by Glen | Apr 18, 2022 | 2022 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Denver Hard Money, Denver private Lending, General real estate financing information, Government Bailout, hard money, Housing Price Trends / Information, interest rates, mortgage rates, Other Questions, Private Lending

The federal housing finance agency (FHFA), the largest buyer of mortgages through Fannie Mae and Freddie Mac (Fannie/Freddie), announced huge changes to there fee structure. In particular they are targeting high cost loans with big jumps for second...

by Glen | Apr 4, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Atlanta Hard Money, Colorado Hard Money, credit scoring, Denver Hard Money, Georgia hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

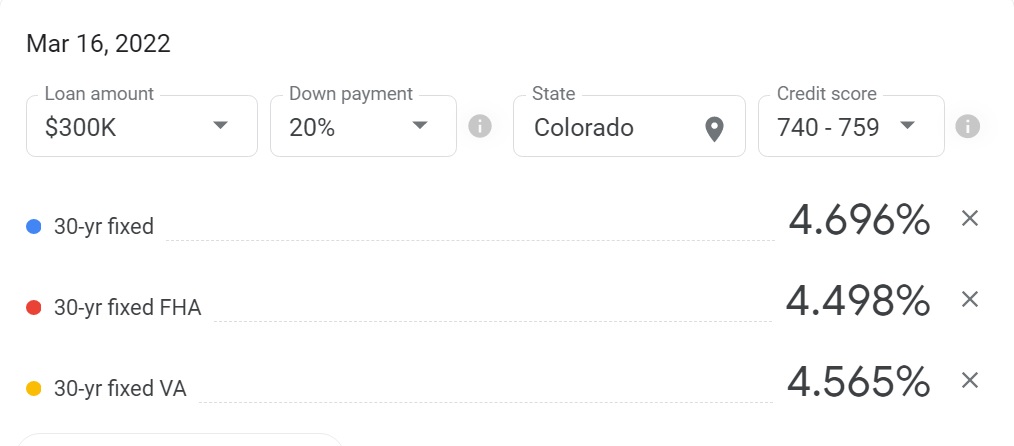

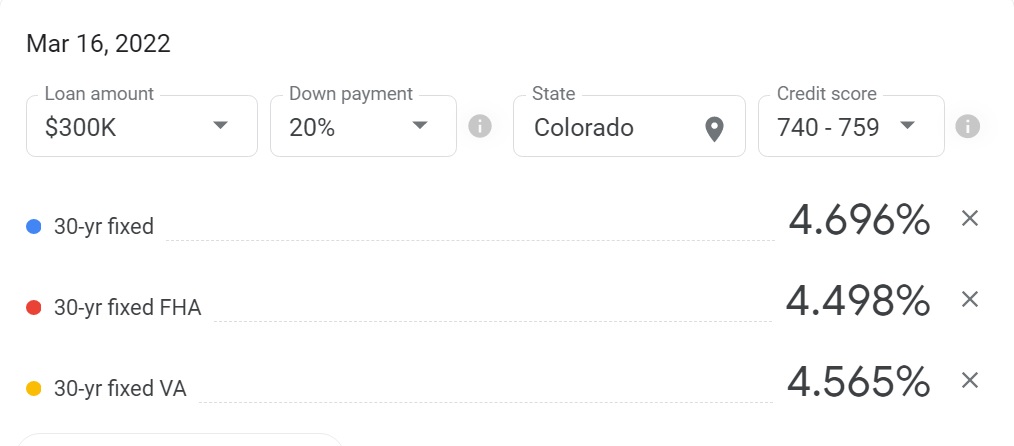

The swiftness of the changes in the real estate market are astonishing, yet not unexpected. I predicted last year mortgage rates would top 5% and they already have come close. This has led to a 60% drop in refinances and a sharp reduction in sales. What do these...

by Glen | Mar 2, 2022 | 2022 real estate predictions, 2022 stock market correction impact on real estate prices, Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, commercial hard money, Hard Money Commercial Lending, interest rates, mortgage rates, Real Estate economic trends, real estate ibuyers, real estate investing

Redfin plunges 26% in one day and foreshadows 4 trends shaping the 2022 and beyond real estate market. Redfin, the darling of the real estate market the last several years has plunged 45% over the last year. At the same time numerous analysists are downgrading the...

by Glen | Feb 25, 2022 | Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates, Private Lending, Real Estate economic trends, Real Estate Trends, Real estate Valuation

Initially when Ukraine was invaded the stock market dropped precipitously over 800 points during the day only to make a huge rebound into positive territory. What does this volatility mean for interest rates and in turn real estate? Does the invasion change the path...

by Glen | Feb 16, 2022 | 2022 real estate predictions, 2022 stock market correction, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Denver Hard Money, Denver private Lending, General real estate financing information, Hard Money Lending, interest rates, mortgage rates, Property Valuation

Gary Shilling, the author of the Case-Shilling real estate index, accurately predicted the last real estate bust. He has come out with recent predictions that throw a cold towel on how this housing cycle ends. Are we at a bear market or a peak in real estate? Where...

by Glen | Feb 10, 2022 | 2022 real estate predictions, Atlanta Hard Money, Colorado Hard Money, Denver Hard Money, Georgia hard money, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation, residential lending valuation, Small Balance Commercial Lending, Underwriting/Valuation, what happens to real estate in a correction

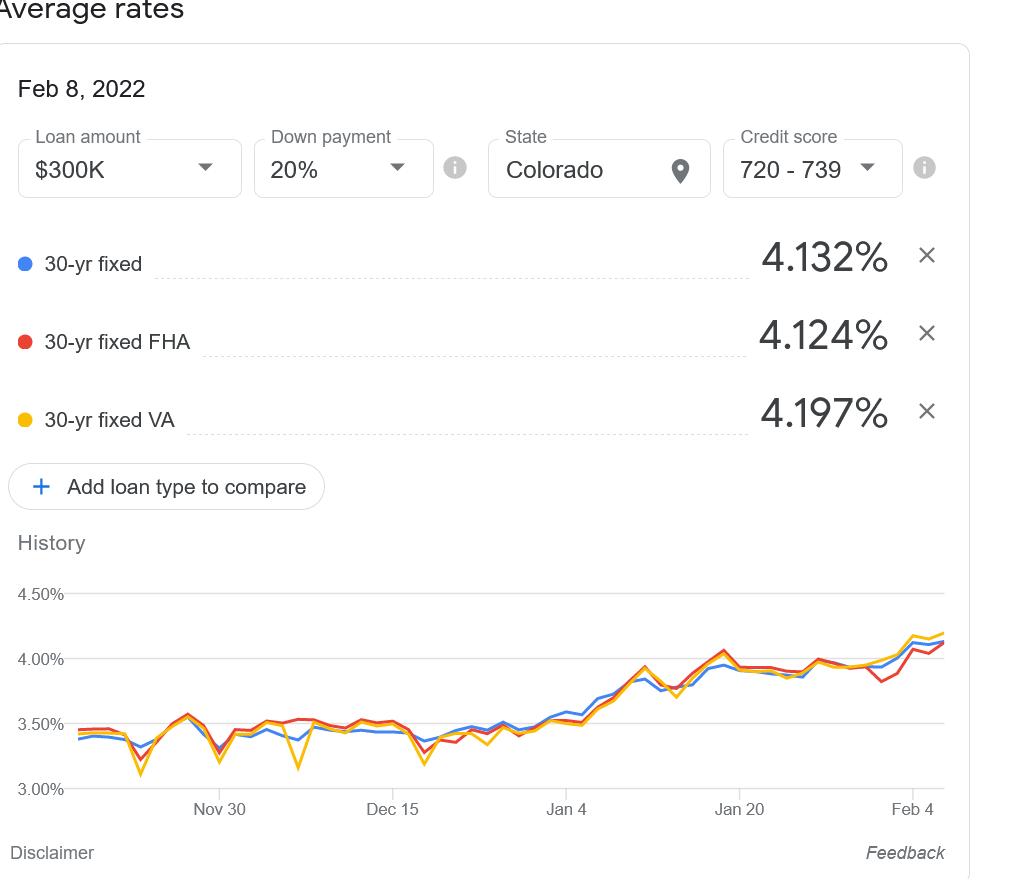

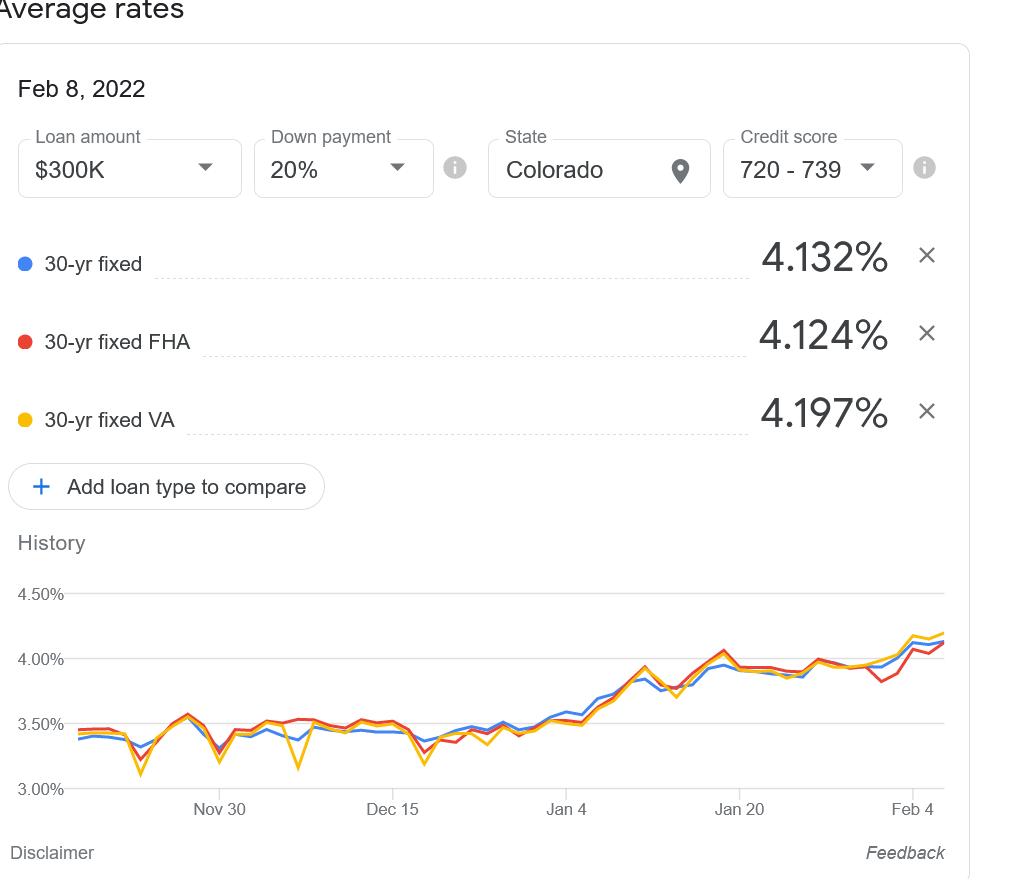

Inflation plowed ahead at its fastest 12-month pace in nearly 40 years during January and substantially higher than any estimates according to a closely watched gauge the Labor Department released Thursday (CPI). The stock and bond markets are continuing to awaken,...