by Glen | Jul 3, 2023 | Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, Private Lending

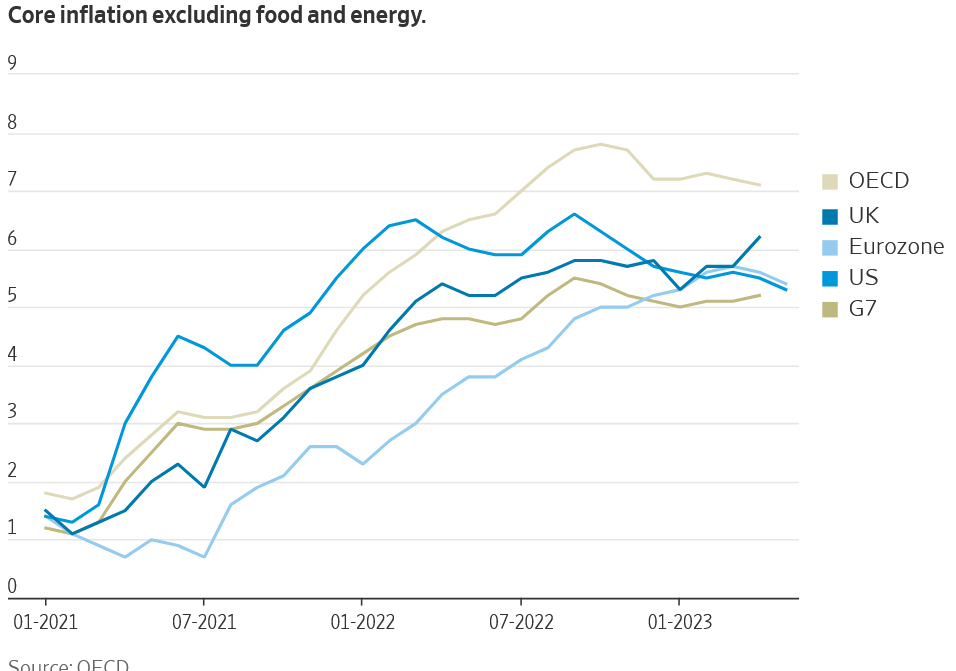

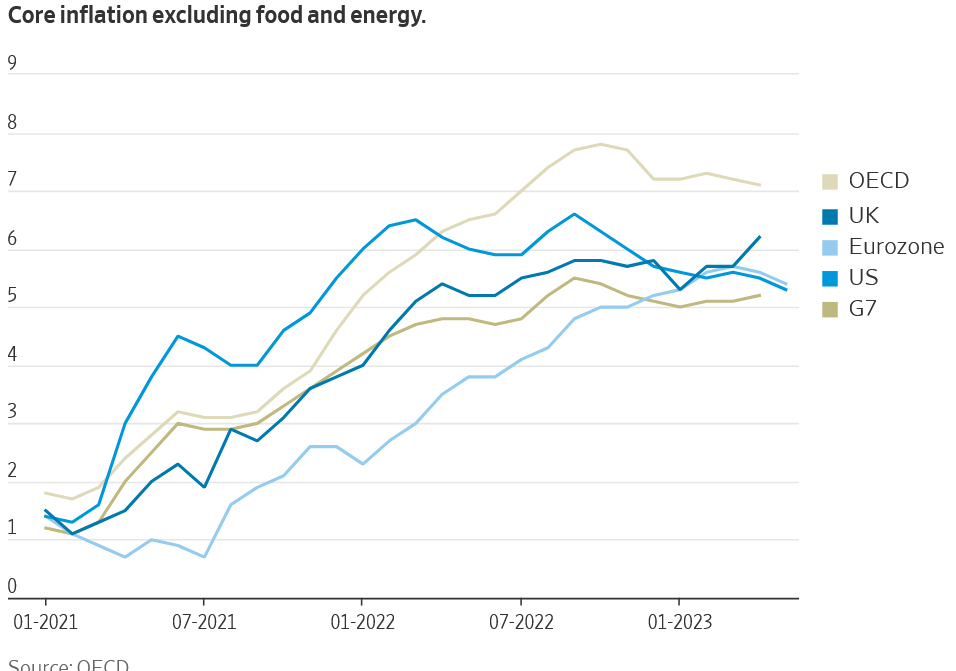

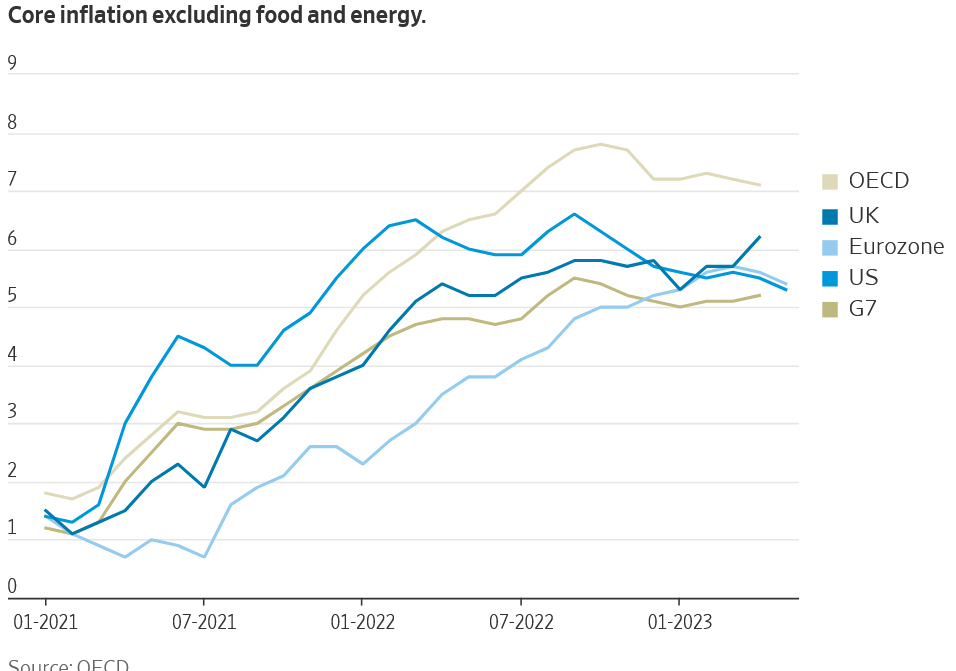

Although the market rejoiced in the recent fed “skip”, as you dig into the numbers more the outcome is a lot less sanguine. Why does inflation continue running hotter than anticipated? What does this mean for interest rates and real estate? What happens when...

by Glen | Jun 19, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, hard money, Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

Interesting times we are in. Consumers keep spending big on services like travel and eating out, but on the flip side Home Depot just reported its first drop since the pandemic. On the other hand Target tops earnings estimates. What is driving the continued...

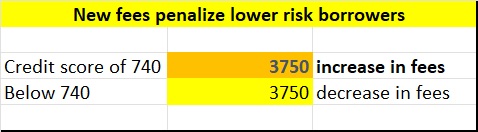

by Glen | May 8, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Biden tax plan, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, credit scoring, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending, interest rates, mortgage rates

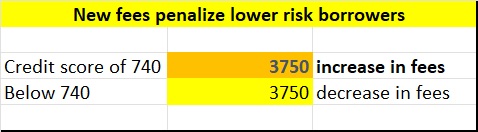

No this is not a joke, I had to read the recent Fannie Mae press release multiple times to actually believe what I was reading. Who would have ever thought that someone with a high credit score above 740 would be penalized for having a high score. Under a new rule...

by Glen | Mar 27, 2023 | Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, if there is a recession what happens to real estate, interest rates, mortgage rates

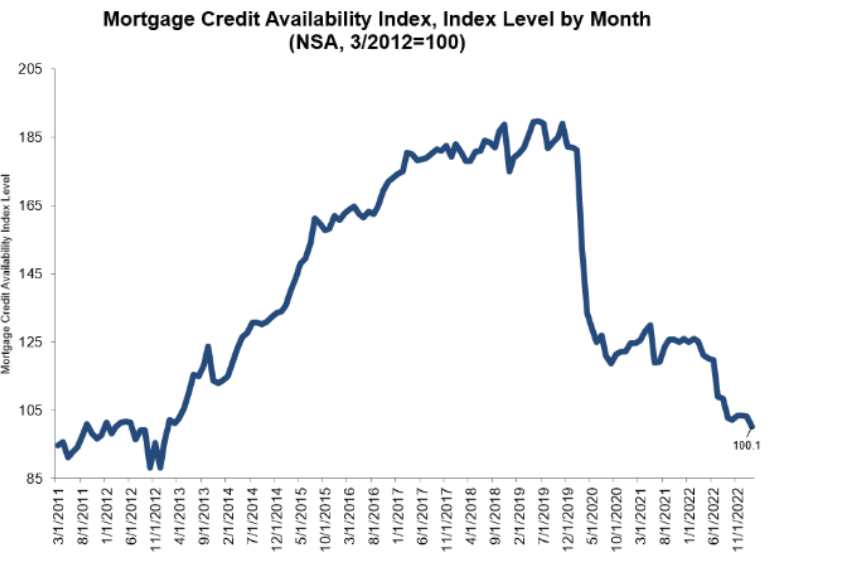

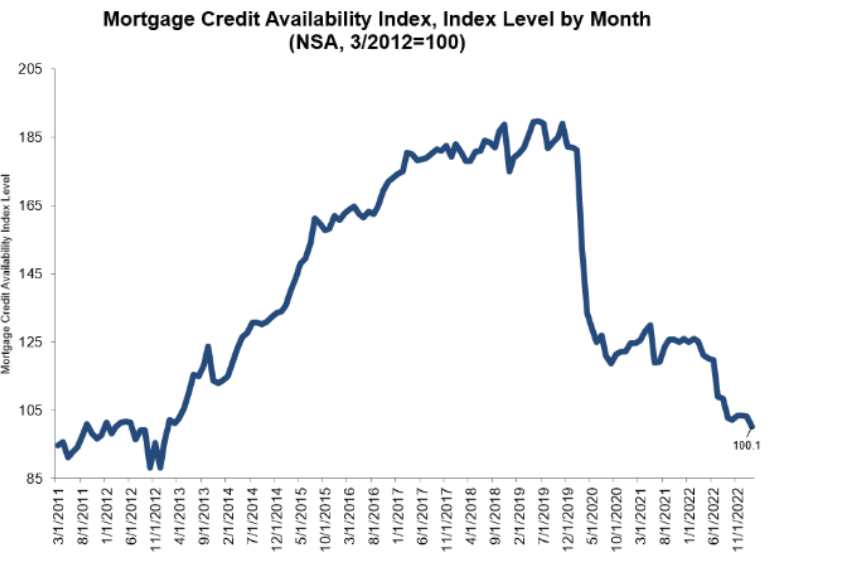

As a private lender, my call volume and closings the first quarter have been off the charts as borrowers fall out of more conventional products. This trend is now playing out with the Mortgage Credit Availability Index showing substantial tightening of credit for all...

by Glen | Mar 20, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, if there is a recession what happens to real estate, interest rates, mortgage rates, private lender, Private Lending

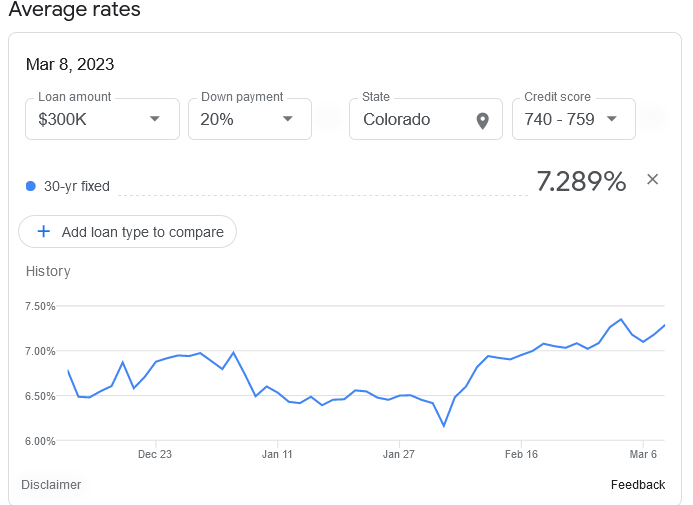

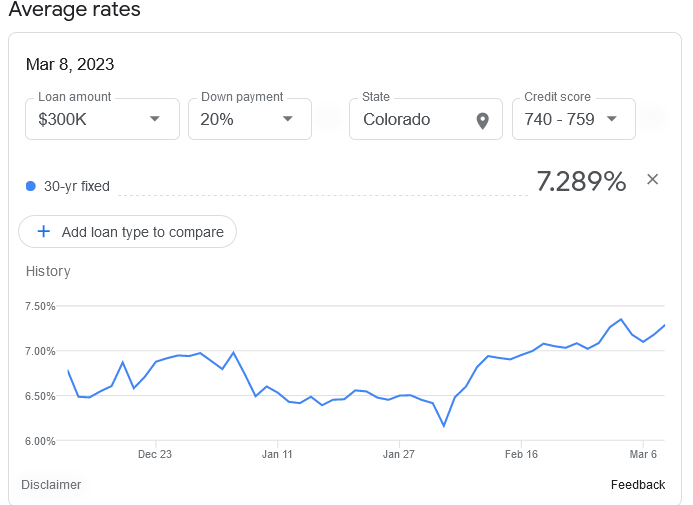

Wow, a few weeks ago rates had fallen from a peak of over 7% to almost 6%. Unfortunately the party was short lived as rates are now heading much higher. The recent jobs report was another blow out upping the odds of another half point increase at the next Fed...

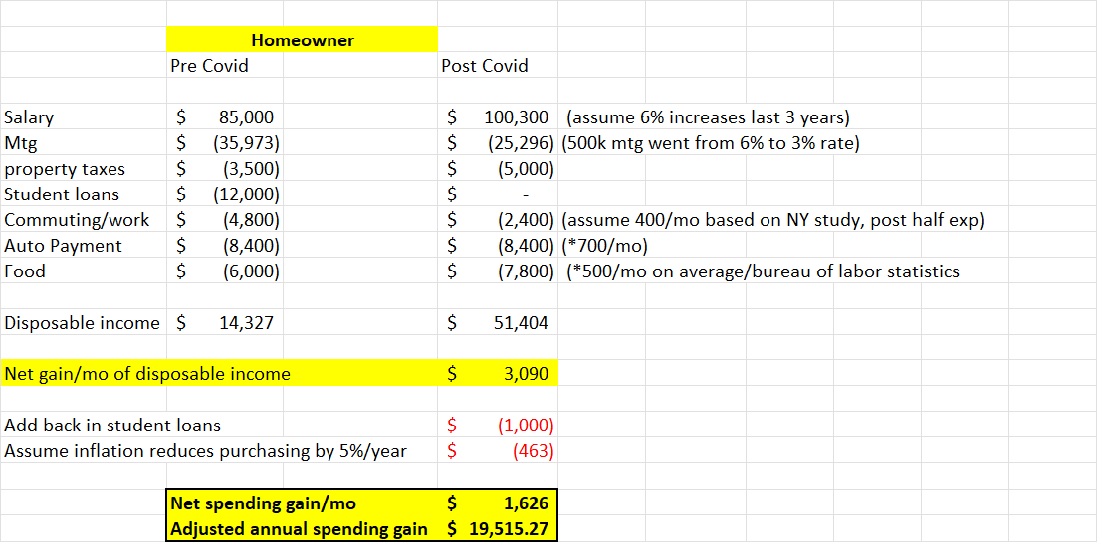

by Glen | Mar 6, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation, Realtor, recession, recession impact on real estate

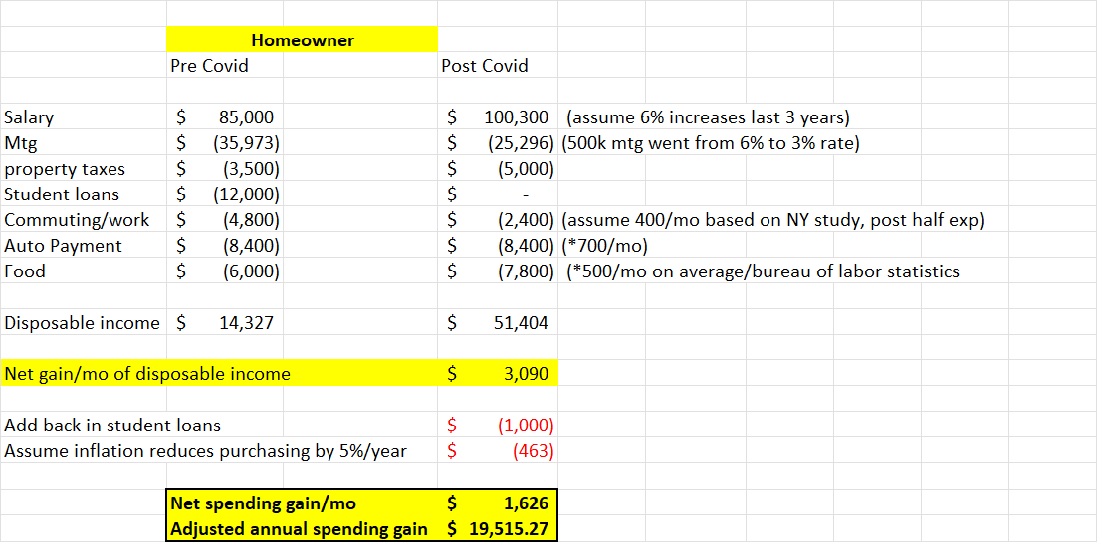

In only a couple of months, the world has changed substantially. In December, inflation was supposedly decreasing rapidly and the odds of a soft landing were non existent. Fast forward a few months and inflation is running hot, consumers are spending like crazy,...