by Glen | Dec 5, 2022 | 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, recession, recession impact on real estate, Residential hard money, Underwriting/Valuation, what does this real estate recession look like

Since Covid it seems like traditional patterns have been broken. I hear time and time again that X or Y is different and there have been fundamental changes. Is this true, is everything “radically” different now? Is a bear walking around in the snow a sign (zoom in...

by Glen | Nov 14, 2022 | 2022 real estate predictions, 2023 real estate prediction, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates, Private Lending

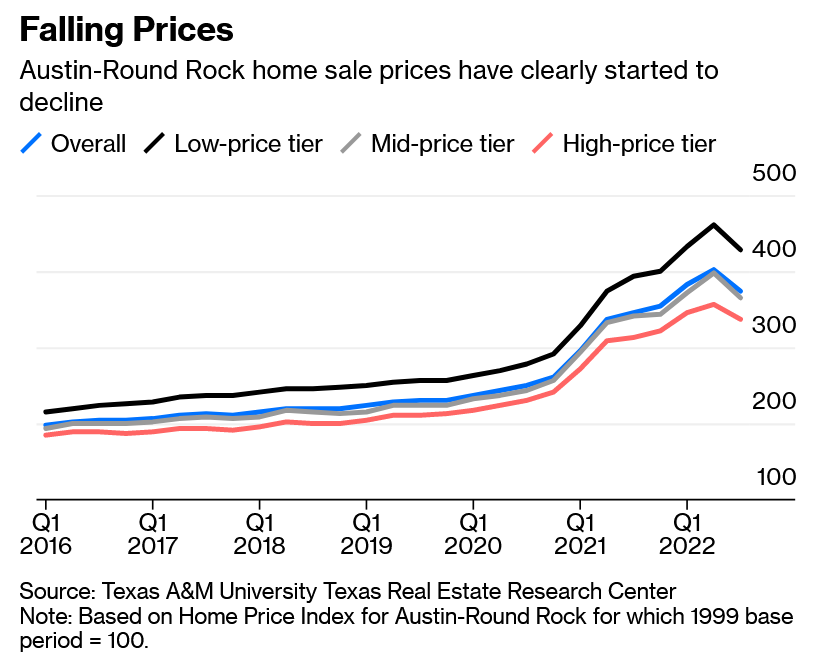

The prevailing theory is that this real estate cycle will be considerably better than others as so many people locked in rock bottom rates which will serve as “golden handcuffs” and prevent a meaningful increase in inventory. How accurate is this theory? What is the...

by Glen | Sep 26, 2022 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, Private Lending, Property Valuation, Real Estate Trends, Real estate Valuation

First, the pic above was the leading picture for a listing I looked at. I guess they were stressing the work from home conveniences in the office Unfortunately this could lead to some “interesting” conversations with coworkers. With the back to office trend in full...

by Glen | Aug 15, 2022 | 2022 real estate predictions, 2022 stock market correction impact on real estate prices, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, CO hard money, Colorado Hard Money, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, hard money, Hard Money Commercial Lending, hard money loans, Housing Price Trends / Information, if there is a recession what happens to real estate, interest rates, mortgage rates, private lender, Private Lending

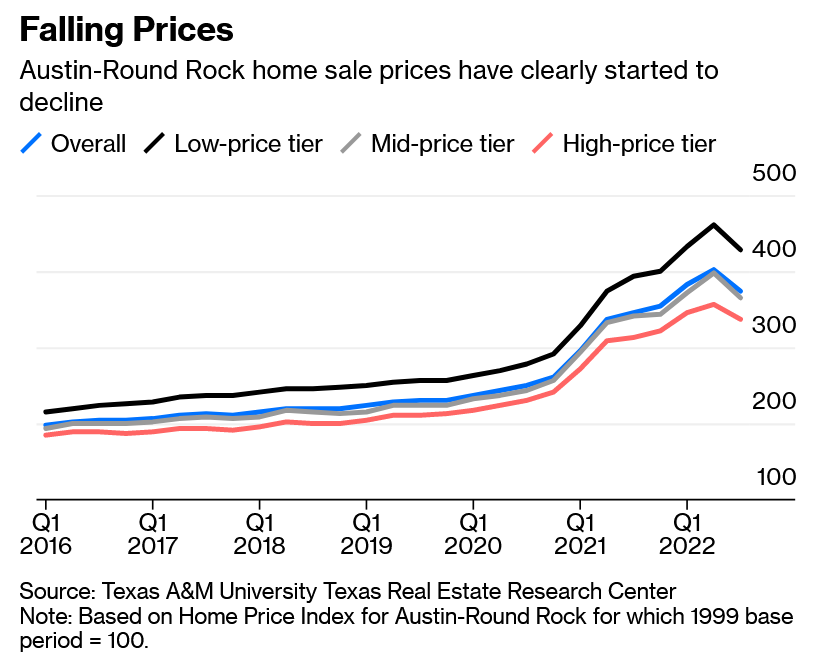

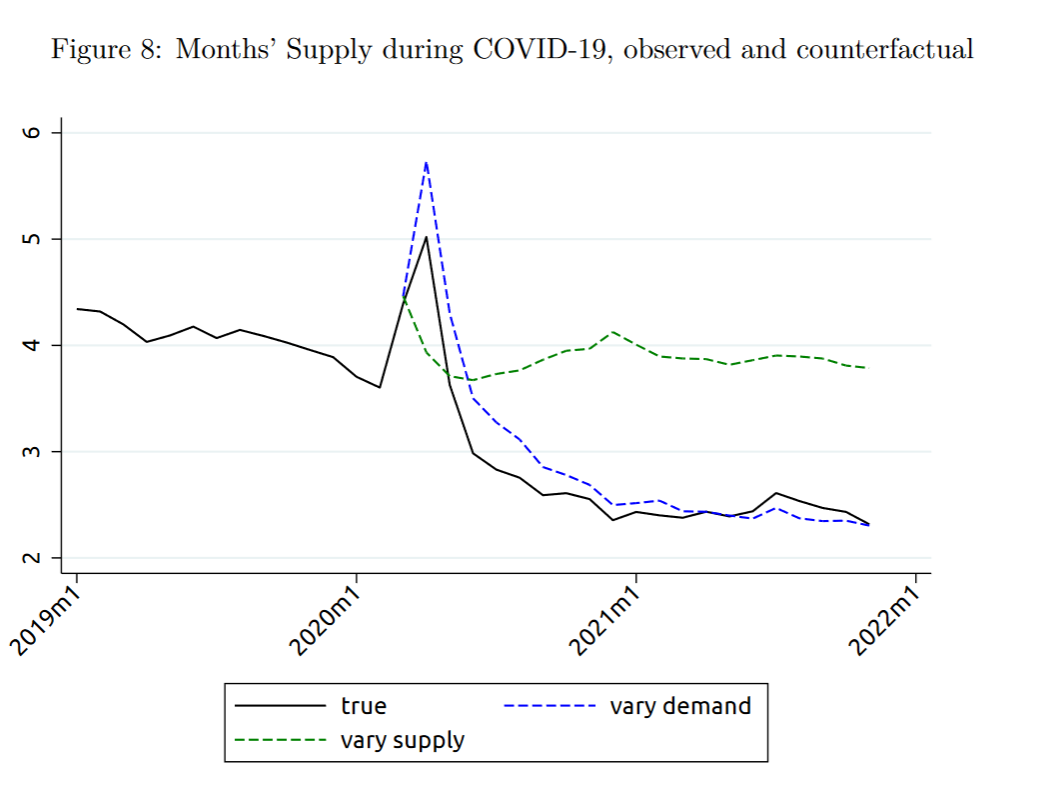

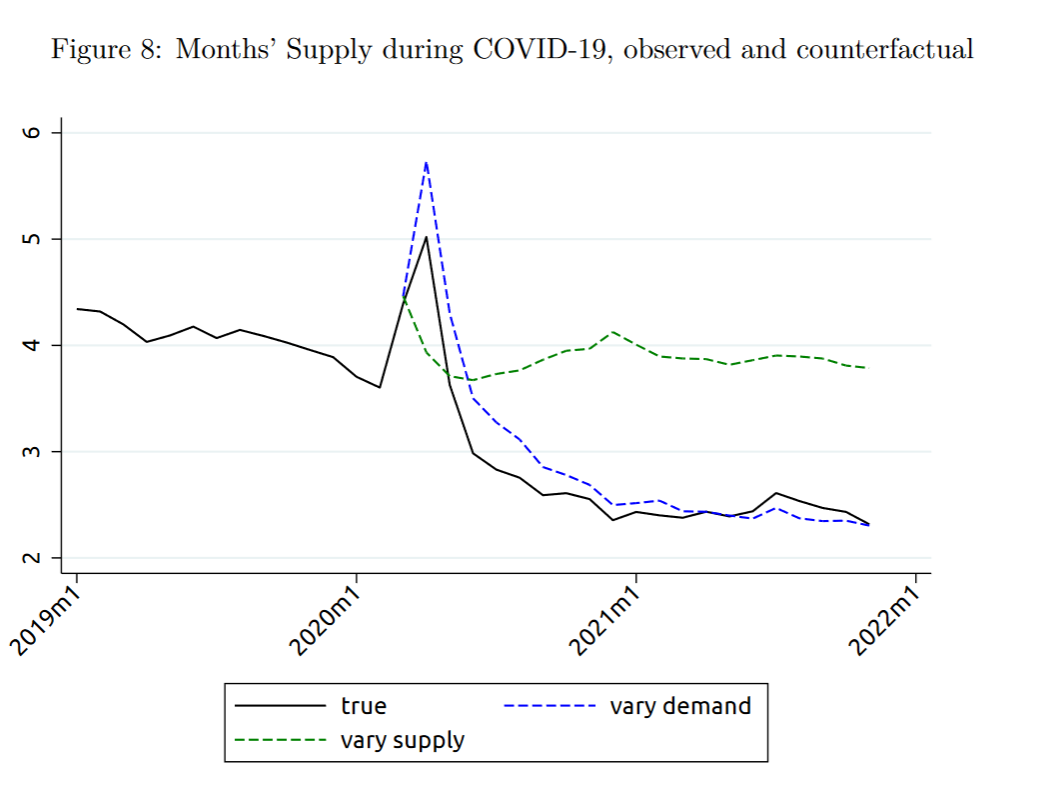

The federal reserve did an analysis of what has led to the surge in housing prices and has a conclusive answer; the driver of high prices is not that we don’t have enough houses as the media has been claiming. What is the real culprit behind soaring prices? Is there...

by Glen | May 23, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Atlanta Hard Money, Atlanta real estate trends, CO hard money, Colorado Hard Money, commercial private lending, commercial property trends, Denver Hard Money, General real estate financing information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates, Private Lending

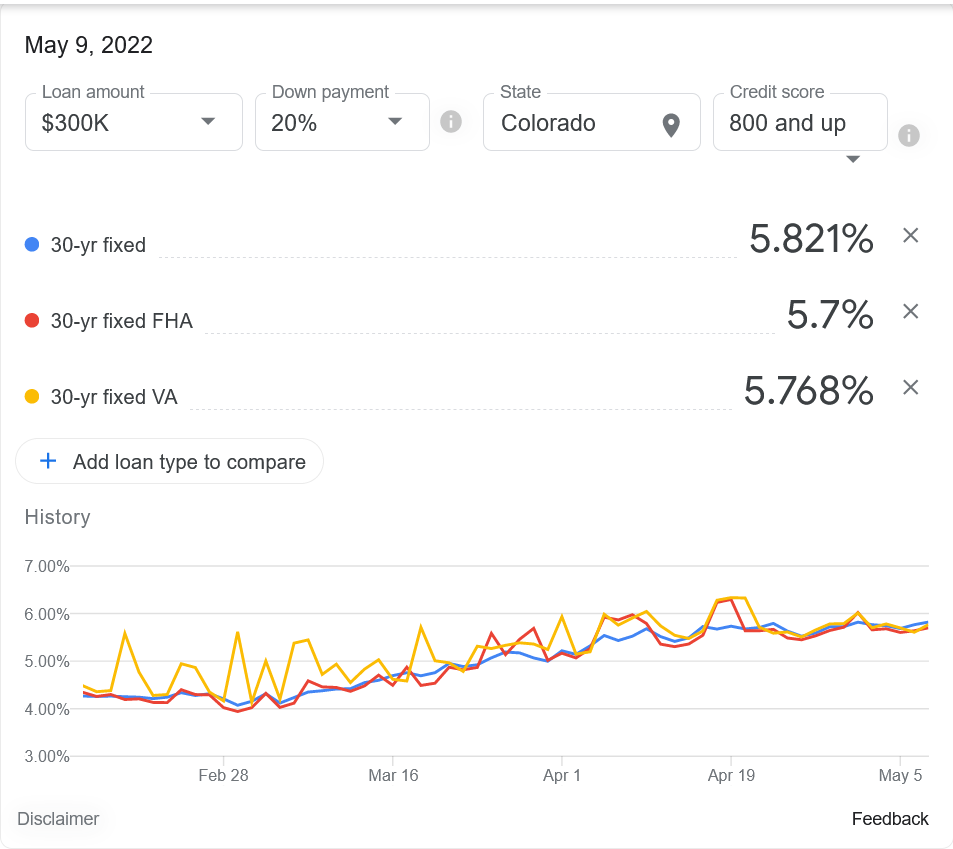

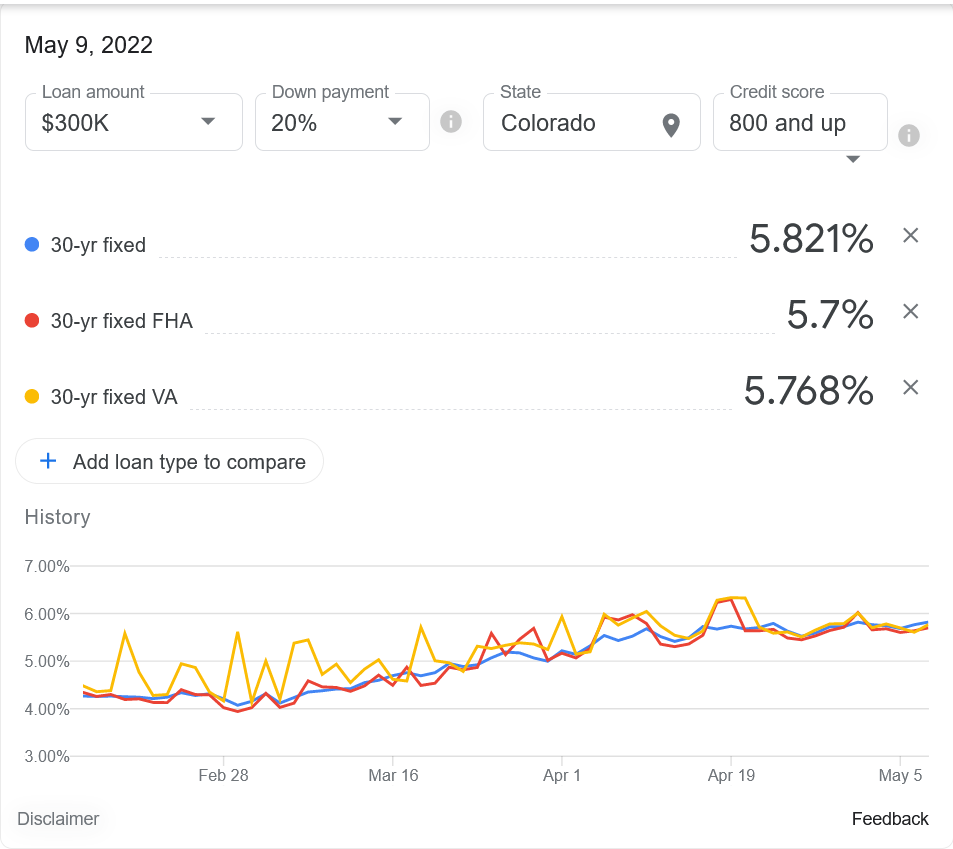

Where mortgage rates are heading seems to be the biggest question on everyone’s mind in real estate. As of this writing rates were around 5.821% which is substantially higher than any economists had predicted even a few months ago. What is causing the jump in...

by Glen | Apr 18, 2022 | 2022 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Denver Hard Money, Denver private Lending, General real estate financing information, Government Bailout, hard money, Housing Price Trends / Information, interest rates, mortgage rates, Other Questions, Private Lending

The federal housing finance agency (FHFA), the largest buyer of mortgages through Fannie Mae and Freddie Mac (Fannie/Freddie), announced huge changes to there fee structure. In particular they are targeting high cost loans with big jumps for second...