by Glen | Nov 27, 2023 | 2023 real estate prediction, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

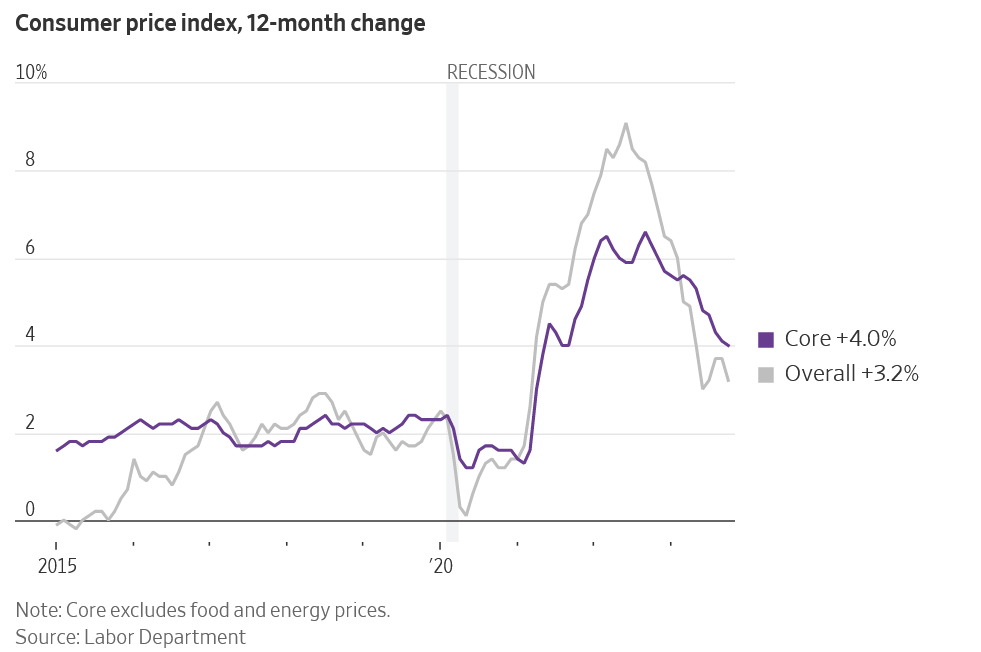

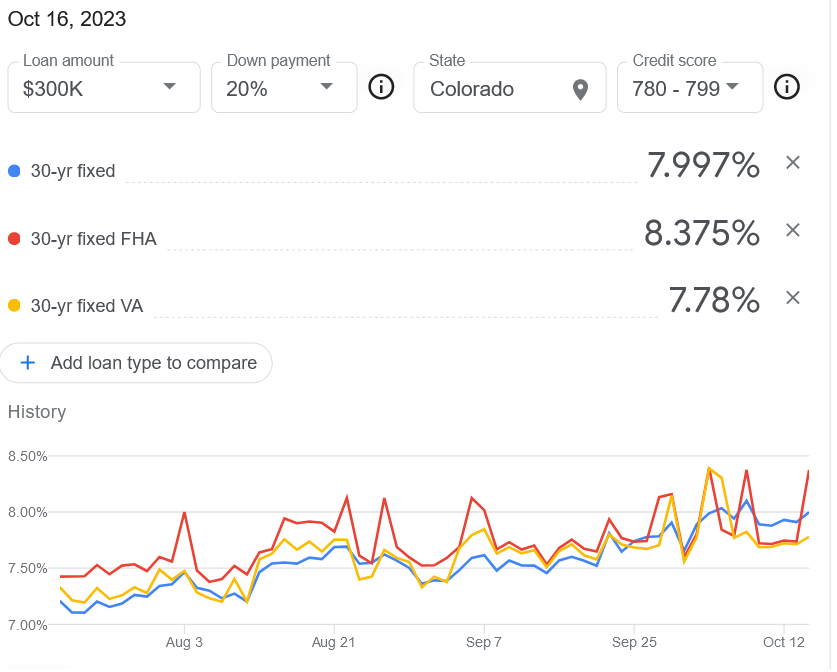

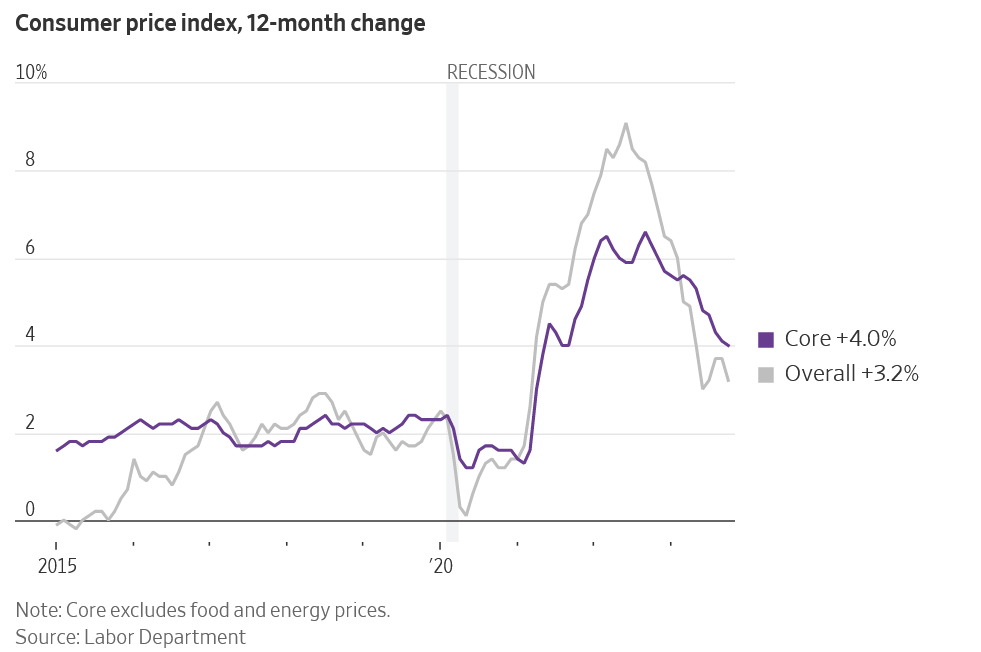

What does the recent CPI fall mean for mortgage rates and real estate prices? A broad slowdown in inflation continued in October, likely ending the Federal Reserve’s historic interest rate increases. The slowdown came below most median estimates and the...

by Glen | Oct 30, 2023 | 2023 real estate prediction, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending, Housing Price Trends / Information, interest rates, mortgage rates

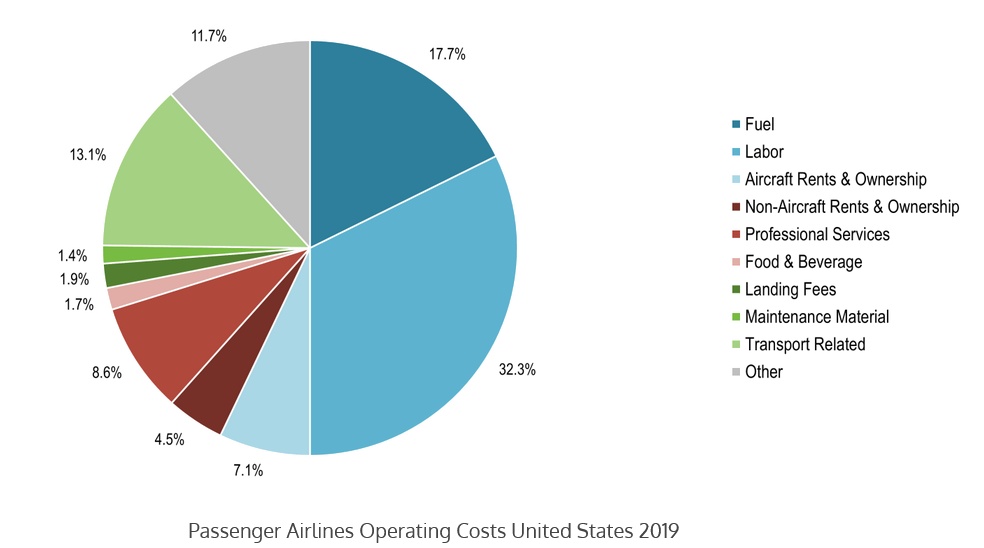

Housing industry urges Fed to stop raising rates, does it even matter? Top real estate and banking officials are calling on the Federal Reserve to stop raising interest rates as the industry suffers through surging housing costs and a “historic shortage” of available...

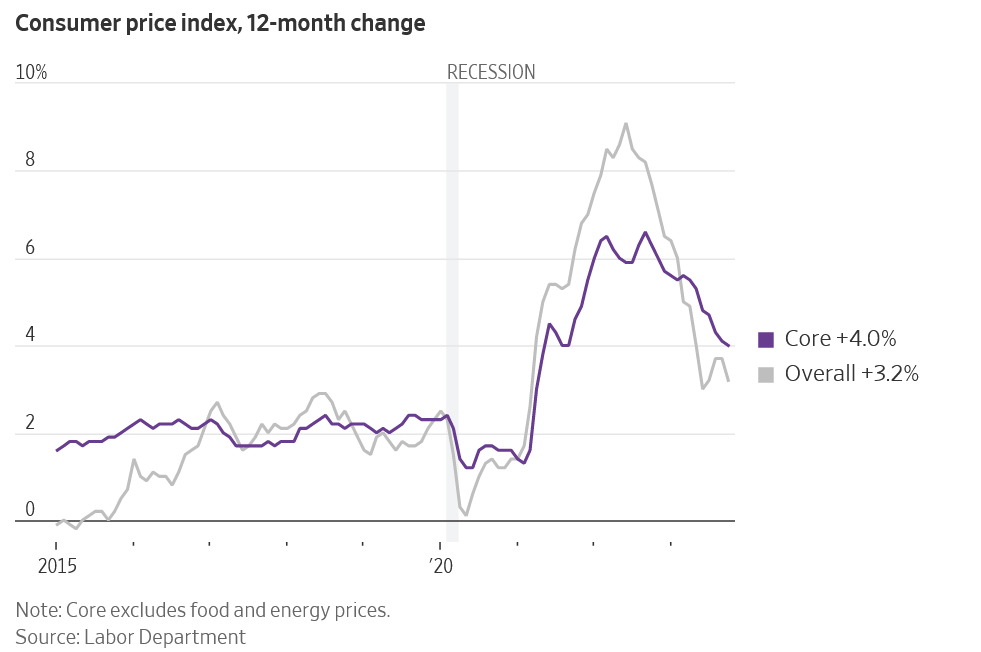

by Glen | Oct 16, 2023 | 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Bank failures, Colorado Hard Money, Colorado private lender, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Government Bailout, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates

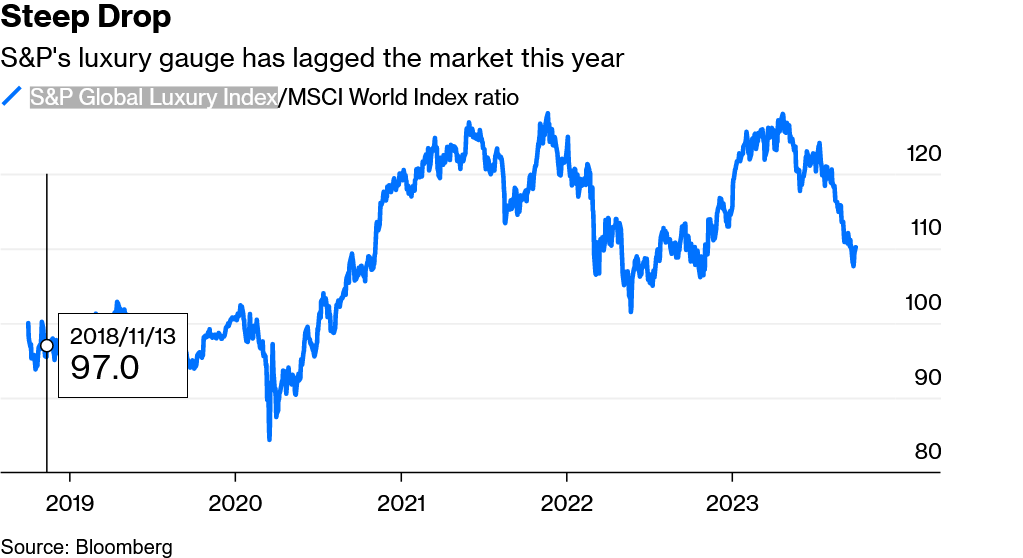

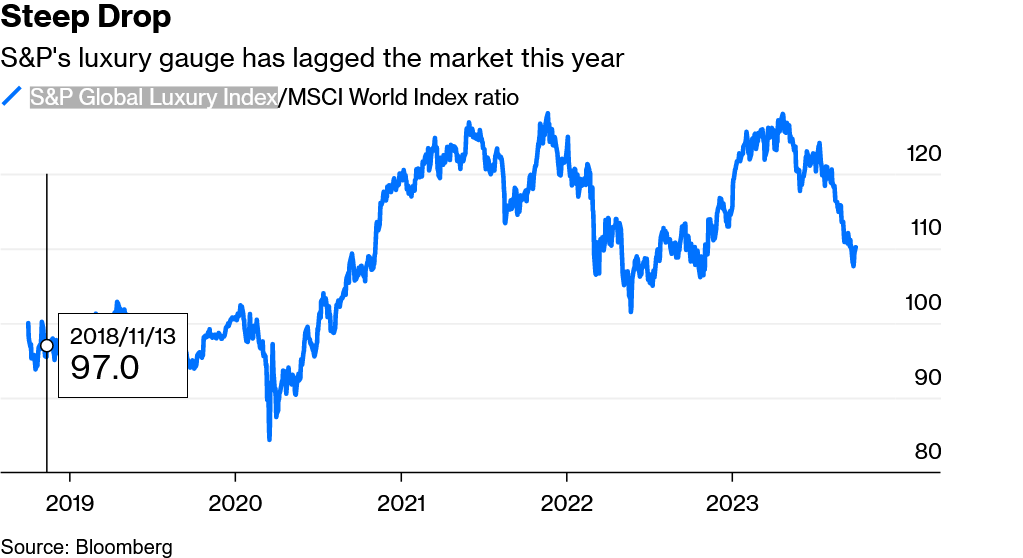

In the past recessions, especially in 2008, just prior to the crash we saw a big pull back in luxury purchases. This was an early indicator of huge drops in real estate prices. Currently we are seeing a resounding change in luxury spending, does this mean luxury...

by Glen | Aug 28, 2023 | 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Housing Price Trends / Information, interest rates, mortgage rates

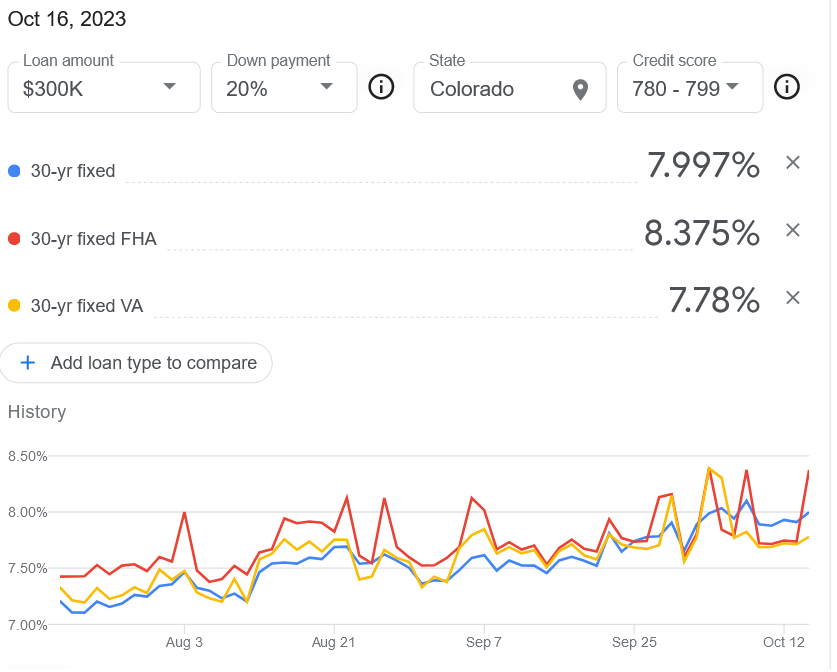

In almost every real estate advertisement I receive, there is a common theme that prospective buyers should not focus on the rate as they will be able to refinance relatively soon at a much lower rate. How true is this theory? Are rates going to drop quickly like in...

by Glen | Aug 21, 2023 | 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, interest rates, mortgage rates

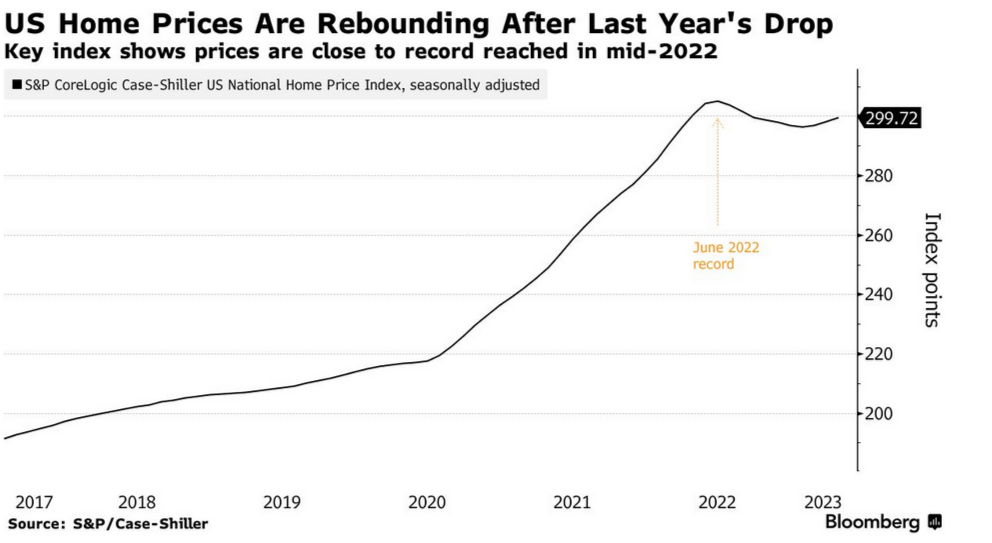

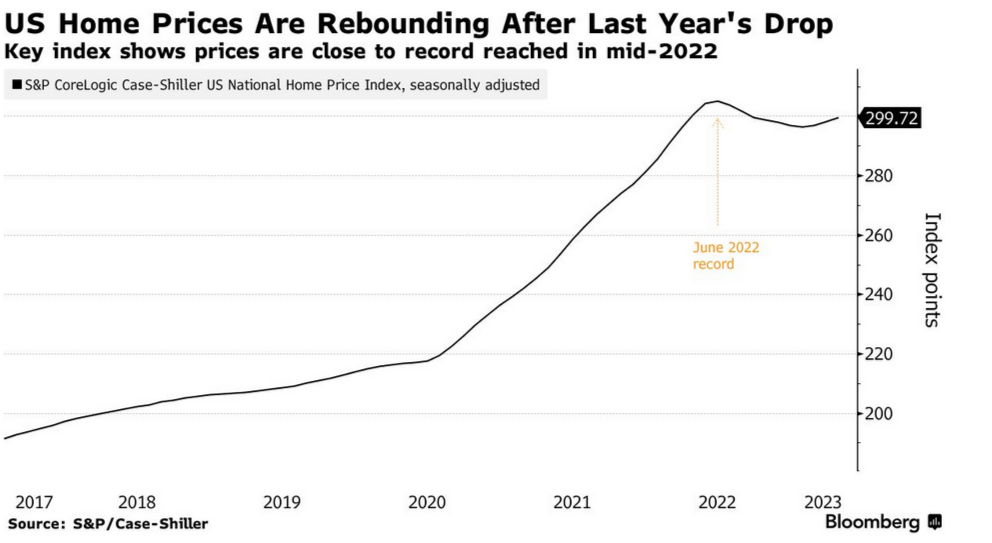

Like most, I have been surprised at the recent upward movement in prices. Did we just experience the shortest housing cycle ever? Are housing prices going to continue their recent upward swing? Why are housing prices now moving higher after a very shallow decline...

by Glen | Aug 14, 2023 | 2023 real estate prediction, 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Hard Money Lending, interest rates, mortgage rates

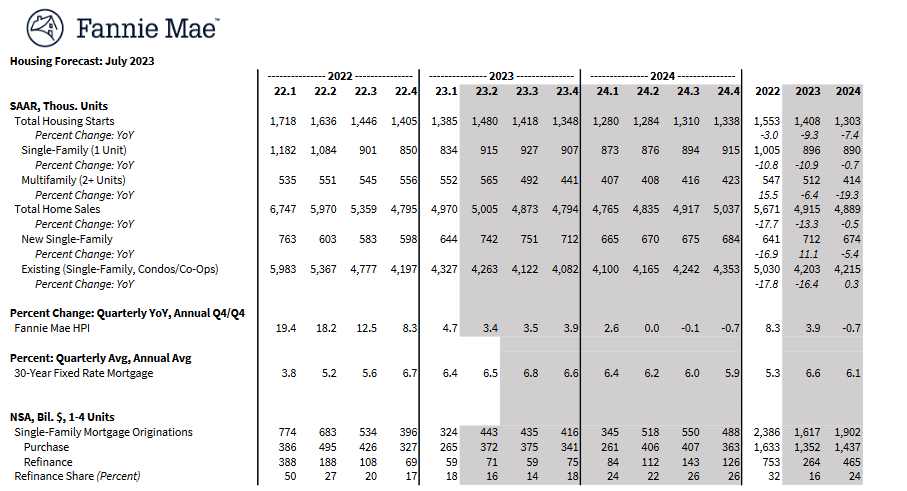

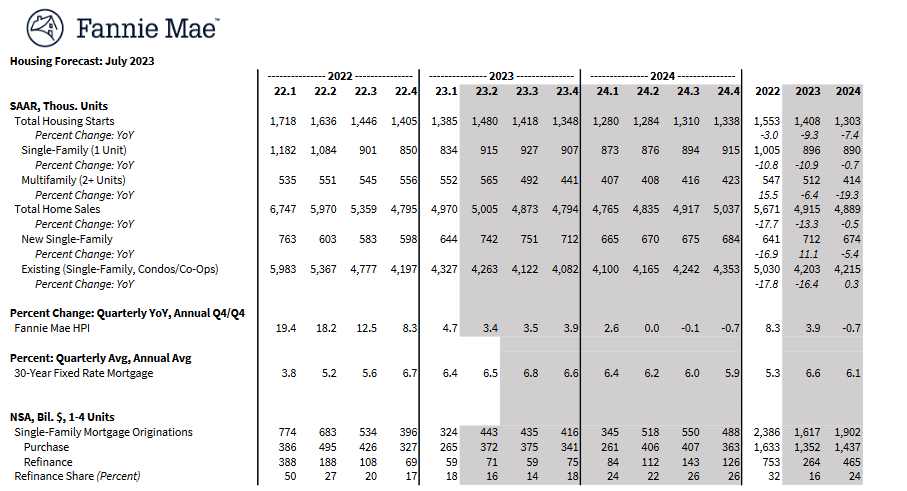

Both the stock and bond markets are partying like its 99 again. Fannie Mae, the largest buyer of US mortgages, is not buying into the theory that a soft landing is the base case for the economy. What is Fannie Mae predicting for inflation and in turn interest rates? ...