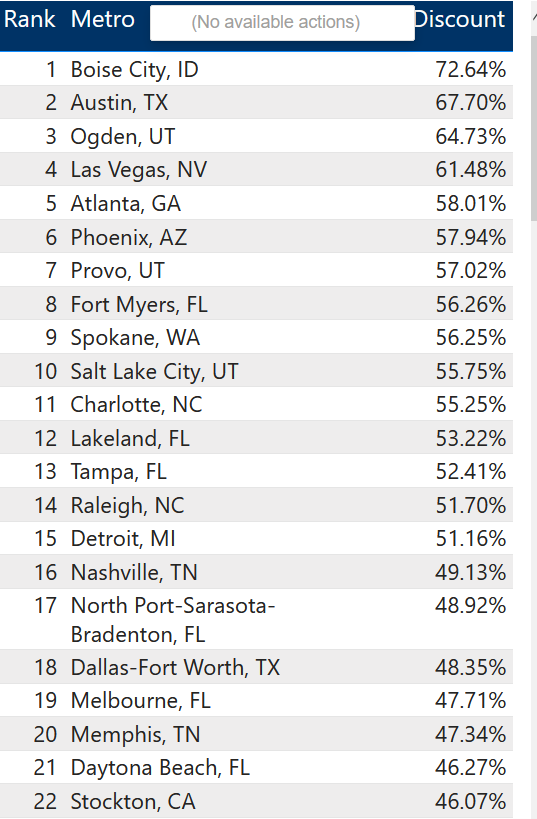

“A reckoning is due. Home prices and rents can’t separate as significantly as they have from their long-term fundamental trends without major issues arising in the marketplace,” said Ken Johnson, an economist at Florida Atlantic University, in an analysis. “Few...