by Glen | Apr 1, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski real estate, Commercial Lending valuation, commercial private lending, commercial property trends, Consumer price index and inflation, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout

The market currently has a fixation on interest rates. Senators are now jumping on the bandwagon pushing the federal reserve to “immediately” cut rates to help the real estate market and affordability. Unfortunately, the senators do not fully grasp how...

by Glen | Feb 26, 2024 | 2024 mortgage rates, 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, Housing Price Trends / Information

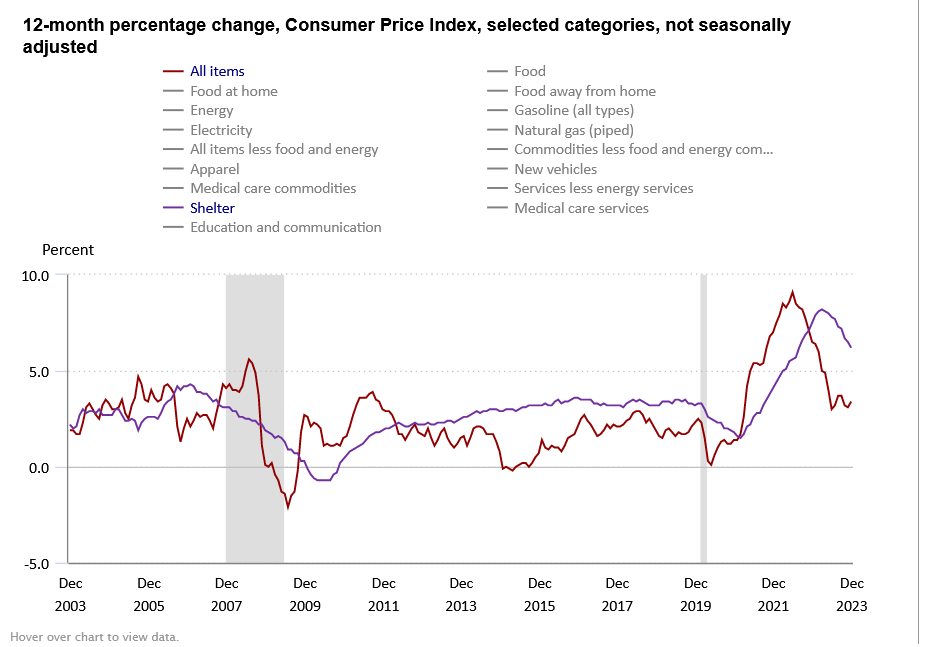

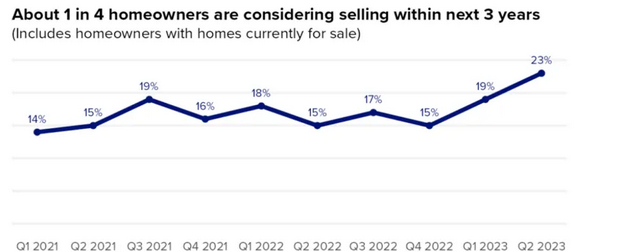

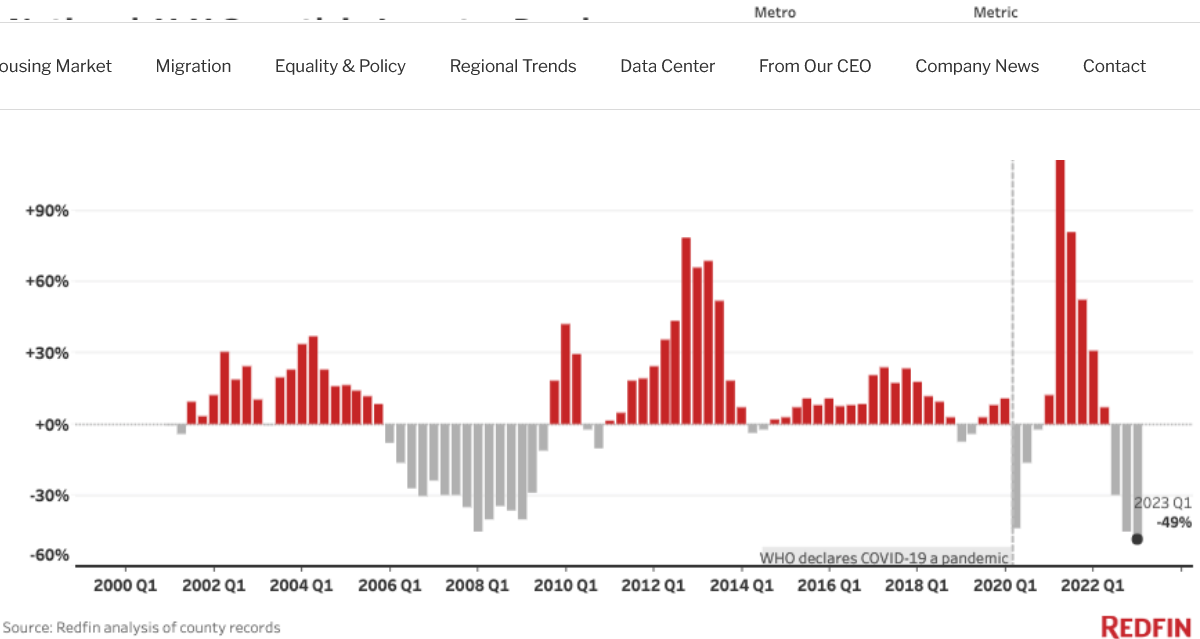

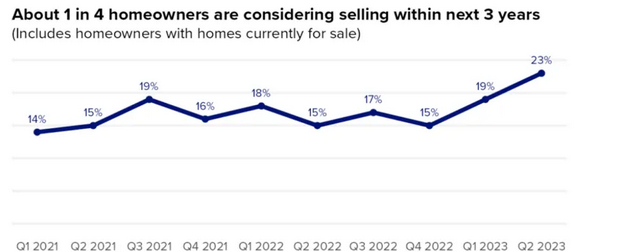

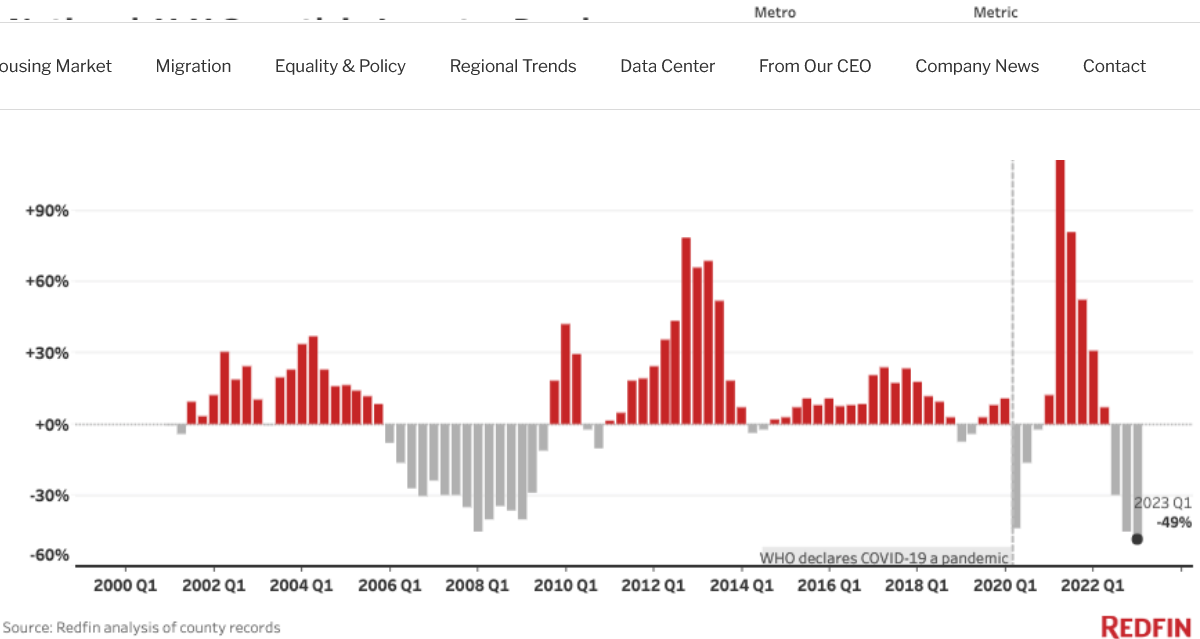

There is a theory that locked in low mortgage rates will force owners to stay in their houses. This has led to a huge shortage of inventory throughout the country. Why is the “lock in effect” starting to wind down? What does this mean for real estate prices over...

by Glen | Jan 15, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, hard money, Housing Price Trends / Information

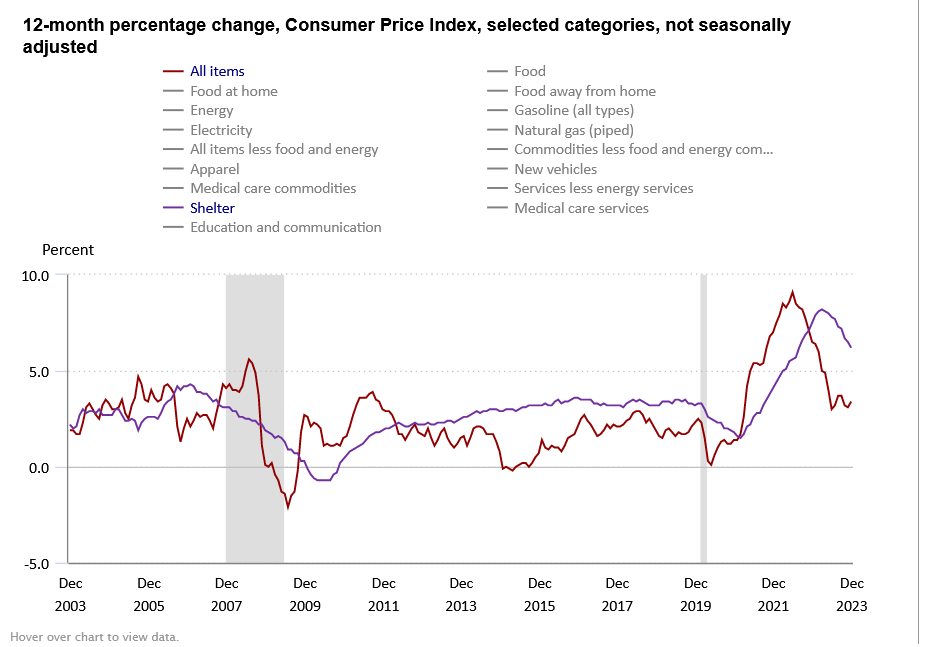

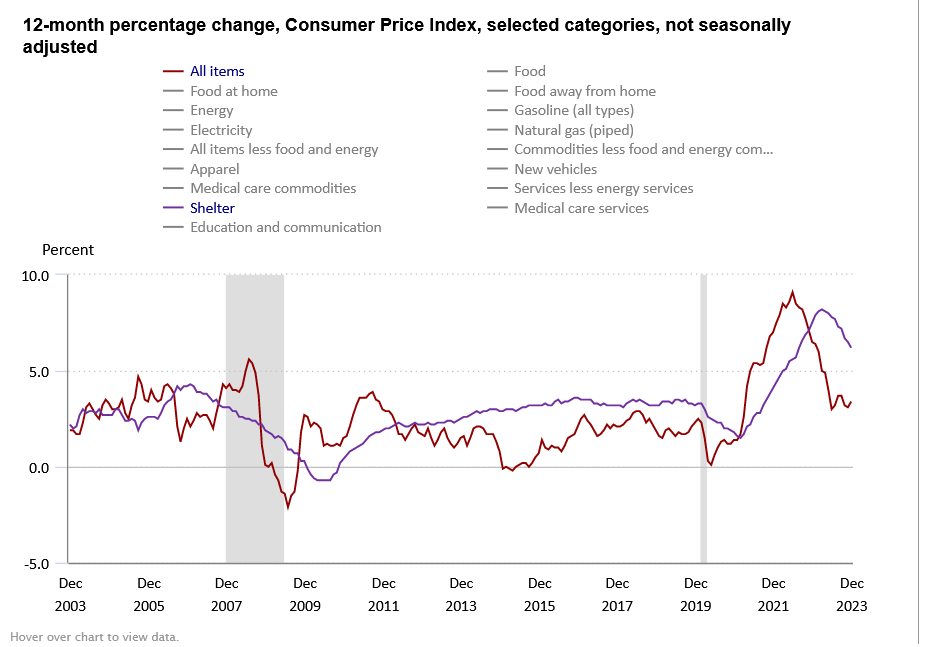

The market keeps predicting a goldilocks scenario with 100% certainty where inflation falls without much if any impact on residential real estate. The “soft landing” will occur at the same time interest rates have skyrocketed and supposedly the consumer...

by Glen | Dec 11, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial private lending, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, Housing Price Trends / Information, if there is a recession what happens to real estate, interest rates, mortgage rates

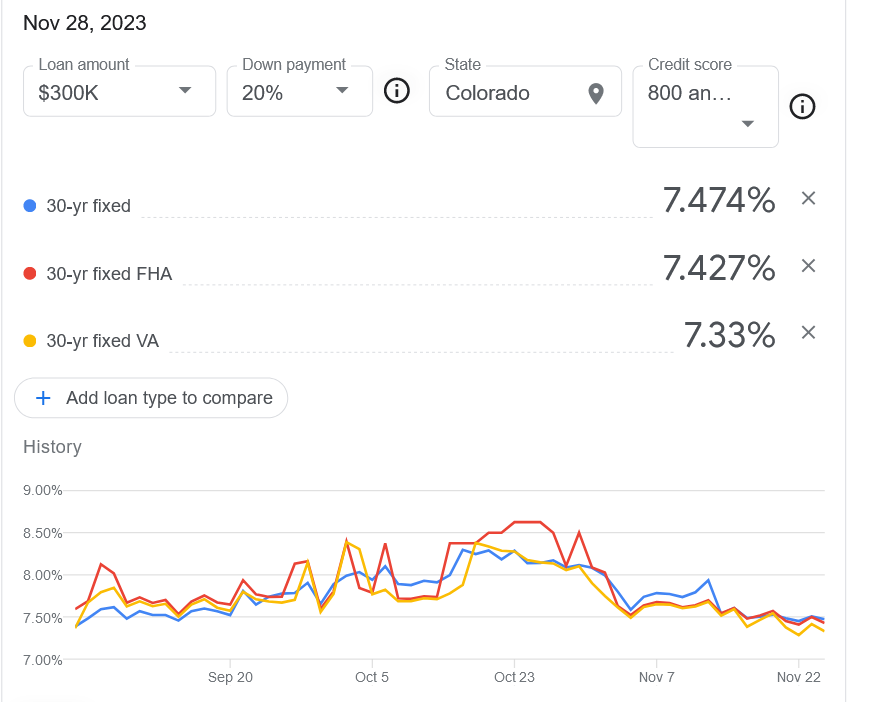

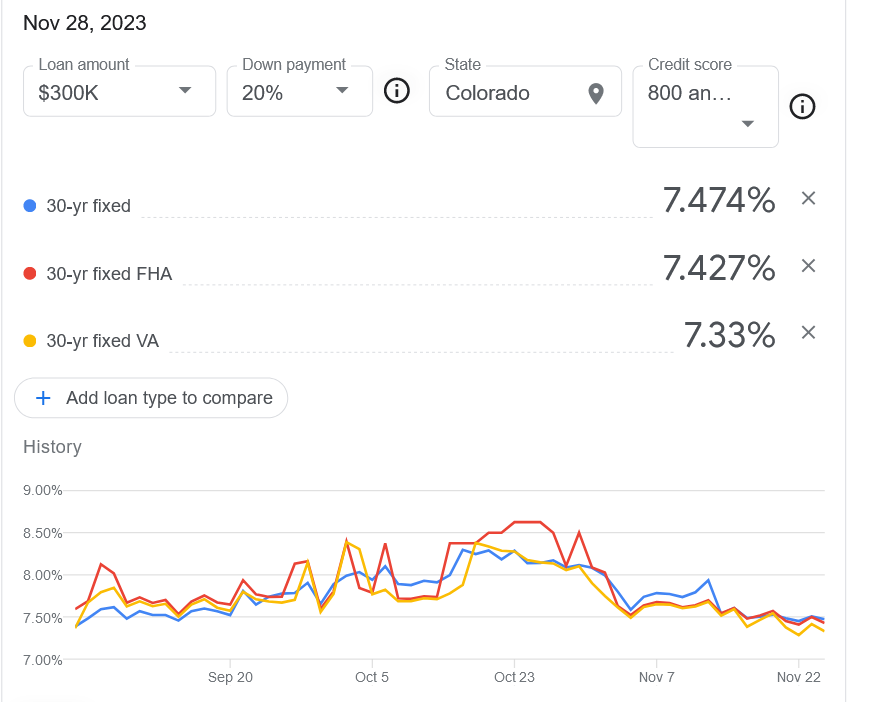

In a WSJ survey, economists lower recession probability below 50% and say Fed is finished raising interest rates It has been quite a ride for mortgage rates over the last two years. As of this writing mortgage rates were around 7.5% (with no points) which is quite...

by Glen | Oct 16, 2023 | 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Bank failures, Colorado Hard Money, Colorado private lender, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Government Bailout, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates

In the past recessions, especially in 2008, just prior to the crash we saw a big pull back in luxury purchases. This was an early indicator of huge drops in real estate prices. Currently we are seeing a resounding change in luxury spending, does this mean luxury...

by Glen | Jul 31, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, General real estate financing information, Government Bailout, Hard Money Lending, hard money loans, Housing Price Trends / Information, real estate investing, Real Estate Trends

Lawmakers introduced a bill Tuesday aimed at curtailing investor activity in the housing market that they say is driving up home prices. The Stop Predatory Investing Act is targeting single family investors. What is in the newly proposed bill and how will this impact...