by Glen | May 22, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Bank failures, Bankruptcy, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, Property Valuation

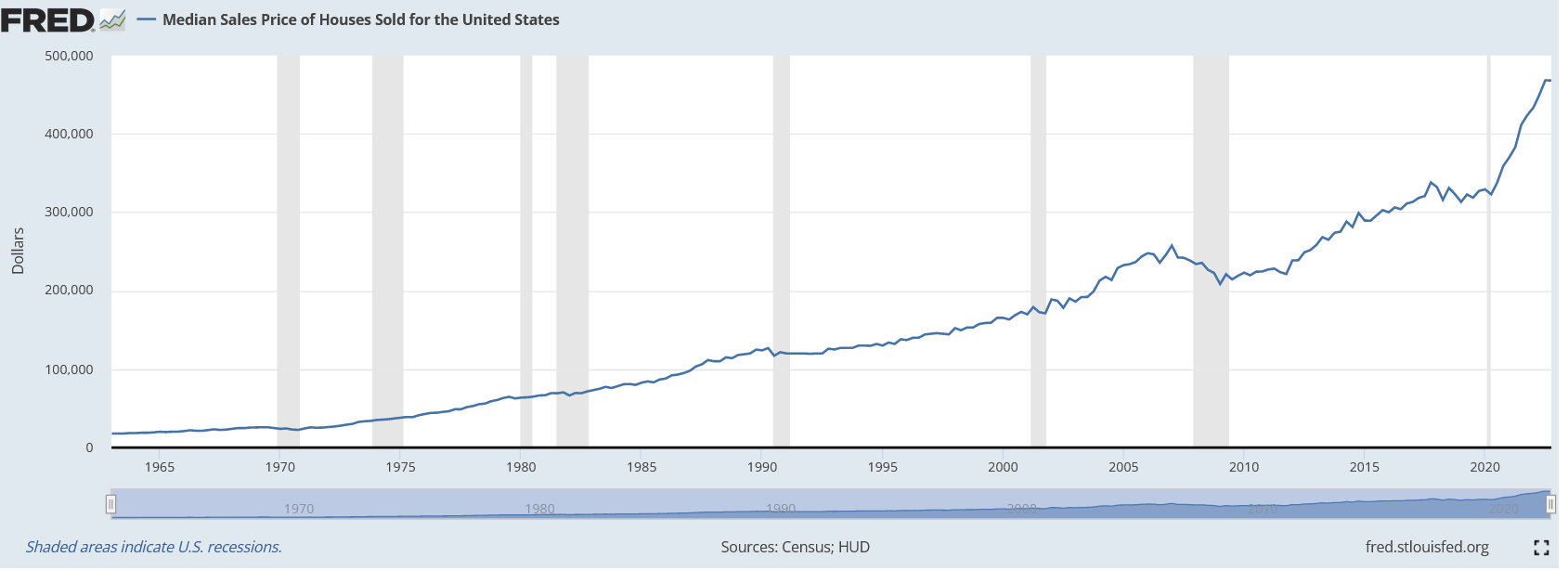

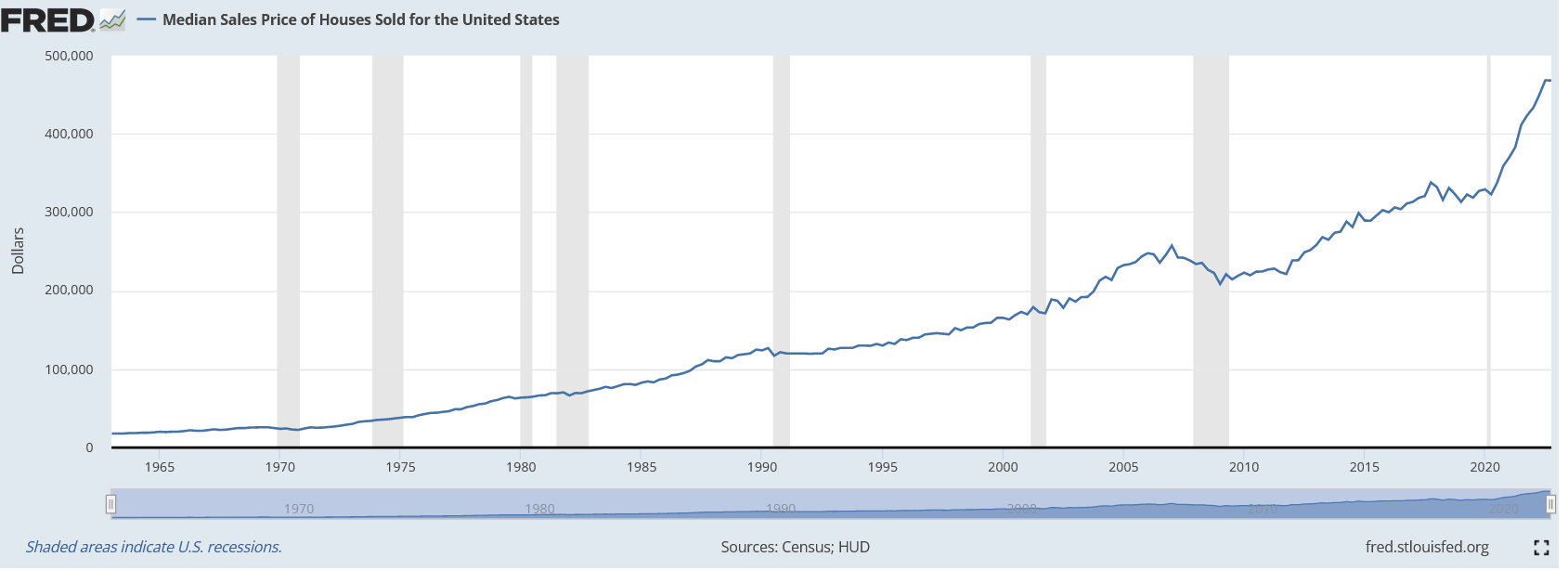

Although the spring real estate market has slowed drastically from the pandemic days, the bottom has not fallen out. Quite the opposite has occurred, in suburban markets and sunbelt cities, real estate keeps charging higher. A good example is Boulder, CO, a...

by Glen | May 1, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, commercial property trends, Denver Hard Money, Denver private Lending, hard money, Hard Money Lending, hard money loans

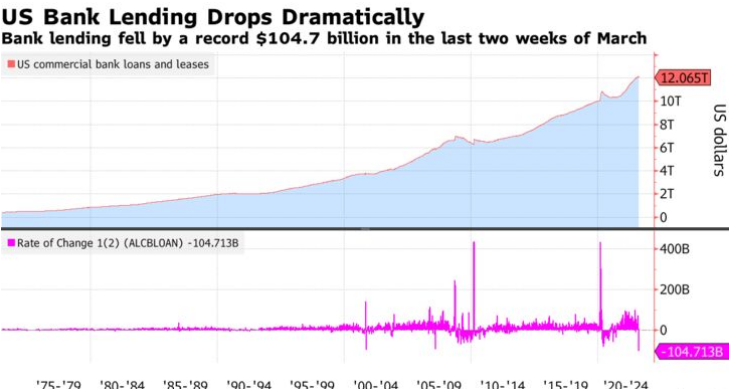

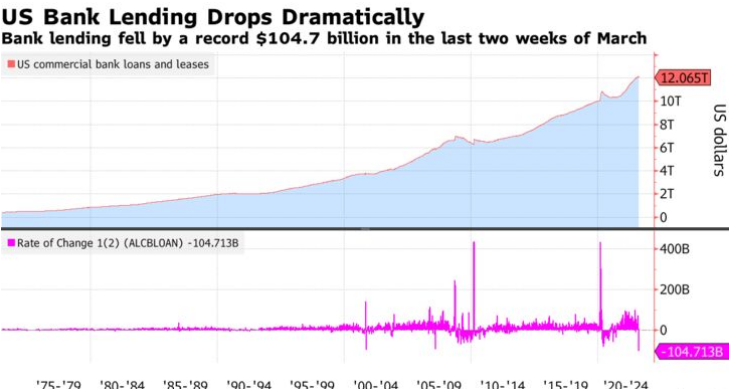

US bank lending contracted by the most on record in the last two weeks of March, indicating a tightening of credit conditions in the wake of several high-profile bank collapses. Why the sharp pullback in lending? What does this mean for commercial and residential...

by Glen | Apr 10, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, commercial property trends, Denver Hard Money, Georgia hard money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, if there is a recession what happens to real estate

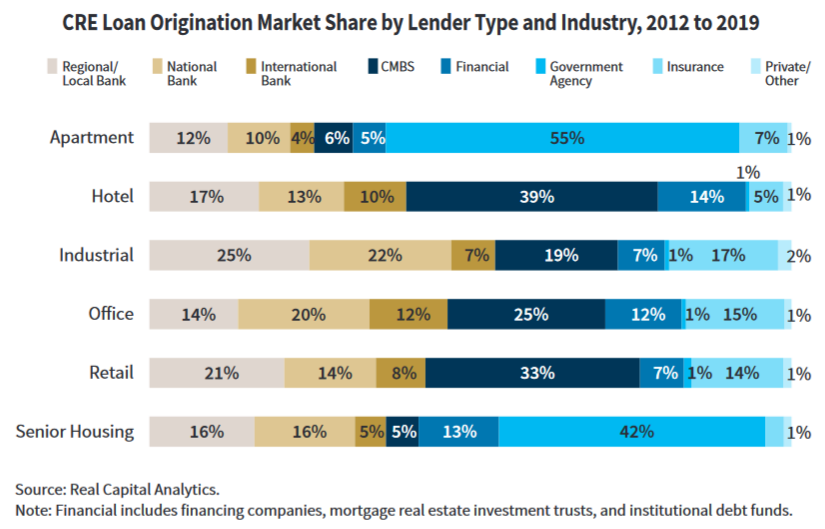

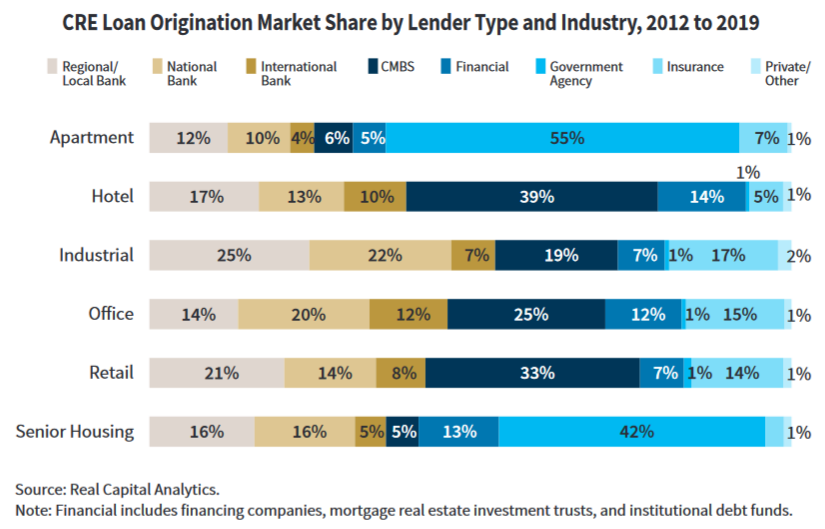

As the banking crisis unfolds, the media continues to focus on depositors and shareholders. Although both are important, there is an even bigger issue that is not being discussed. According to the FDIC, community banks made 67% of all commercial real estate loans in...

by Glen | Mar 27, 2023 | Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, if there is a recession what happens to real estate, interest rates, mortgage rates

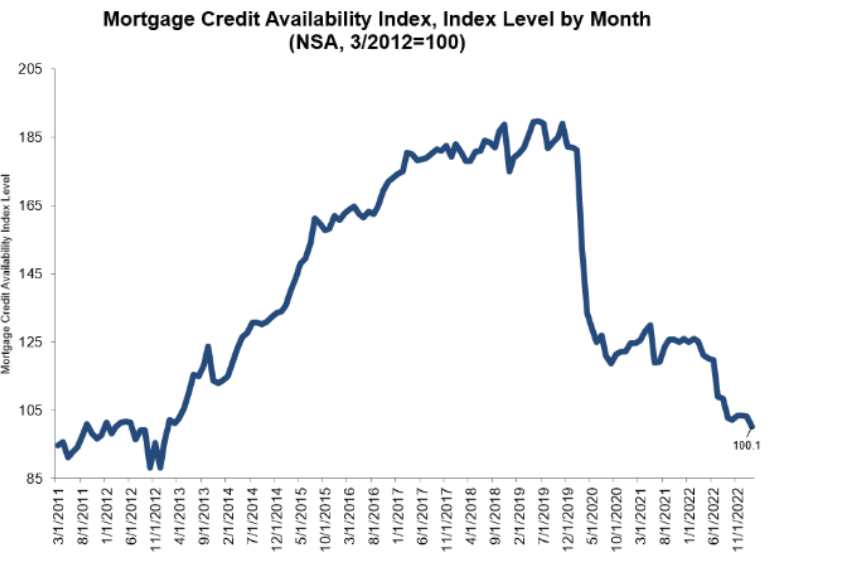

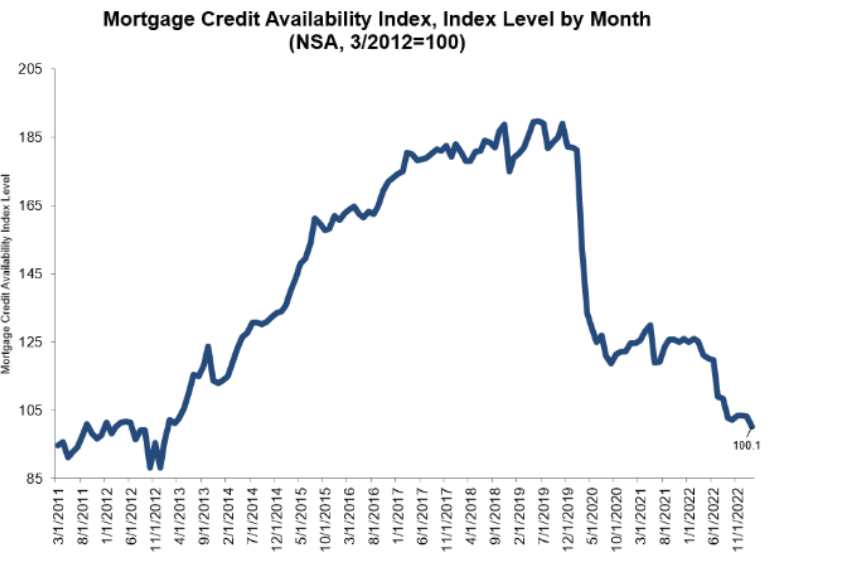

As a private lender, my call volume and closings the first quarter have been off the charts as borrowers fall out of more conventional products. This trend is now playing out with the Mortgage Credit Availability Index showing substantial tightening of credit for all...

by Glen | Mar 20, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, if there is a recession what happens to real estate, interest rates, mortgage rates, private lender, Private Lending

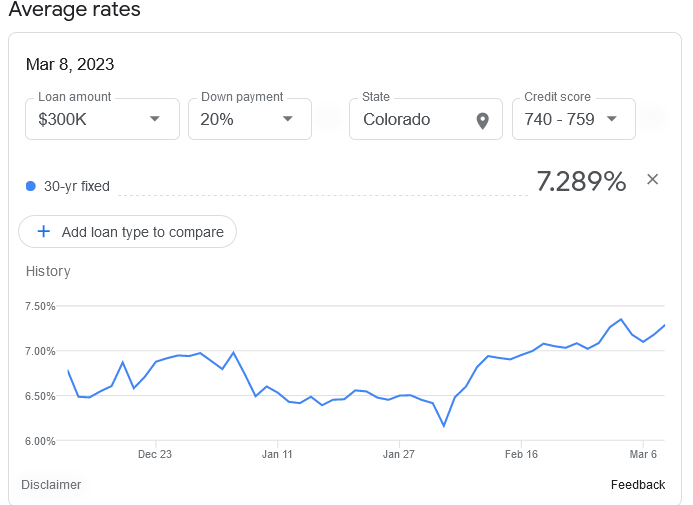

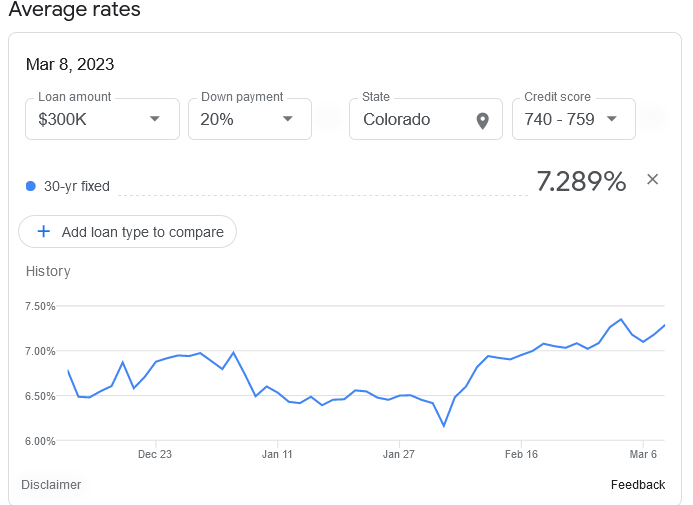

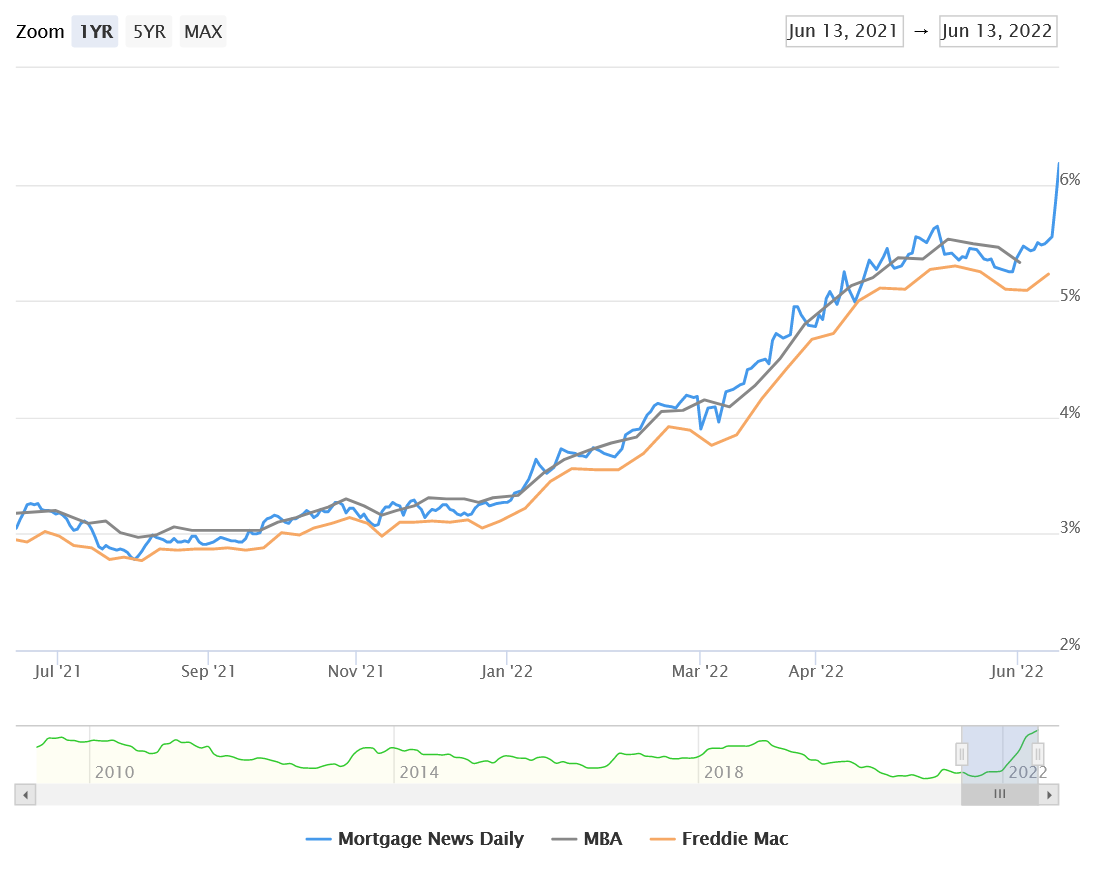

Wow, a few weeks ago rates had fallen from a peak of over 7% to almost 6%. Unfortunately the party was short lived as rates are now heading much higher. The recent jobs report was another blow out upping the odds of another half point increase at the next Fed...

by Glen | Feb 13, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates

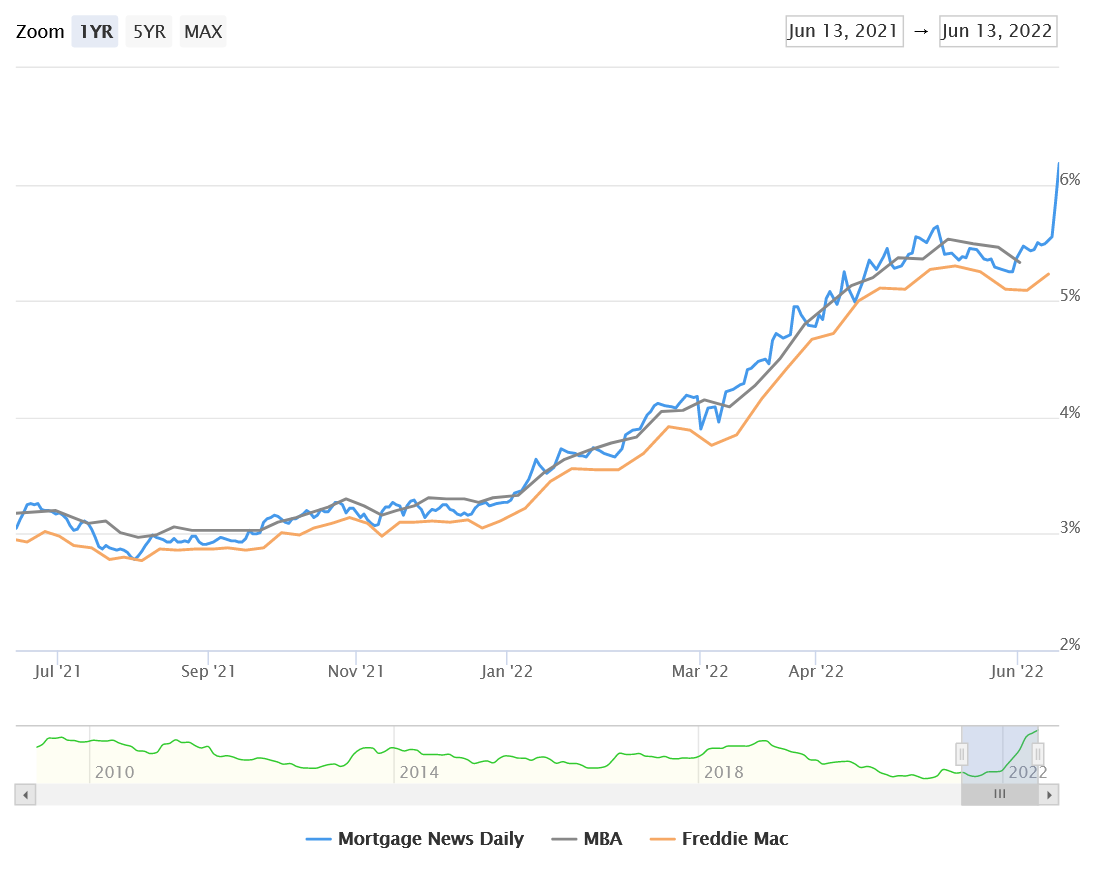

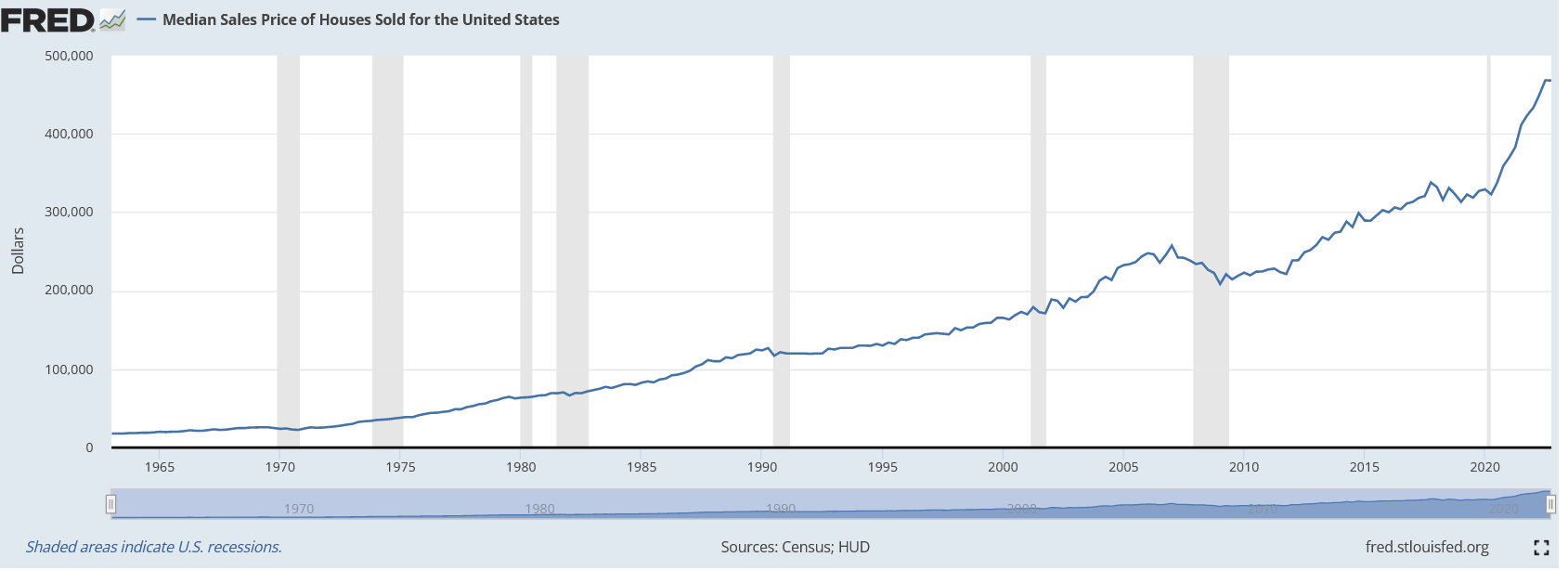

The market currently has a fixation on interest rates. Essentially whatever interest rates do the market reacts accordingly. For example if rates rise, sales fall and vice versa. Are rates really the driver of the slow down in real estate sales? If rates...