by Glen | Jun 19, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, hard money, Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

Interesting times we are in. Consumers keep spending big on services like travel and eating out, but on the flip side Home Depot just reported its first drop since the pandemic. On the other hand Target tops earnings estimates. What is driving the continued...

by Glen | May 22, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Bank failures, Bankruptcy, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, Property Valuation

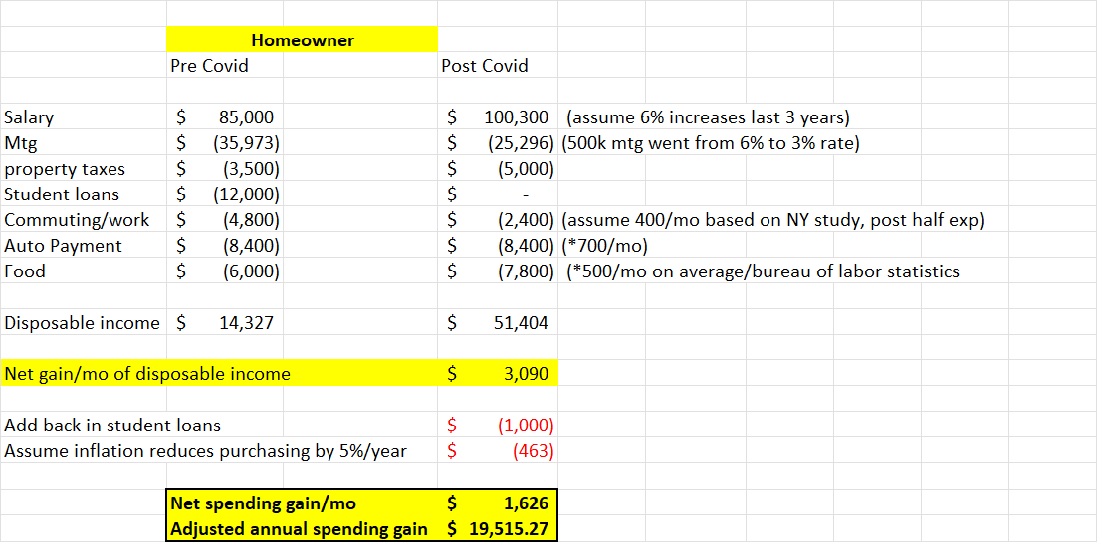

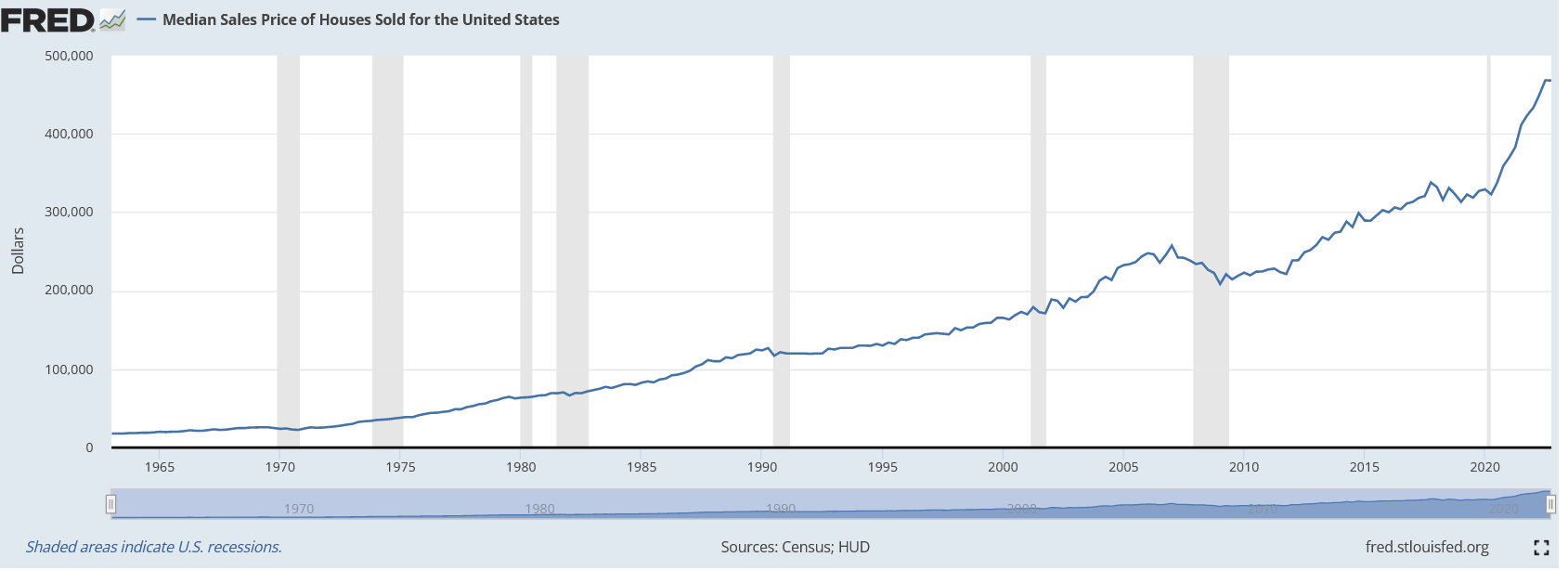

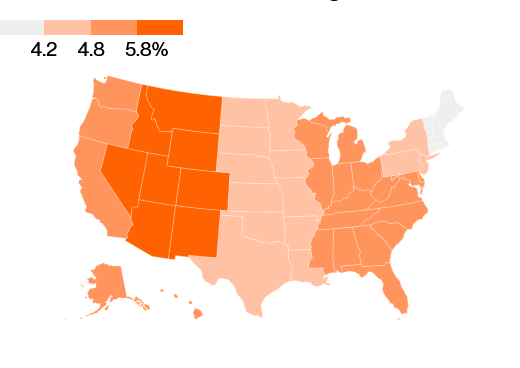

Although the spring real estate market has slowed drastically from the pandemic days, the bottom has not fallen out. Quite the opposite has occurred, in suburban markets and sunbelt cities, real estate keeps charging higher. A good example is Boulder, CO, a...

by Glen | Apr 24, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money in the News, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

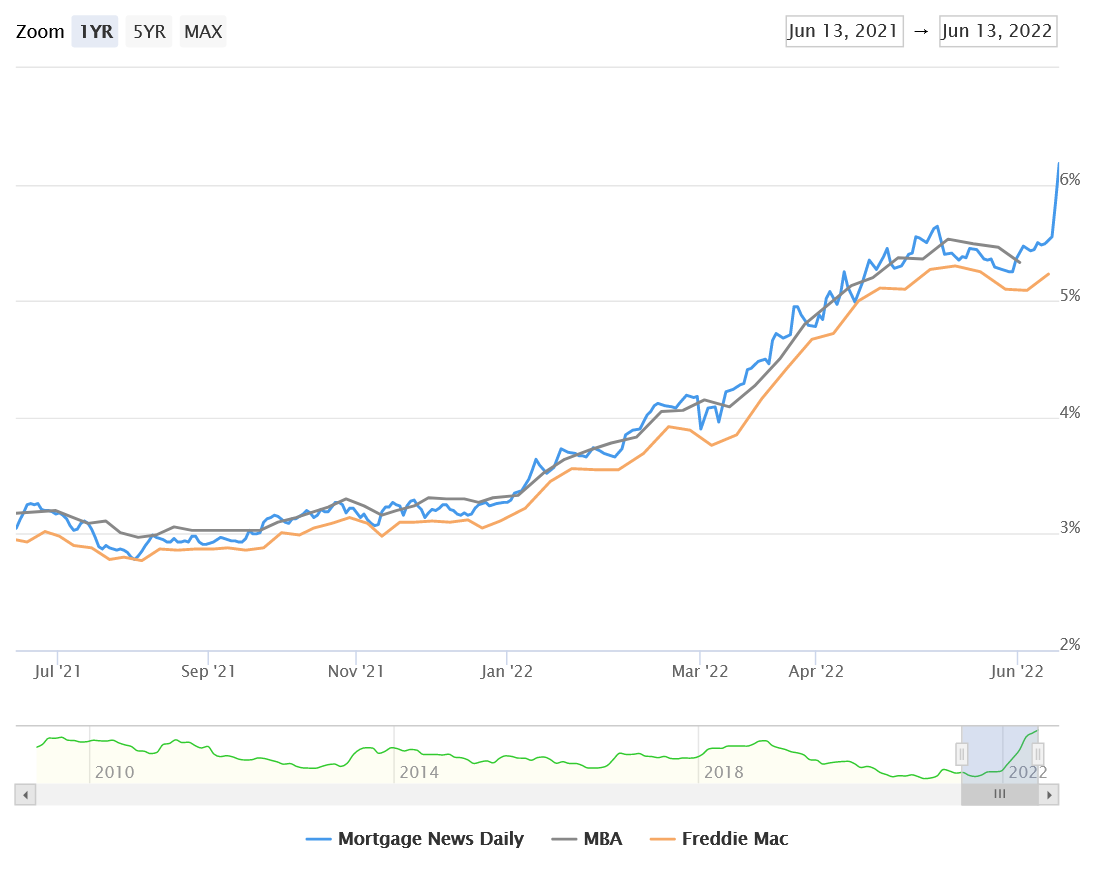

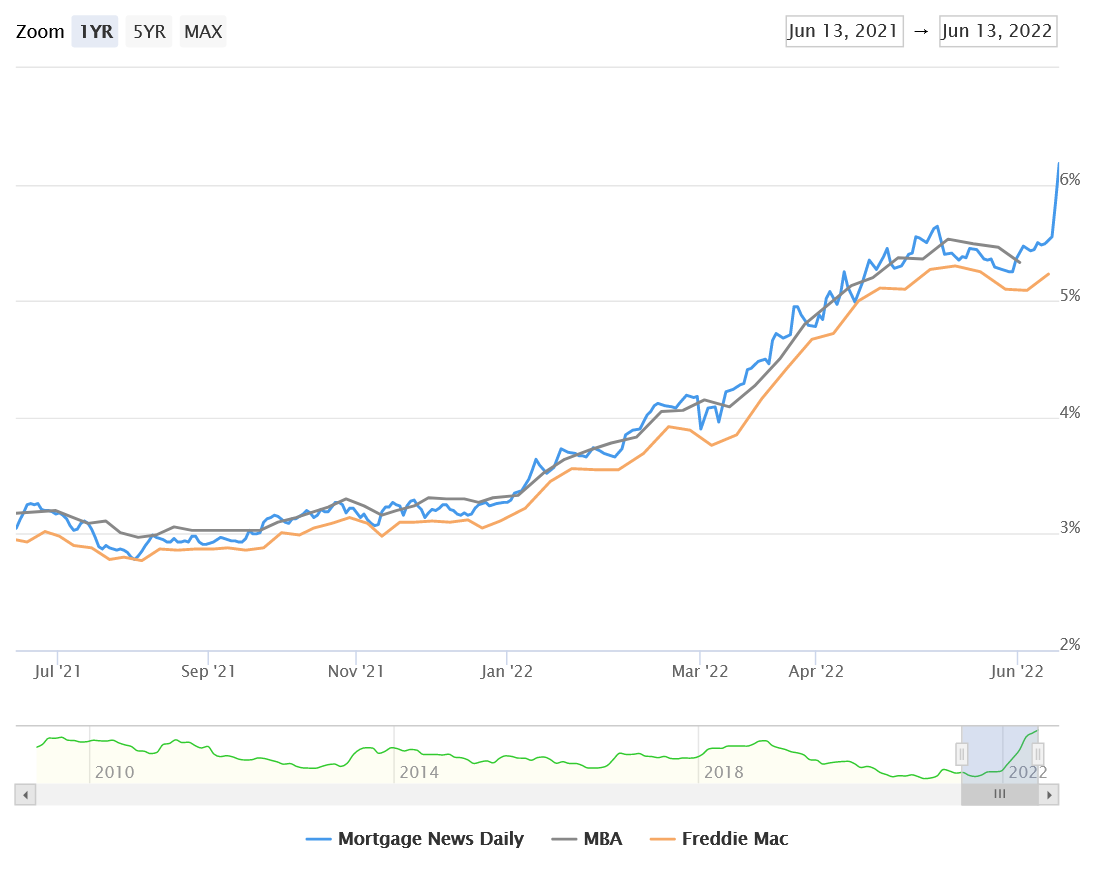

Inflation continues to stick around with core CPI running near record highs. This will keep the federal reserve on a likely path to hike rates once again in May. What does this mean for interest rates and real estate? What happens when interest rates finally...

by Glen | Feb 20, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks

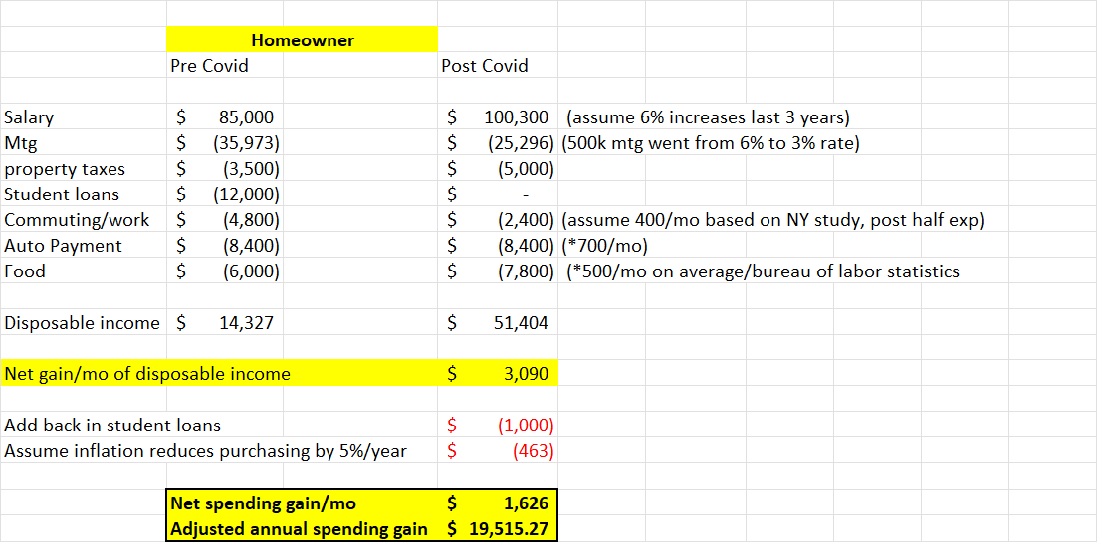

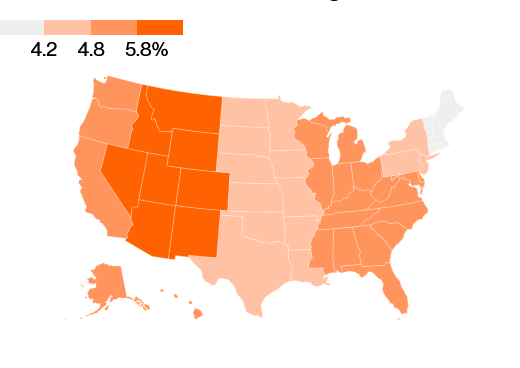

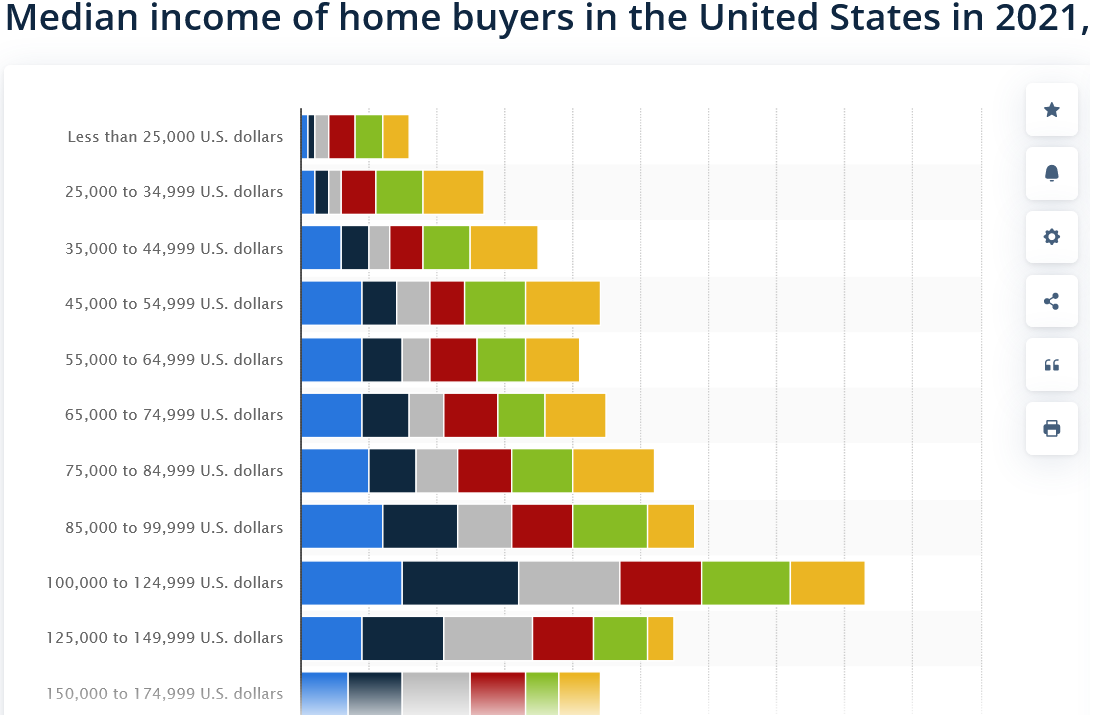

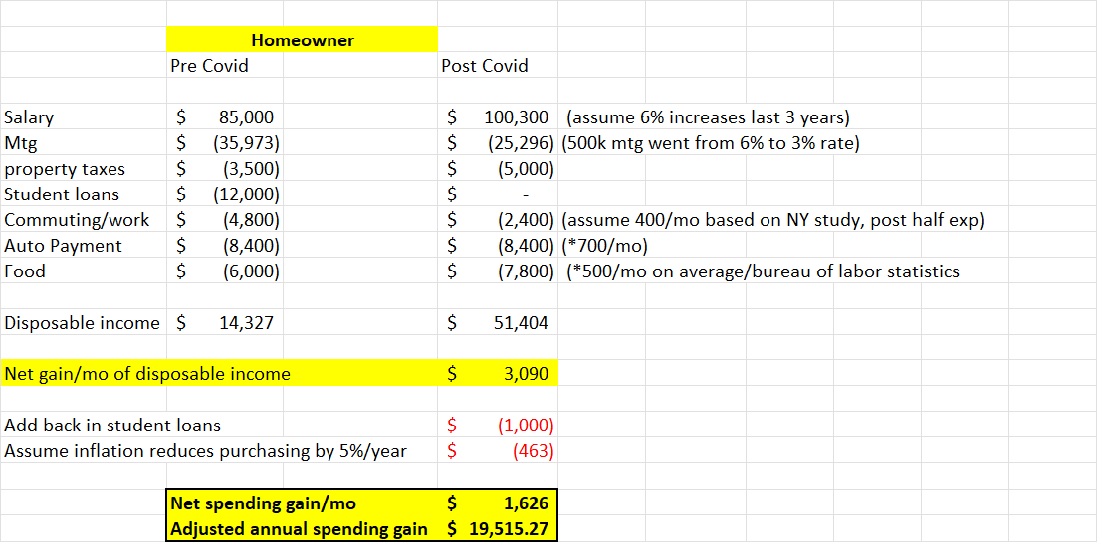

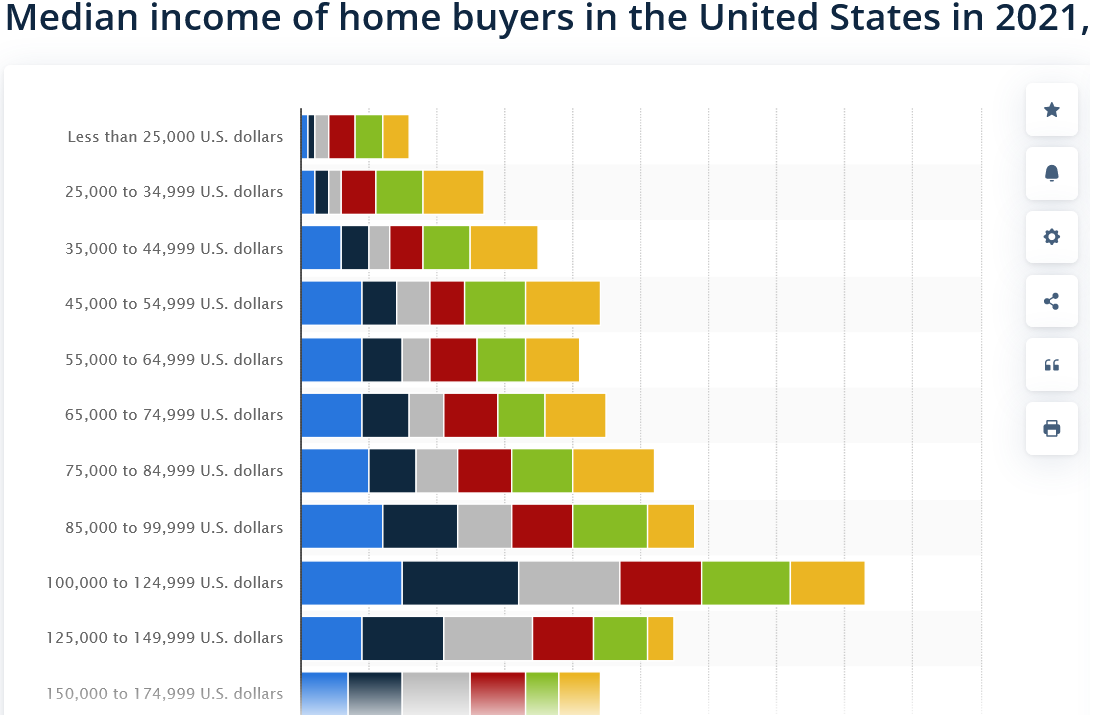

Purchasing power from paychecks fell 2.9% for middle-income households in 2022 compared with 2021, while rising 1.5% for the bottom fifth of households and 1.1% for the top, according to the Congressional Budget Office study. Furthermore, nearly 40 percent of...

by Glen | Feb 13, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates

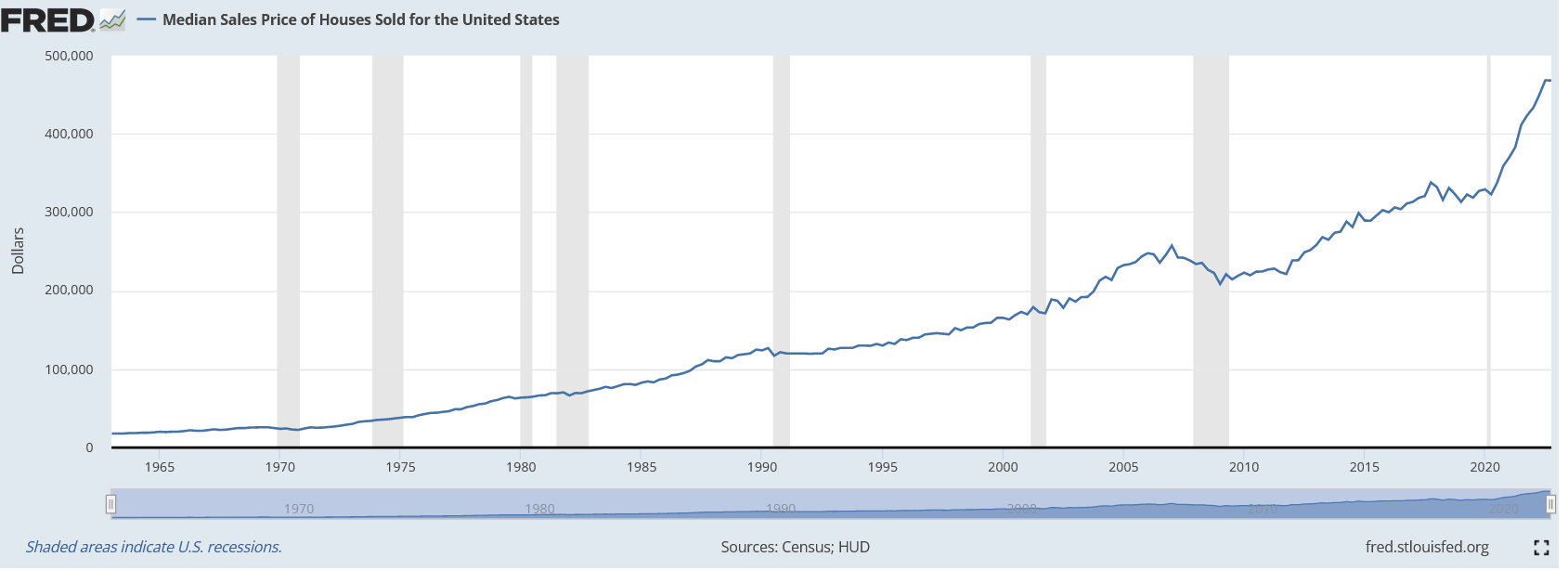

The market currently has a fixation on interest rates. Essentially whatever interest rates do the market reacts accordingly. For example if rates rise, sales fall and vice versa. Are rates really the driver of the slow down in real estate sales? If rates...

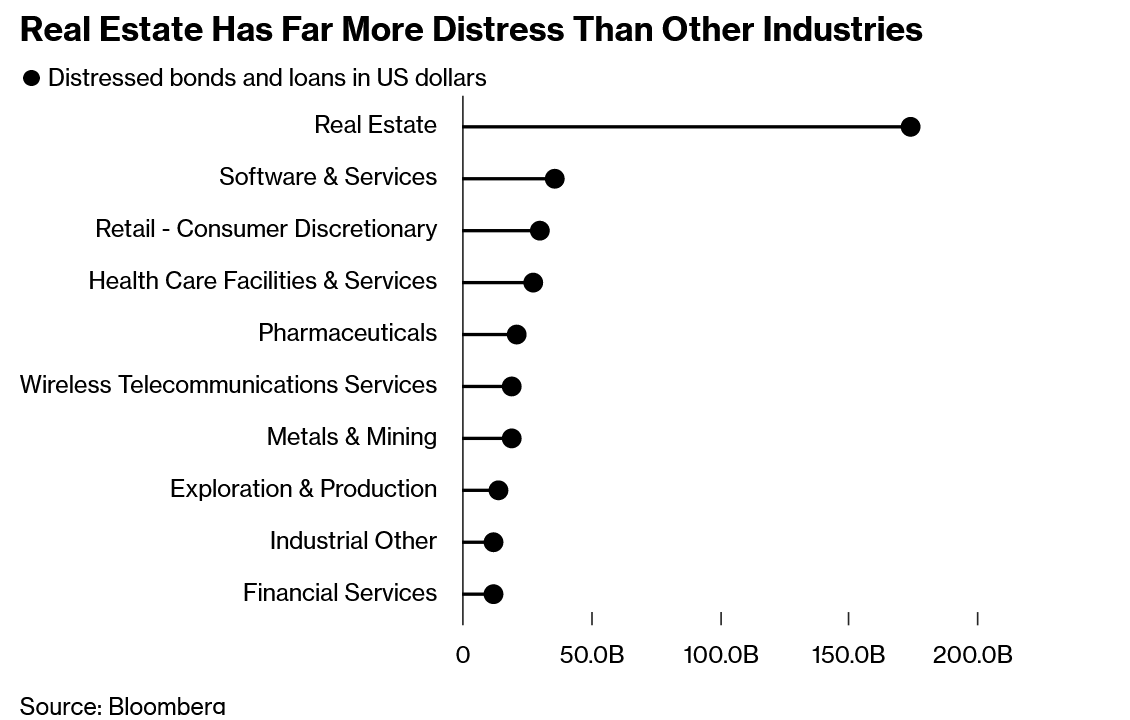

by Glen | Feb 6, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Colorado Hard Money, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Georgia hard money, Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates

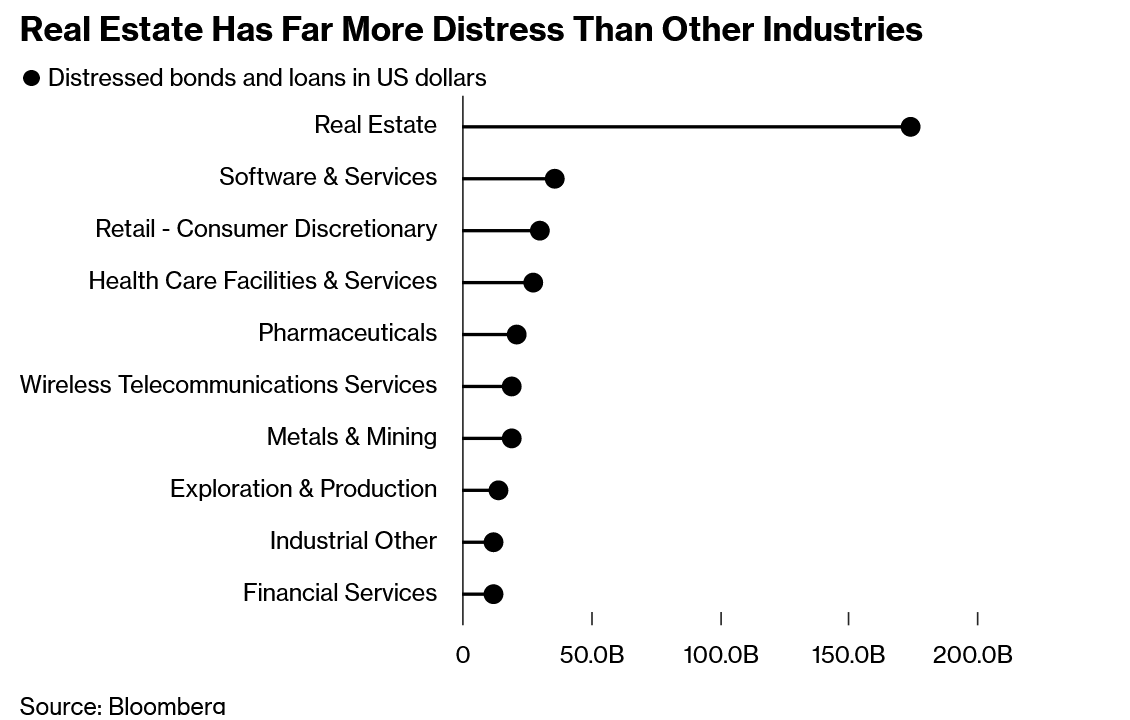

I rarely say that Covid caused radical changes in behavior but the commercial property sector is bucking this trend. This is not because of return to office or lack thereof, but leverage and the central bank. In every cycle in recent memory as the economy started to...