by Glen | Mar 5, 2020 | Coronavirus 2020 real estate impact, General real estate financing information, Hard Money in the News, Housing Price Trends / Information, interest rates, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money

The picture above is a bit more relaxing to look at as opposed to the media barrage of the coronavirus and stock market (do you know where I took the pic, hint in CO, email me if you know). The Coronavirus has caused stock markets around the world to quickly sell off...

by Glen | Feb 25, 2020 | interest rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money

We are at an interesting crossroads in the economy. The Federal Reserve and economic data show that the economy is very strong with consumer spending and confidence at all-time highs. At the same time the bond market is portraying a different picture after a new...

by Glen | Jan 21, 2020 | Hard Money Commercial Lending, Hard Money Lending, Housing Price Trends / Information, interest rates

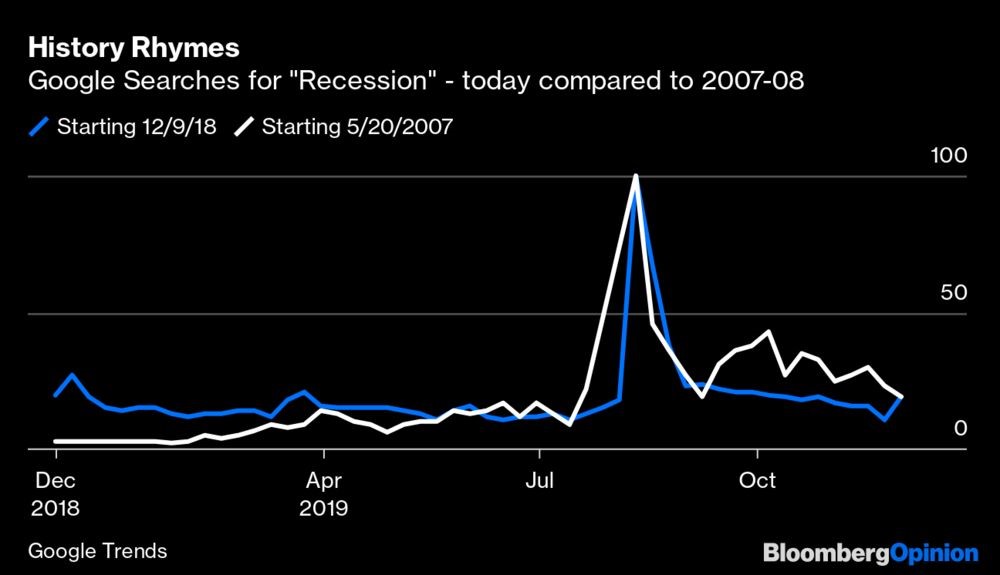

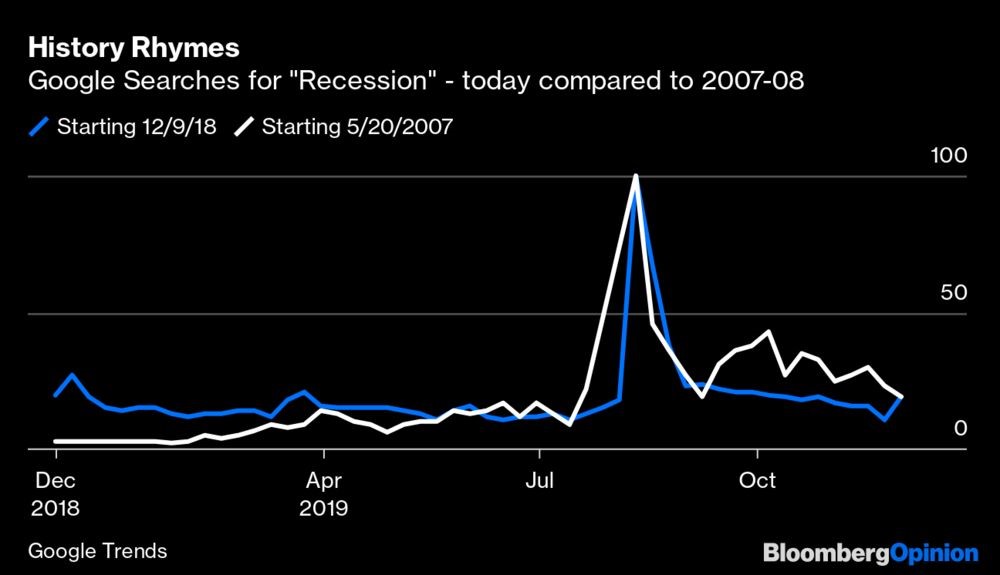

As the economy shrugs off recession fears with unemployment hovering near record lows and the stock market continuing to heat up there is one major byproduct that could be impacted, mortgage rates. There was a ton of bad news priced into the market last year that...

by Glen | Jan 11, 2020 | interest rates, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation

Yes, it is hard to believe but you, along with me and millions of others, are actually making mortgage rates go down and therefore real estate relatively less expensive. How is this possible? How are your thoughts influencing long term rates and in turn real...

by Glen | Dec 10, 2019 | interest rates, News, private lender, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation

The jobs report last week was a welcome surprise beating expectations with 266k jobs created, almost 50% more than expectations. This is the lowest jobless rate since 1969 underpinning a strong consumer that continues to spend and drive the bull market. What does...

by Glen | Nov 4, 2019 | Commercial Lending valuation, Housing Price Trends / Information, interest rates, Property Valuation, real estate investing, Real Estate Trends, Real estate Valuation, Realtor, residential lending valuation

The Federal reserve dropped the federal funds rate again which wasn’t a big surprise as the market was pricing in a 96% probability of a rate cut. This is the third cut this year effectively creating a “floor” under real estate. How did the federal reserve create a...