by Glen | Nov 21, 2022 | 2023 real estate prediction, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Commercial Lending valuation, credit scoring, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, real estate investing, Real Estate Trends, Residential hard money, residential lending valuation

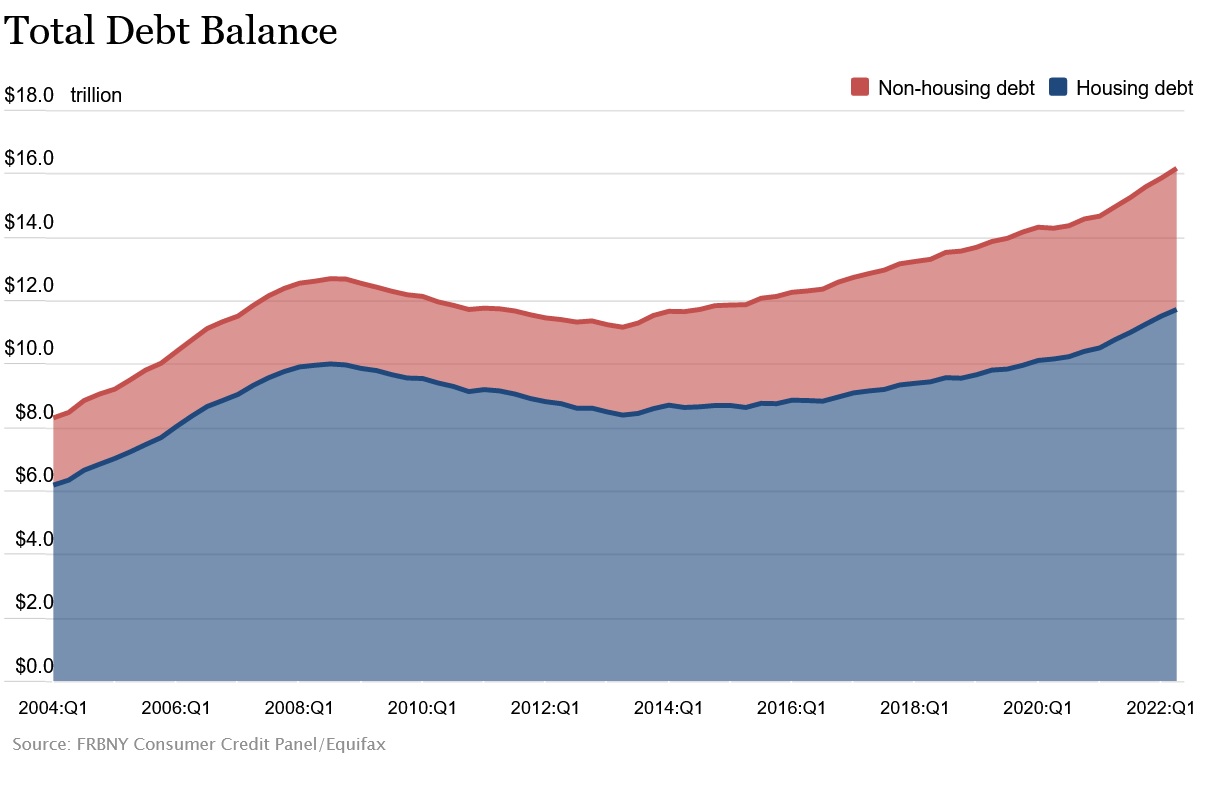

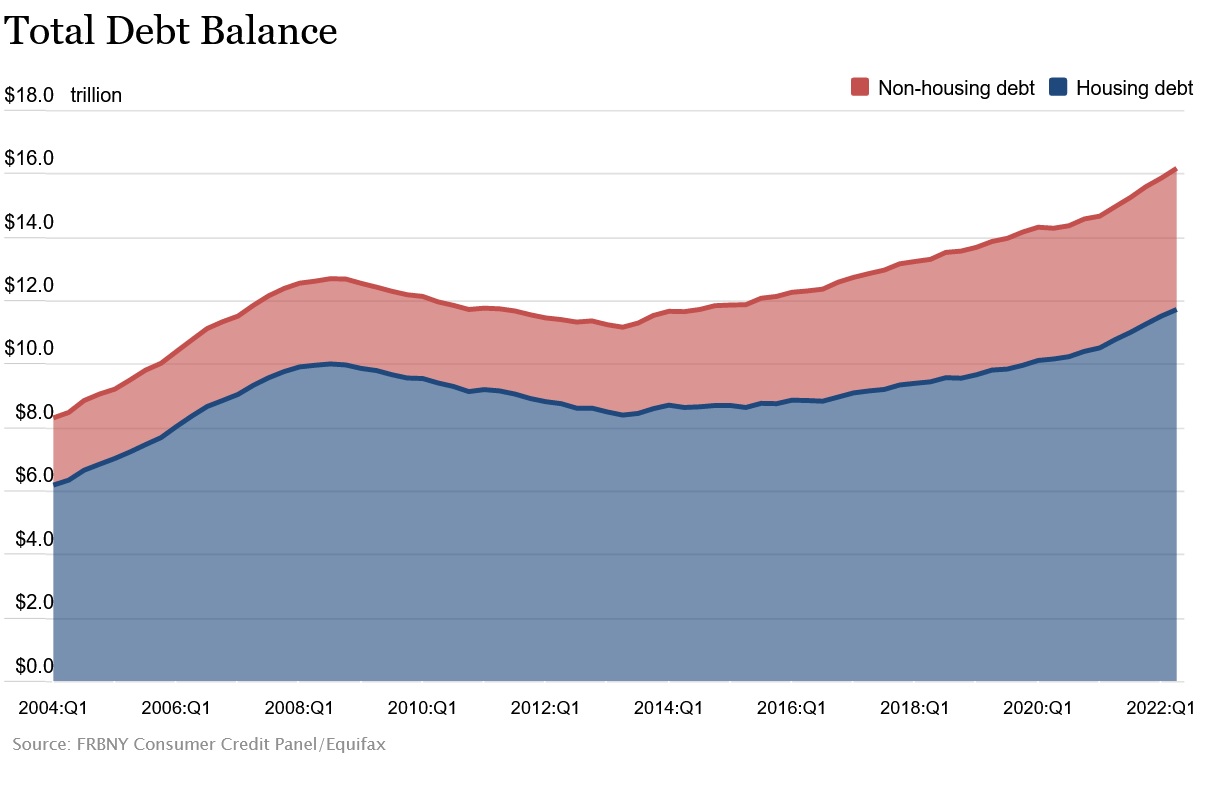

The federal reserve bank of NY recently published a report showing consumer debt jumping to the highest levels ever recorded with every category growing from mortgages, autos, credit cards, lines of credit, etc… Is some consumer debt better/worse than others for the...

by Glen | Nov 14, 2022 | 2022 real estate predictions, 2023 real estate prediction, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates, Private Lending

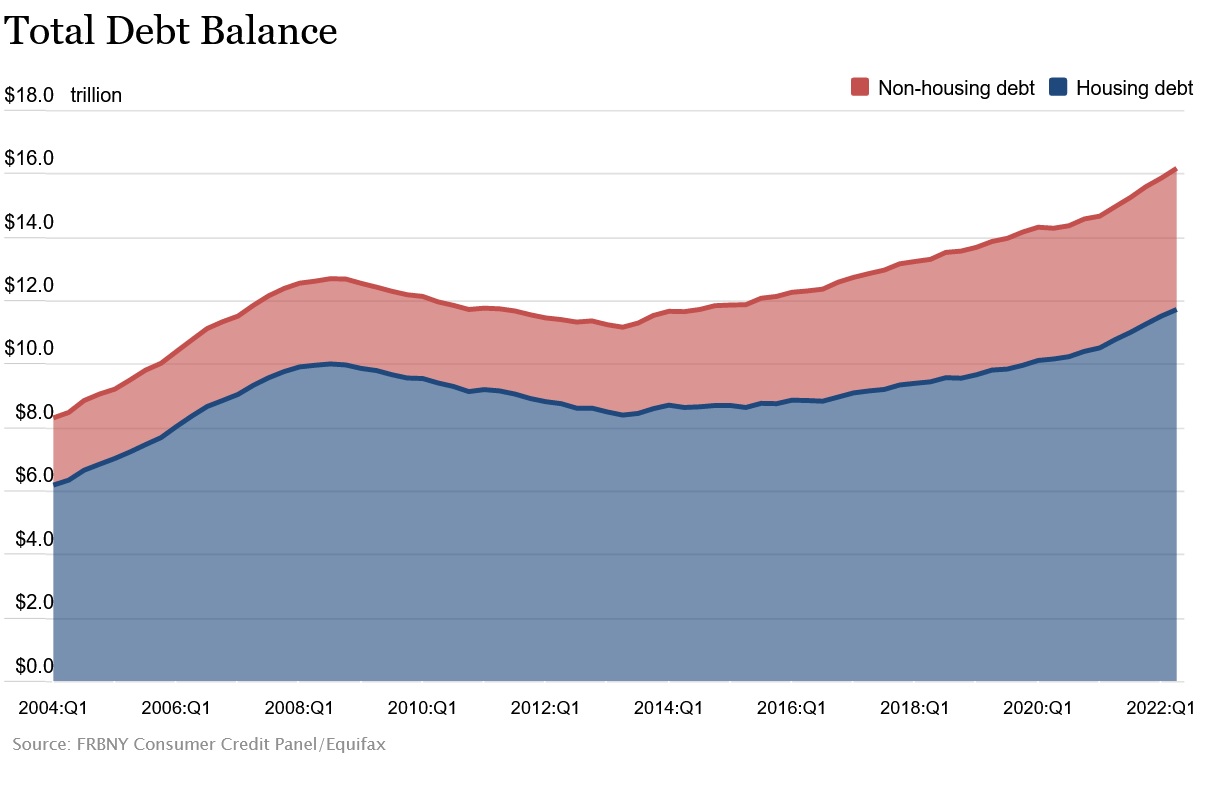

The prevailing theory is that this real estate cycle will be considerably better than others as so many people locked in rock bottom rates which will serve as “golden handcuffs” and prevent a meaningful increase in inventory. How accurate is this theory? What is the...

by Glen | Oct 17, 2022 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Denver Hard Money, Georgia hard money, hard money, Hard Money Commercial Lending, Hard Money Lending, hard money loans, interest rates, mortgage rates

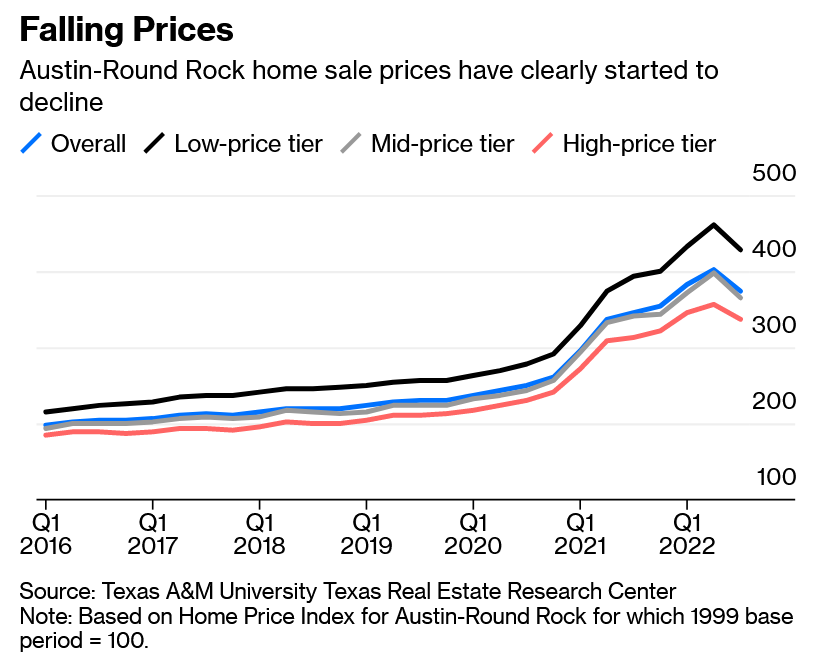

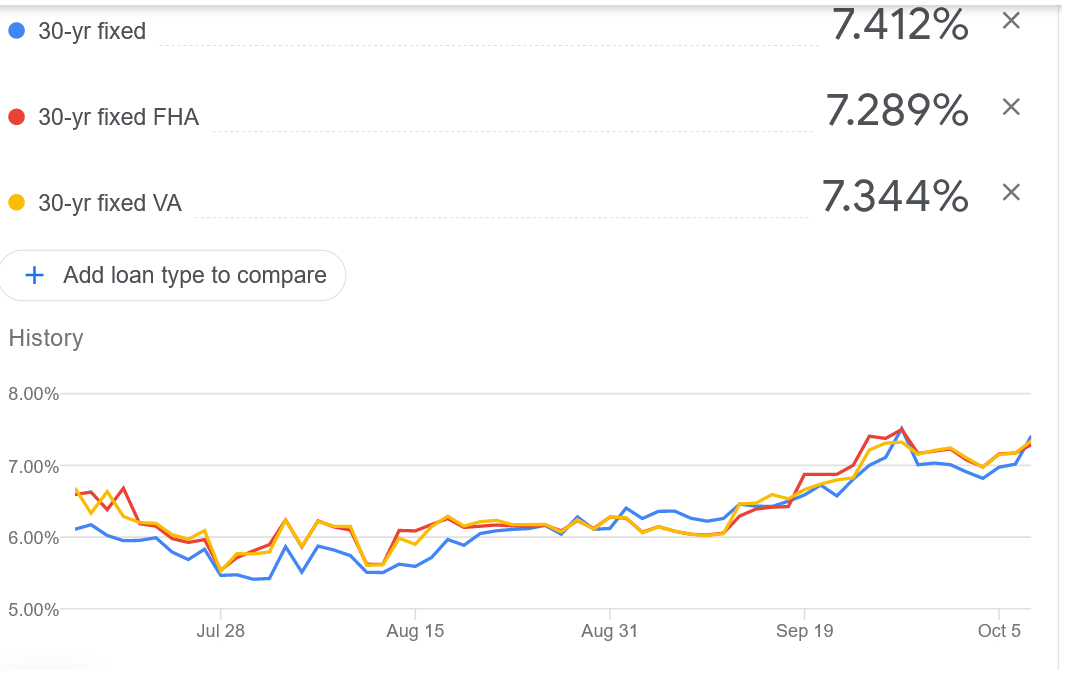

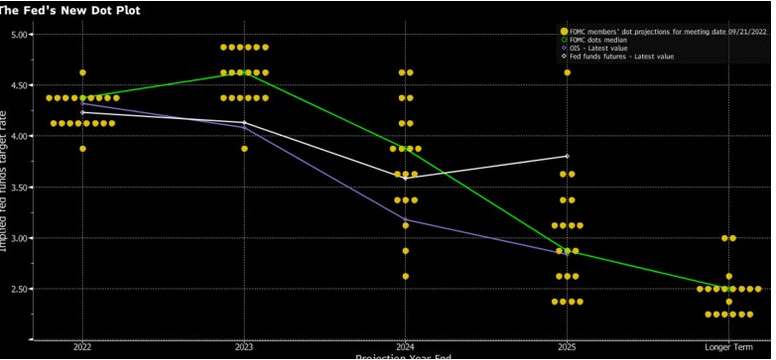

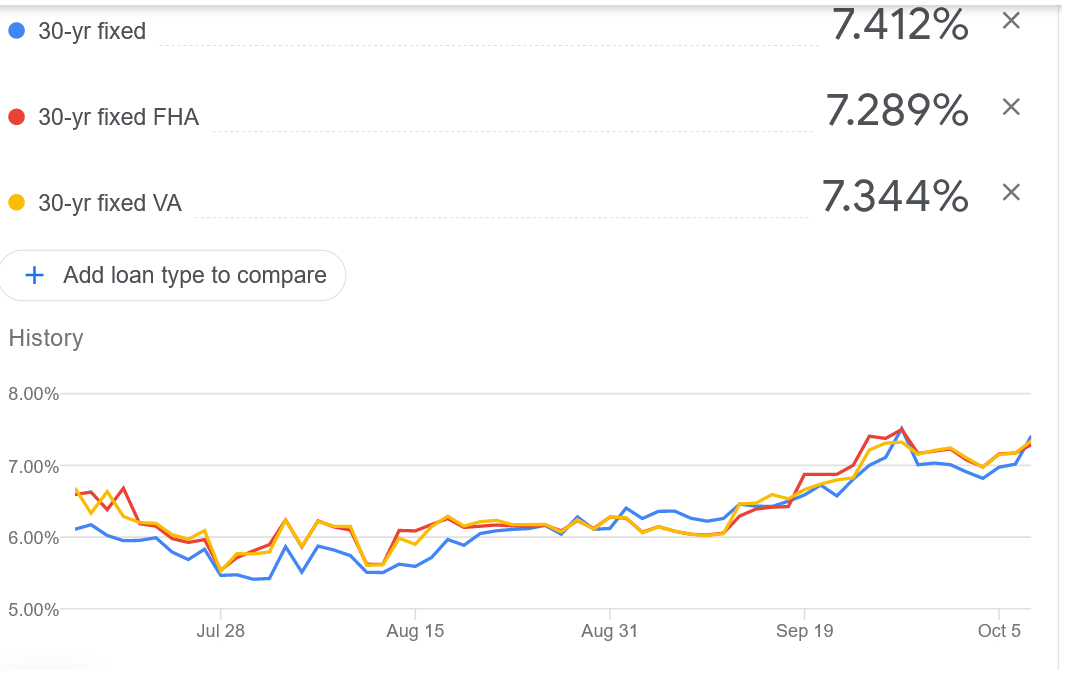

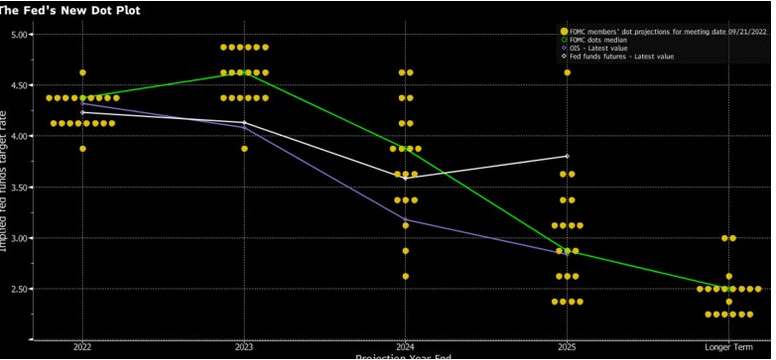

A few weeks ago, the big news was 6% rates and now everyone suddenly woke up with stocks crashing and yields soaring to new highs and rates jumping again. What does this mean in the short term for interest rates? Is focusing on the 30 year mortgage rate the correct...

by Glen | Oct 10, 2022 | 2022 real estate predictions, 2022 stock market correction impact on real estate prices, 2023 real estate prediction, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending, Hard Money in the News, Hard Money Lending, hard money loans, Housing Price Trends / Information, interest rates, mortgage rates, Property Valuation, Real Estate Trends, Real estate Valuation

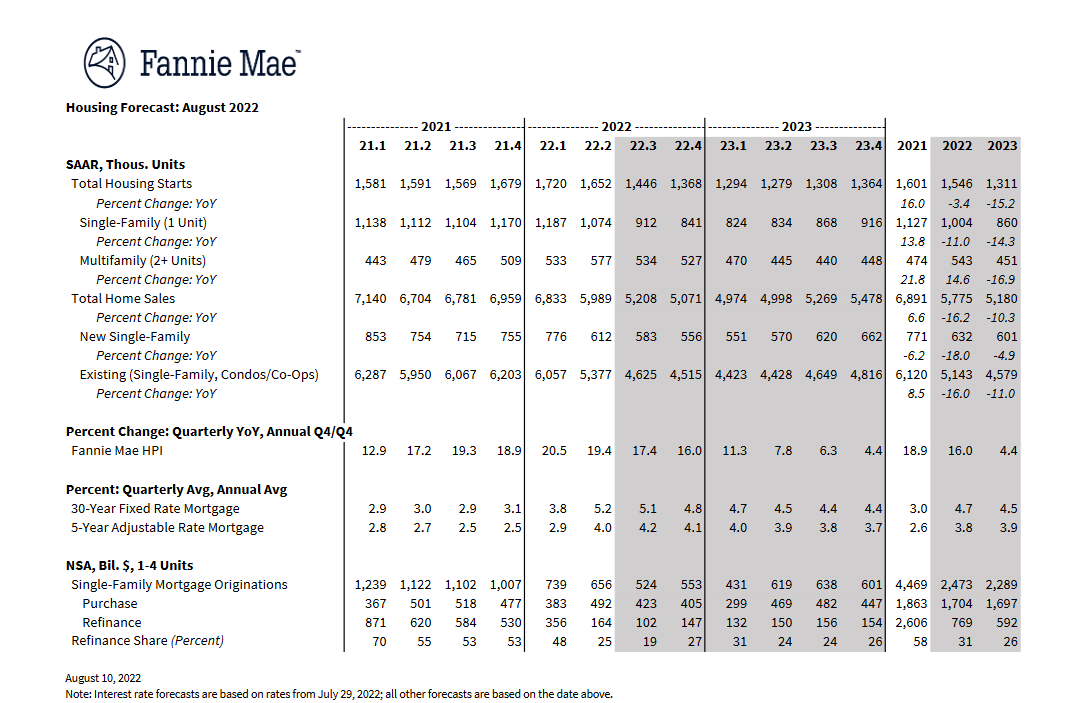

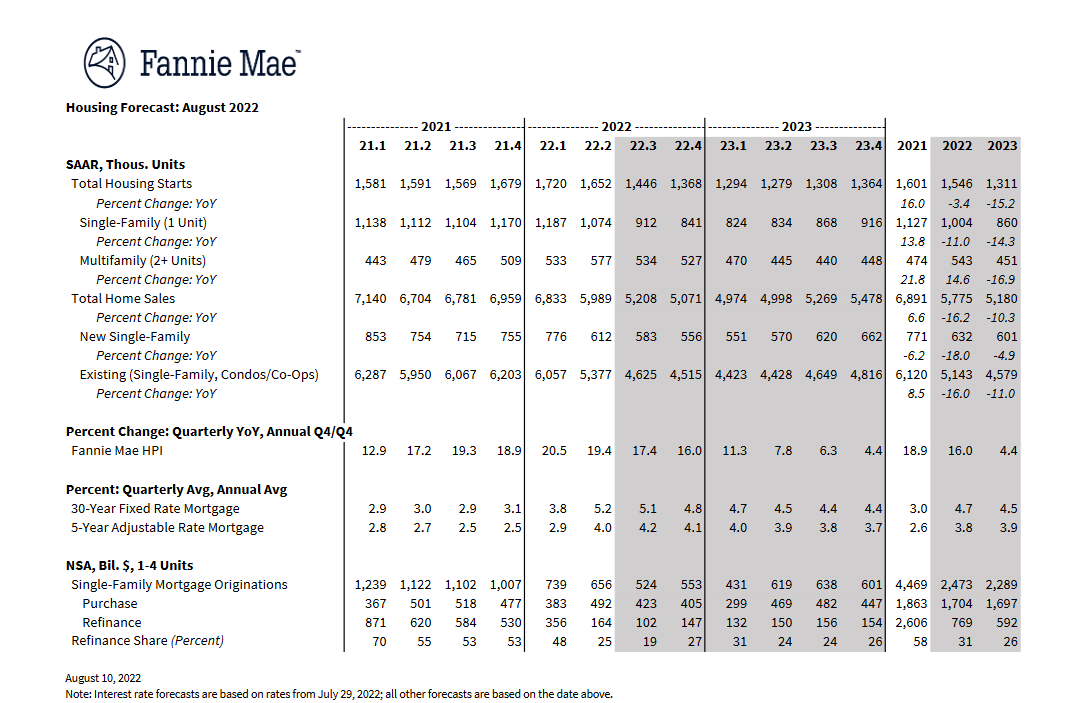

It will get much worse for the housing market and the mortgage industry. That’s the takeaway from a group of economists at Fannie Mae who slashed their forecast for 2022 home sales this week. Federal Reserve chairman Powell recently threw even more cold water on their...

by Glen | Oct 3, 2022 | 2022 real estate predictions, 2023 real estate prediction, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, commercial hard money, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates

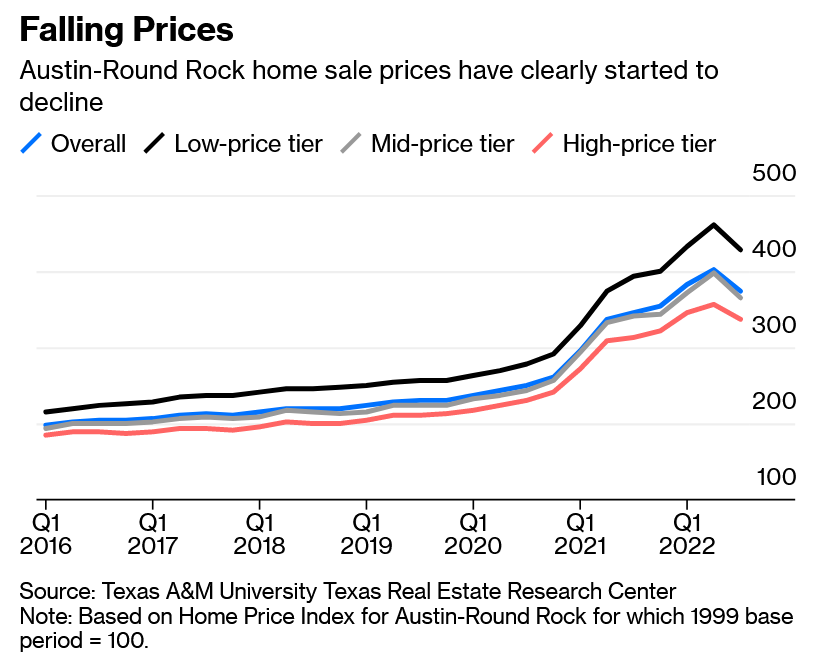

Home values slipped for the second consecutive month as mortgage costs continue to sideline buyers. From June through August, prices usually decline about 2%, but this year they have fallen about 6%. At the same time, mortgage rates hit highs of around 6.4%. ...

by Glen | Sep 13, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, 2023 real estate prediction, Atlanta Hard Money, Atlanta Private Lending, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates

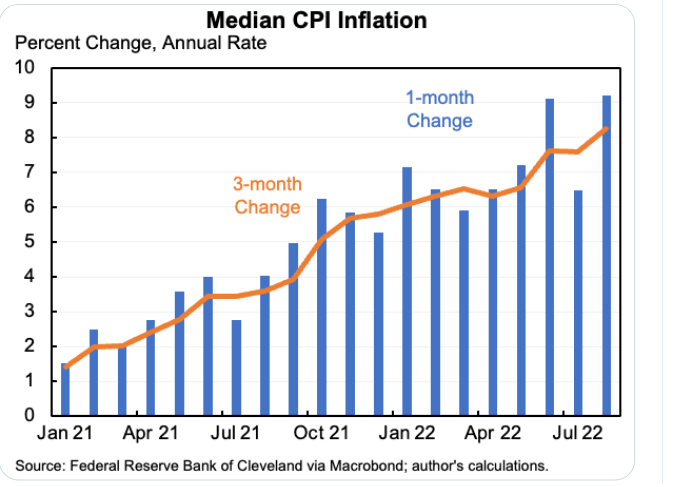

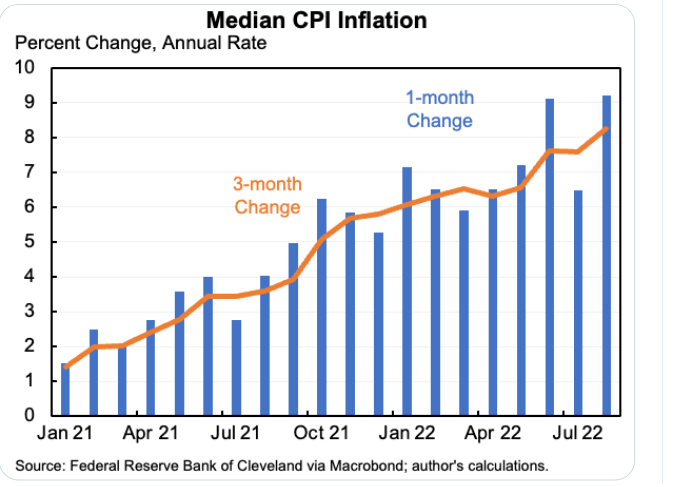

Once again, the recent CPI report came in much higher than expected. Why did the market drastically miss this prediction? I’m not even an economist and figured out months ago inflation would be higher for longer as everything I buy from groceries, dining out,...