by Glen | Aug 28, 2023 | 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Housing Price Trends / Information, interest rates, mortgage rates

In almost every real estate advertisement I receive, there is a common theme that prospective buyers should not focus on the rate as they will be able to refinance relatively soon at a much lower rate. How true is this theory? Are rates going to drop quickly like in...

by Glen | Aug 21, 2023 | 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, interest rates, mortgage rates

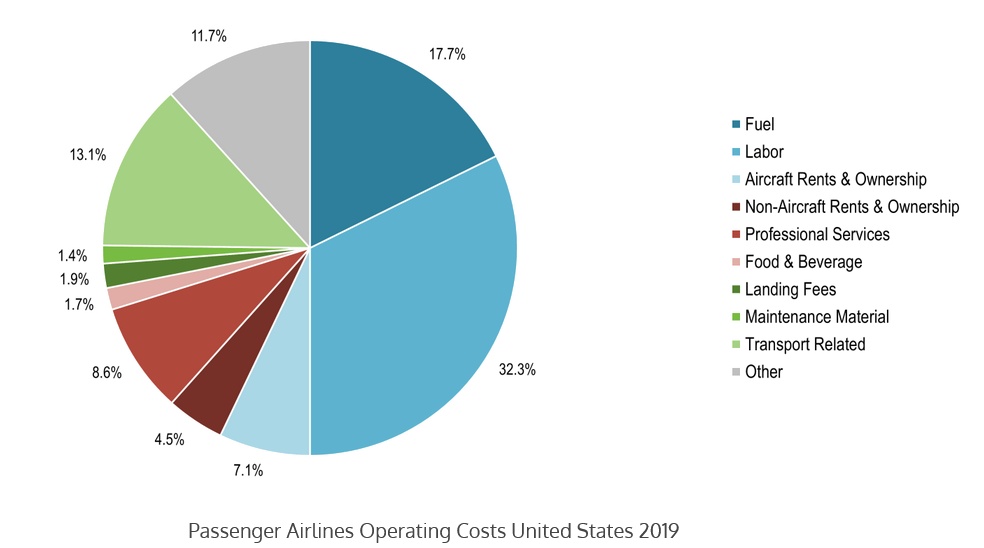

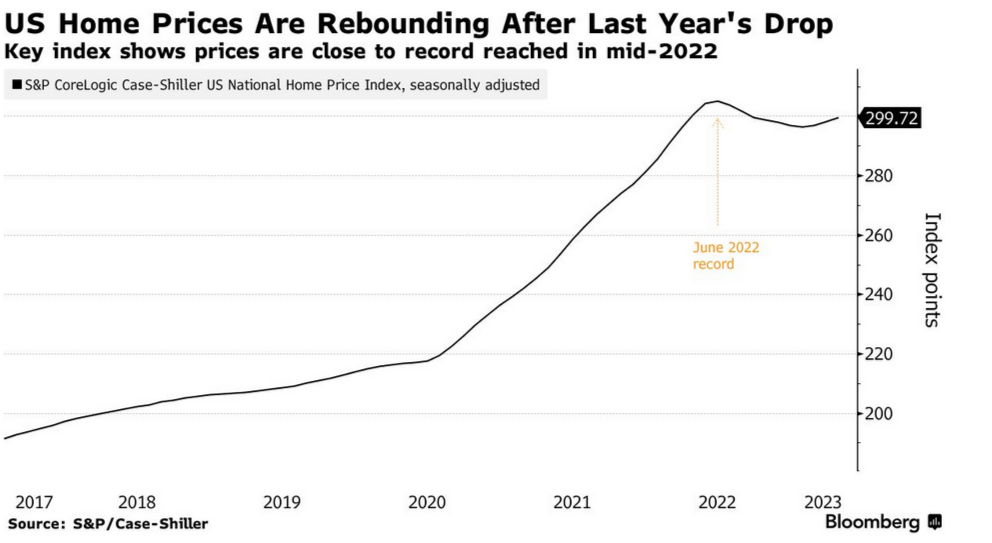

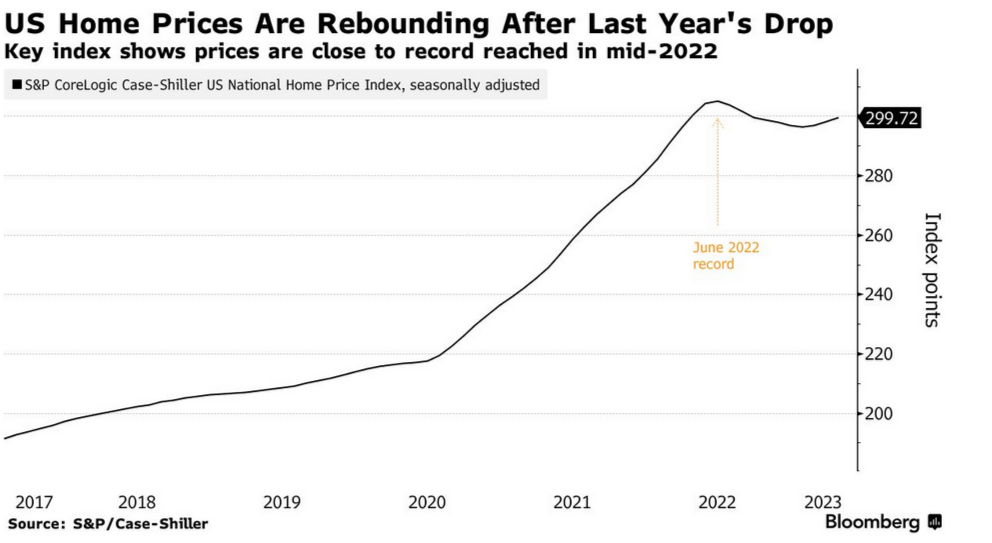

Like most, I have been surprised at the recent upward movement in prices. Did we just experience the shortest housing cycle ever? Are housing prices going to continue their recent upward swing? Why are housing prices now moving higher after a very shallow decline...

by Glen | Aug 14, 2023 | 2023 real estate prediction, 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Hard Money Lending, interest rates, mortgage rates

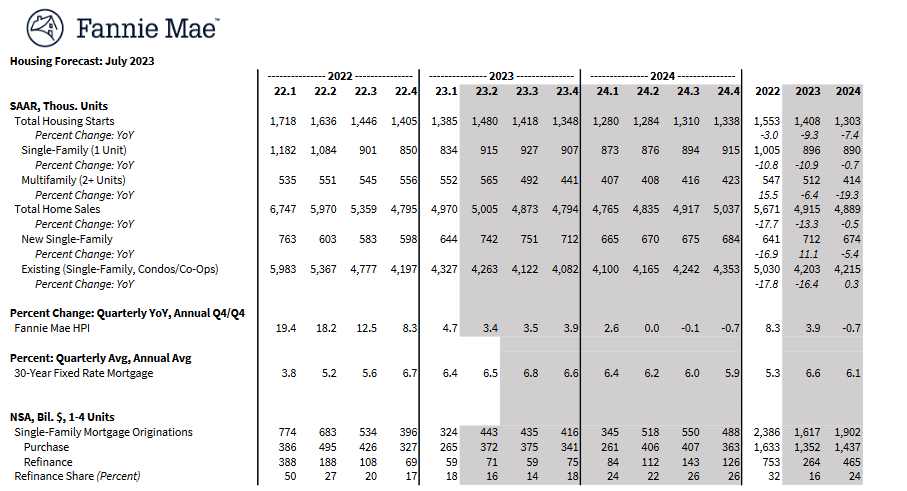

Both the stock and bond markets are partying like its 99 again. Fannie Mae, the largest buyer of US mortgages, is not buying into the theory that a soft landing is the base case for the economy. What is Fannie Mae predicting for inflation and in turn interest rates? ...

by Glen | Aug 7, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Housing Price Trends / Information, interest rates, mortgage rates

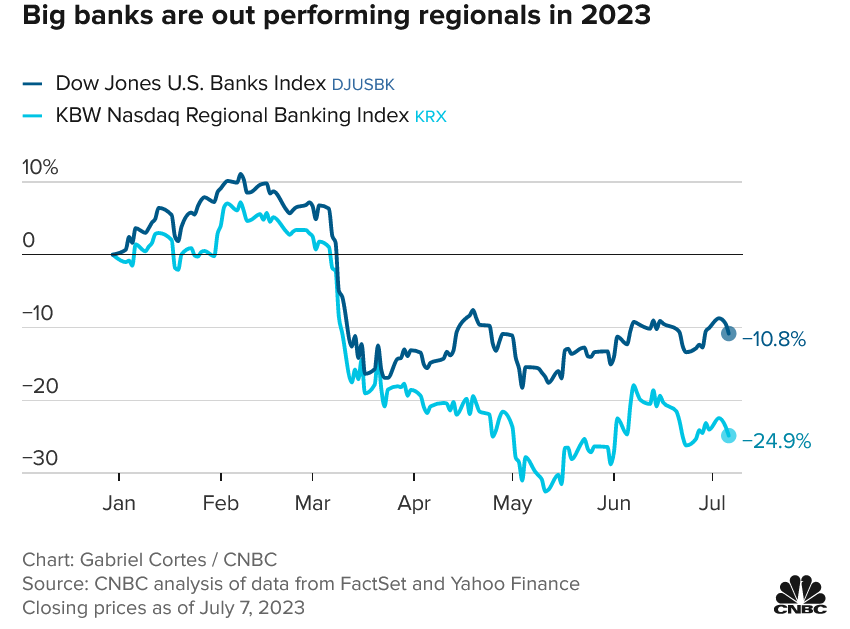

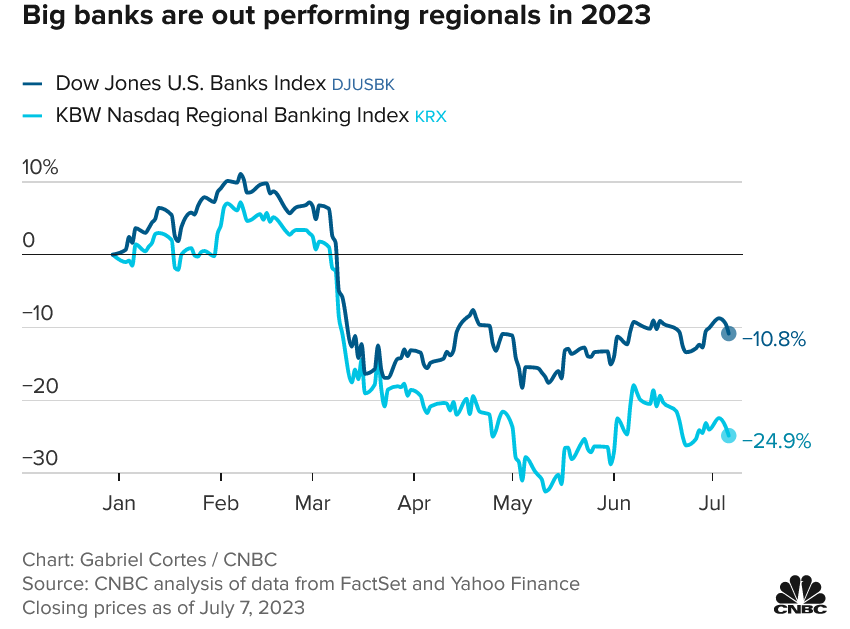

Major banks are facing one of the biggest regulatory overhauls since the financial crisis of 2008, setting up a major clash over the amount of capital that they have to set aside to weather downturns. At the same time regional banks are already struggling with...

by Glen | Jul 24, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, Housing Price Trends / Information, interest rates, mortgage rates

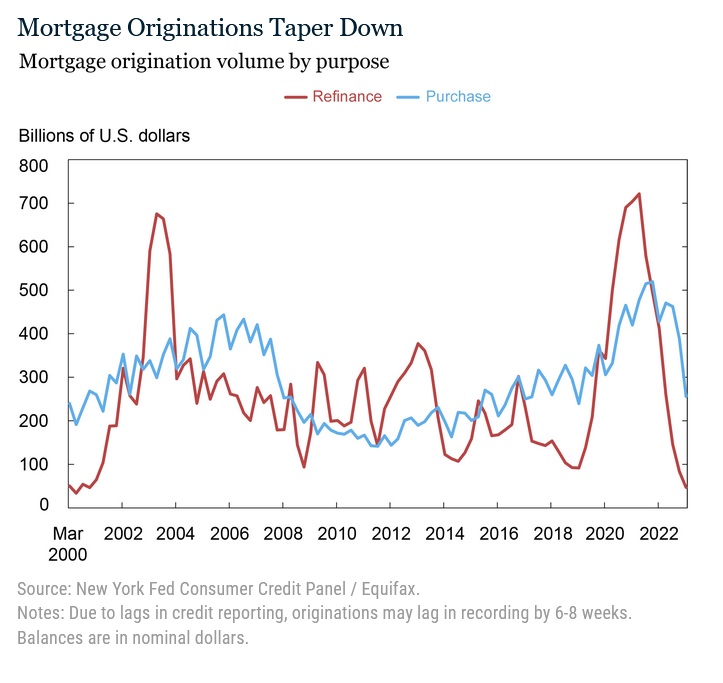

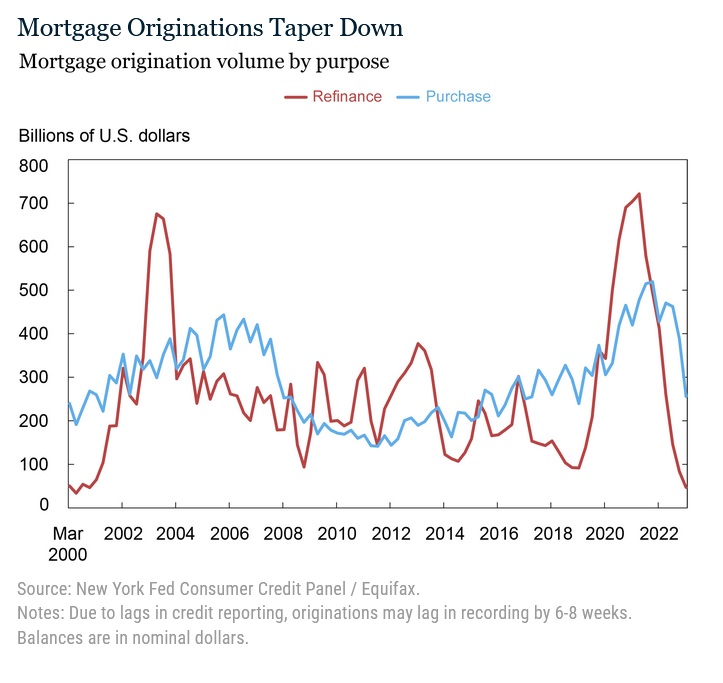

According to a recent Federal Reserve Report, fourteen million mortgages were refinanced during the COVID refinance boom, and these refinances will have effects on the mortgage market, real estate, and the general economy for years to come. An astonishing 430 billion...

by Glen | Jul 10, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates

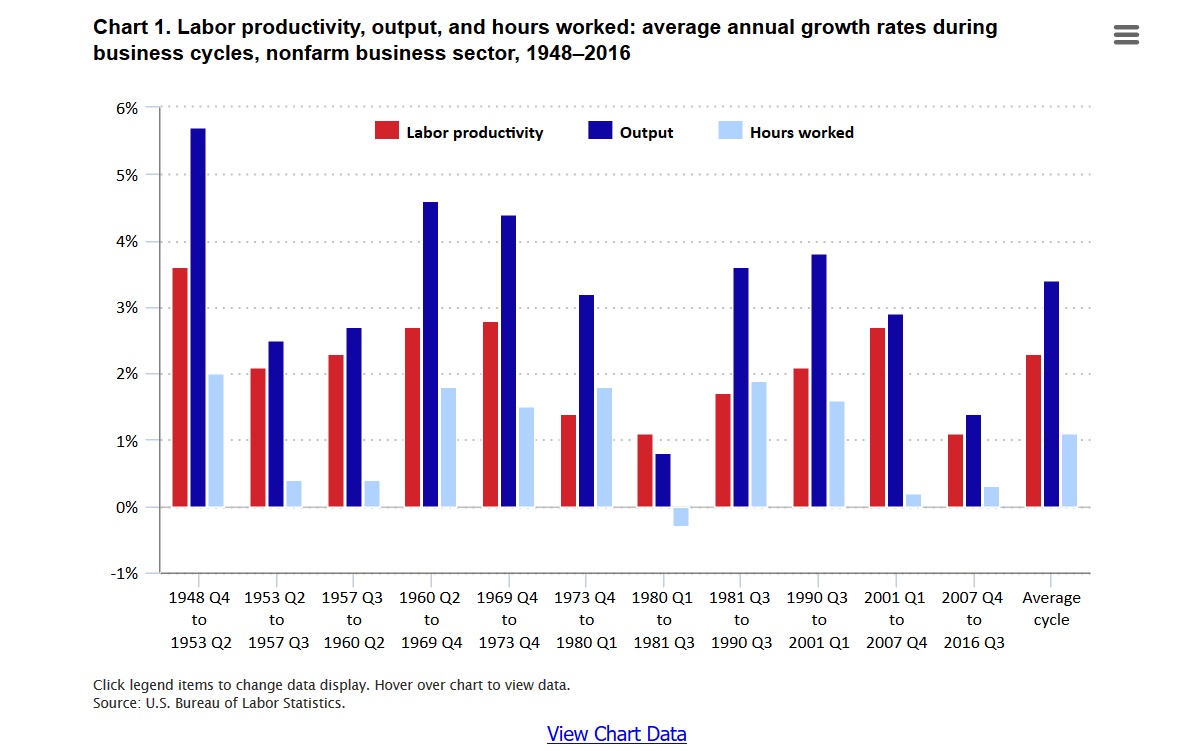

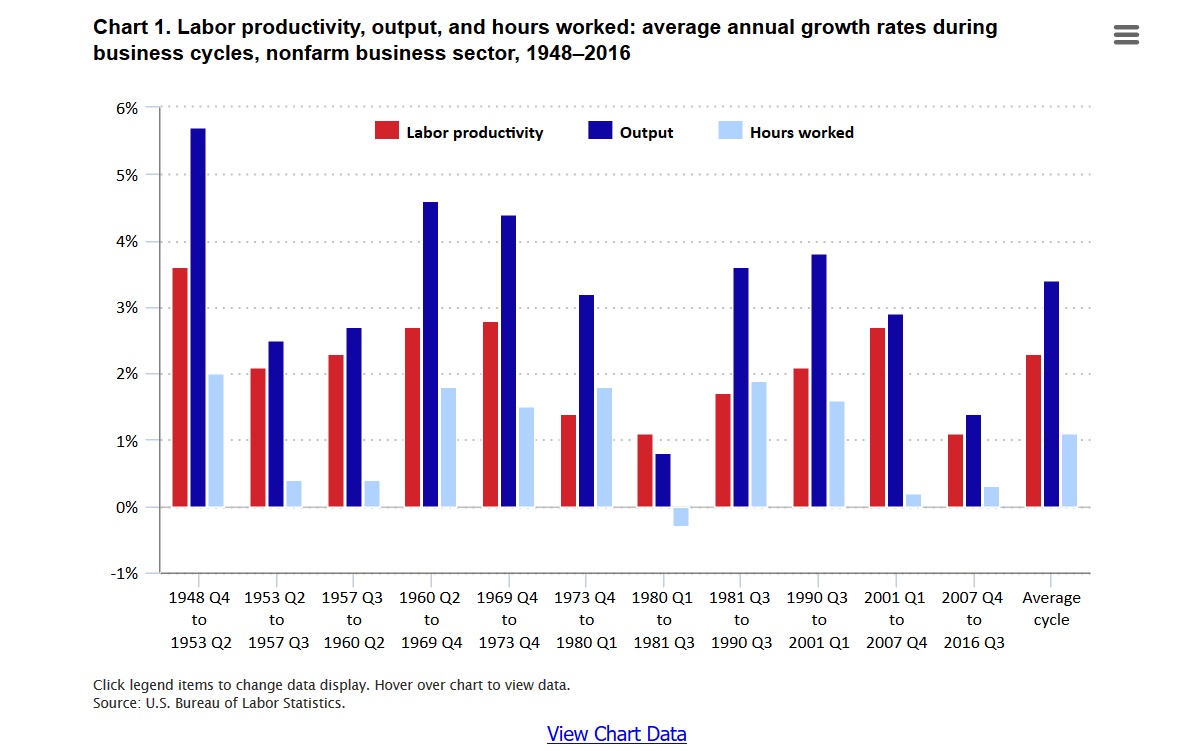

US labor productivity tumbled by 7.5% in the first quarter of 2023 – the largest decline in worker output per hour since 1947, according to Labor Department data released Thursday. What does declining productivity mean for interest rates, commercial and residential...