by Glen | Sep 5, 2022 | 2022 real estate predictions, 2023 real estate prediction, 90s real estate recession, Atlanta Hard Money, Colorado Hard Money, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates

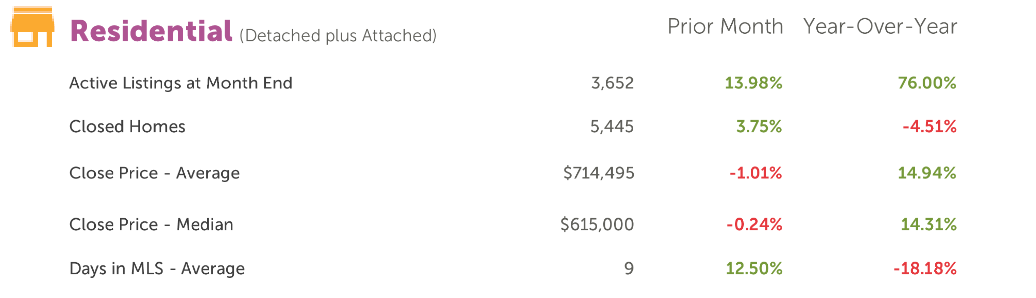

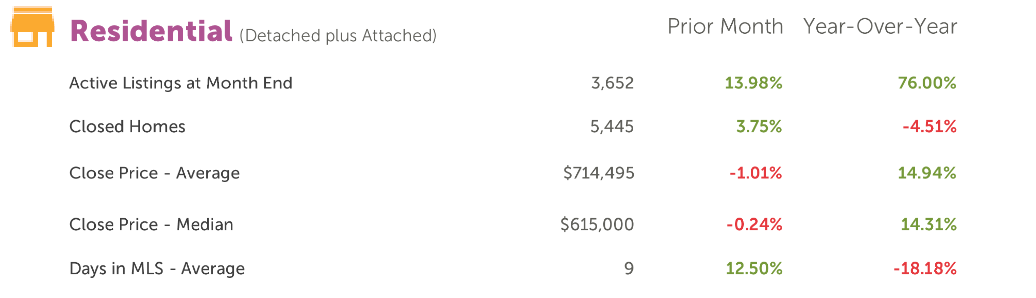

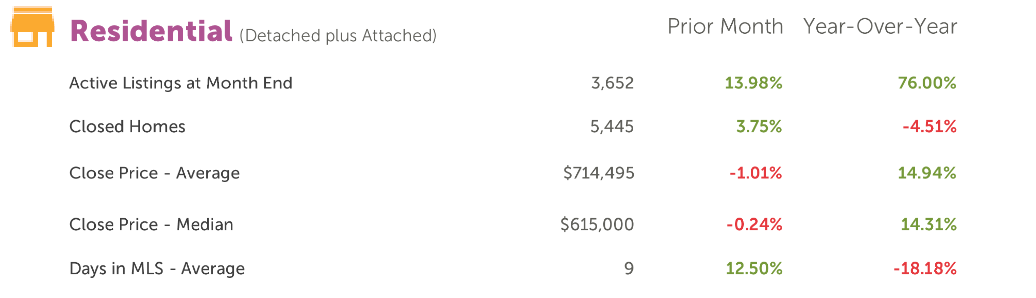

The National Association of Realtors predicts sales to rise again throughout 2023. At the same time, demand for mortgage refinances are down 83% from a year ago. Applications for a loan to purchase a home were 18% lower than the same week one year ago. Signed...

by Glen | Aug 25, 2022 | 2023 real estate prediction, 90s real estate recession, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Denver Hard Money, Denver private Lending, if there is a recession what happens to real estate, mortgage rates, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation

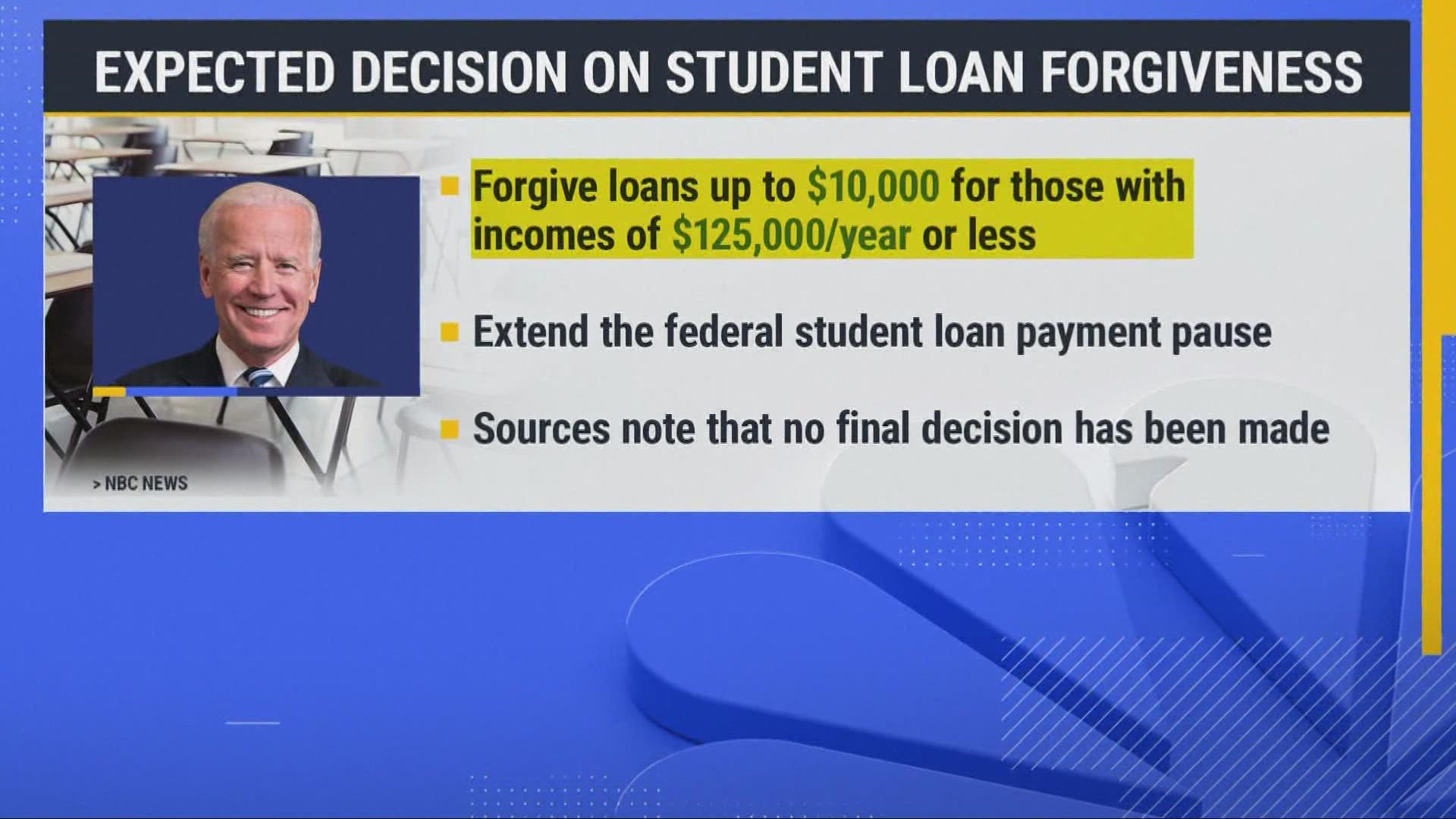

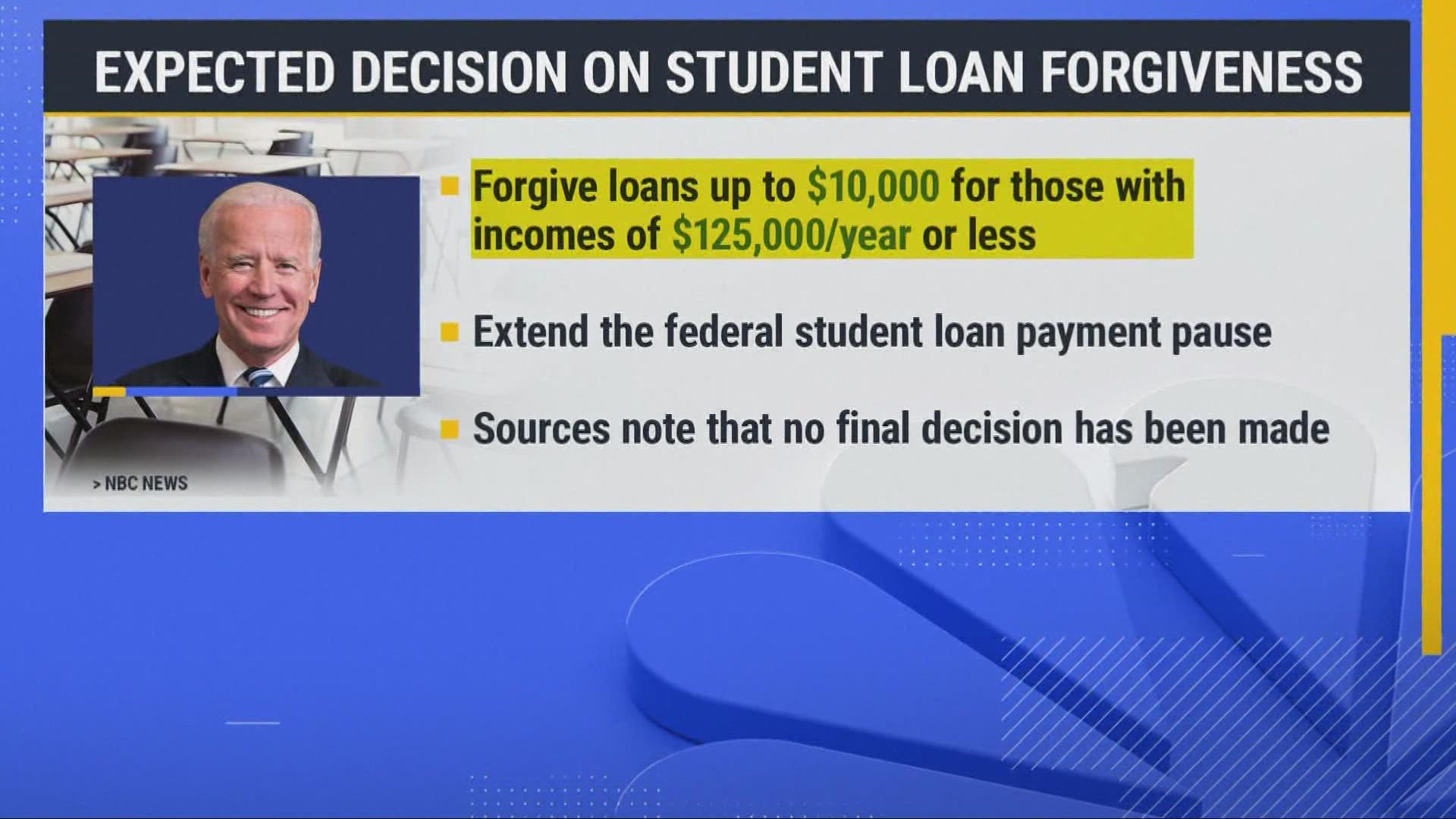

As of the writing of this article, President’s Biden’s plan is to forgive 10k in student loan per each borrower and further extend the payment pause until year end. How will this forgiveness impact real estate prices, mortgage rates, and prospective purchasers? What...

by Glen | Aug 15, 2022 | 2022 real estate predictions, 2022 stock market correction impact on real estate prices, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, CO hard money, Colorado Hard Money, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, hard money, Hard Money Commercial Lending, hard money loans, Housing Price Trends / Information, if there is a recession what happens to real estate, interest rates, mortgage rates, private lender, Private Lending

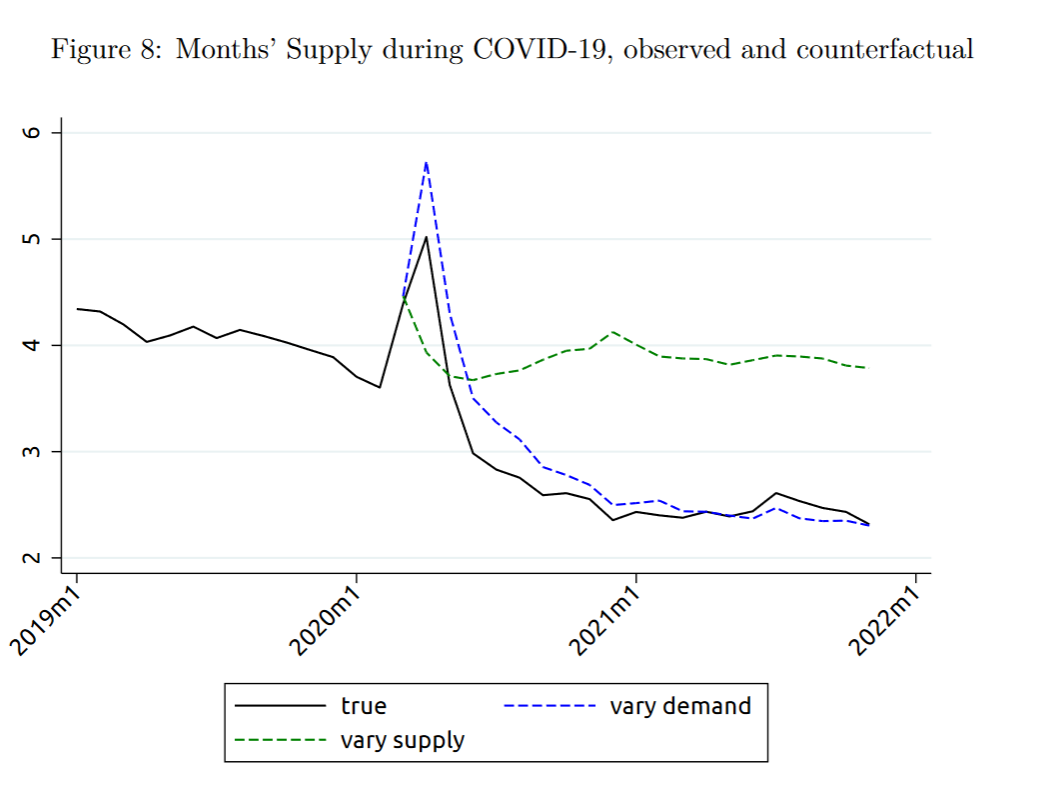

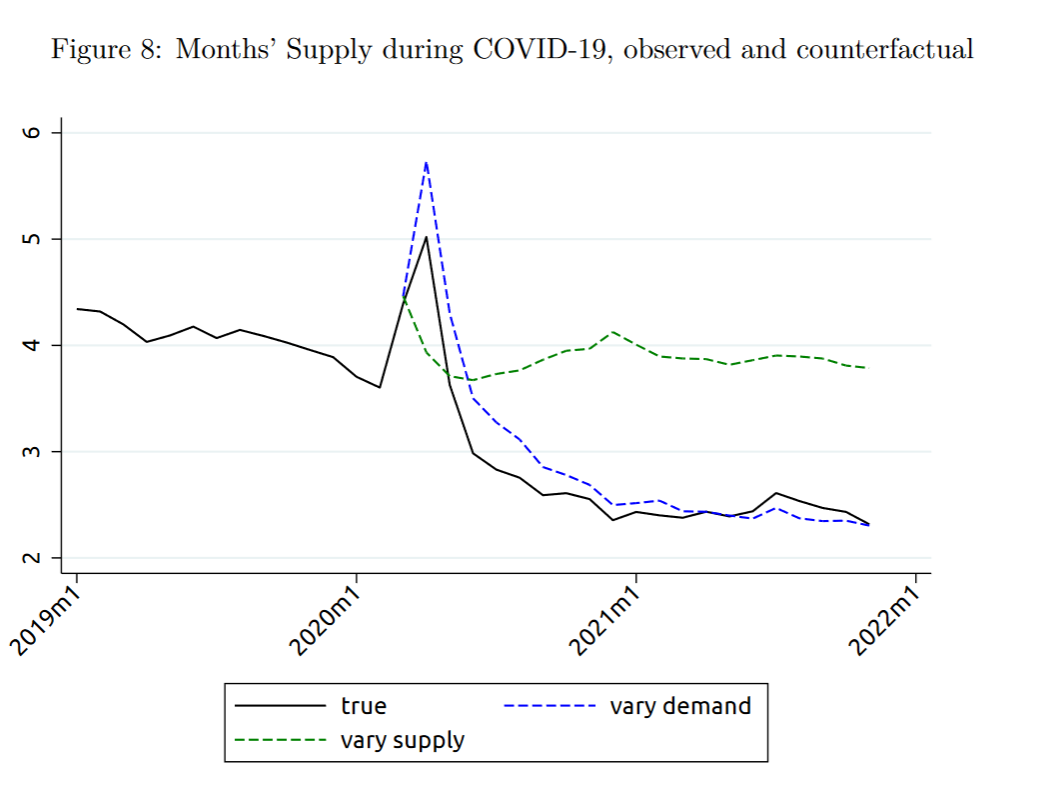

The federal reserve did an analysis of what has led to the surge in housing prices and has a conclusive answer; the driver of high prices is not that we don’t have enough houses as the media has been claiming. What is the real culprit behind soaring prices? Is there...

by Glen | Aug 8, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Colorado ski real estate, Commercial Lending in the news, Commercial Lending valuation, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates

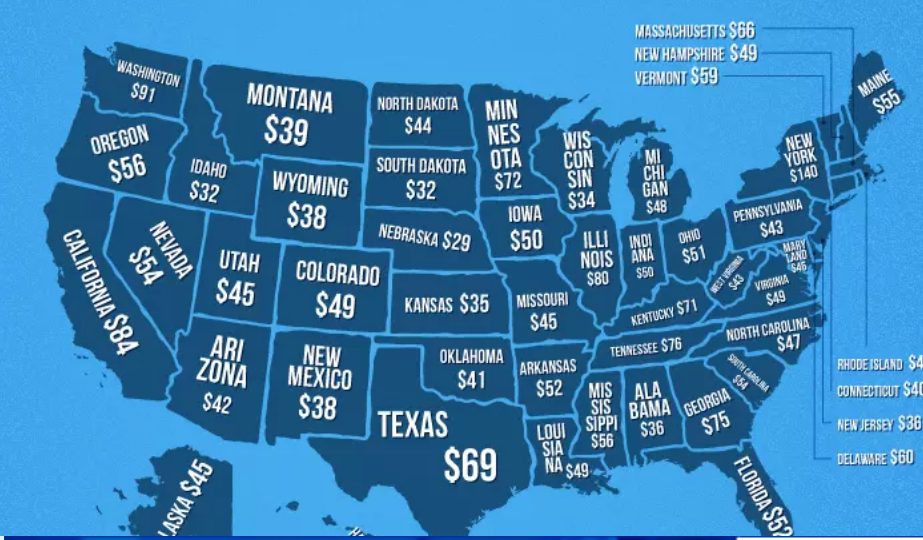

If you haven’t gotten a haircut in a while, you are in for a surprise. Haircut prices like many other services in the economy are experiencing large increases. What does the increase in haircut prices mean for the economy and in turn real estate? Why are haircuts...

by Glen | Jul 25, 2022 | 2022 real estate predictions, 2022 stock market correction, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, Property Valuation, real estate investing, Real Estate Trends, Real estate Valuation, recession, recession impact on real estate, Residential hard money, residential lending valuation

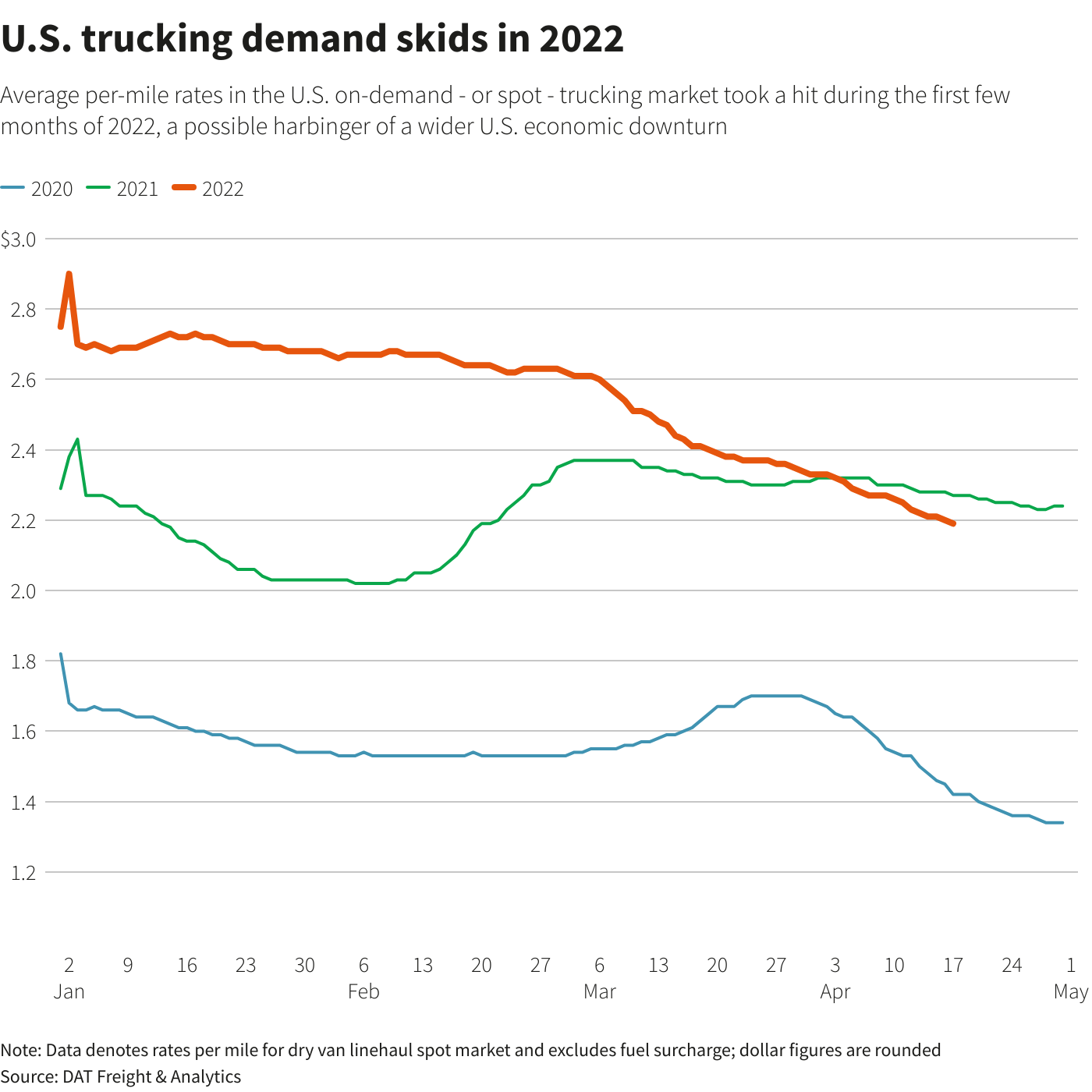

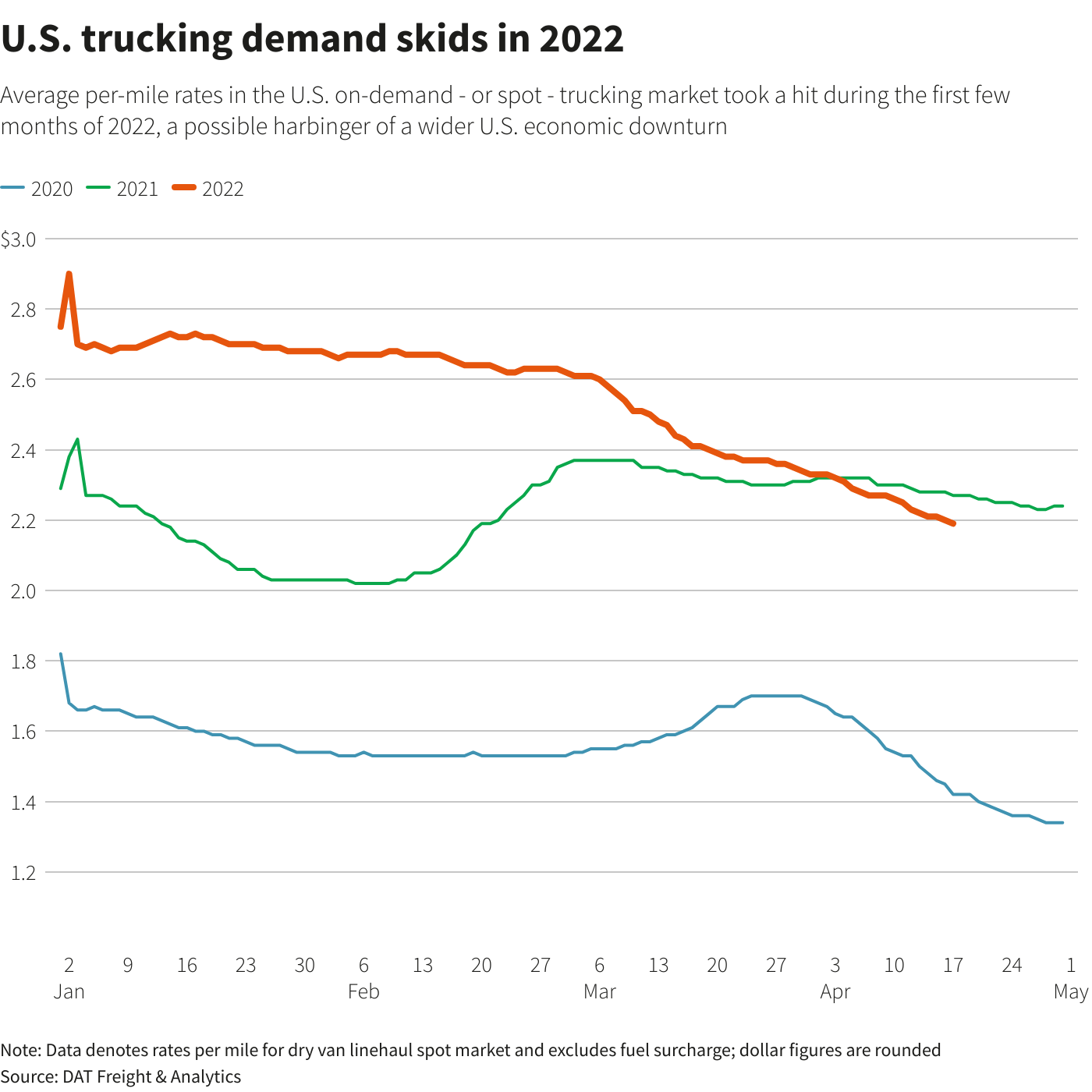

There has been an unexpectedly sharp downturn in demand to truck everything from food to furniture since the beginning of March and rates in the overheated segment that deals in on-demand trucking jobs – known as the spot market – are skidding. Why are...

by Glen | Jun 6, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, Government Bailout, hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

One of the world’s bubbliest real estate housing markets is tilting from sellers to buyers with dizzying speed. Canadian home prices fell for the first time in two years as a rapid rise in interest rates looks set to threaten one of the world’s hottest housing...