by Glen | Apr 29, 2024 | 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Biden tax plan, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Lending, How will Biden tax plan impact real estate?, national rental regulations

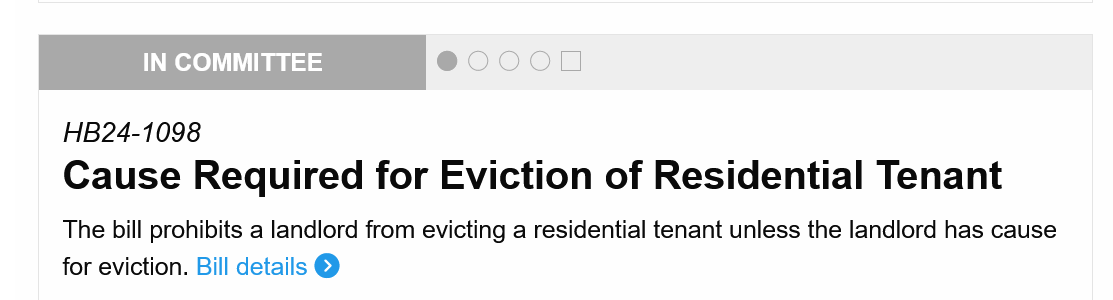

States have traditionally set rental regulations including zoning, evictions, etc… but that is all set to change with the president’s new proposal. The federal government will now be assuming many of the powers that were granted to the states. The biggest change is...

by Glen | Apr 22, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money

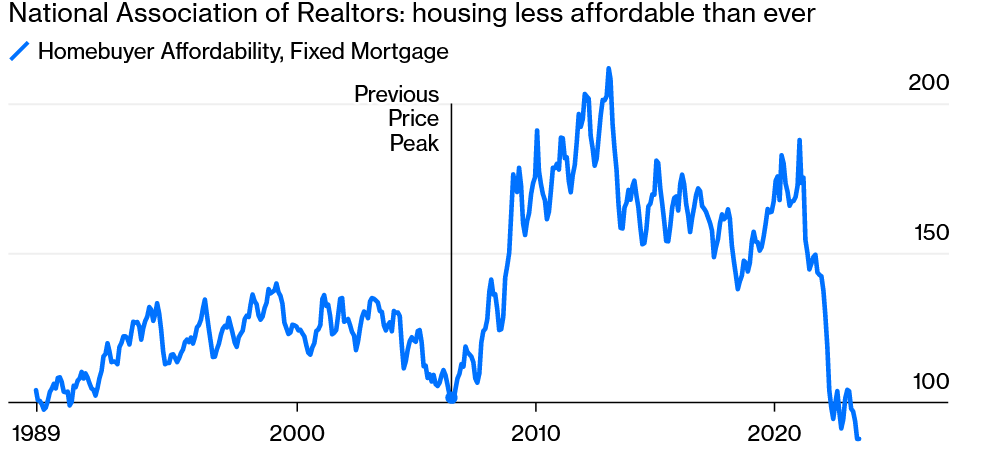

The big premise of the commission lawsuit against the national association of realtors is that high commission fees were one of the leading drivers of real estate prices. How true is this statement? Will the new commission structure for realtors lead to a reduction...

by Glen | Mar 4, 2024 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Closing, Commercial Loan Servicing, General real estate financing information, Georgia hard money, hard money, Hard Money Commercial Lending, Hard Money Lending, hard money loans, Housing Price Trends / Information

It is crazy how far technologically we have come, but at the same time how fragile our infrastructure is. On of the largest cities in Atlanta (Fulton County) recently had a cyber “incident” which shut down the city and halted all real estate closings. This...

by Glen | Jan 15, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, hard money, Housing Price Trends / Information

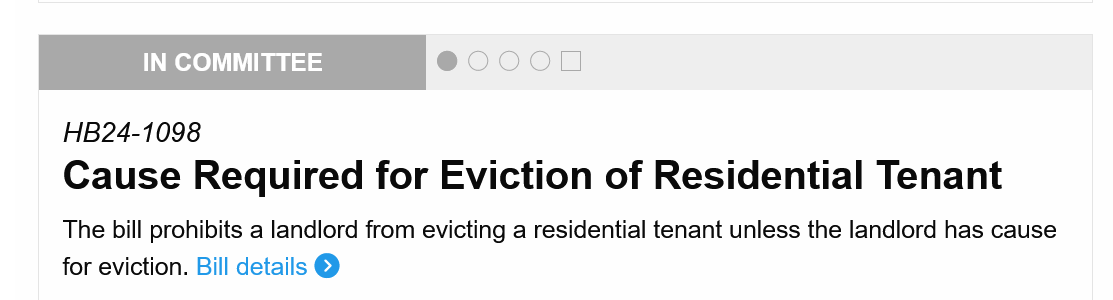

The market keeps predicting a goldilocks scenario with 100% certainty where inflation falls without much if any impact on residential real estate. The “soft landing” will occur at the same time interest rates have skyrocketed and supposedly the consumer...

by Glen | Jan 1, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, Commercial Loan Servicing, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, interest rates, mortgage rates

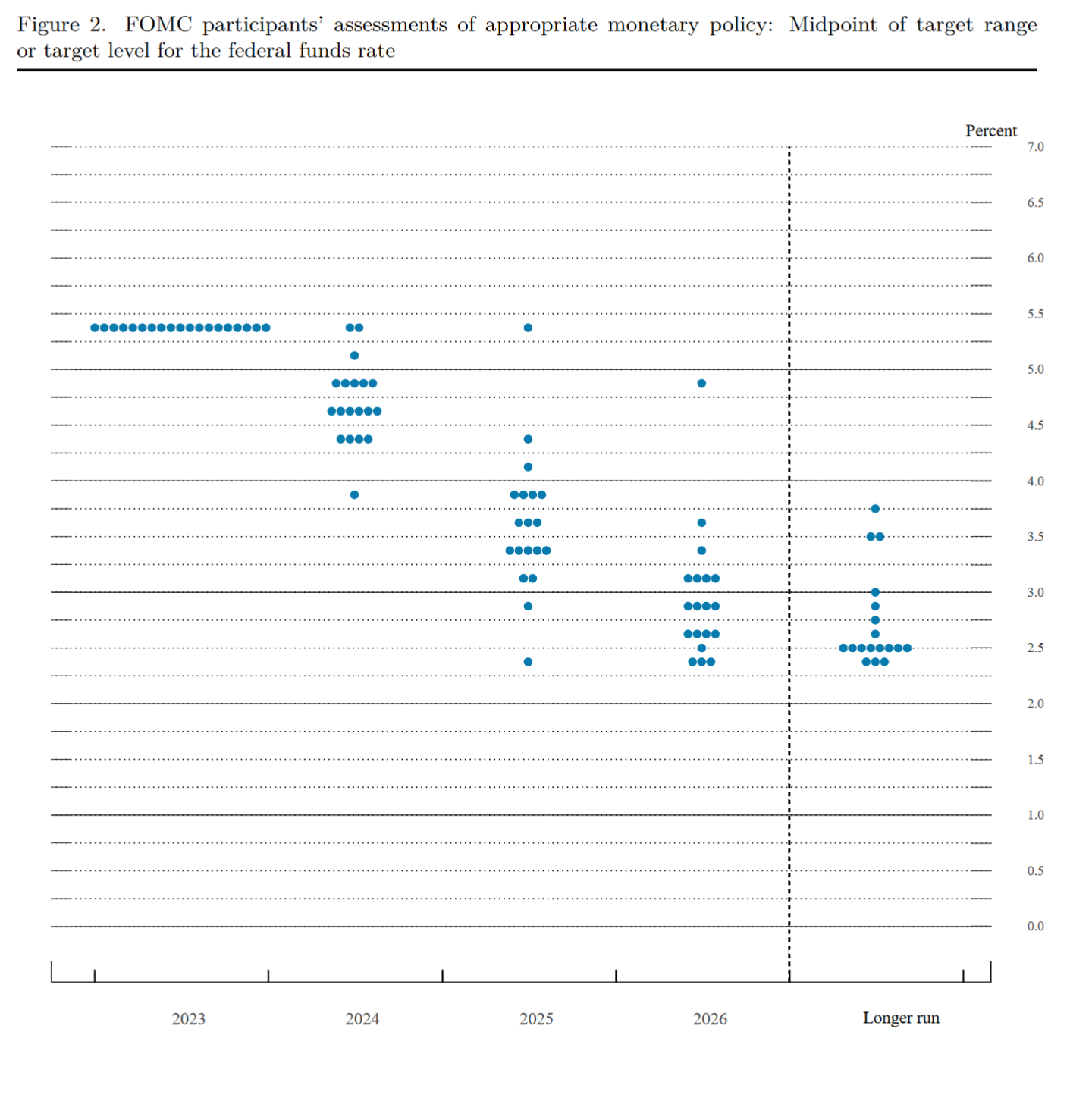

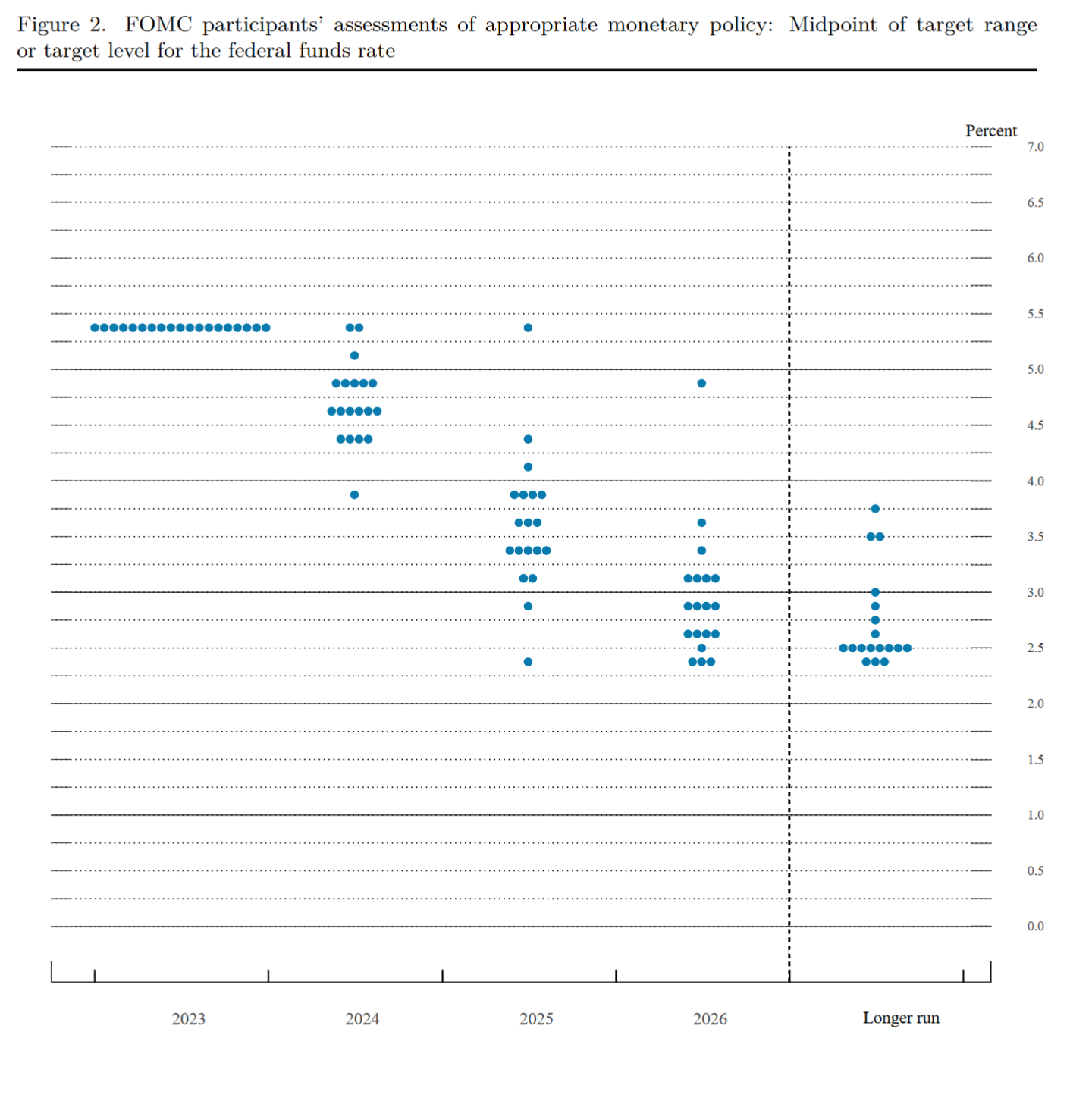

Although the graph above looks like an old Atari game, it is the Federal reserve dot plot which shows a profound shift. Ironically, just a few weeks ago the Federal Reserve was touting higher rates for longer. Now the federal reserve has done a 180 and has...

by Glen | Oct 9, 2023 | 2023 real estate prediction, 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, hard money loans, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

Earlier in the year most economists and myself predicted a recession by now, but the cards have changed with most now predicting the opposite, a soft landing. What is a soft landing? Is a soft or hard landing better for real estate? Does it really matter which...