by Glen | Feb 20, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks

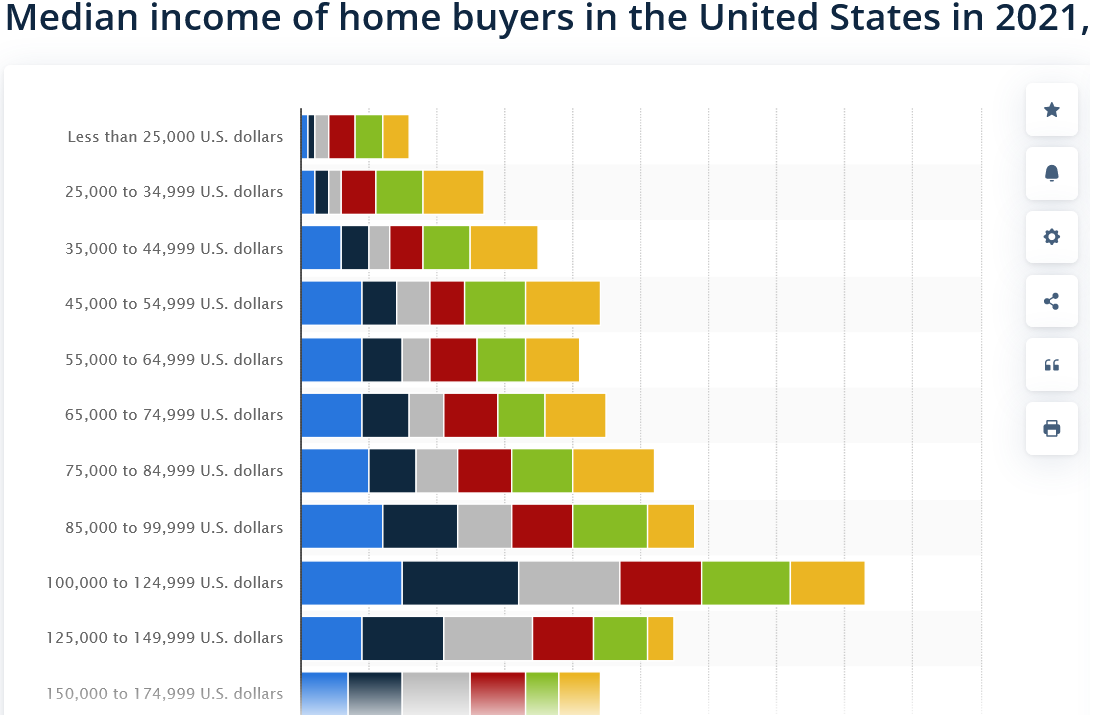

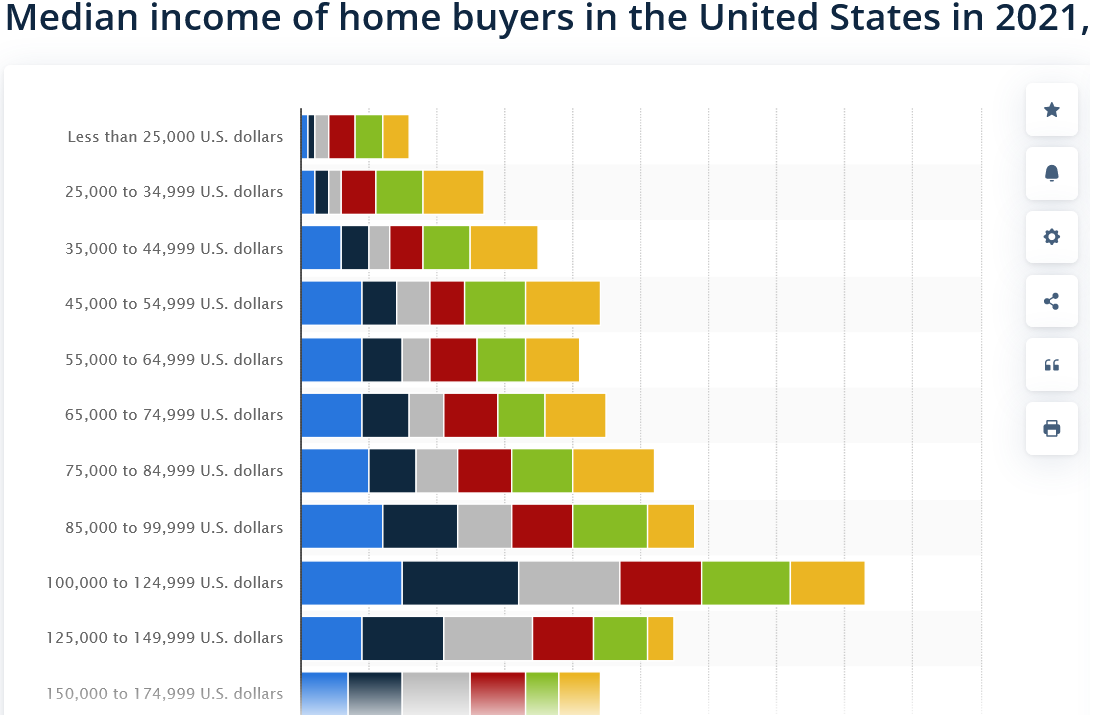

Purchasing power from paychecks fell 2.9% for middle-income households in 2022 compared with 2021, while rising 1.5% for the bottom fifth of households and 1.1% for the top, according to the Congressional Budget Office study. Furthermore, nearly 40 percent of...

by Glen | Jan 30, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Government Bailout, Housing Price Trends / Information, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, rent control

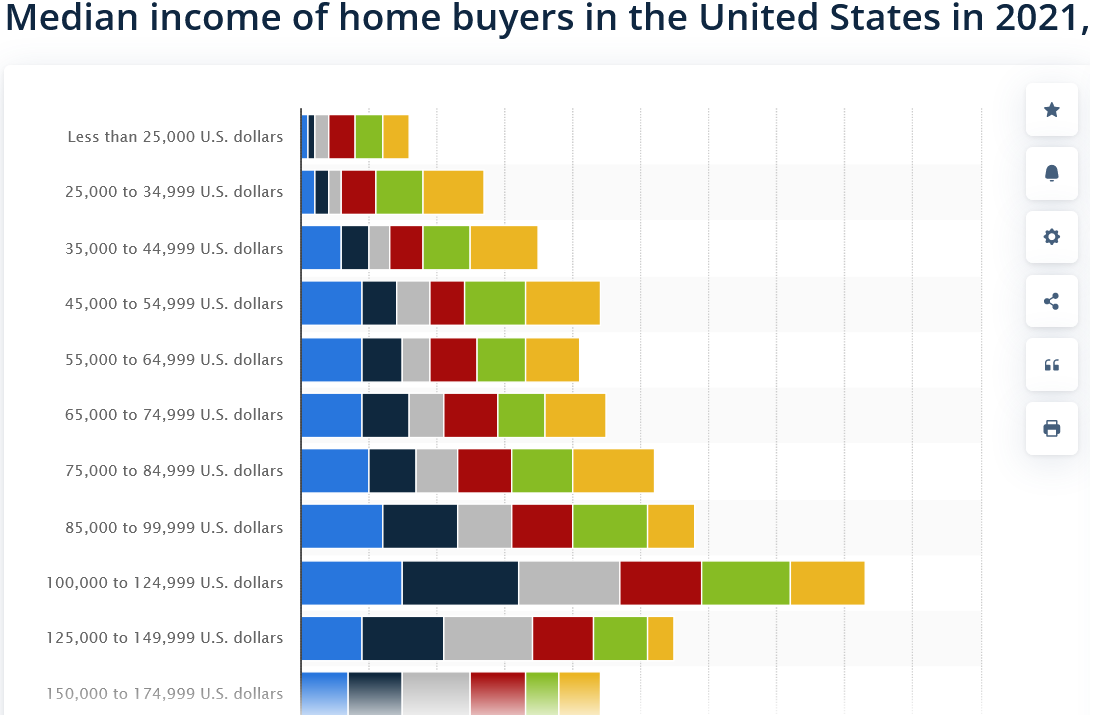

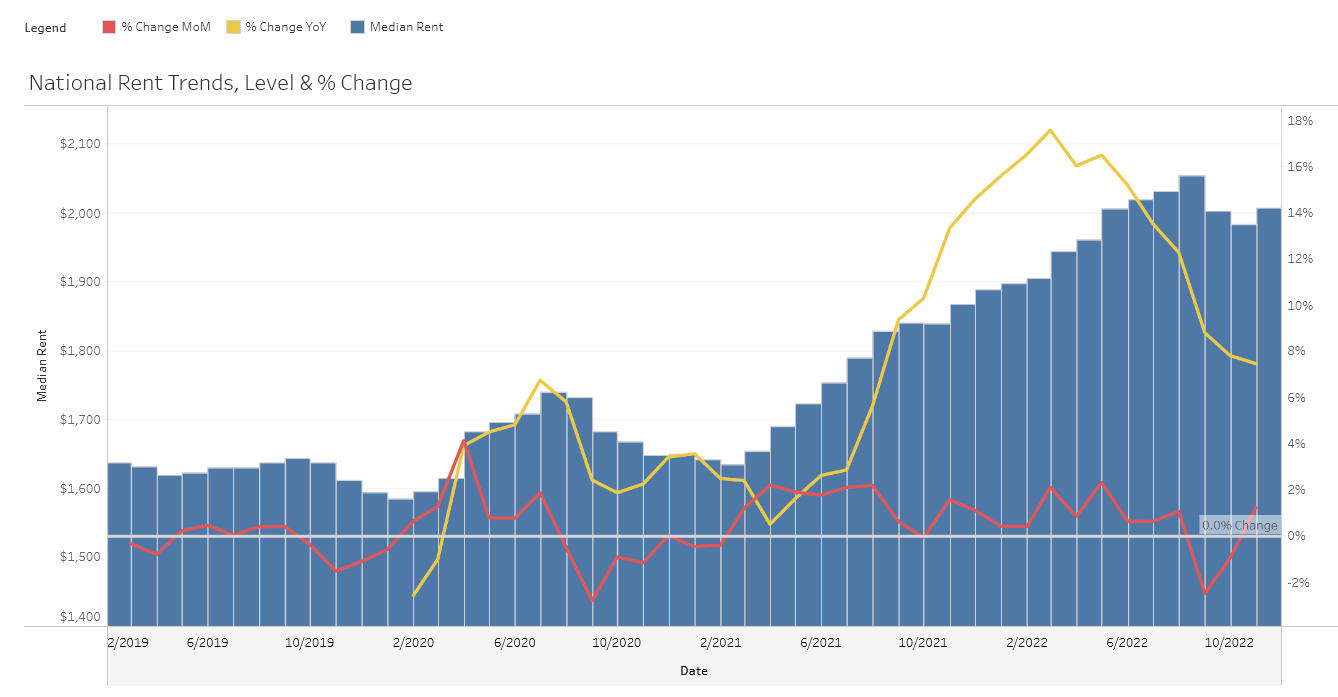

It is no secret that rent has skyrocketed throughout the country. Nationally rental growth peaked at 17.45% year over year in March of 2022. Some markets like NY and FL have exceeded over 31% rent growth annually. What are the three causes of huge jumps in rents?...

by Glen | Jan 2, 2023 | 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money loans, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

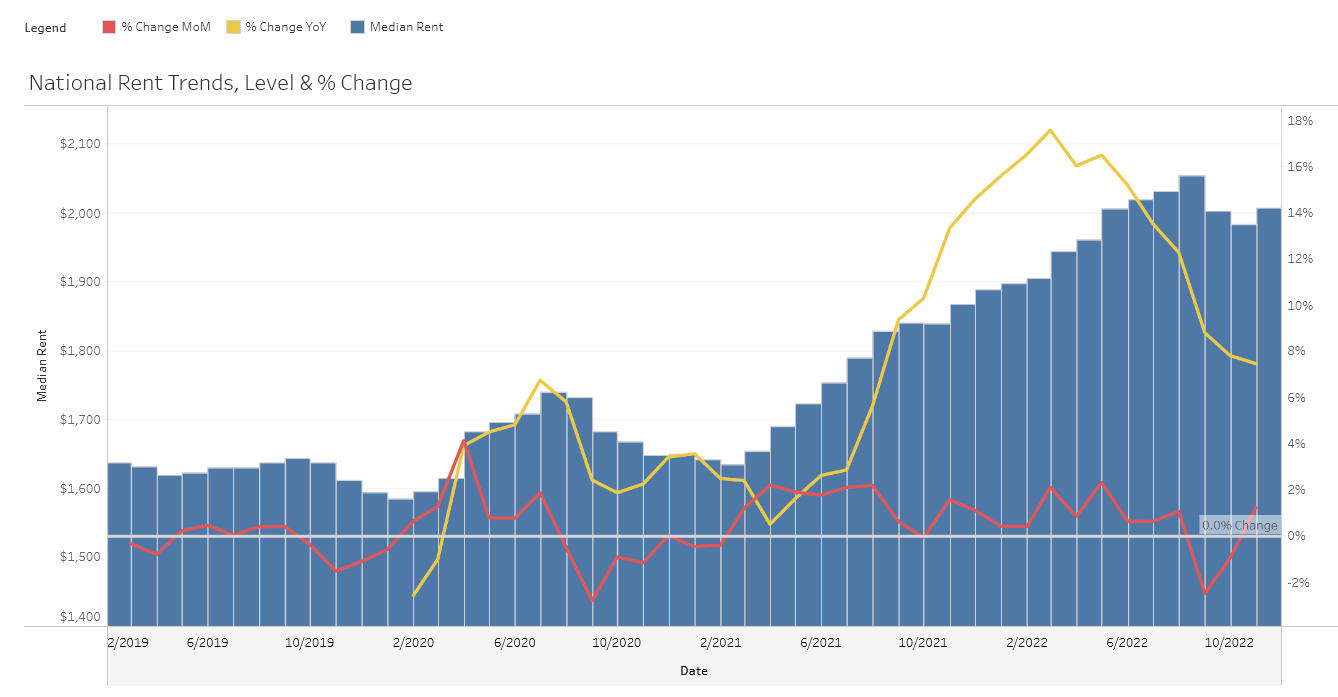

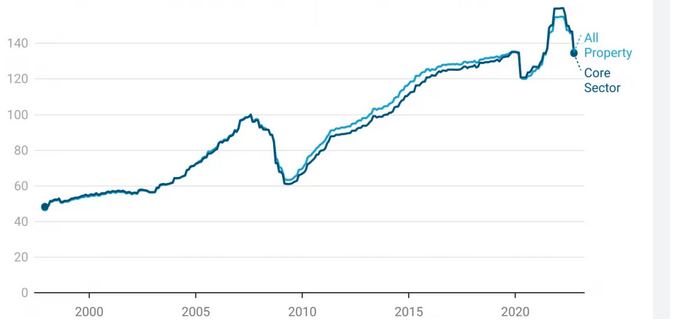

US commercial real estate prices have plunged 13% from a peak this year, the biggest drop since the global financial crisis of 2008. What is causing the decline in commercial property prices. Is this a blip or will the slide in commercial property prices worsen in...

by Glen | Dec 26, 2022 | 2022 real estate predictions, 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski real estate, Denver Hard Money, Denver private Lending, General real estate financing information, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates, private lender, Private Lending, Property Valuation

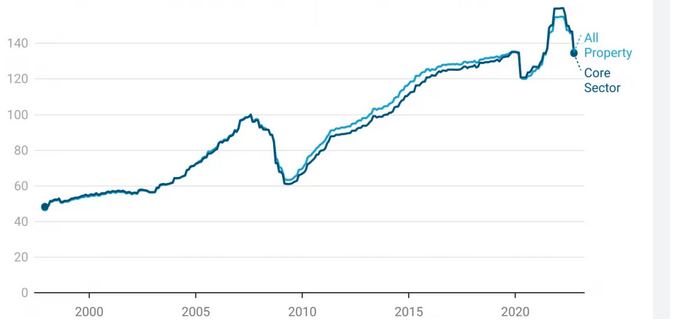

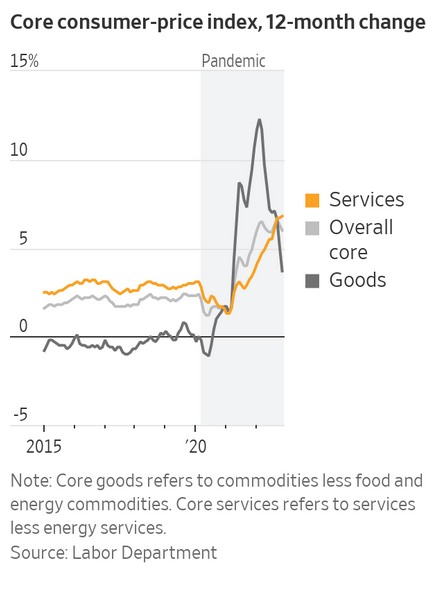

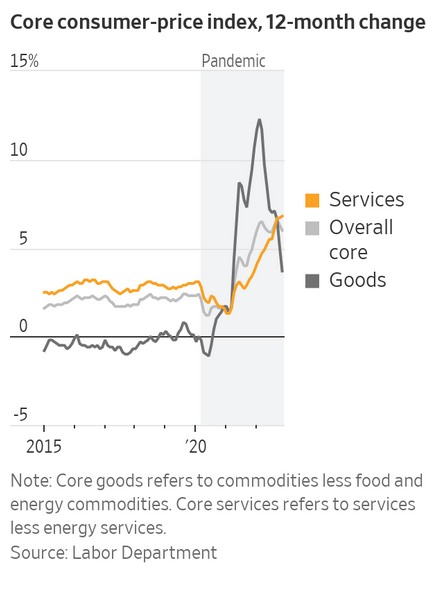

I hope everyone is having a happy holiday season. Before getting into my predictions for next year, there are three crucial factors to discuss that will shape the real estate market in 2023 and beyond: Interest rates, inflation, and consumer sentiment. All three are...

by Glen | Dec 19, 2022 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, General real estate financing information, hard money

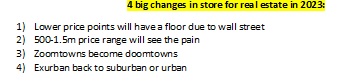

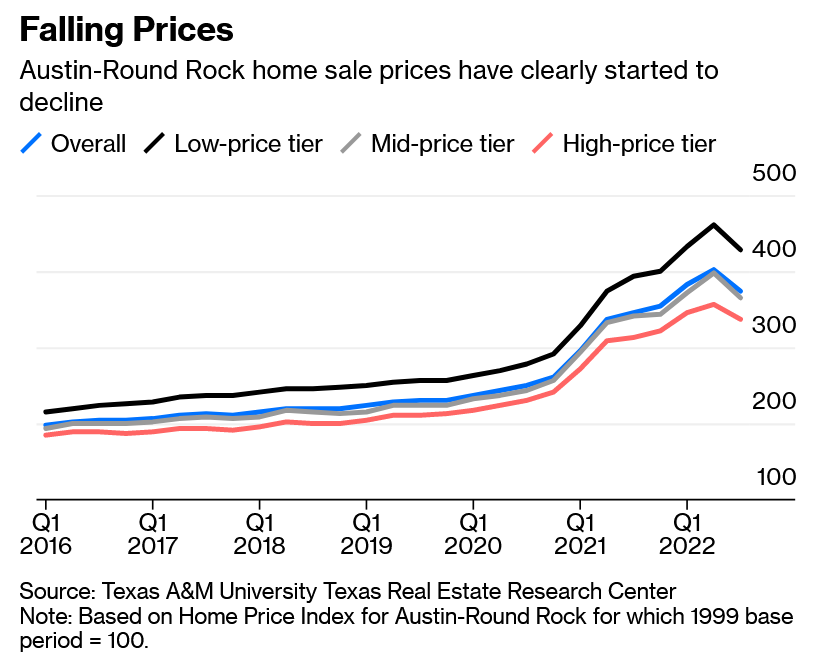

There is definitely allot of doom and gloom heading into 23 with interest rates double their lows, inventory increasing, and prices coming off their highs. In every cycle there will be winners and losers. Where will the real estate opportunities be? Are their certain...

by Glen | Nov 14, 2022 | 2022 real estate predictions, 2023 real estate prediction, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates, Private Lending

The prevailing theory is that this real estate cycle will be considerably better than others as so many people locked in rock bottom rates which will serve as “golden handcuffs” and prevent a meaningful increase in inventory. How accurate is this theory? What is the...