by Glen | Apr 14, 2025 | 2025 mortgage rates, 2025 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, Georgia hard money, Government Bailout, hard money, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, private lender, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, recession, recession impact on real estate

Are the bulls running or are the bears coming? Any business media you pick up is harping on the idea of a “recession watch” and the economy is basically coming to an end! On the flip side my proprietary lending data is giving me a radically different answer. What...

by Glen | Jan 6, 2025 | 2025 mortgage rates, 2025 real estate predictions, 90s real estate recession, About Fairview Commercial Lending, Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, Colorado ski real estate, Denver Hard Money, General real estate financing information, Georgia hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, private lender

The above is a picture of my windshield after a chance early morning encounter with an elk; I walked away while my car was basically totaled. Why is 2025 the year of the elk as elk should typically be the least of your worries? What does this mean for the upcoming...

by Glen | Oct 7, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Buy now Pay later impact on real estate, CO hard money, Colorado Hard Money, Denver Hard Money, Georgia hard money, Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, mortgage rates, Private Lending, Property Valuation

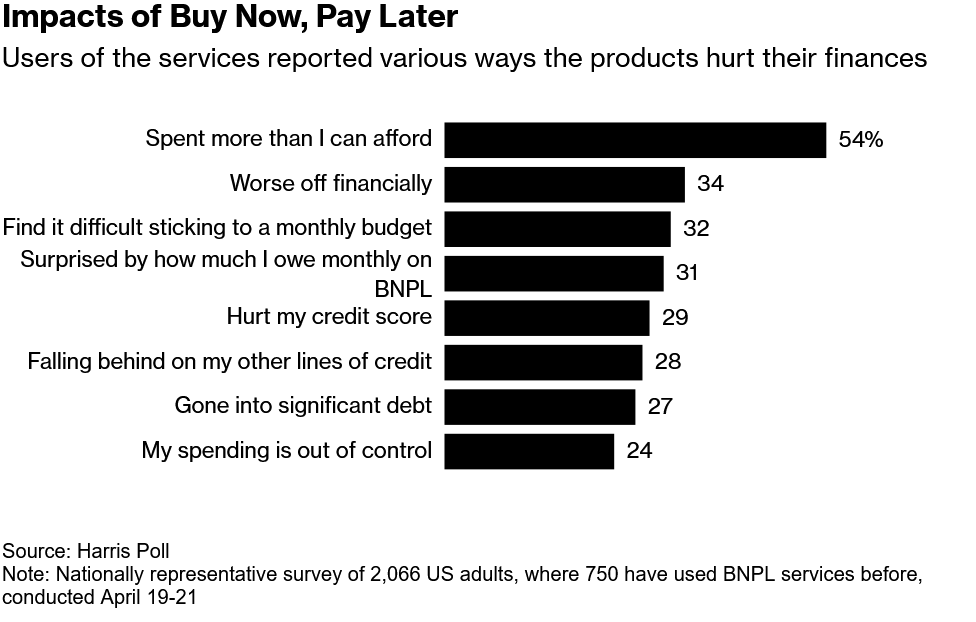

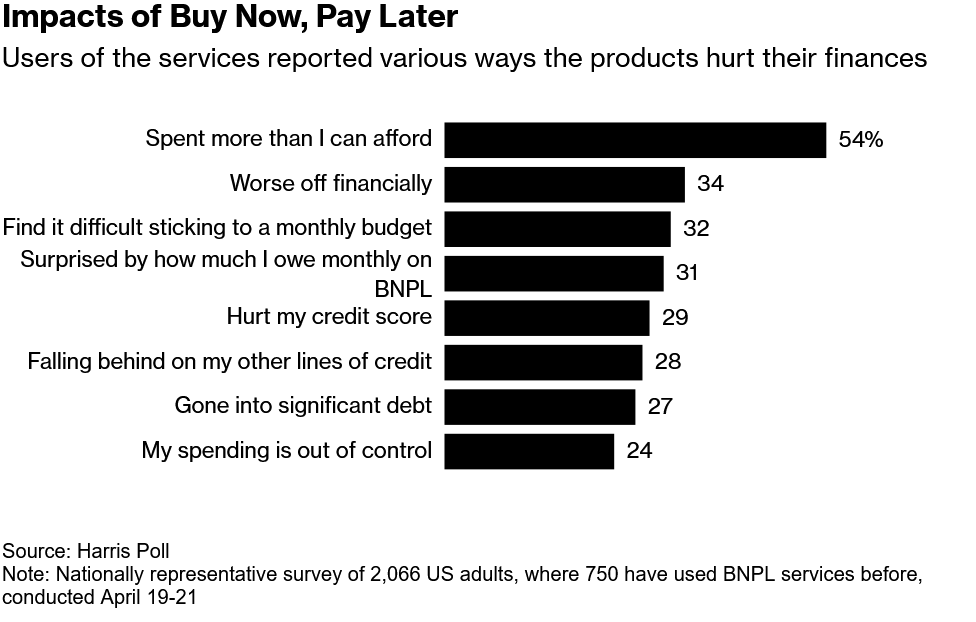

Consumer spending in the world’s largest economy has been so resilient in the face of stubbornly high inflation that economists and traders have had to repeatedly rip up their forecasts for slowing growth and interest-rate cuts. Is Phantom Debt driving consumer...

by Glen | Aug 12, 2024 | 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Housing Price Trends / Information, Housing shortage, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates, Property Valuation, will house prices increase

I just saw an article on CNBC with the headline: America is short 5 million houses. The media is proclaiming a housing crisis throughout the country due to the shortage. Ironically at the same time the US has hit a record for the slowest population growth in the...

by Glen | Jul 15, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

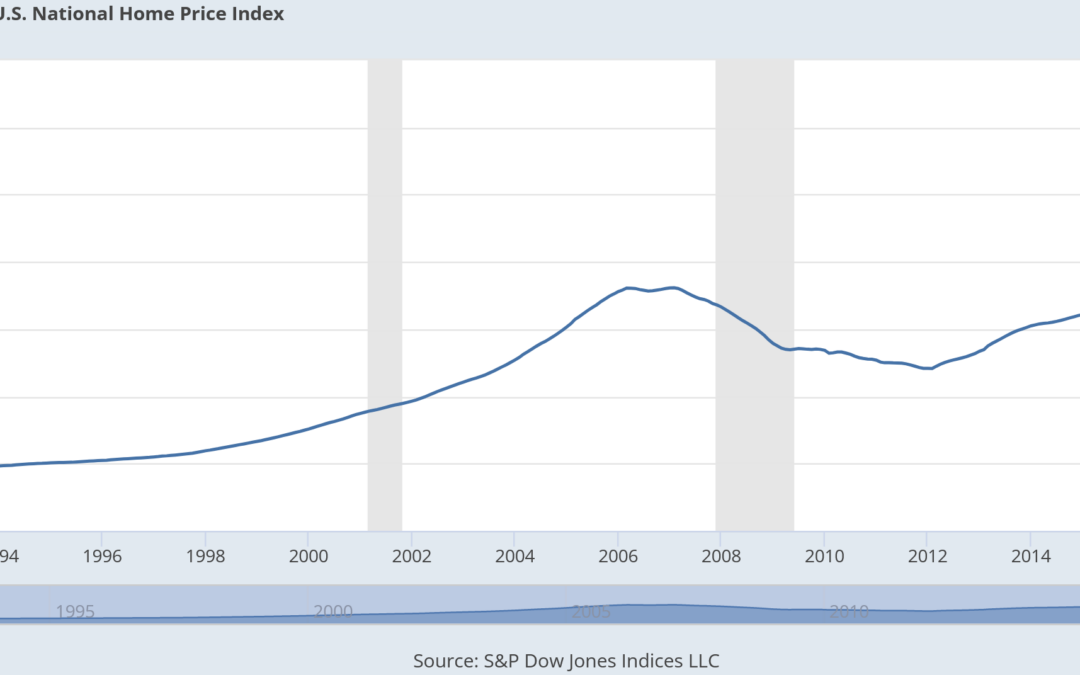

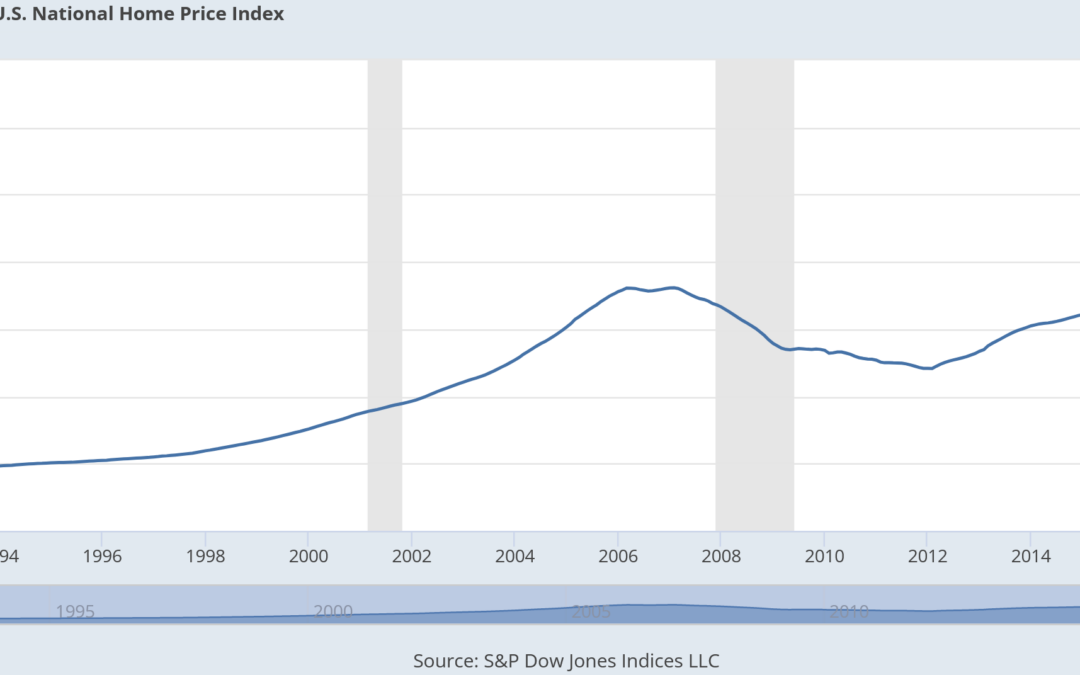

It is astonishing that house prices continue higher in the face of high interest rates and a slowing economy. The media keeps pinning the continued appreciation on lack of supply even while listings in places like Denver have jumped 33% year over year. What is...

by Glen | Jun 17, 2024 | Atlanta Hard Money, Atlanta Private Lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, hard money loans, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, Real Estate economic trends, Real Estate Trends, Real estate Valuation

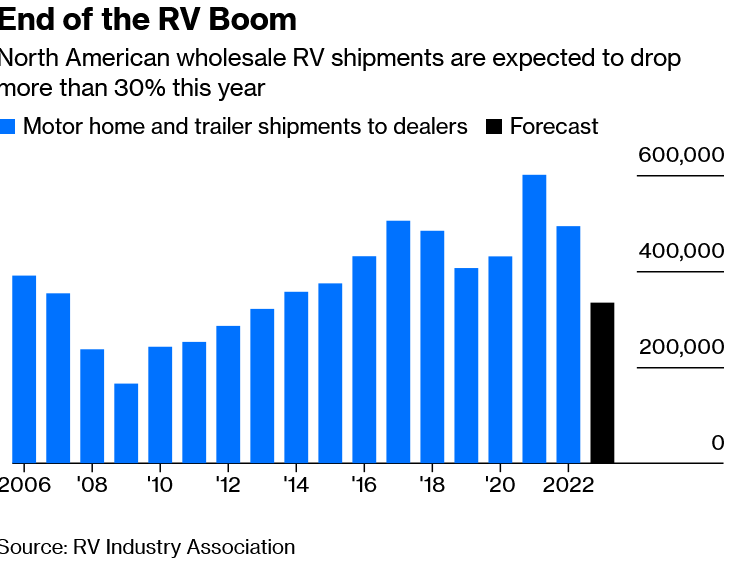

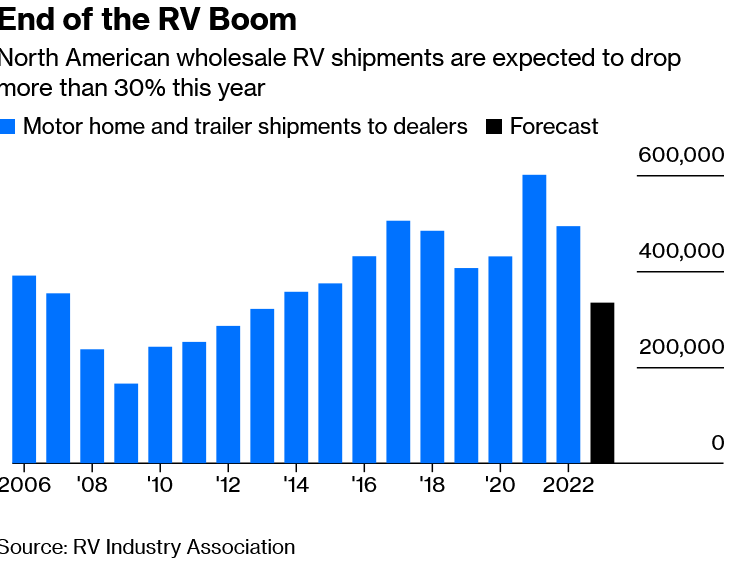

The economy is currently in a “transition” phase. To determine if the sun is setting on our current cycle, it is critical to watch for leading indicators of where we might be heading. One of the strongest predictors of a recession is consumer purchases of one...