by Glen | Aug 7, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Housing Price Trends / Information, interest rates, mortgage rates

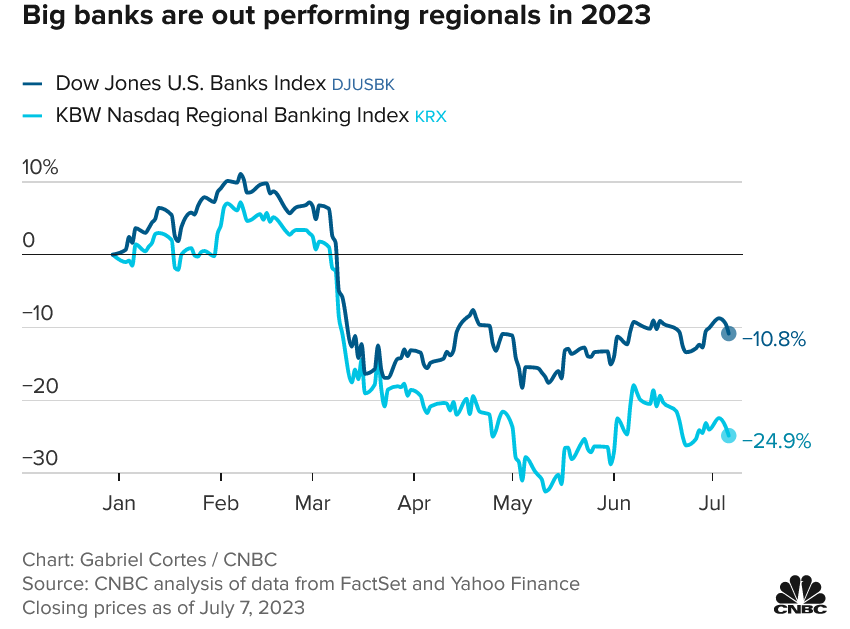

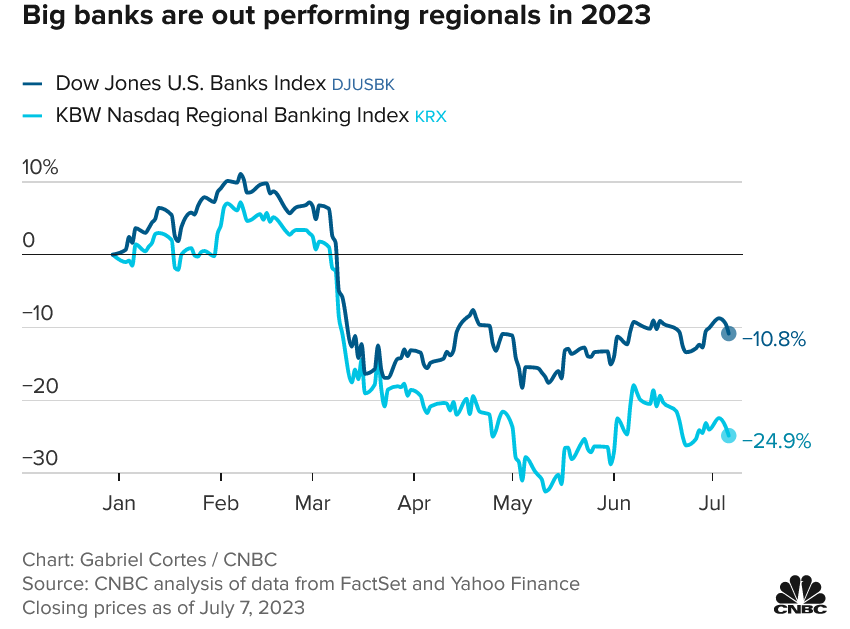

Major banks are facing one of the biggest regulatory overhauls since the financial crisis of 2008, setting up a major clash over the amount of capital that they have to set aside to weather downturns. At the same time regional banks are already struggling with...

by Glen | Jul 24, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, Housing Price Trends / Information, interest rates, mortgage rates

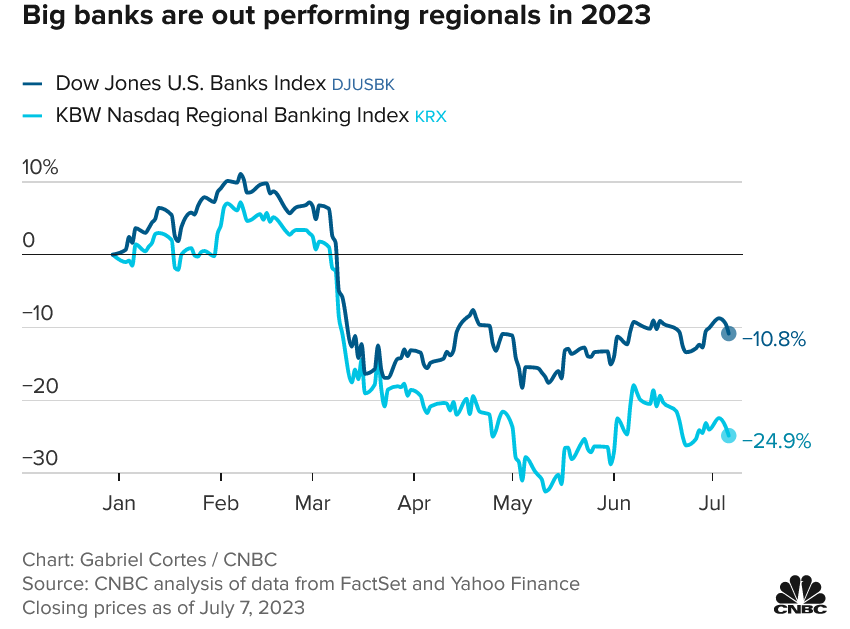

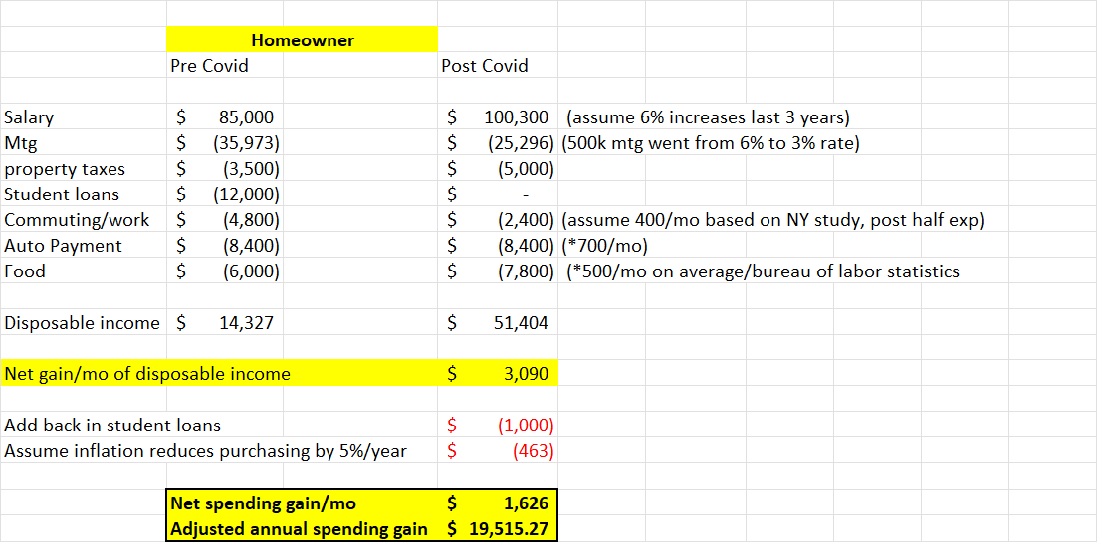

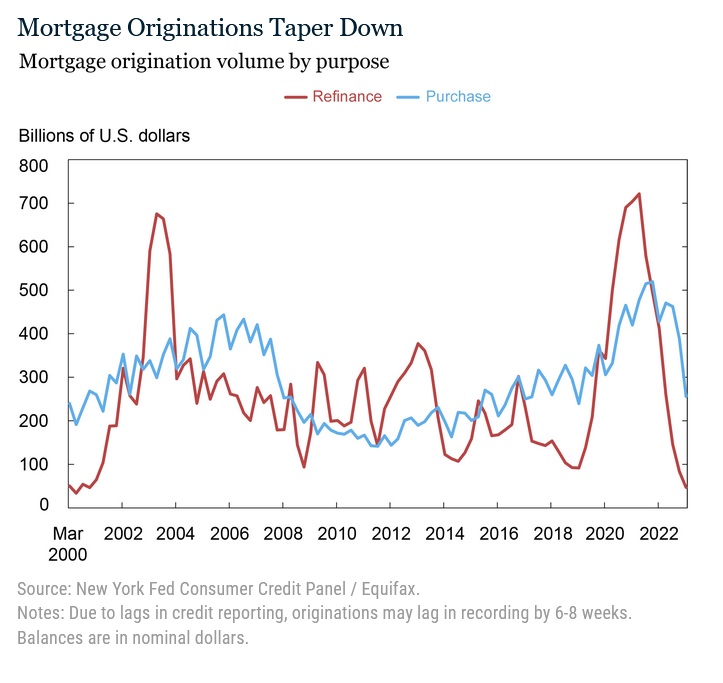

According to a recent Federal Reserve Report, fourteen million mortgages were refinanced during the COVID refinance boom, and these refinances will have effects on the mortgage market, real estate, and the general economy for years to come. An astonishing 430 billion...

by Glen | Jul 10, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates

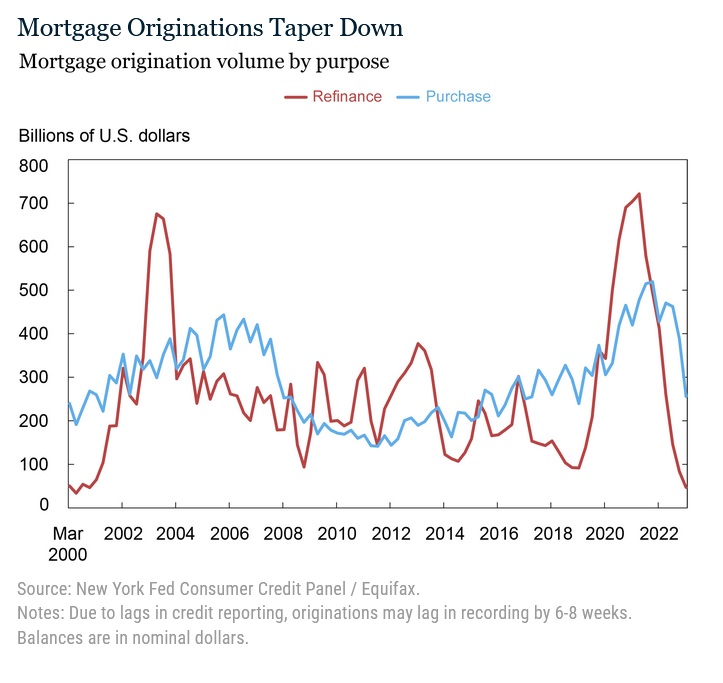

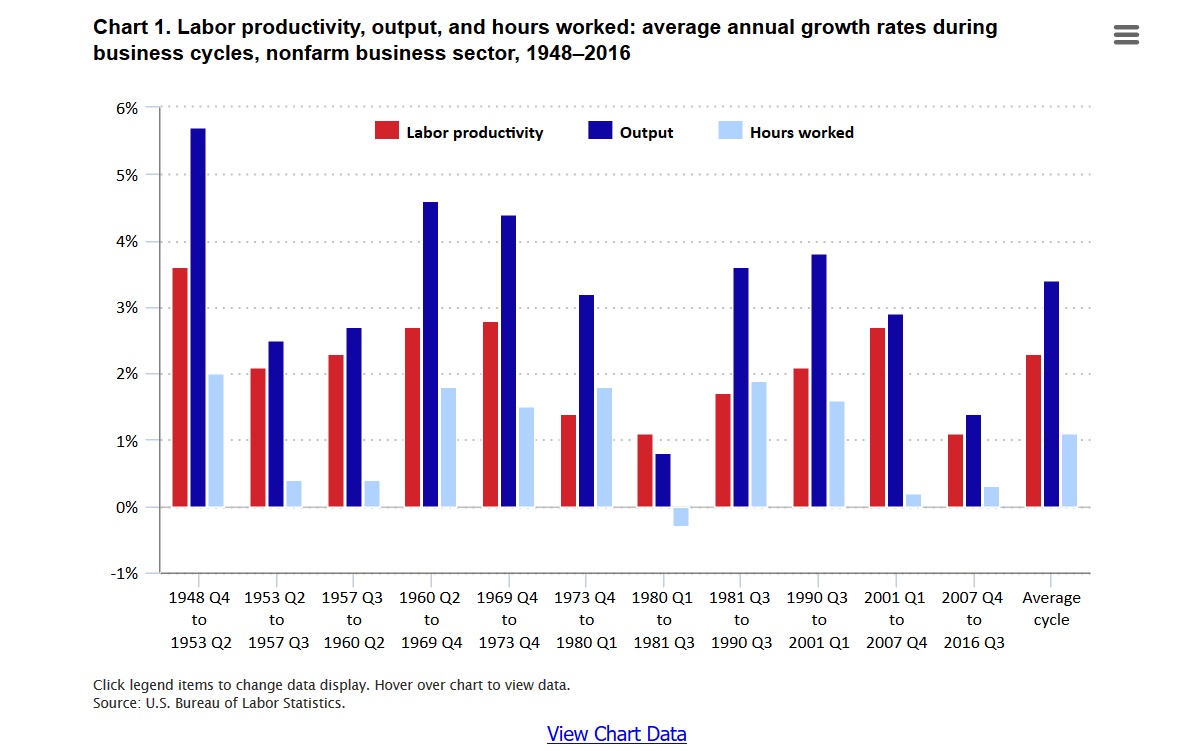

US labor productivity tumbled by 7.5% in the first quarter of 2023 – the largest decline in worker output per hour since 1947, according to Labor Department data released Thursday. What does declining productivity mean for interest rates, commercial and residential...

by Glen | Jul 3, 2023 | Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, Private Lending

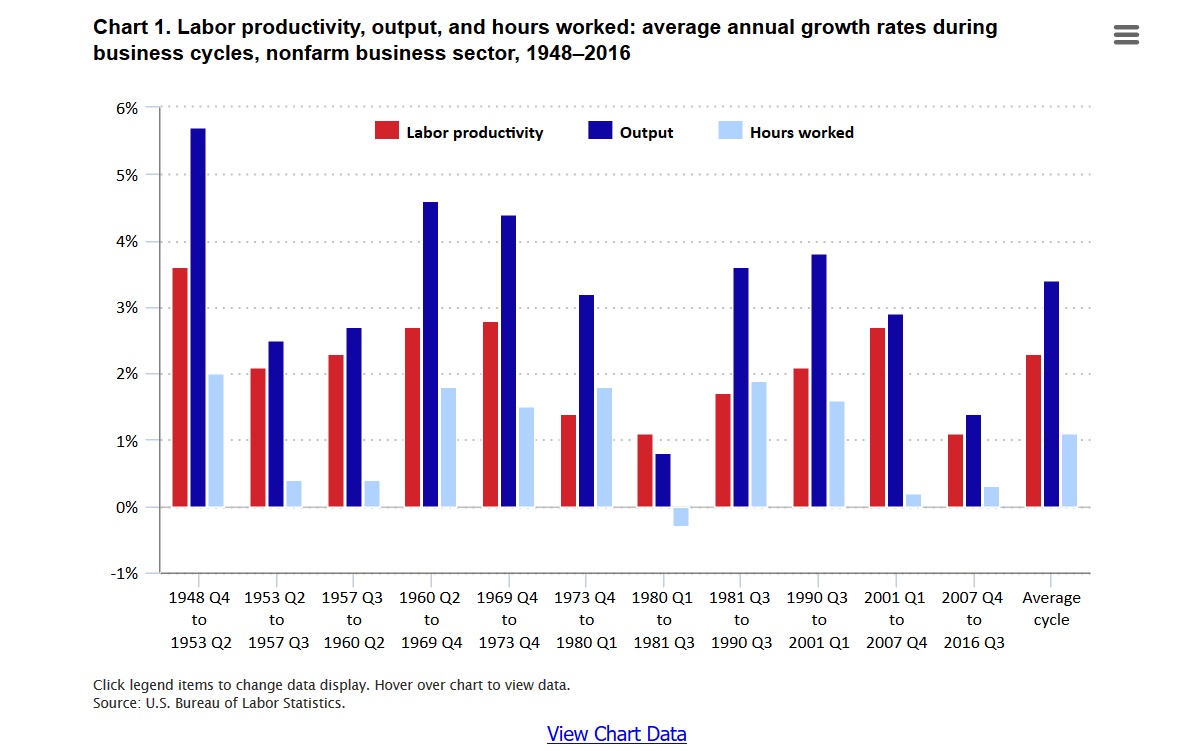

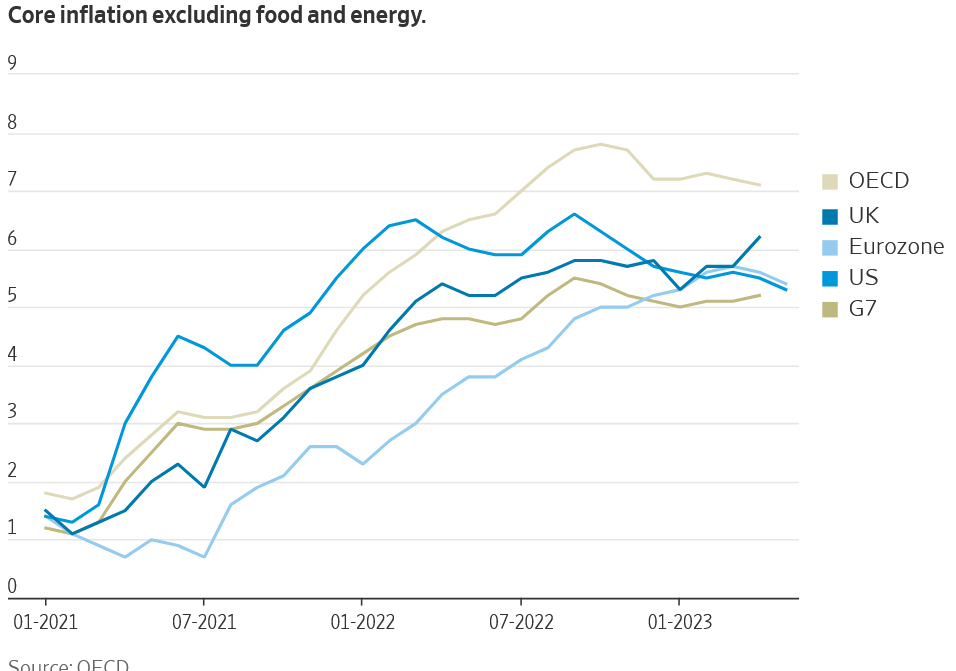

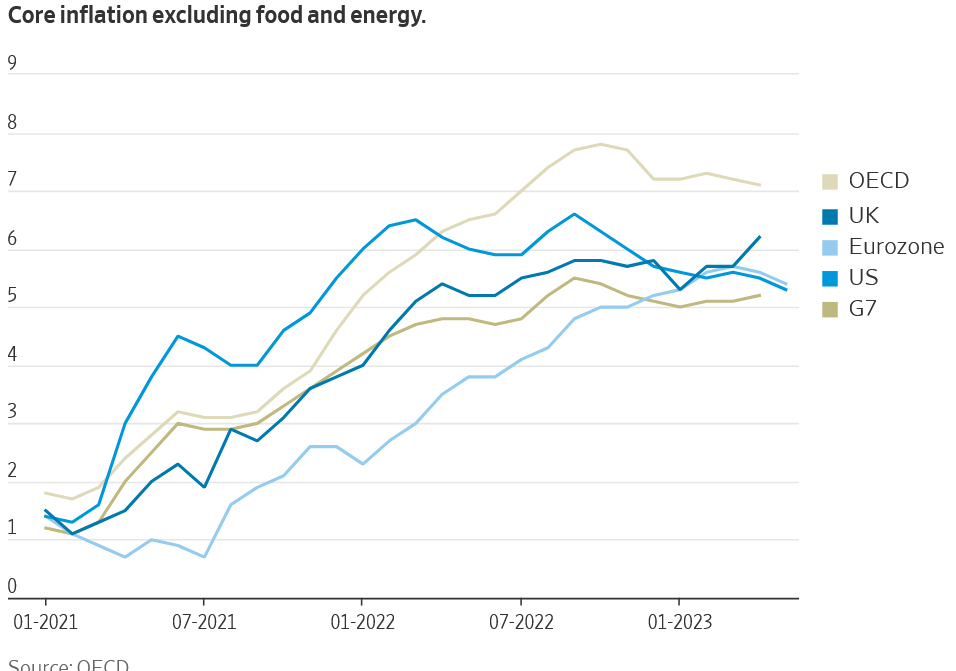

Although the market rejoiced in the recent fed “skip”, as you dig into the numbers more the outcome is a lot less sanguine. Why does inflation continue running hotter than anticipated? What does this mean for interest rates and real estate? What happens when...

by Glen | Jun 19, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, hard money, Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

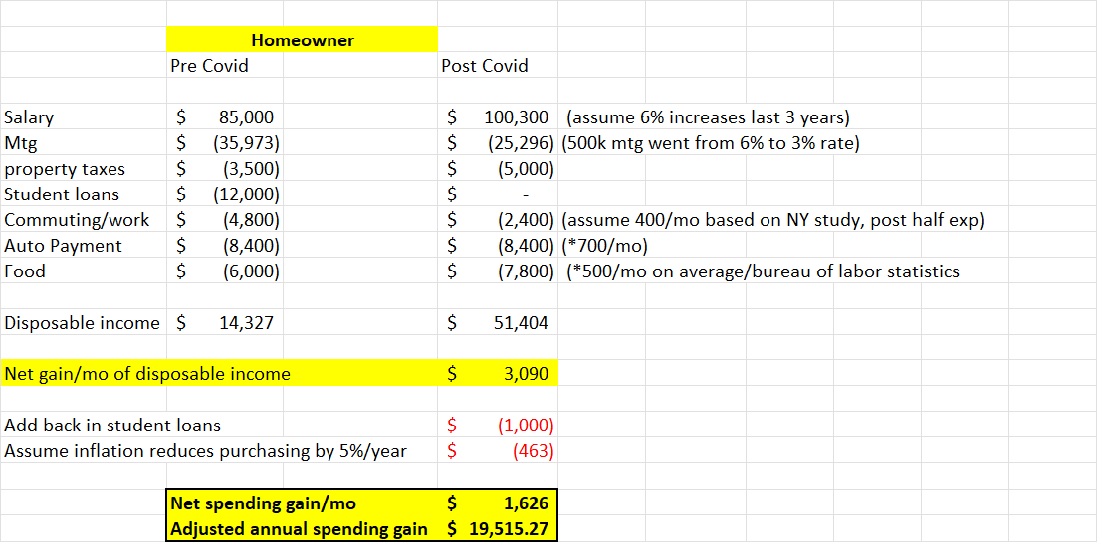

Interesting times we are in. Consumers keep spending big on services like travel and eating out, but on the flip side Home Depot just reported its first drop since the pandemic. On the other hand Target tops earnings estimates. What is driving the continued...

by Glen | May 8, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Biden tax plan, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, credit scoring, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending, interest rates, mortgage rates

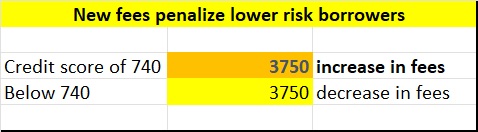

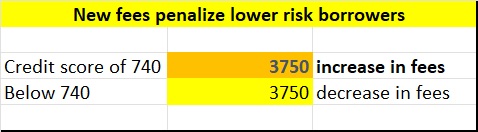

No this is not a joke, I had to read the recent Fannie Mae press release multiple times to actually believe what I was reading. Who would have ever thought that someone with a high credit score above 740 would be penalized for having a high score. Under a new rule...