by Glen | Feb 10, 2022 | 2022 real estate predictions, Atlanta Hard Money, Colorado Hard Money, Denver Hard Money, Georgia hard money, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation, residential lending valuation, Small Balance Commercial Lending, Underwriting/Valuation, what happens to real estate in a correction

Inflation plowed ahead at its fastest 12-month pace in nearly 40 years during January and substantially higher than any estimates according to a closely watched gauge the Labor Department released Thursday (CPI). The stock and bond markets are continuing to awaken,...

by Glen | Jan 24, 2022 | 2022 stock market correction, hard money loans, private lender, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Realtor, Residential hard money, Small Balance Commercial Lending, Uncategorized

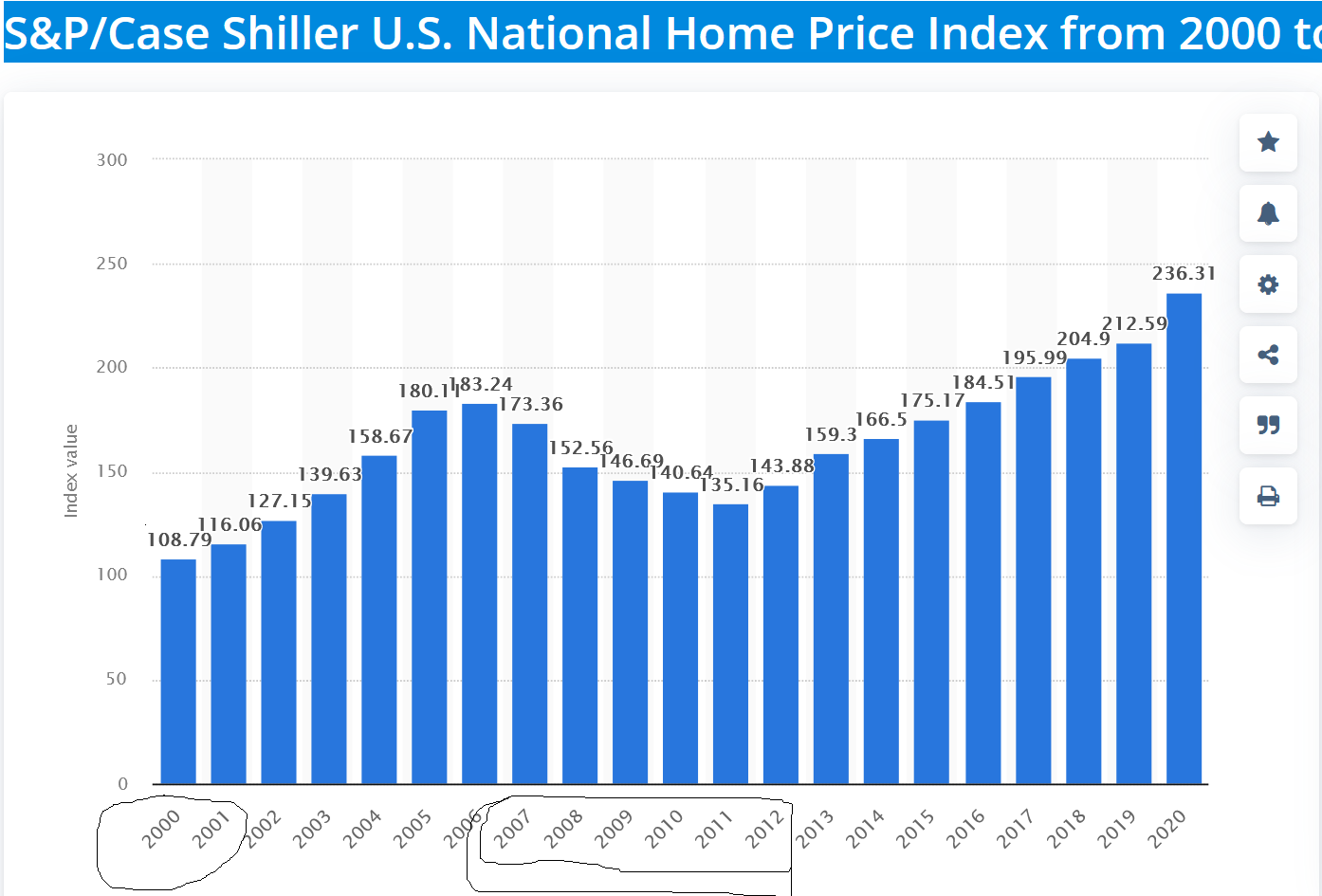

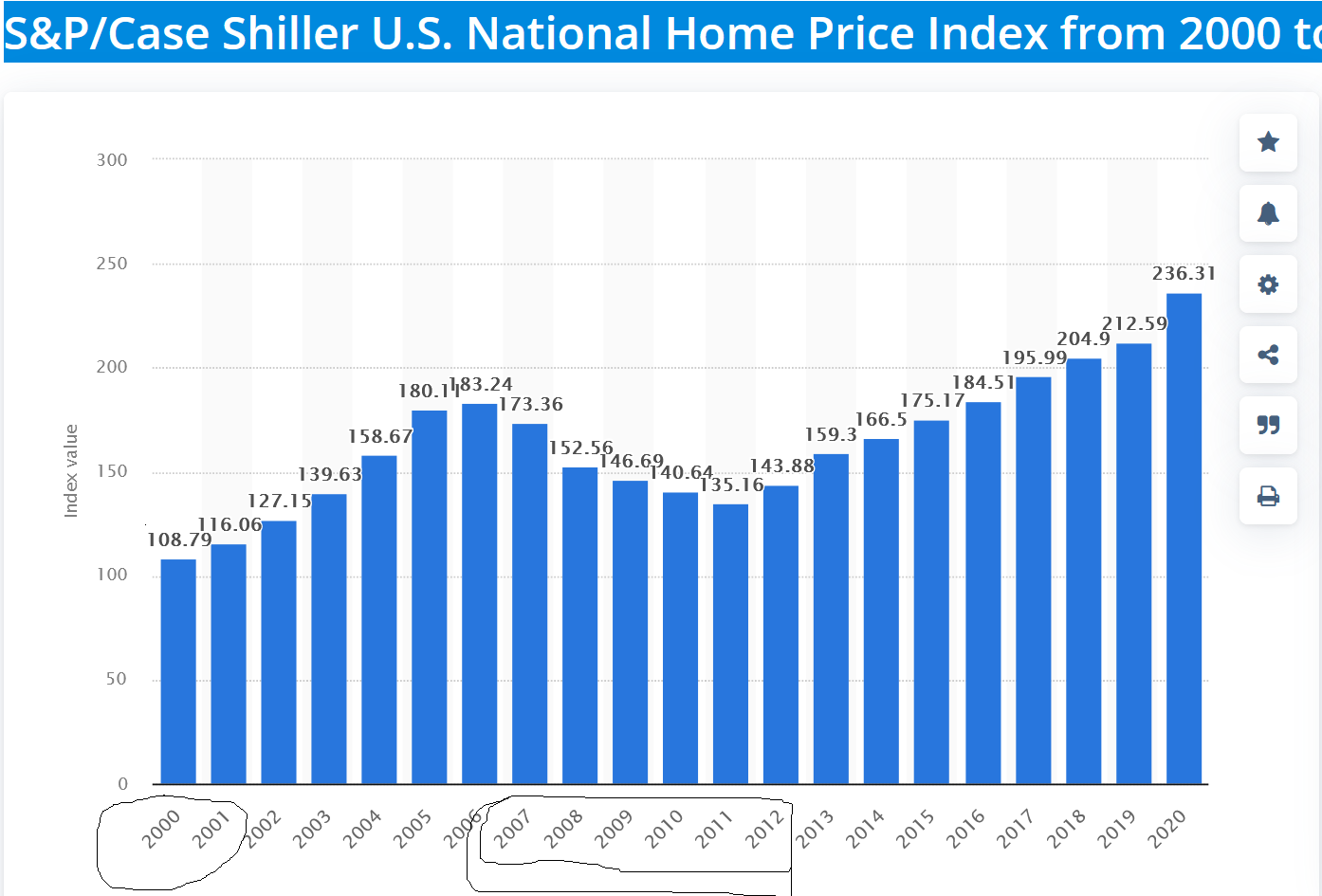

It has been quite the year for the stock market. As I am writing this blog, the market has already plunged 10% to kick off the year. Morgan Stanley just warned that stocks are more overvalued than the tech bubble. How will this impact real estate? What happened...

by Glen | Dec 22, 2021 | Atlanta Hard Money, Atlanta Private Lending, Denver Hard Money, Denver private Lending, Hard Money Lending, Housing Price Trends / Information, interest rates, mortgage rates, private lender, Private Lending, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation, Underwriting/Valuation

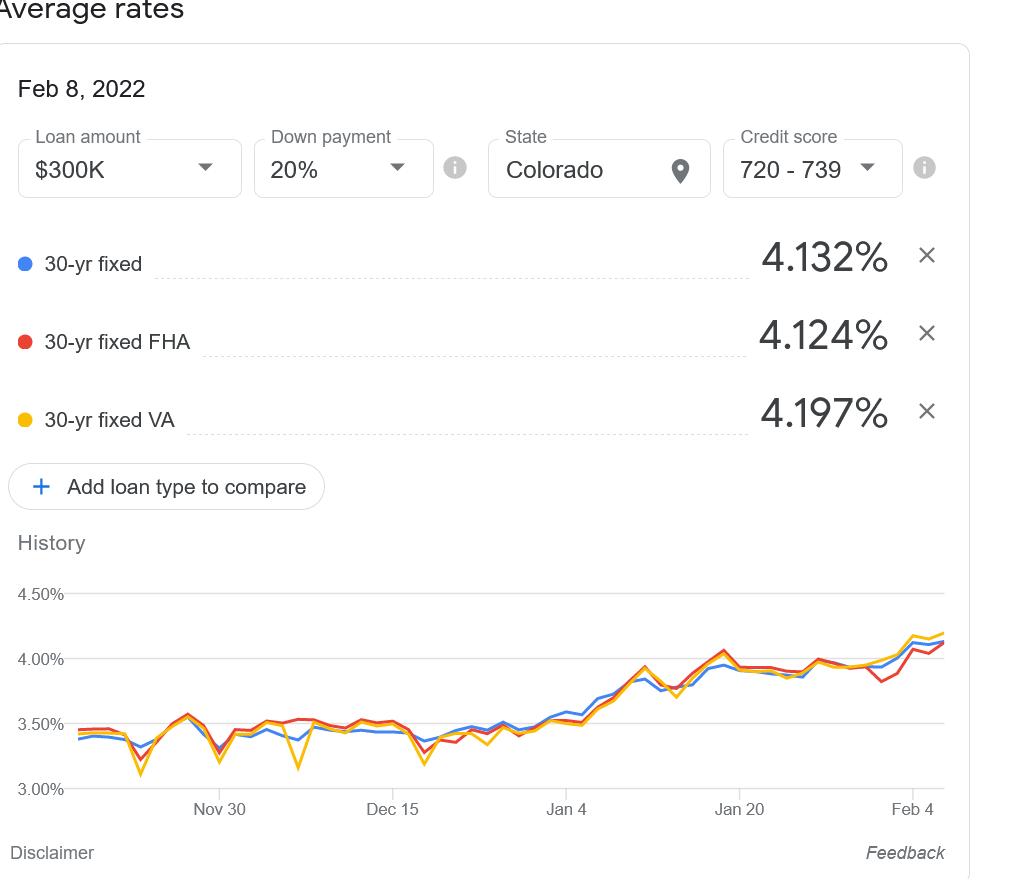

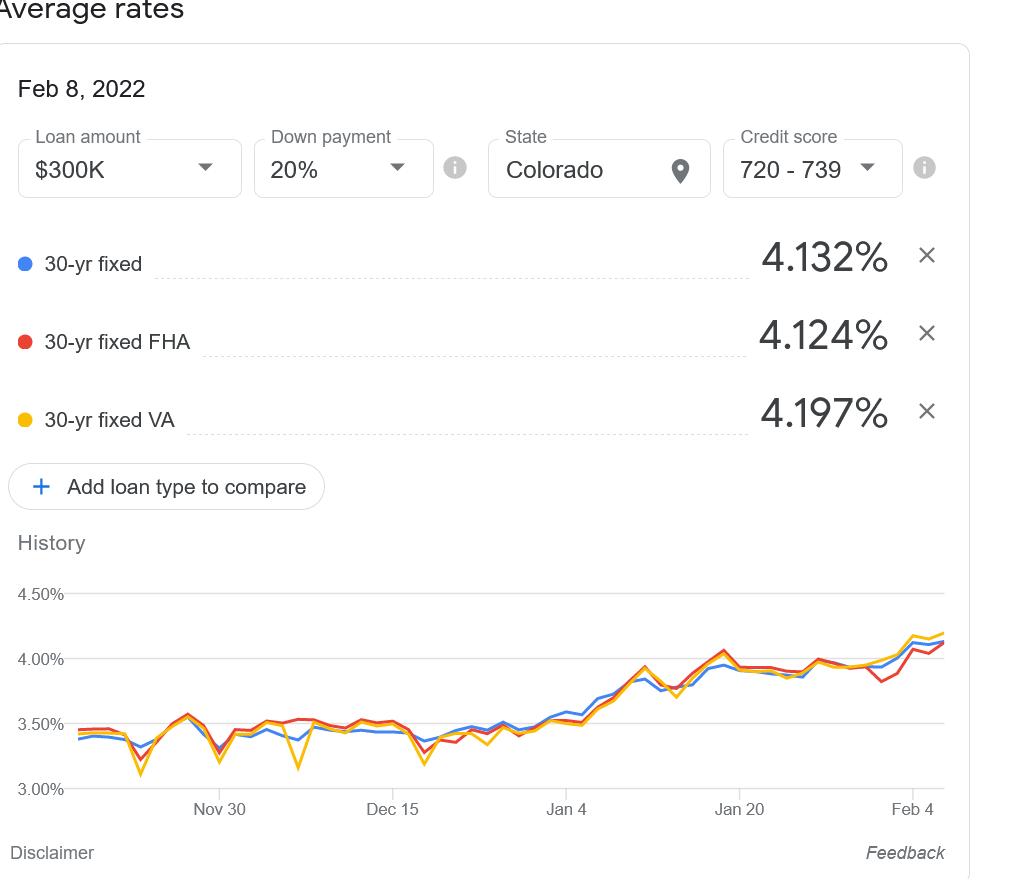

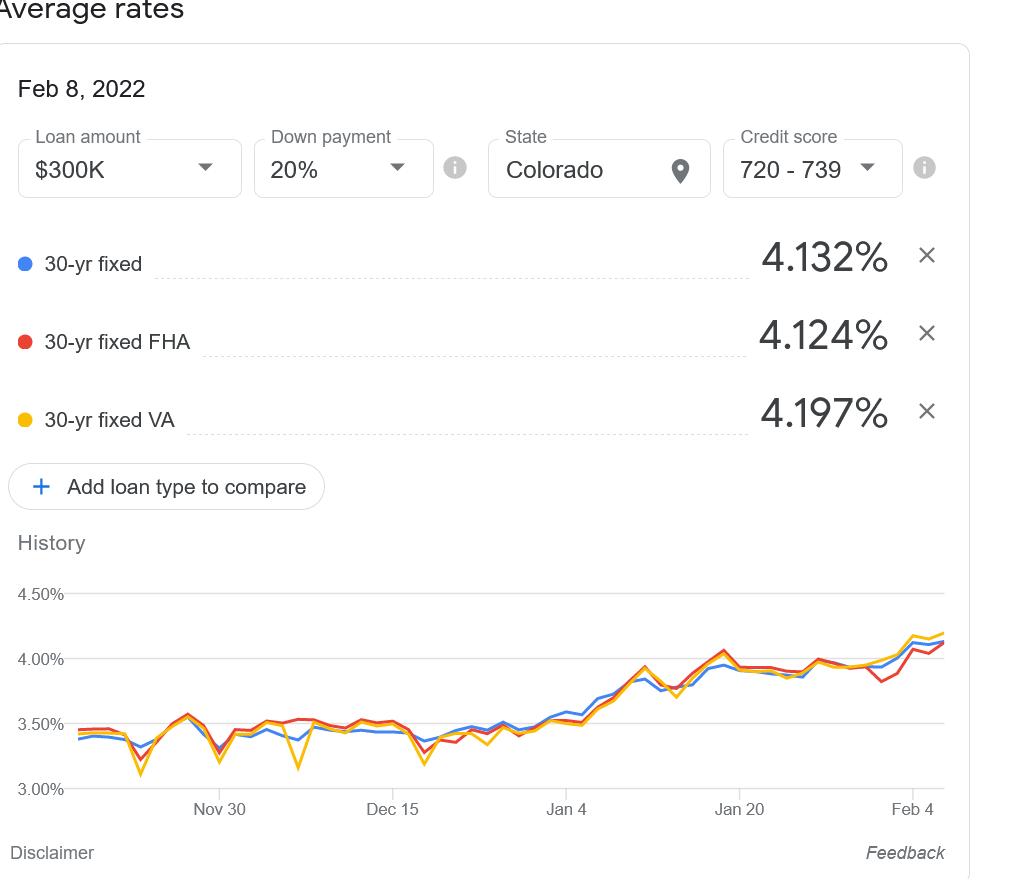

I hope everyone is having a happy holiday season. Before getting into my predictions for next year, there are three crucial factors to discuss that will shape the real estate market in 2022 and beyond. Interest rates, inflation, and where the pandemic goes from here....

by Glen | Jul 20, 2021 | Colorado ski real estate, General real estate financing information, Hard Money Commercial Lending, Hard Money Lending, Housing Price Trends / Information, interest rates, mortgage rates, nightly rental real estate, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing

According to a recent Well’s Fargo economic report: the forecast for the level of services spending is expected to swell to more than four and a half years of typical spending packed into nine months. What does this transition from goods to services mean for real...

by Glen | Apr 21, 2021 | private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation

For years Zillow has been buying houses, but they have refused to use the Zestimate as their purchase price. The cards have now turned with Zillow announcing that the “Zestimate” is now the price they will pay for your house. How will this change allow Zillow to...

by Glen | Mar 29, 2020 | Coronavirus 2020 real estate impact, hard money, Other Questions, private lender, Private Lending, Process/Loan Submittal, Program Details

The Coronavirus pandemic has thrown the economy off a cliff leaving many equity rich property owners with no cash flow. The pandemic has caused many residential and commercial tenants to defer or totally miss payments as the economy shuts down. Property owners are...