by Glen | Apr 14, 2025 | 2025 mortgage rates, 2025 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, Georgia hard money, Government Bailout, hard money, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, private lender, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, recession, recession impact on real estate

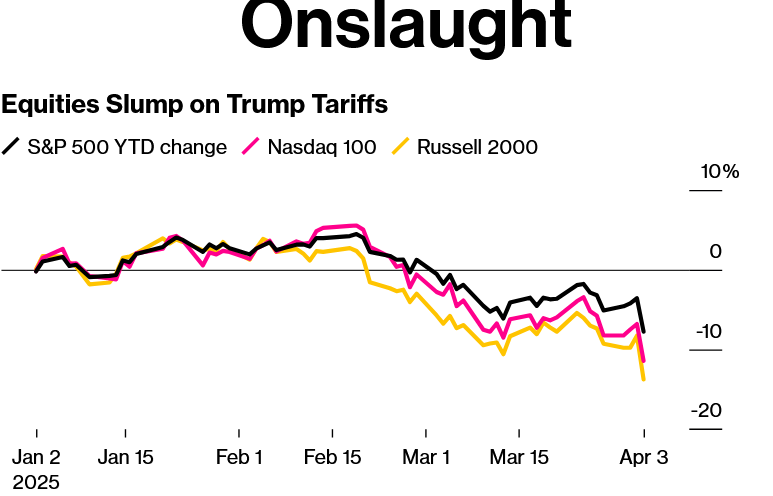

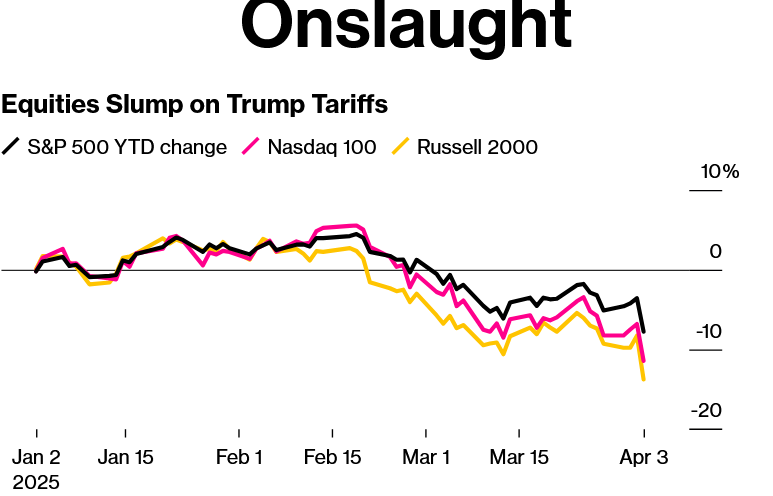

Are the bulls running or are the bears coming? Any business media you pick up is harping on the idea of a “recession watch” and the economy is basically coming to an end! On the flip side my proprietary lending data is giving me a radically different answer. What...

by Glen | Apr 7, 2025 | Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, Denver Hard Money, Georgia hard money, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Realtor, Residential hard money

For years, myself, and many others have thought that interest rates were the predictor of housing prices. Fast forward to post COVID where interest rates have doubled and yet housing prices remain high and are still trending higher in many markets. What other...

by Glen | Jan 20, 2025 | 2025 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Brokering Loans to Fairview, Closing, Colorado Hard Money, Colorado private lender, Colorado ski real estate, Denver Hard Money, Georgia hard money, interest rates, mortgage rates, Other Questions, private lender, Process/Loan Submittal, Program Details, Questions Regarding Fairview, real estate investing, Real Estate Trends, Realtor, Underwriting/Valuation, will house prices continue to increase

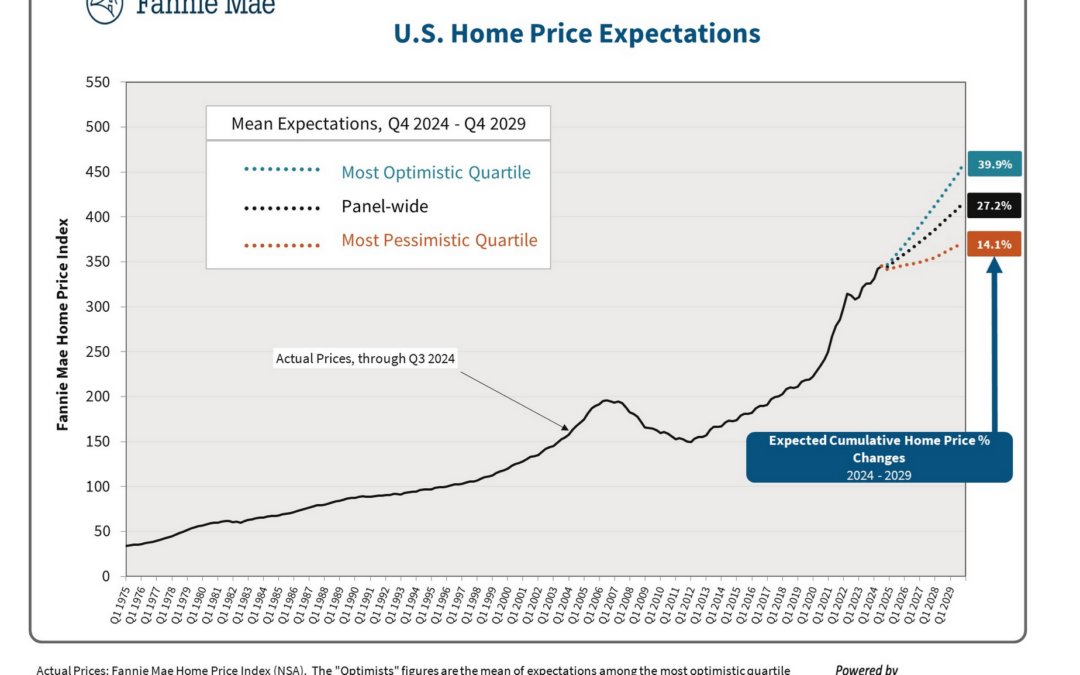

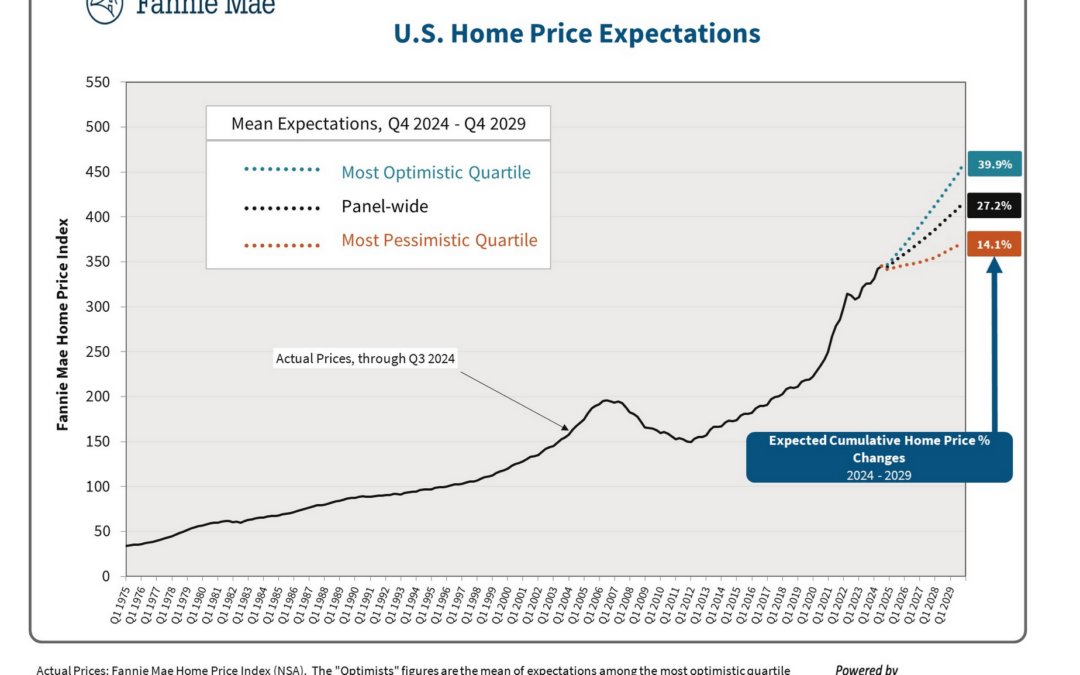

Fannie Mae, one of the largest buyers of residential mortgages has some profound predictions. Will house prices continue their upward trend through 2030? How accurate are the predictions below? How can house prices continue in such a linear fashion? Will...

by Glen | Dec 16, 2024 | 2025 mortgage rates, 2025 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, if there is a recession what happens to real estate, mortgage rates, Private Lending, real estate investing, Real Estate Trends, Real estate Valuation

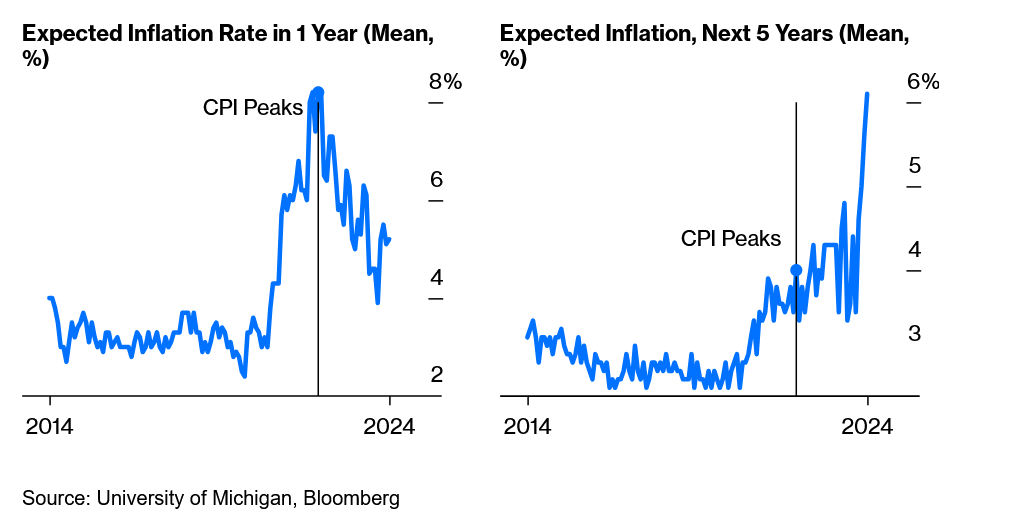

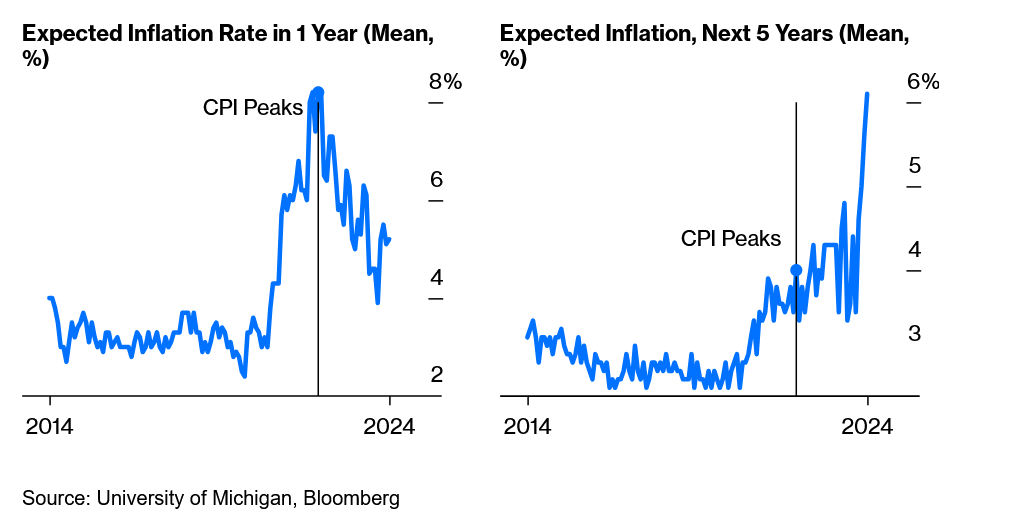

When I was writing this article mortgage rates were hovering right around 7%. At the same time economists had been predicting a sharp decline in mortgage rates and a booming 2024 real estate market as the fed has cut rates. On the other hand, the chart above...

by Glen | Nov 18, 2024 | 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, General real estate financing information, Georgia hard money, interest rates, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation

The conventional wisdom is that inflation causes higher interest rates which in turn causes lower housing prices. We are now seeing an interesting phenomenon where housing prices continue to stay high and in some markets head even higher with interest rates double...

by Glen | Oct 23, 2023 | 2023 real estate predictions, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation, recession, recession impact on real estate

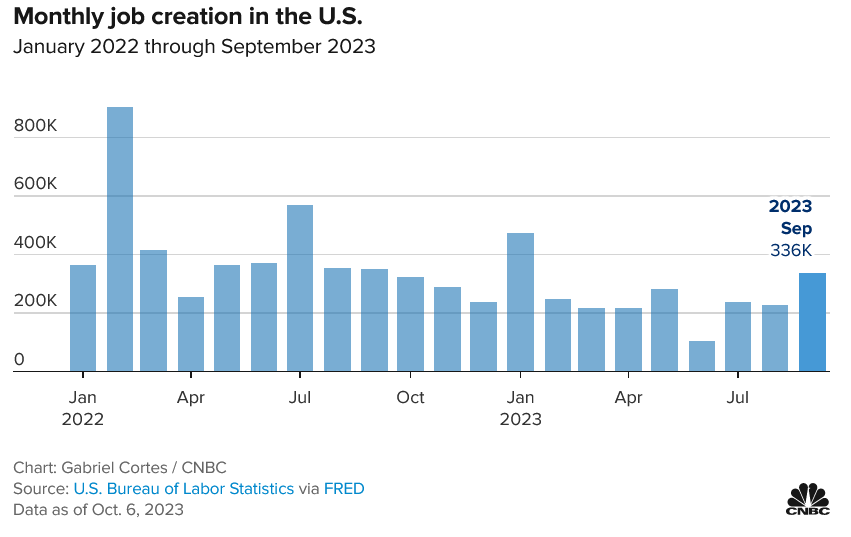

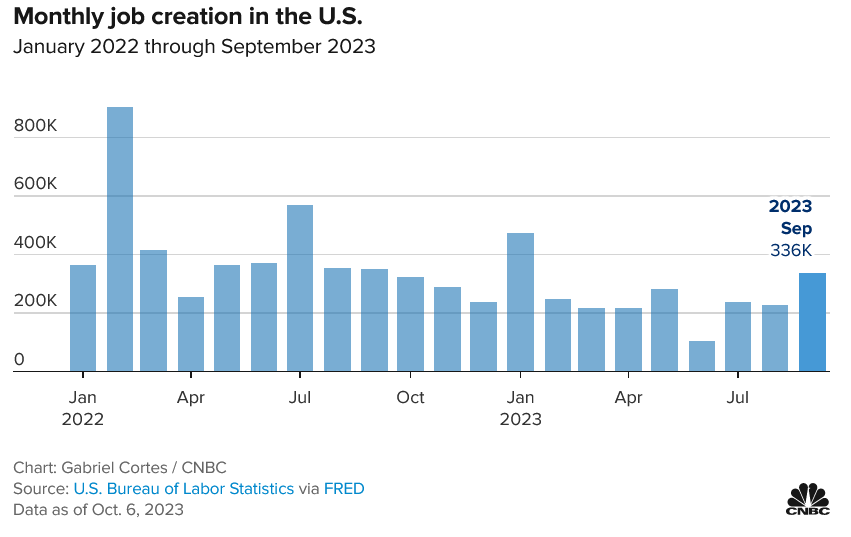

The economists forecasting the jobs data missed big time, with the recent jobs report almost double their predictions. Why is job growth still surging while interest rates hit 20 year highs. What does this mean for future interest rate increases? Does this change...