by Glen | Dec 2, 2020 | Colorado Hard Money, commercial property trends, Housing Price Trends / Information, interest rates, Property Valuation

President-elect Joe Biden nominated former Federal Reserve Chairwoman Janet Yellen, the prior head of the Federal Reserve, to become the next Treasury secretary. The “market” loved the pick, should you? What does a Yellen pick for treasury mean for interest rates? ...

by Glen | Nov 9, 2020 | Housing Price Trends / Information, interest rates, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation

Pfizer announced that their Covid vaccine in trials was 90% effective at preventing infection. The stock market took off and traders began reshuffling their pandemic bets with Zoom down 20% and Disney, hotels, and cruise operators up substantially. Will there be a...

by Glen | Oct 6, 2020 | credit scoring, General real estate financing information, Hard Money Lending, Housing Price Trends / Information, interest rates, Private Lending

The Urban Institute think tank says nearly two out of three loans made in 2019 would fail to meet at least one of the stricter standards lenders have imposed since March. Banks are tripping over themselves to be the first to hedge against future downside risks and...

by Glen | Sep 15, 2020 | interest rates, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation, Small Balance Commercial Lending, Underwriting/Valuation

If you have been tracking interest rates in the mortgage market, your head is likely spinning. Mortgage rates hit a record low of 3% less than a week later rates have risen again. What is causing the drastic swings? Is now the time to lock in or refinance? What did...

by Glen | Aug 19, 2020 | interest rates, Private Lending, Real Estate economic trends, real estate investing, Residential hard money

The mortgage market is an interesting animal. Long term mortgage rates traditionally track the 10 year treasury and historically trade in a very narrow band, approximately one percent higher than the 10 year treasuries. This would put mortgages today in the low 2%...

by Glen | Jul 15, 2020 | Housing Price Trends / Information, interest rates, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation, Underwriting/Valuation

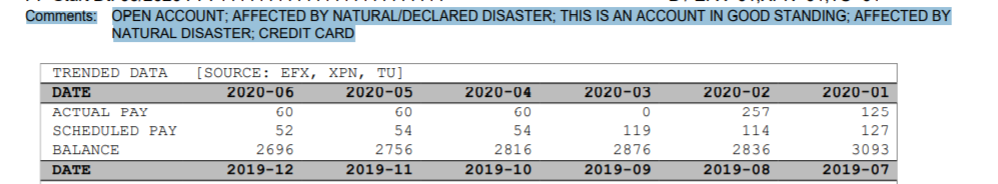

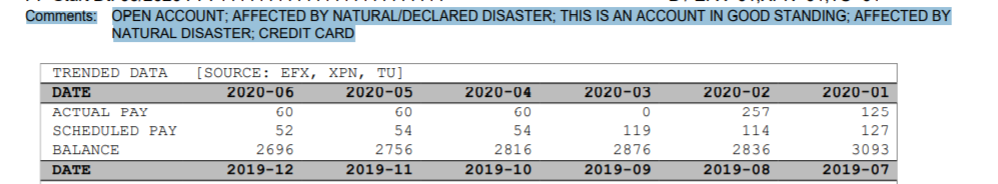

From March 1 through the end of May, Americans deferred debt payments on more than 100 million accounts, according to credit-reporting firm TransUnion, a sign of widespread financial distress. Millions are out of work, yet house prices are increasing in most...