by Glen | Jun 3, 2024 | 2024 mortgage rates, 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

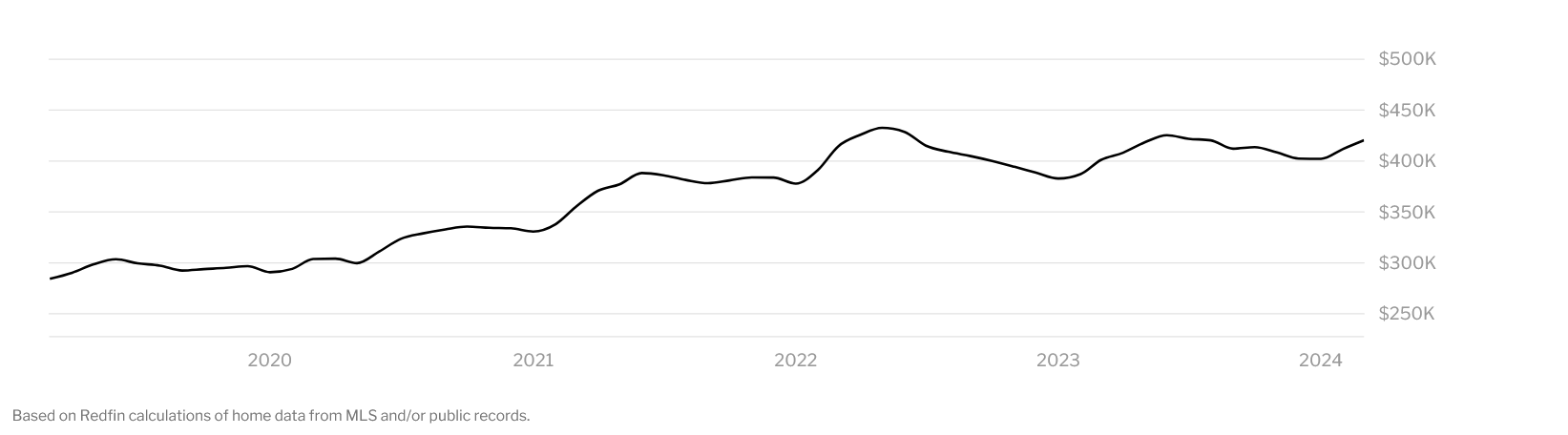

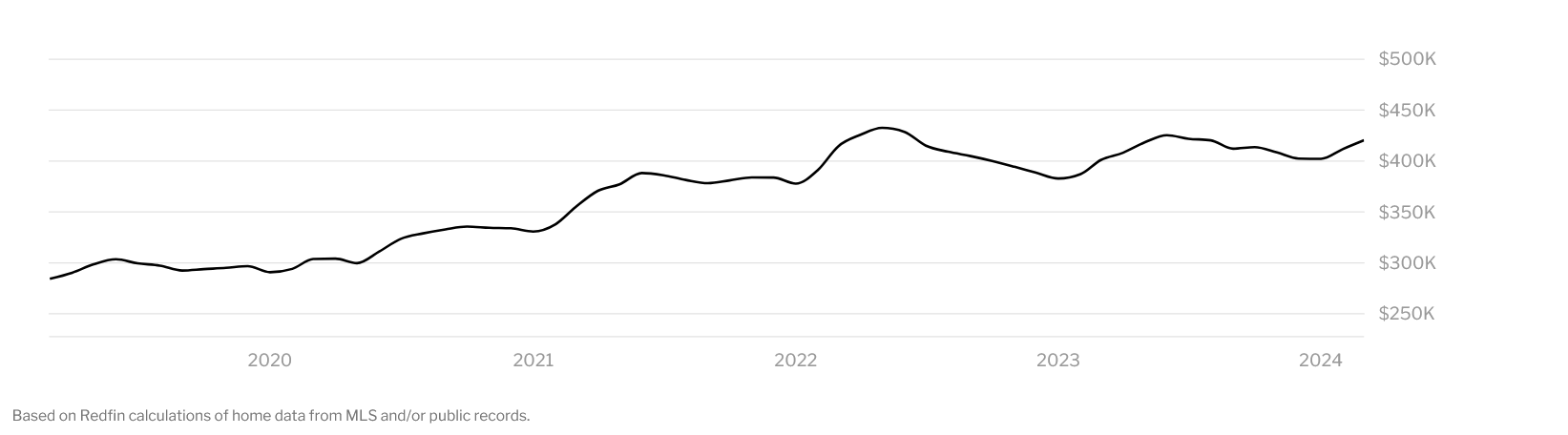

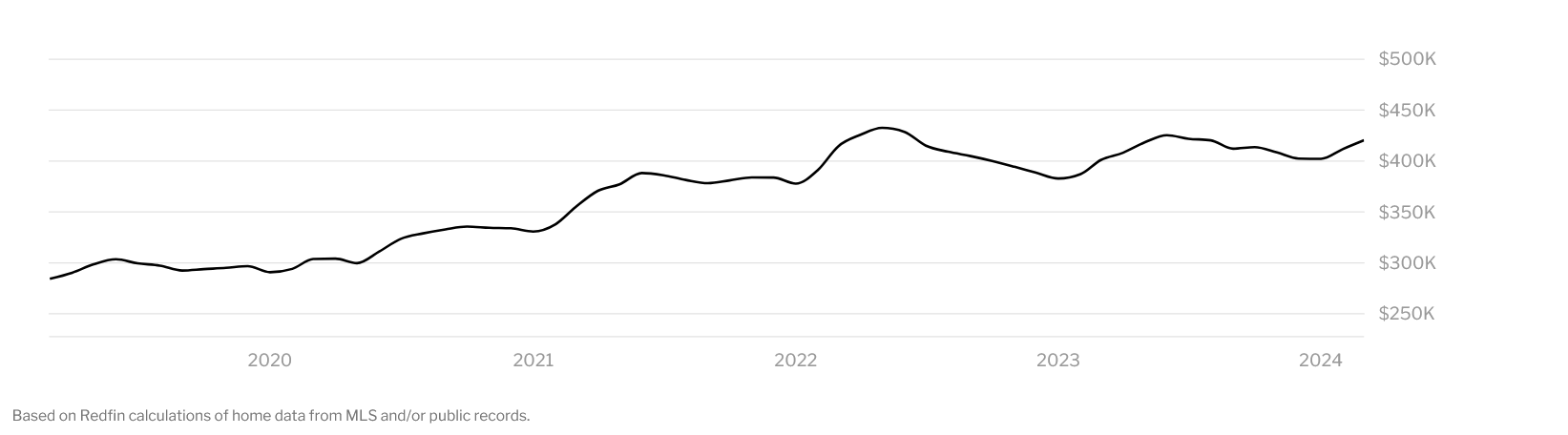

It is a bit perplexing; mortgage rates are over 7%, well over double their lows, and yet real estate prices are once again heading higher after a minor pullback late last year. Prices have pivoted from last fall to make a strong comeback and approach new highs. What...

by Glen | Apr 10, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Bank failures, Colorado Hard Money, commercial hard money, Denver Hard Money, Georgia hard money, hard money loans, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates

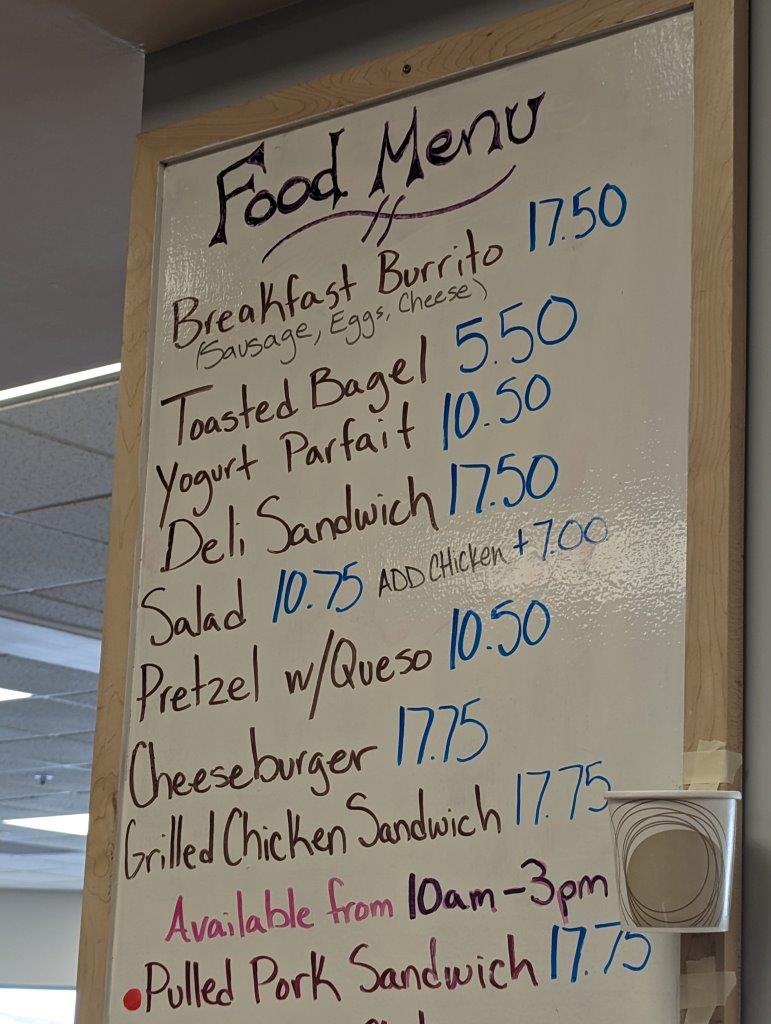

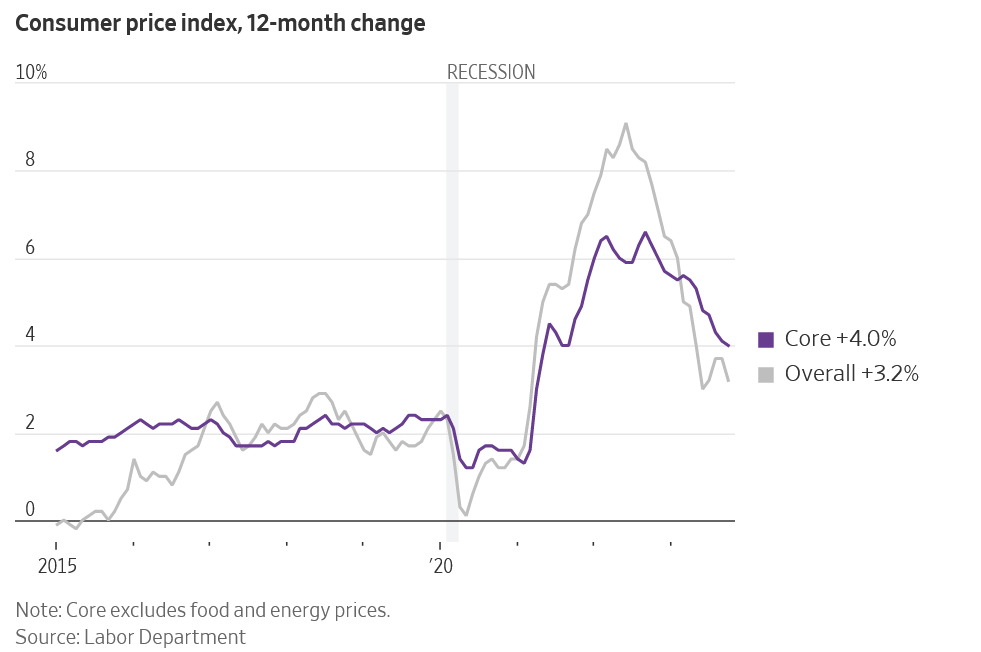

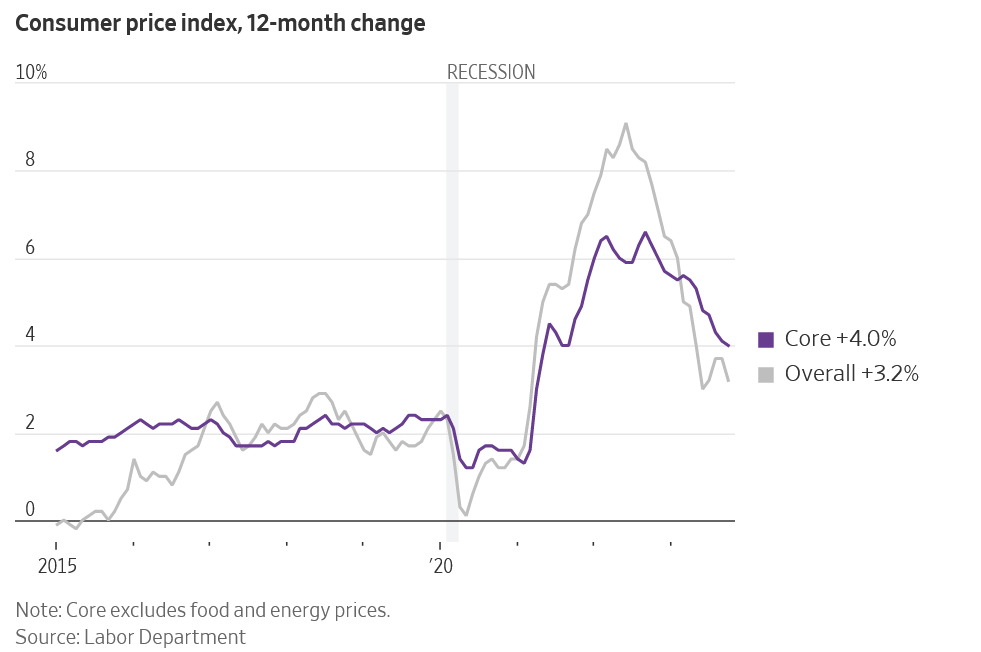

As suspected the March consumer price index came in hotter than expected which should be no surprise to anyone buying groceries, going out to eat, or traveling, everything is considerably more expensive and there continues to be insatiable demand. What does this mean...

by Glen | Mar 11, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski real estate, Denver Hard Money, Georgia hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

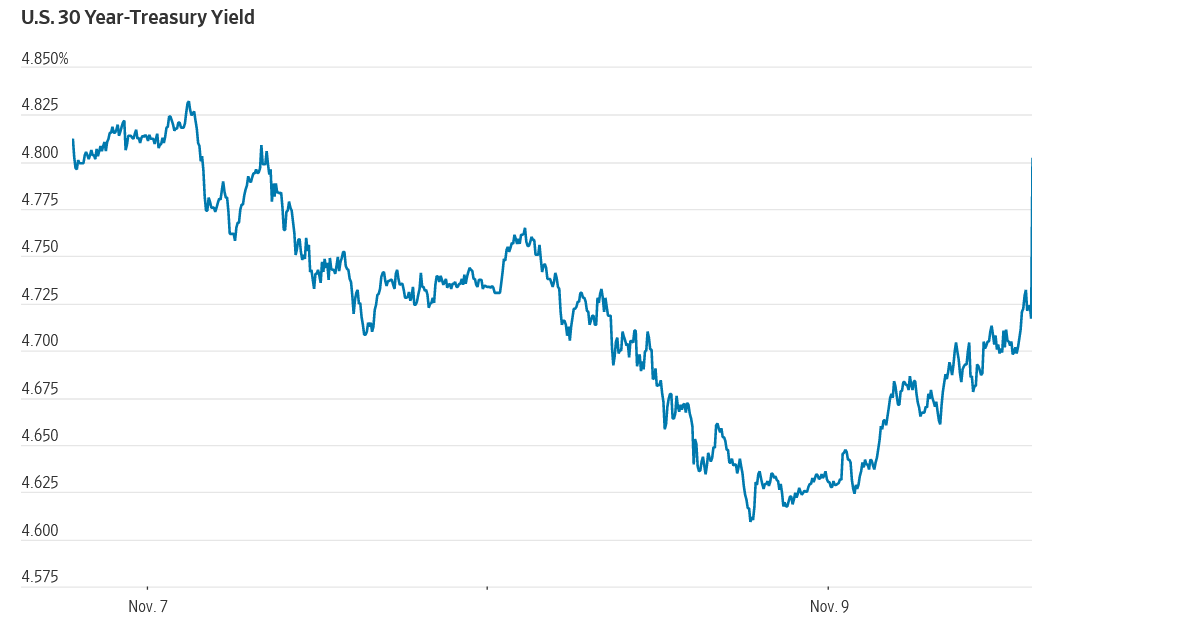

When I was writing this article rates were hovering right around 7%. At the same time economists are predicting a sharp decline in mortgage rates and a booming 2024 real estate market. On the other hand, the chart above shows a much different picture. Where do...

by Glen | Nov 27, 2023 | 2023 real estate prediction, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

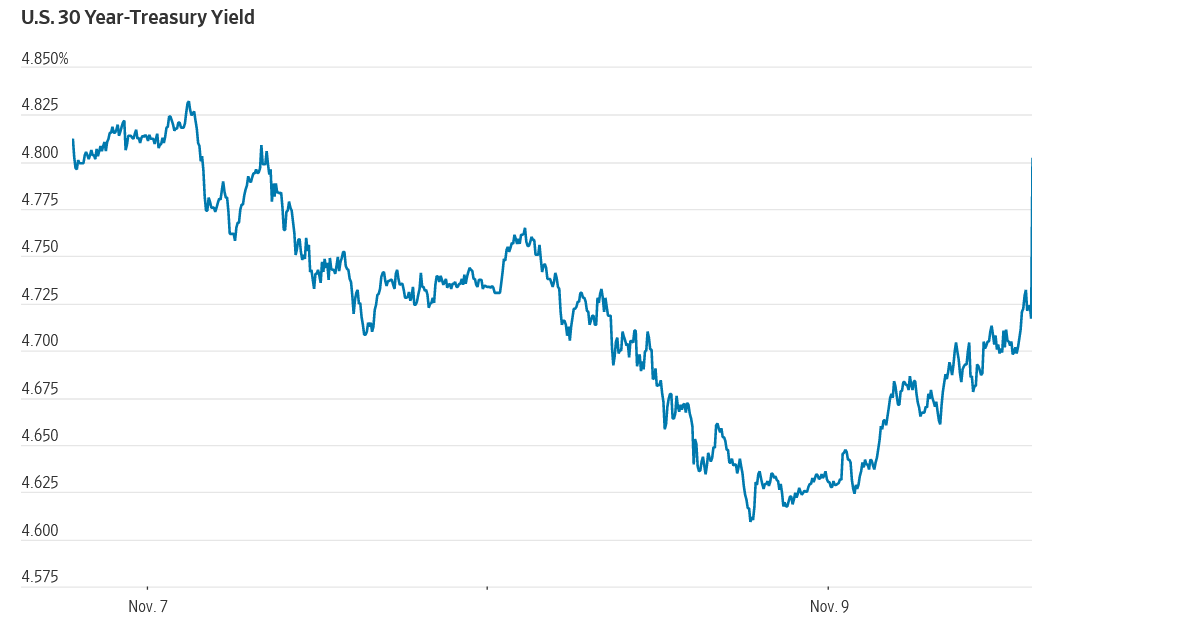

What does the recent CPI fall mean for mortgage rates and real estate prices? A broad slowdown in inflation continued in October, likely ending the Federal Reserve’s historic interest rate increases. The slowdown came below most median estimates and the...

by Glen | Oct 16, 2023 | 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Bank failures, Colorado Hard Money, Colorado private lender, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Government Bailout, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates

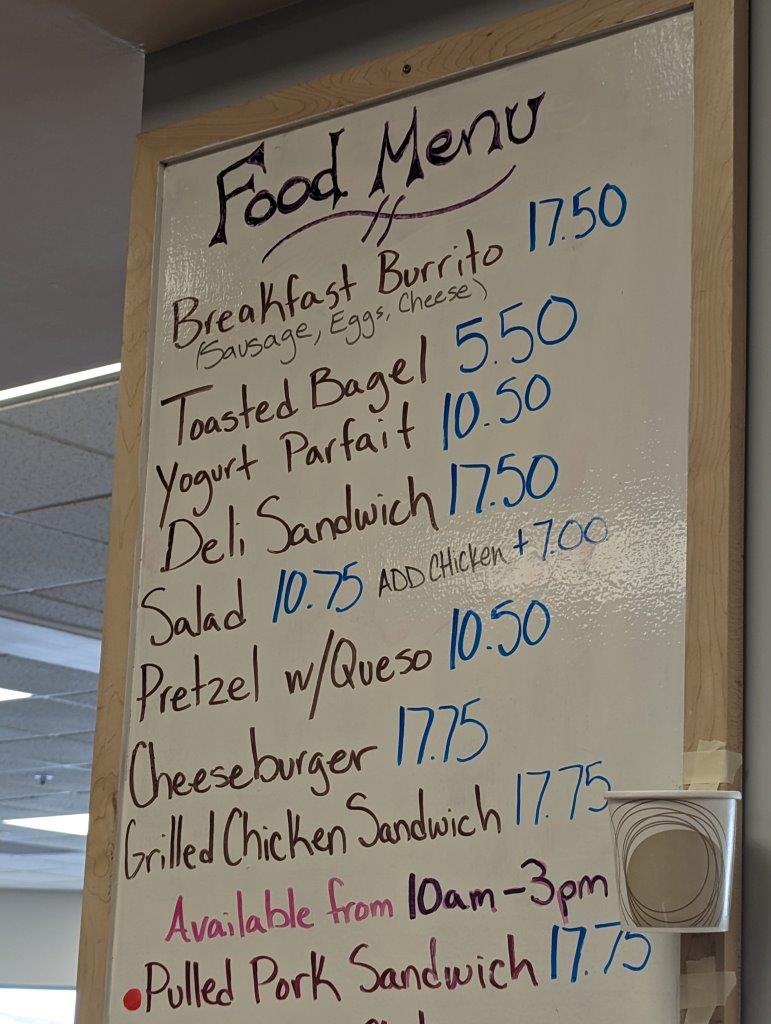

In the past recessions, especially in 2008, just prior to the crash we saw a big pull back in luxury purchases. This was an early indicator of huge drops in real estate prices. Currently we are seeing a resounding change in luxury spending, does this mean luxury...

by Glen | Oct 9, 2023 | 2023 real estate prediction, 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, hard money loans, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

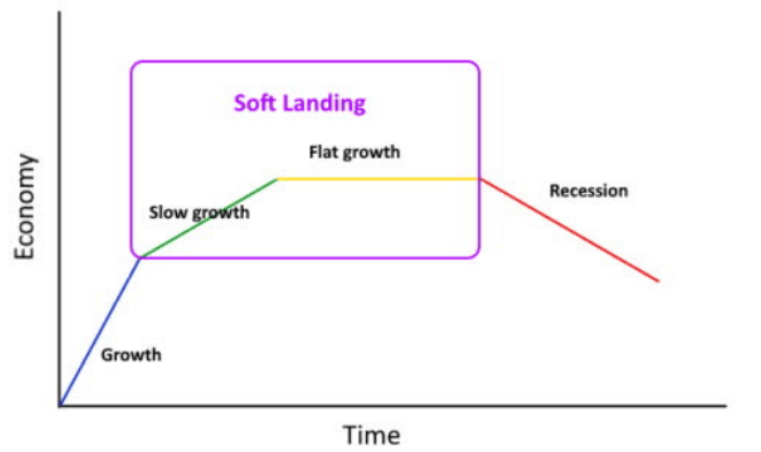

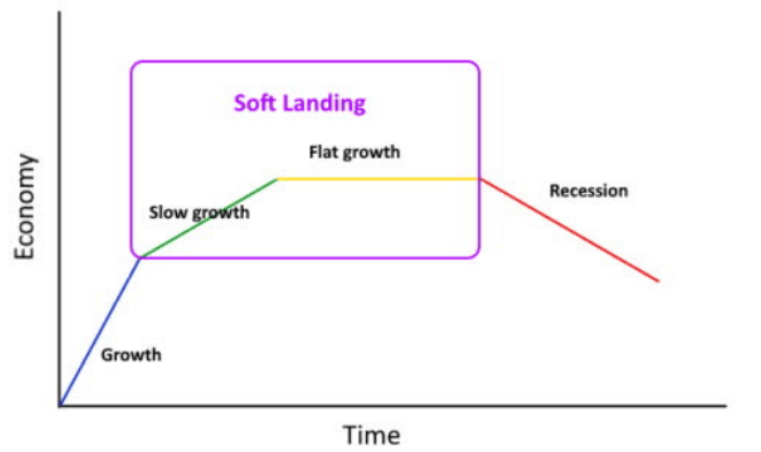

Earlier in the year most economists and myself predicted a recession by now, but the cards have changed with most now predicting the opposite, a soft landing. What is a soft landing? Is a soft or hard landing better for real estate? Does it really matter which...