by Glen | Dec 4, 2023 | Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, Commercial Loan Servicing, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money

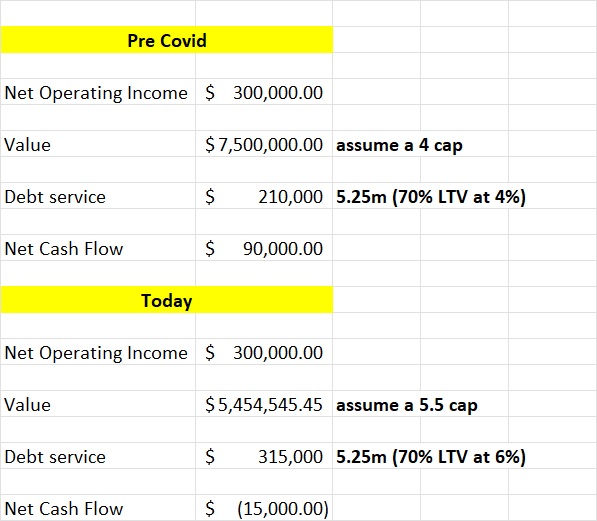

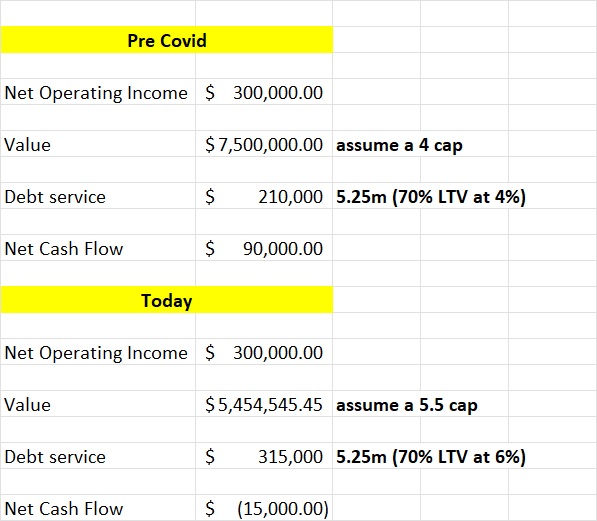

US commercial real estate prices have fallen this year for the first time in more than a decade, according to Moody’s Analytics, heightening the risk of more financial stress in the banking industry. What property types are declining? (hint not just office...

by Glen | Nov 27, 2023 | 2023 real estate prediction, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

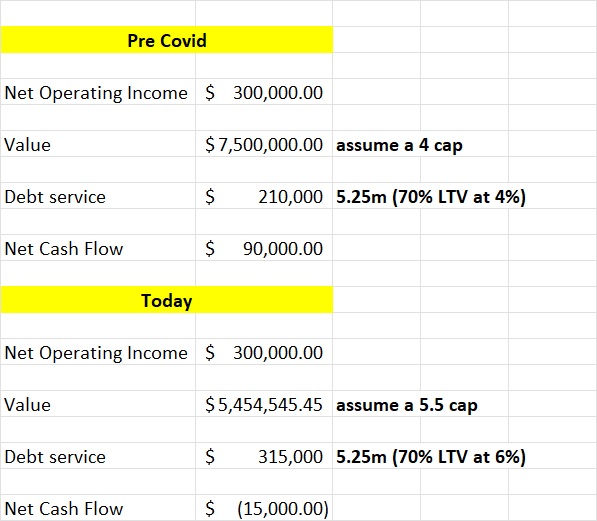

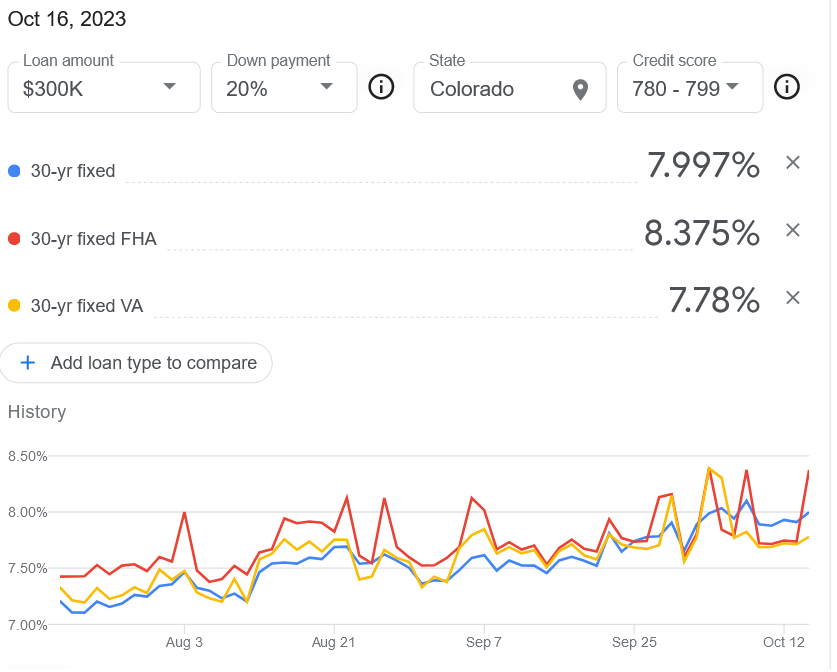

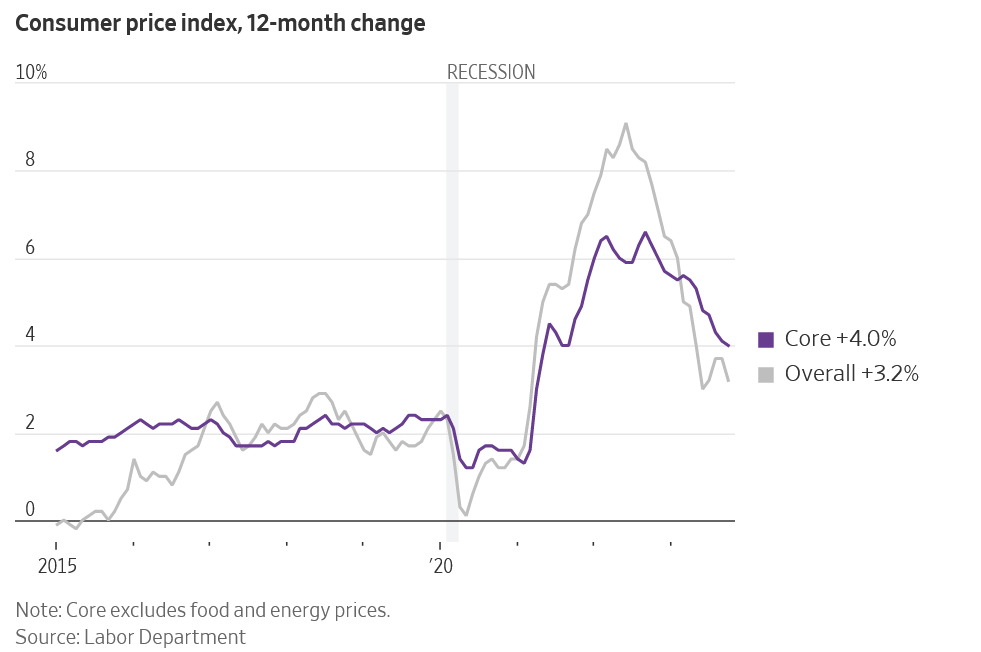

What does the recent CPI fall mean for mortgage rates and real estate prices? A broad slowdown in inflation continued in October, likely ending the Federal Reserve’s historic interest rate increases. The slowdown came below most median estimates and the...

by Glen | Nov 20, 2023 | Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Denver Hard Money, Georgia hard money

I wanted to wish you and your families a very Happy Thanksgiving. I have enjoyed working with each of you and your clients over the past year and look forward to working together in the near future. With everything going on politically and geopolitically the...

by Glen | Nov 6, 2023 | 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Realtor commision lawsuits

A federal jury on Tuesday found the National Association of Realtors and large residential brokerages liable for about $1.8 billion in damages after determining they conspired to keep commissions for home sales artificially high. Two major real estate companies have...

by Glen | Oct 30, 2023 | 2023 real estate prediction, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending, Housing Price Trends / Information, interest rates, mortgage rates

Housing industry urges Fed to stop raising rates, does it even matter? Top real estate and banking officials are calling on the Federal Reserve to stop raising interest rates as the industry suffers through surging housing costs and a “historic shortage” of available...

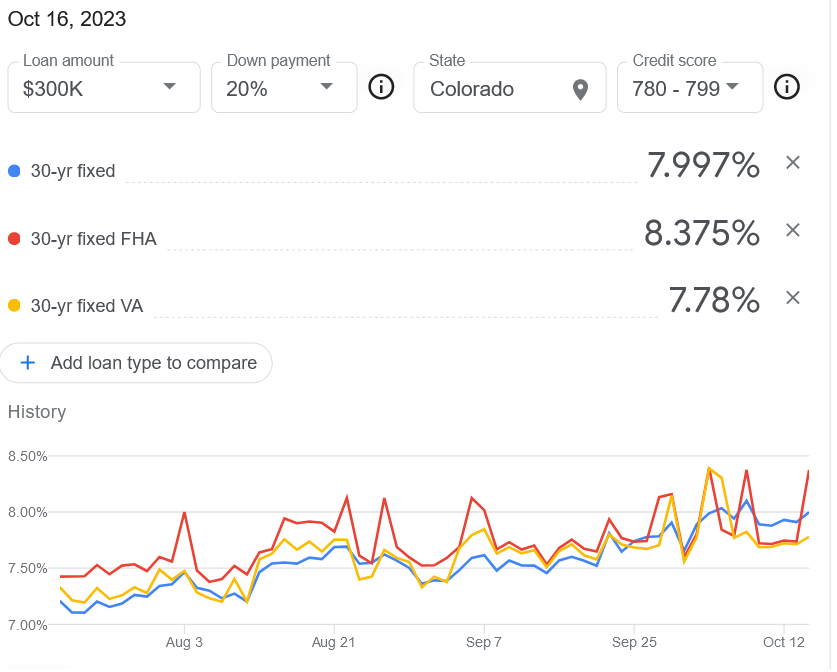

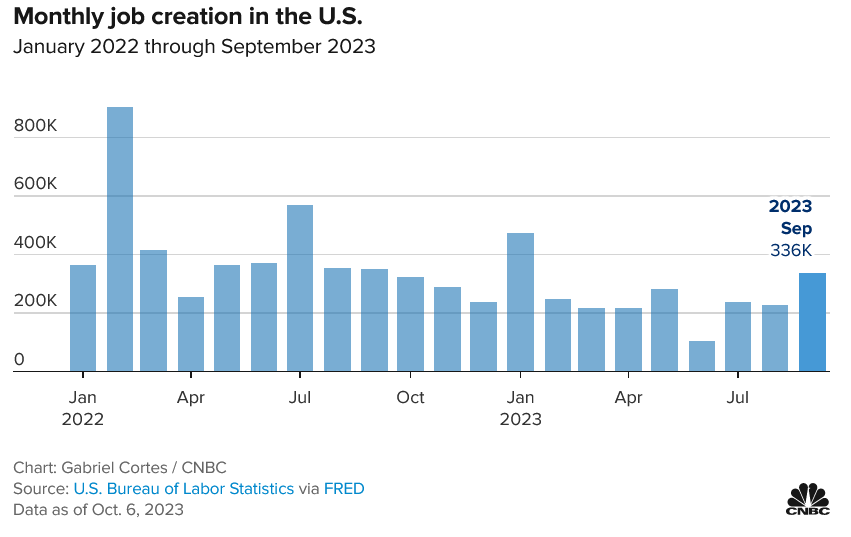

by Glen | Oct 23, 2023 | 2023 real estate predictions, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation, recession, recession impact on real estate

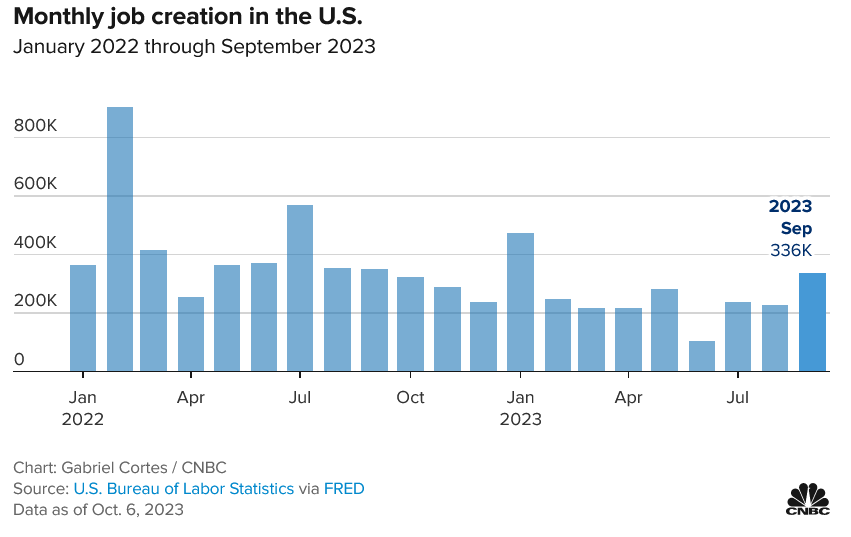

The economists forecasting the jobs data missed big time, with the recent jobs report almost double their predictions. Why is job growth still surging while interest rates hit 20 year highs. What does this mean for future interest rate increases? Does this change...