by Glen | Apr 21, 2021 | private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation

For years Zillow has been buying houses, but they have refused to use the Zestimate as their purchase price. The cards have now turned with Zillow announcing that the “Zestimate” is now the price they will pay for your house. How will this change allow Zillow to...

by Glen | Mar 31, 2021 | commercial property trends, Coronavirus 2020 real estate impact, coronavirus 2021 real estate impacts, Government Bailout, hard money, Housing Price Trends / Information, Private Lending, Real Estate economic trends, real estate investing, Real estate Valuation, Residential hard money

For the first time in a year, since Covid-19 began spreading across the United States forcing Americans to stay home, retail alcohol sales have fallen almost 2%. Why the change in alcohol sales? No, people are not consuming less alcohol. What does this mean...

by Glen | Mar 11, 2021 | interest rates, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, residential lending valuation, Small Balance Commercial Lending, Underwriting/Valuation

As a result of the current loose monetary policy and additional stimulus coming down the pipe, “imbalances” within the economy are starting to form. BofA predicts a 10% drop in stock prices. What are other experts saying on the stock market? How will this impact...

by Glen | Feb 2, 2021 | General real estate financing information, Housing Price Trends / Information, interest rates, Private Lending, Property Valuation, Real Estate economic trends, real estate investing

There has been a flurry of good news with stocks reaching records, talks of more stimulus, and vaccines rolling out. Small stocks like Gamestop and AMC have been off the charts minting new millionaires every day. What does all this mean for real estate? How will...

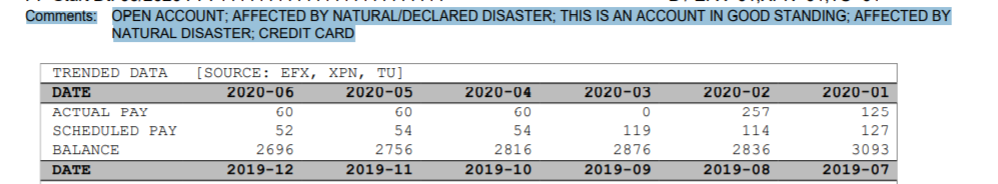

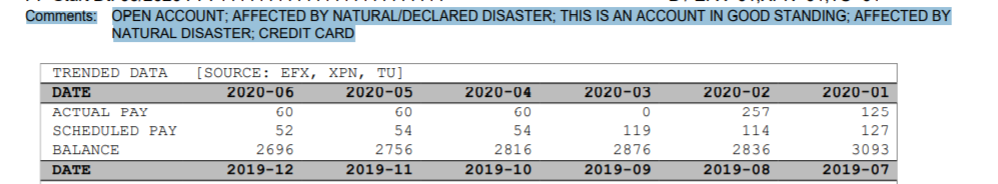

by Glen | Oct 6, 2020 | credit scoring, General real estate financing information, Hard Money Lending, Housing Price Trends / Information, interest rates, Private Lending

The Urban Institute think tank says nearly two out of three loans made in 2019 would fail to meet at least one of the stricter standards lenders have imposed since March. Banks are tripping over themselves to be the first to hedge against future downside risks and...

by Glen | Aug 19, 2020 | interest rates, Private Lending, Real Estate economic trends, real estate investing, Residential hard money

The mortgage market is an interesting animal. Long term mortgage rates traditionally track the 10 year treasury and historically trade in a very narrow band, approximately one percent higher than the 10 year treasuries. This would put mortgages today in the low 2%...