by Glen | Apr 25, 2022 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado ski real estate, Denver Hard Money, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation, Underwriting/Valuation, what happens to real estate in a correction

The average time someone spends in a home has increased from 8.7 years in 2010 to over 13 years in 2020; a whopping 50% increase. How is this impacting house prices? What caused the “break” in the game of musical chairs leading to the inventory shortage? How are...

by Glen | Mar 21, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Atlanta Hard Money, Denver Hard Money, Real Estate economic trends, real estate ibuyers, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money, zestimate

According to Zillow, house prices will continue to skyrocket in 2022 with hot markets posting gains of 25% plus. What factors are driving these predictions? How accurate are Zillow’s 2022 predictions for appreciation? How does Zillow’s estimates compare with...

by Glen | Mar 14, 2022 | Atlanta Hard Money, credit scoring, Denver Hard Money, Private Lending, Real Estate economic trends, Real Estate Trends, Residential hard money, Small Balance Commercial Lending

Buy now pay later included on credit reports, impact on real estate financing Buy now Pay Later loans are a million-dollar industry and yet until now these loans were invisible to lenders. This is all changing as Equifax is now adding buy now pay later payments to...

by Glen | Mar 2, 2022 | 2022 real estate predictions, 2022 stock market correction impact on real estate prices, Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, commercial hard money, Hard Money Commercial Lending, interest rates, mortgage rates, Real Estate economic trends, real estate ibuyers, real estate investing

Redfin plunges 26% in one day and foreshadows 4 trends shaping the 2022 and beyond real estate market. Redfin, the darling of the real estate market the last several years has plunged 45% over the last year. At the same time numerous analysists are downgrading the...

by Glen | Feb 25, 2022 | Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates, Private Lending, Real Estate economic trends, Real Estate Trends, Real estate Valuation

Initially when Ukraine was invaded the stock market dropped precipitously over 800 points during the day only to make a huge rebound into positive territory. What does this volatility mean for interest rates and in turn real estate? Does the invasion change the path...

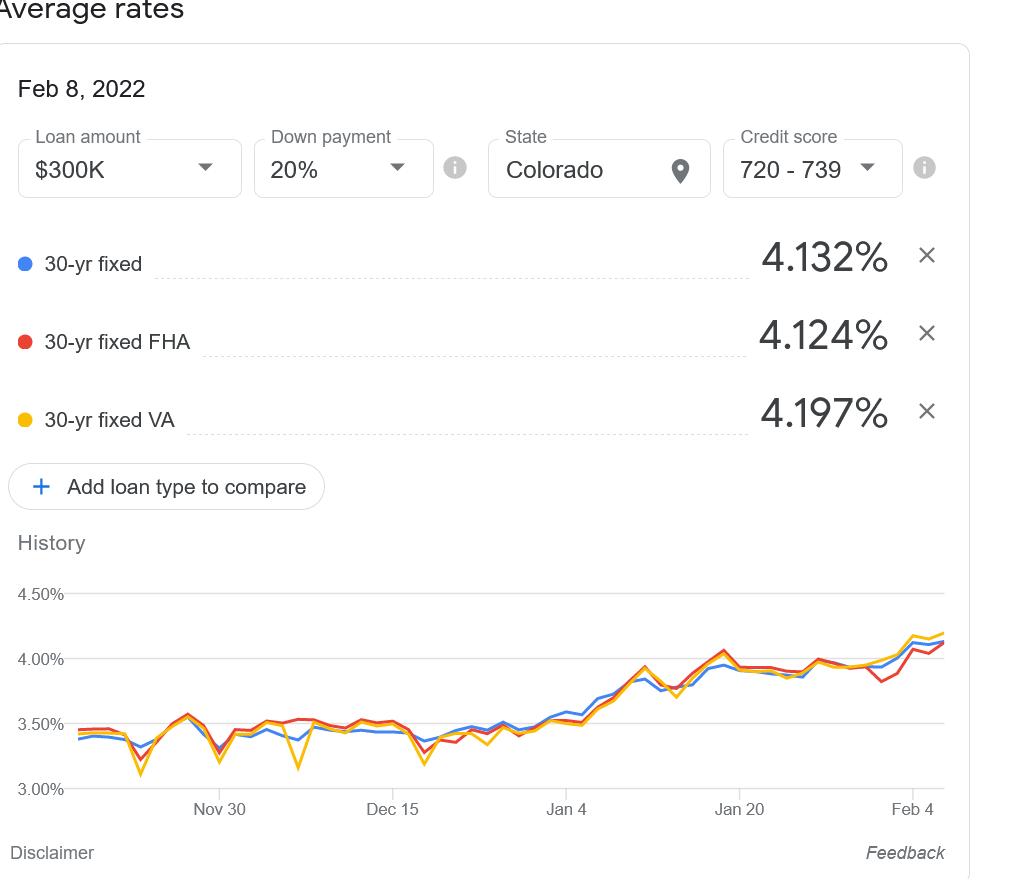

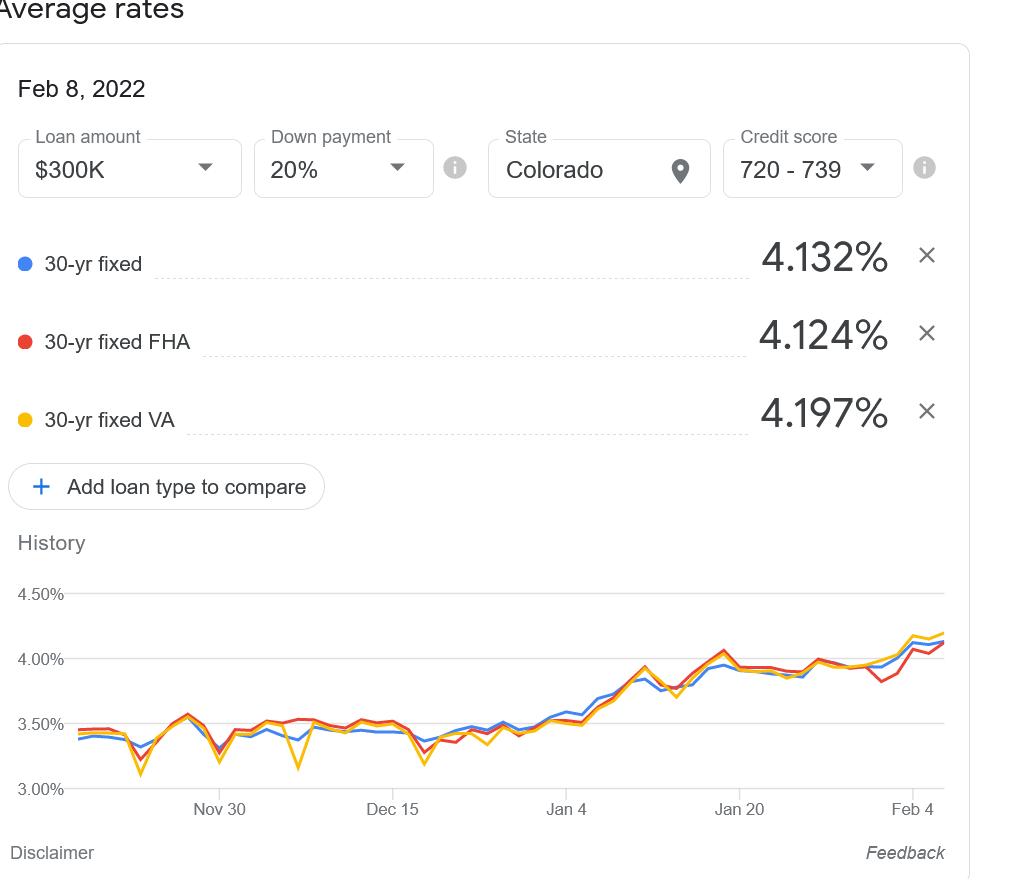

by Glen | Feb 10, 2022 | 2022 real estate predictions, Atlanta Hard Money, Colorado Hard Money, Denver Hard Money, Georgia hard money, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation, residential lending valuation, Small Balance Commercial Lending, Underwriting/Valuation, what happens to real estate in a correction

Inflation plowed ahead at its fastest 12-month pace in nearly 40 years during January and substantially higher than any estimates according to a closely watched gauge the Labor Department released Thursday (CPI). The stock and bond markets are continuing to awaken,...