by Glen | May 22, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Bank failures, Bankruptcy, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, Property Valuation

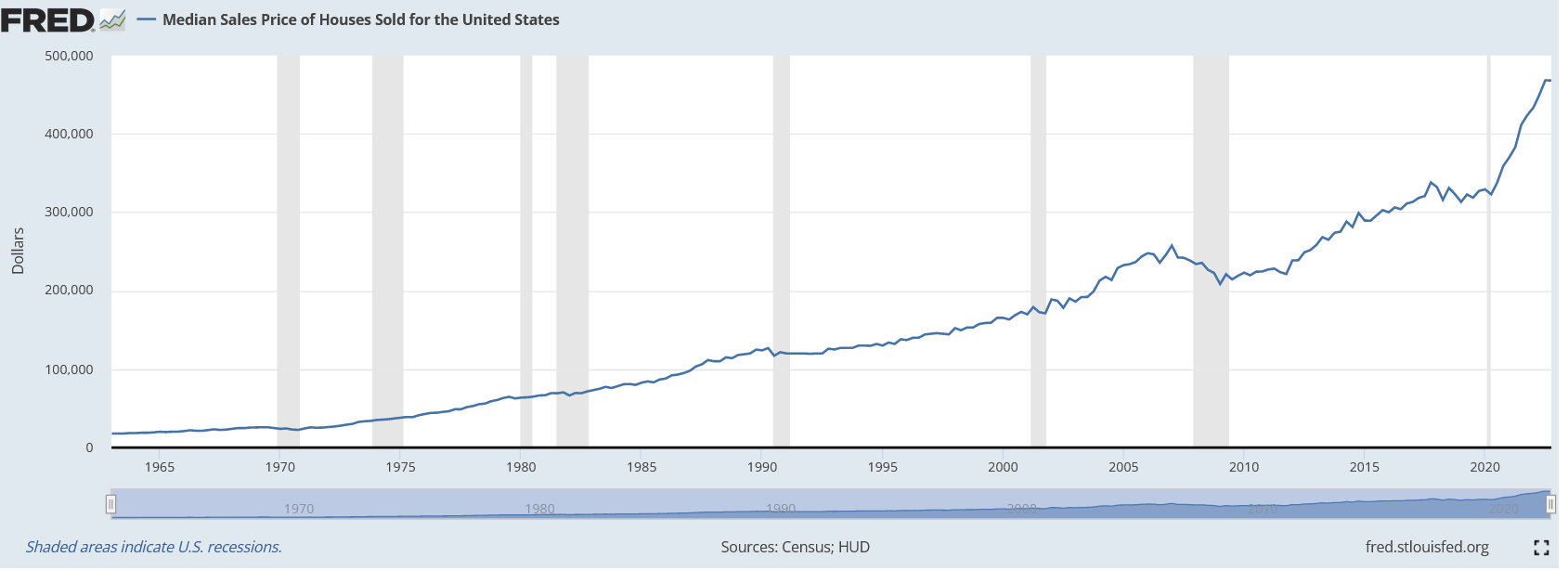

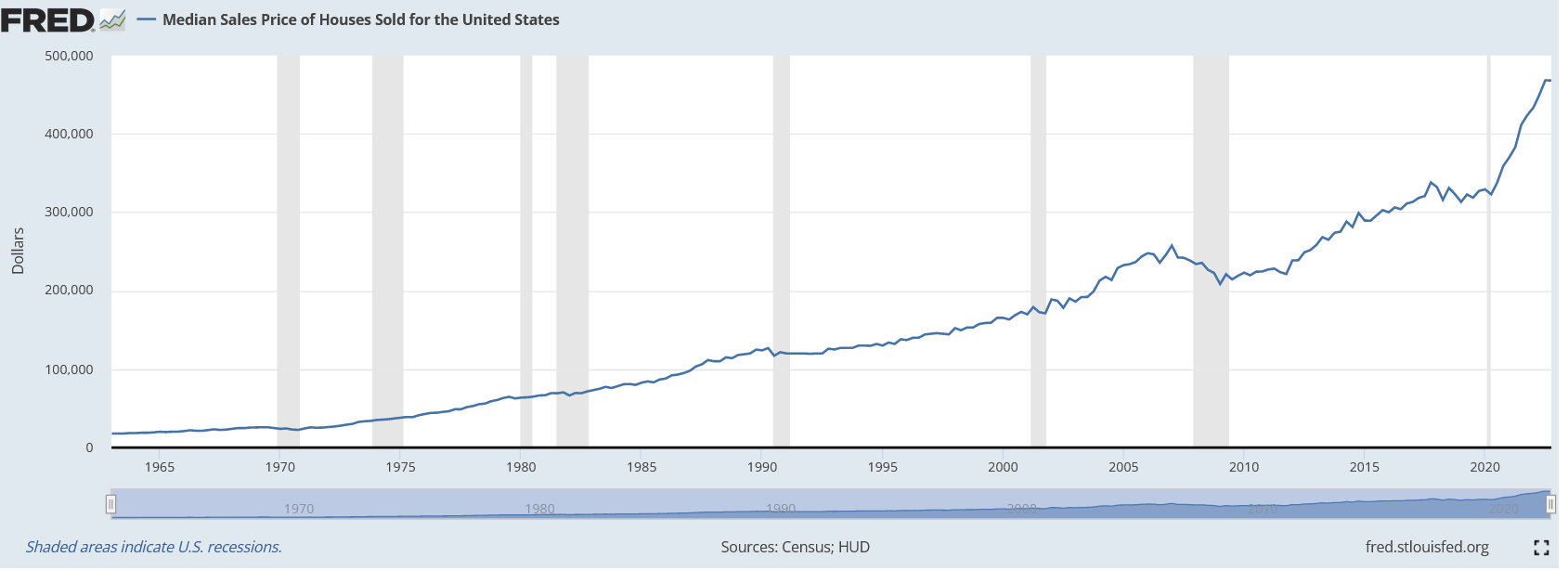

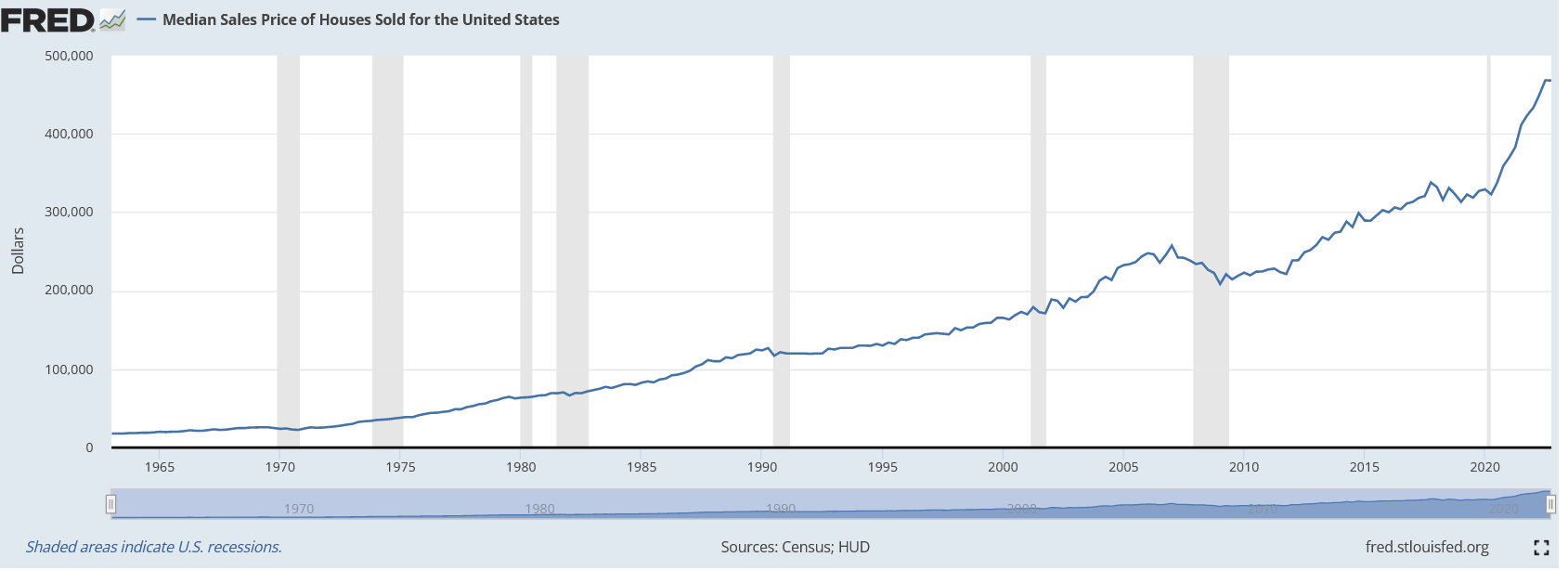

Although the spring real estate market has slowed drastically from the pandemic days, the bottom has not fallen out. Quite the opposite has occurred, in suburban markets and sunbelt cities, real estate keeps charging higher. A good example is Boulder, CO, a...

by Glen | May 15, 2023 | 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, commercial property trends, Denver Hard Money, Denver private Lending, Hard Money Lending, hard money loans, Housing Price Trends / Information

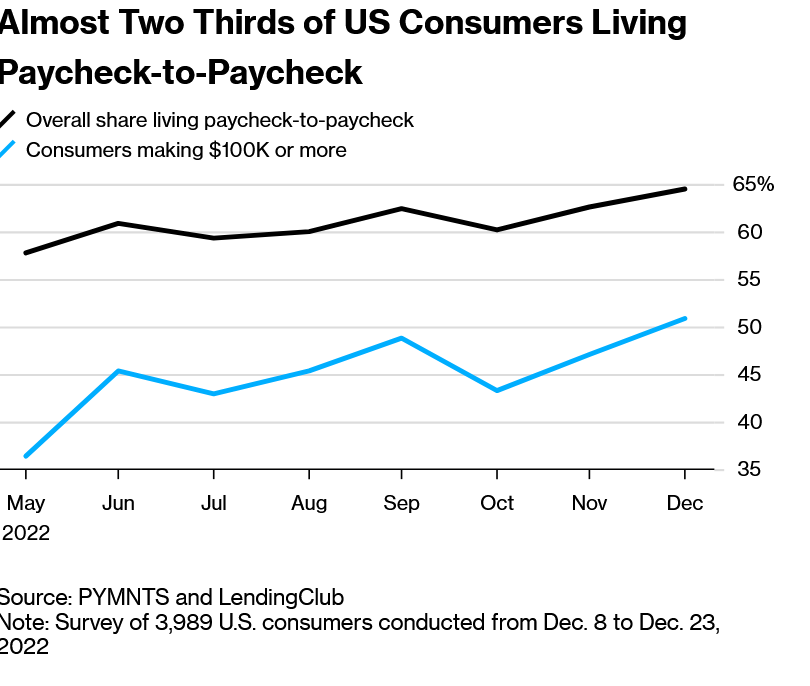

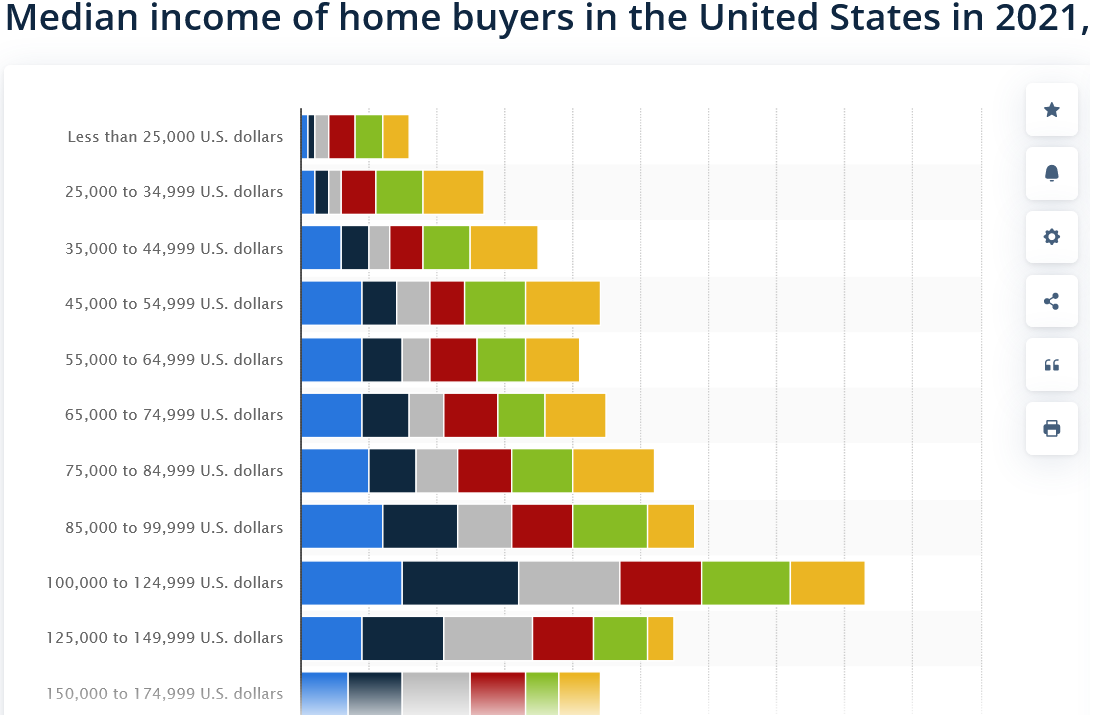

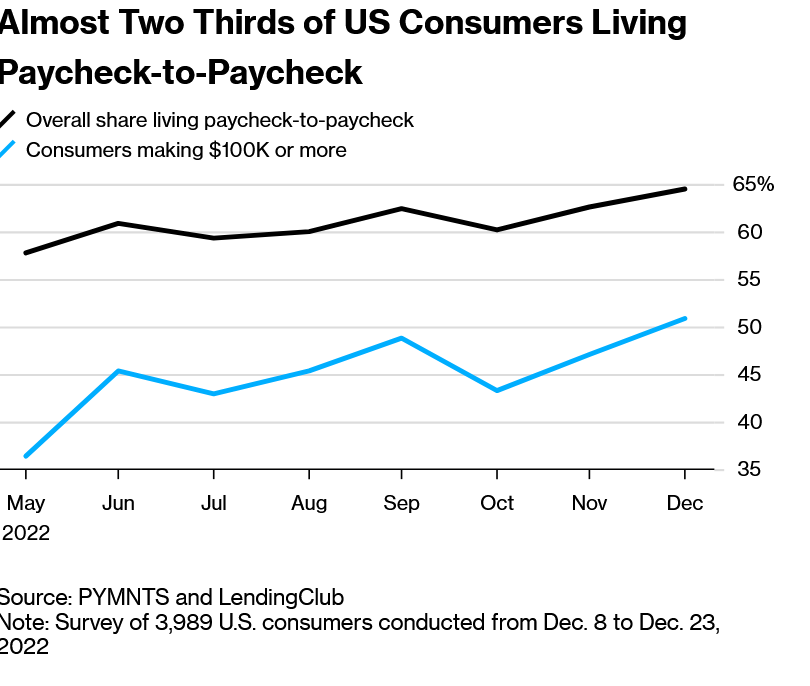

The share of Americans who say they live paycheck-to-paycheck climbed last year, and most of the new arrivals in that category were among the country’s higher earners (greater than 100k), a new study shows. Furthermore 24% had issues paying their bills in...

by Glen | May 1, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, commercial property trends, Denver Hard Money, Denver private Lending, hard money, Hard Money Lending, hard money loans

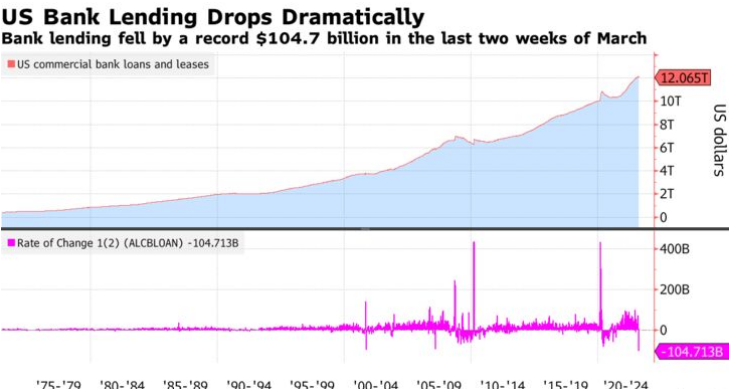

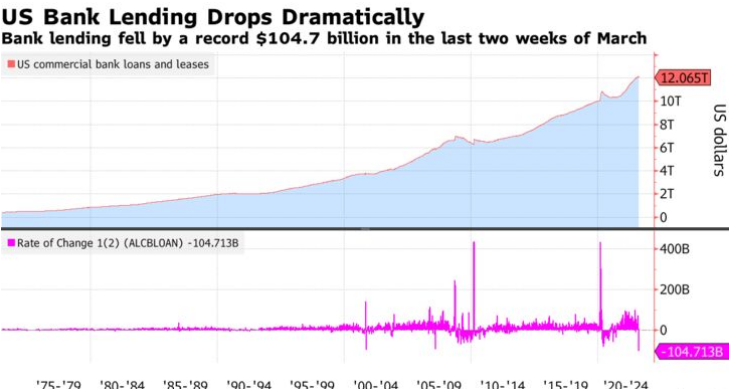

US bank lending contracted by the most on record in the last two weeks of March, indicating a tightening of credit conditions in the wake of several high-profile bank collapses. Why the sharp pullback in lending? What does this mean for commercial and residential...

by Glen | Apr 10, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, commercial property trends, Denver Hard Money, Georgia hard money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, if there is a recession what happens to real estate

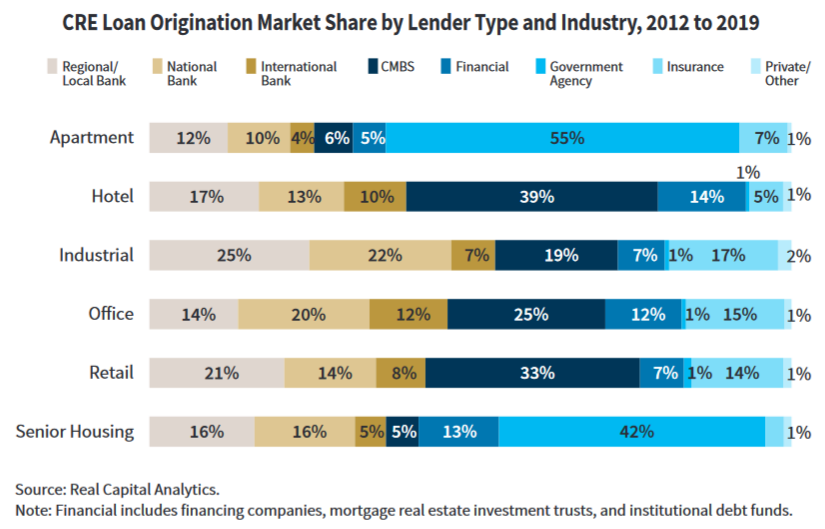

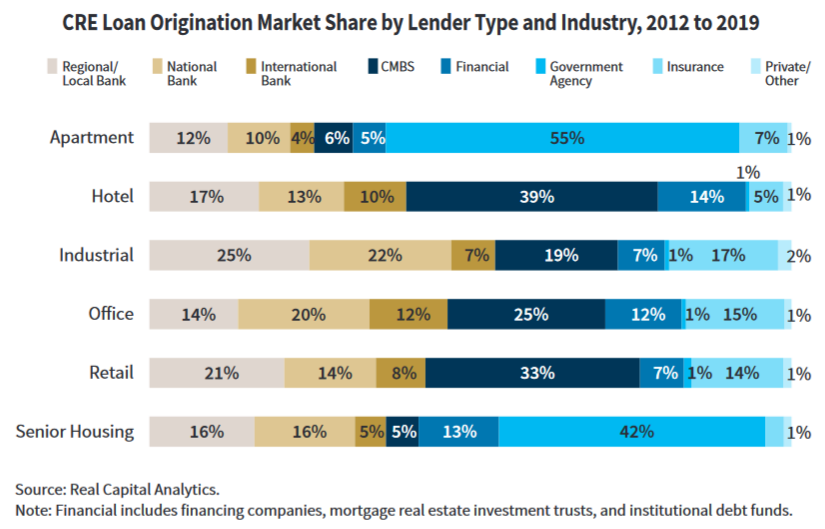

As the banking crisis unfolds, the media continues to focus on depositors and shareholders. Although both are important, there is an even bigger issue that is not being discussed. According to the FDIC, community banks made 67% of all commercial real estate loans in...

by Glen | Mar 13, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, Hard Money Lending, Housing Price Trends / Information

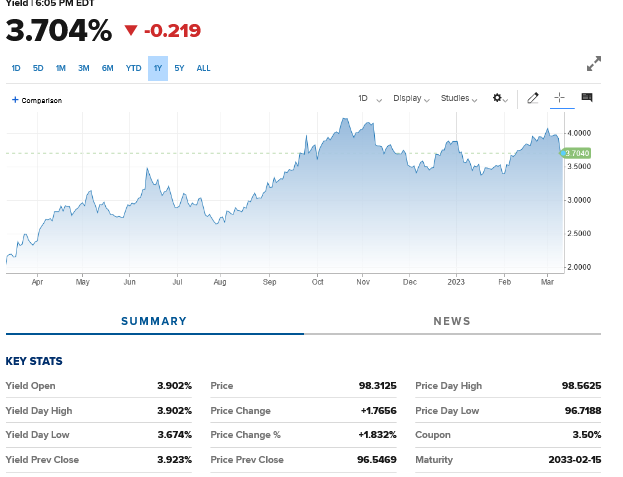

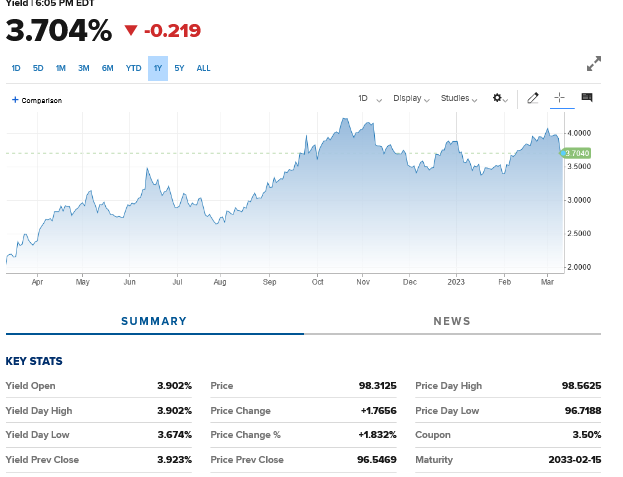

Over 48 hours two banks failed for very different reasons. There is a saying in banking that when rates rise and easy money runs out, we will find the skeletons that have been lurking in plain sight. Are we in for a 2008 rerun? What caused the sudden...

by Glen | Feb 20, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks

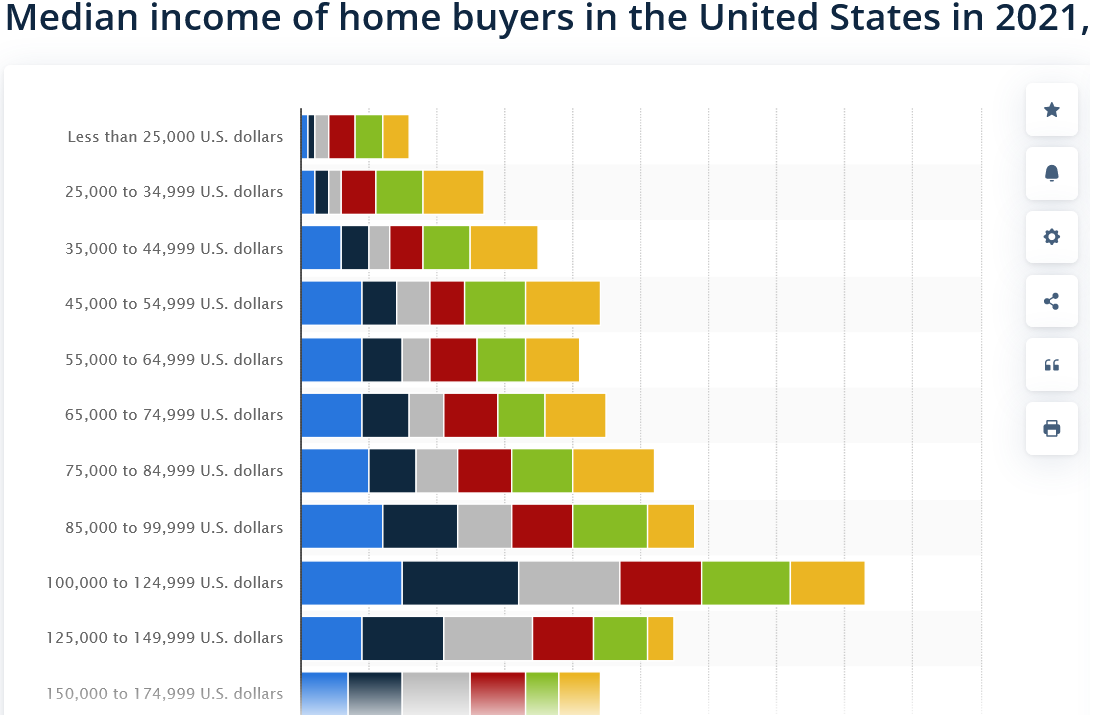

Purchasing power from paychecks fell 2.9% for middle-income households in 2022 compared with 2021, while rising 1.5% for the bottom fifth of households and 1.1% for the top, according to the Congressional Budget Office study. Furthermore, nearly 40 percent of...