by Glen | Jun 19, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, hard money, Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

Interesting times we are in. Consumers keep spending big on services like travel and eating out, but on the flip side Home Depot just reported its first drop since the pandemic. On the other hand Target tops earnings estimates. What is driving the continued...

by Glen | Apr 17, 2023 | 1031 exchange, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Biden tax plan, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, what happens to real estate if long term capital gains eliminated

Presidential nominee Biden has rolled out his proposed tax plan with two major pillars that will impact real estate: 1) Elimination of the 1031 exchange provision 2) elimination of long term capital gains. These two changes, if passed, will have huge implications for...

by Glen | Mar 13, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, Hard Money Lending, Housing Price Trends / Information

Over 48 hours two banks failed for very different reasons. There is a saying in banking that when rates rise and easy money runs out, we will find the skeletons that have been lurking in plain sight. Are we in for a 2008 rerun? What caused the sudden...

by Glen | Jan 30, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Government Bailout, Housing Price Trends / Information, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, rent control

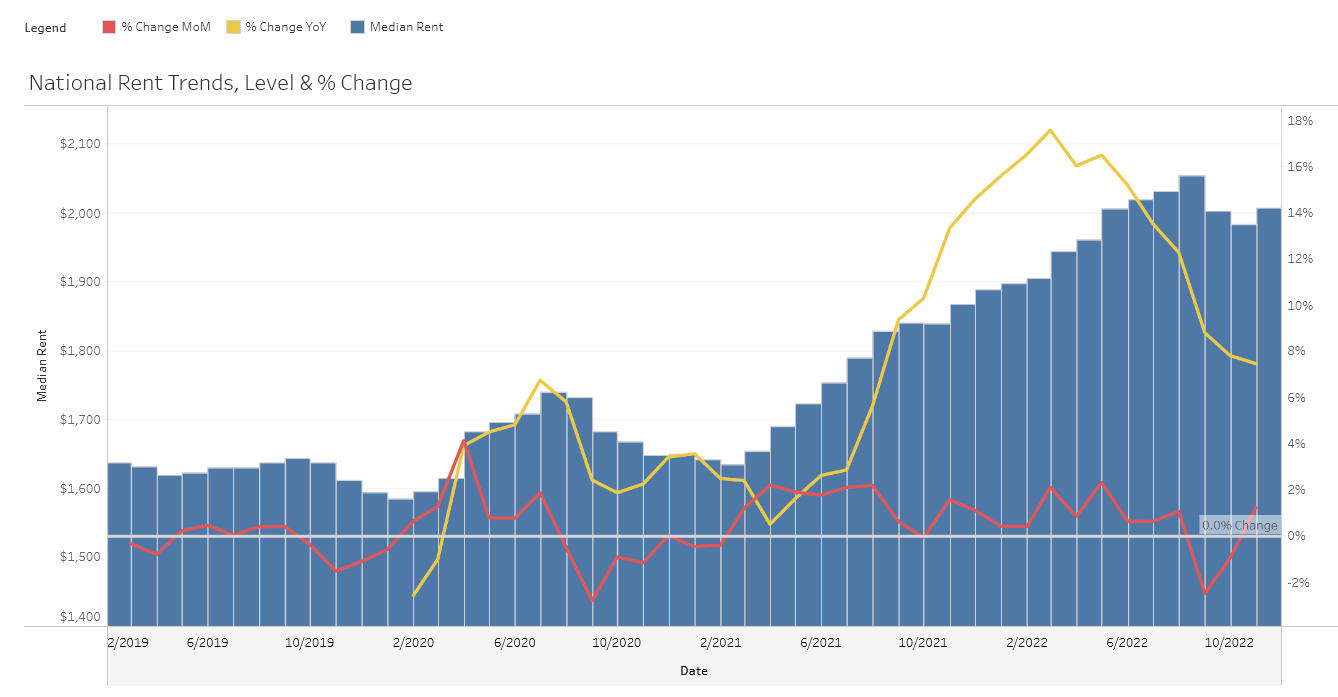

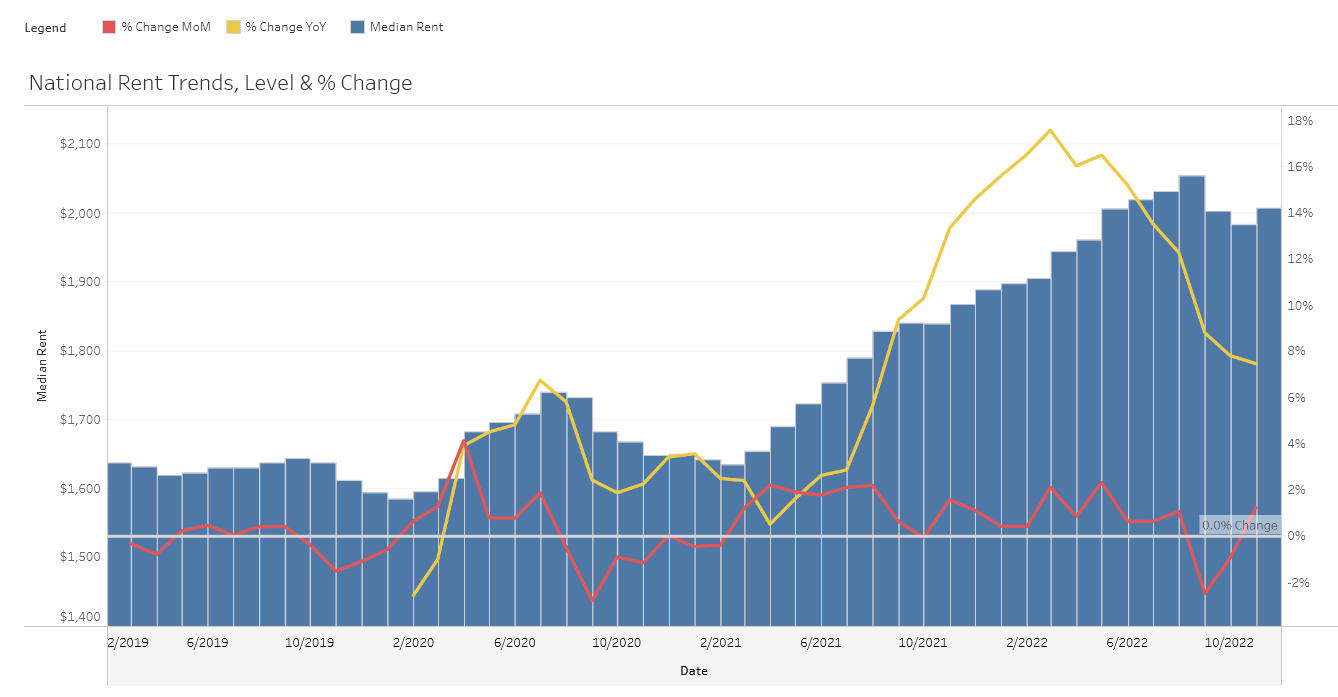

It is no secret that rent has skyrocketed throughout the country. Nationally rental growth peaked at 17.45% year over year in March of 2022. Some markets like NY and FL have exceeded over 31% rent growth annually. What are the three causes of huge jumps in rents?...

by Glen | Jul 18, 2022 | 2022 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, commercial hard money, Denver Hard Money, General real estate financing information, Georgia hard money, Government Bailout, Hard Money Commercial Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

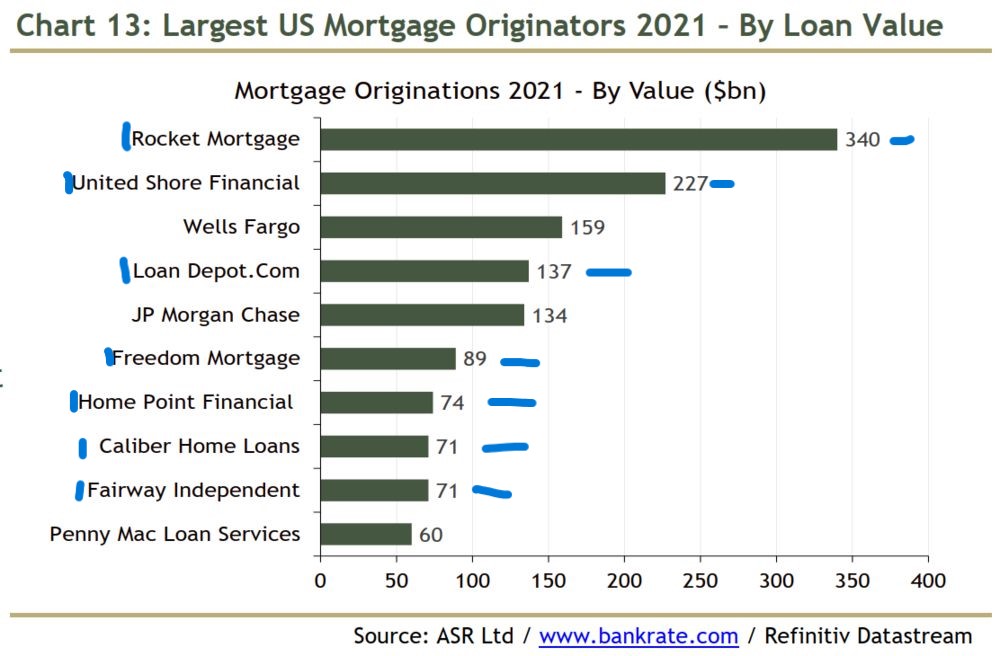

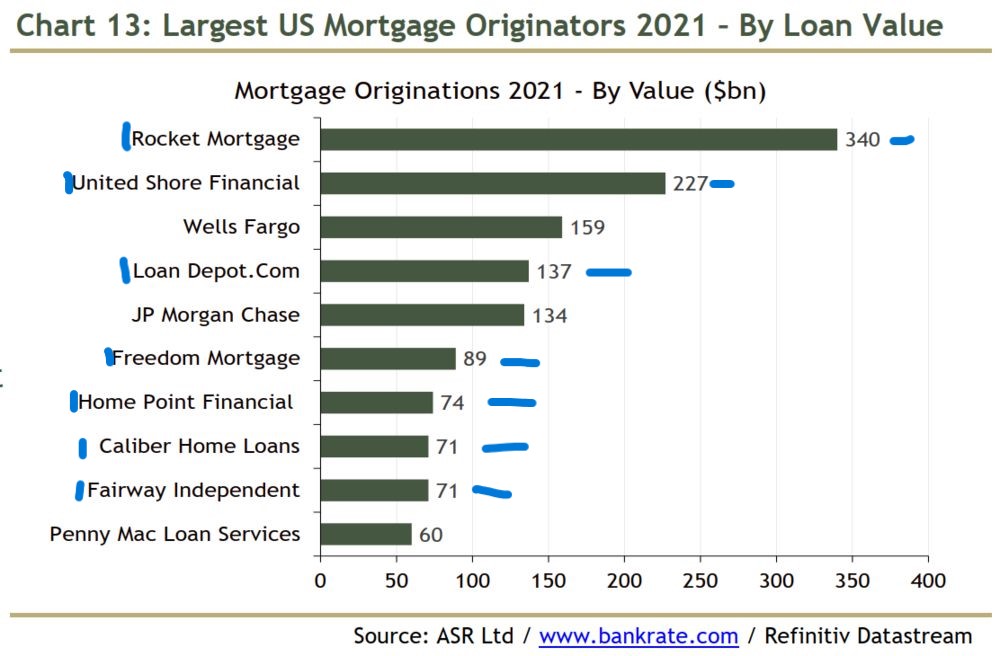

The federal government in their quest to shore up the mortgage market in 2008 has created some new risks to the housing market. Non bank lenders now make up 74% of the origination volume with only 3 banks even making the list. What does this mean for the mortgage...

by Glen | Jun 6, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, Government Bailout, hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

One of the world’s bubbliest real estate housing markets is tilting from sellers to buyers with dizzying speed. Canadian home prices fell for the first time in two years as a rapid rise in interest rates looks set to threaten one of the world’s hottest housing...