by Glen | Aug 14, 2023 | 2023 real estate prediction, 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Hard Money Lending, interest rates, mortgage rates

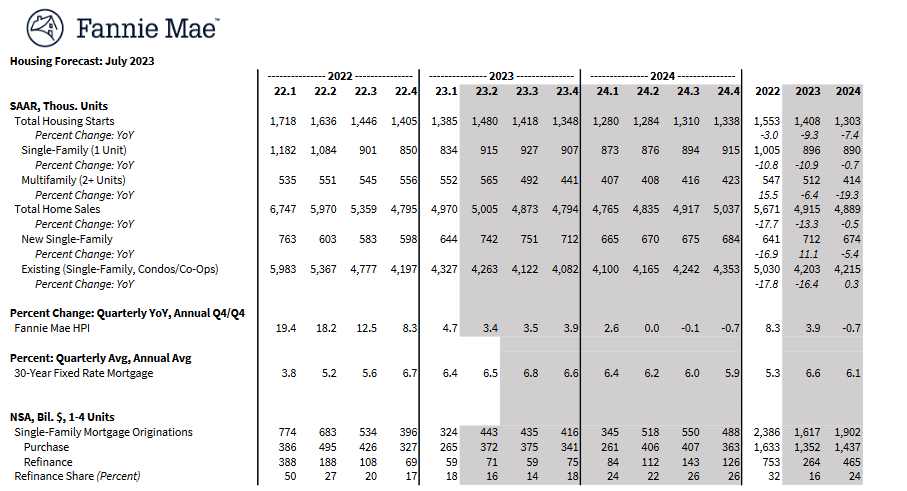

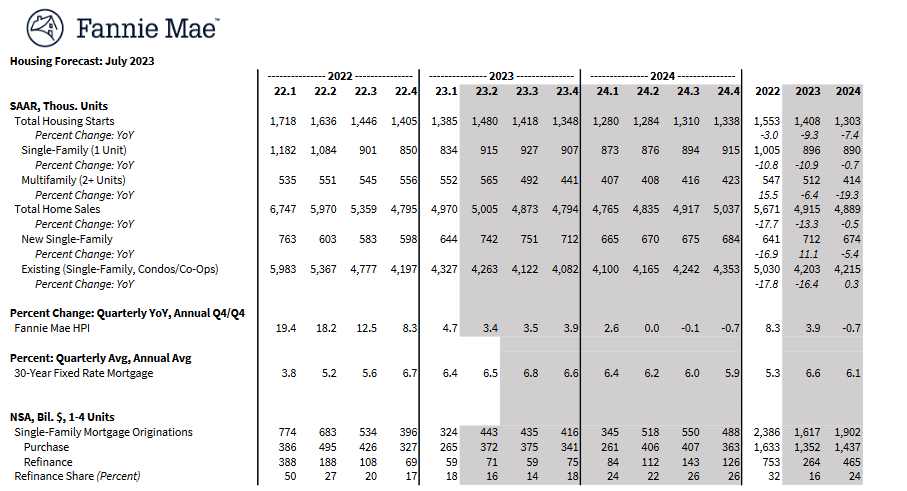

Both the stock and bond markets are partying like its 99 again. Fannie Mae, the largest buyer of US mortgages, is not buying into the theory that a soft landing is the base case for the economy. What is Fannie Mae predicting for inflation and in turn interest rates? ...

by Glen | Jul 31, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, General real estate financing information, Government Bailout, Hard Money Lending, hard money loans, Housing Price Trends / Information, real estate investing, Real Estate Trends

Lawmakers introduced a bill Tuesday aimed at curtailing investor activity in the housing market that they say is driving up home prices. The Stop Predatory Investing Act is targeting single family investors. What is in the newly proposed bill and how will this impact...

by Glen | May 22, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Bank failures, Bankruptcy, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, Property Valuation

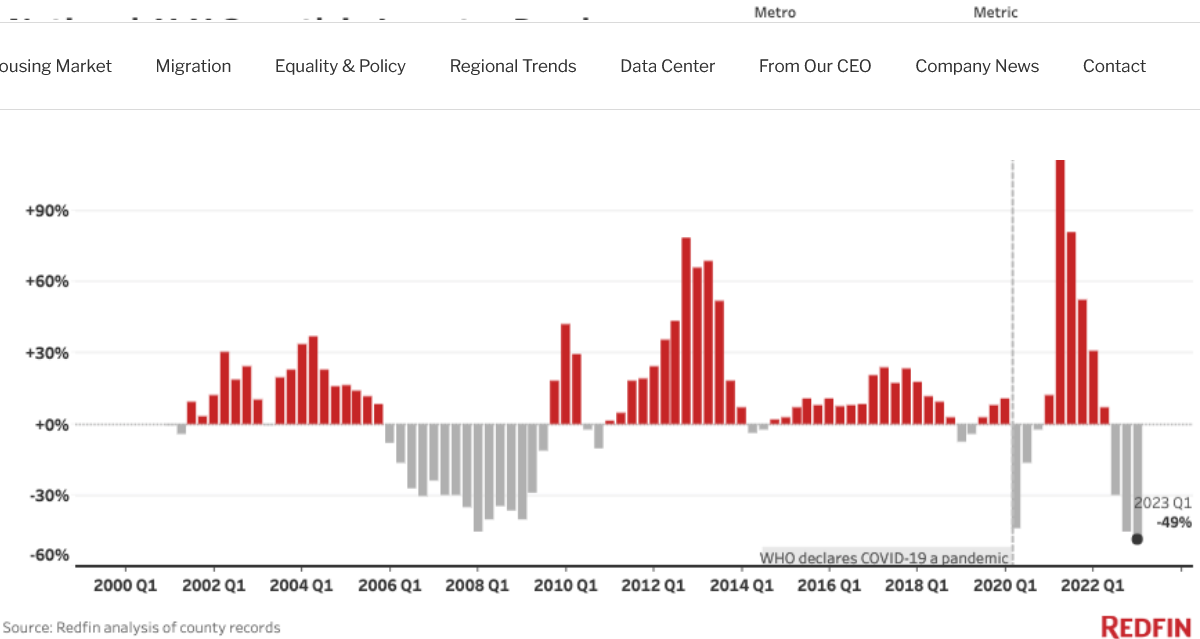

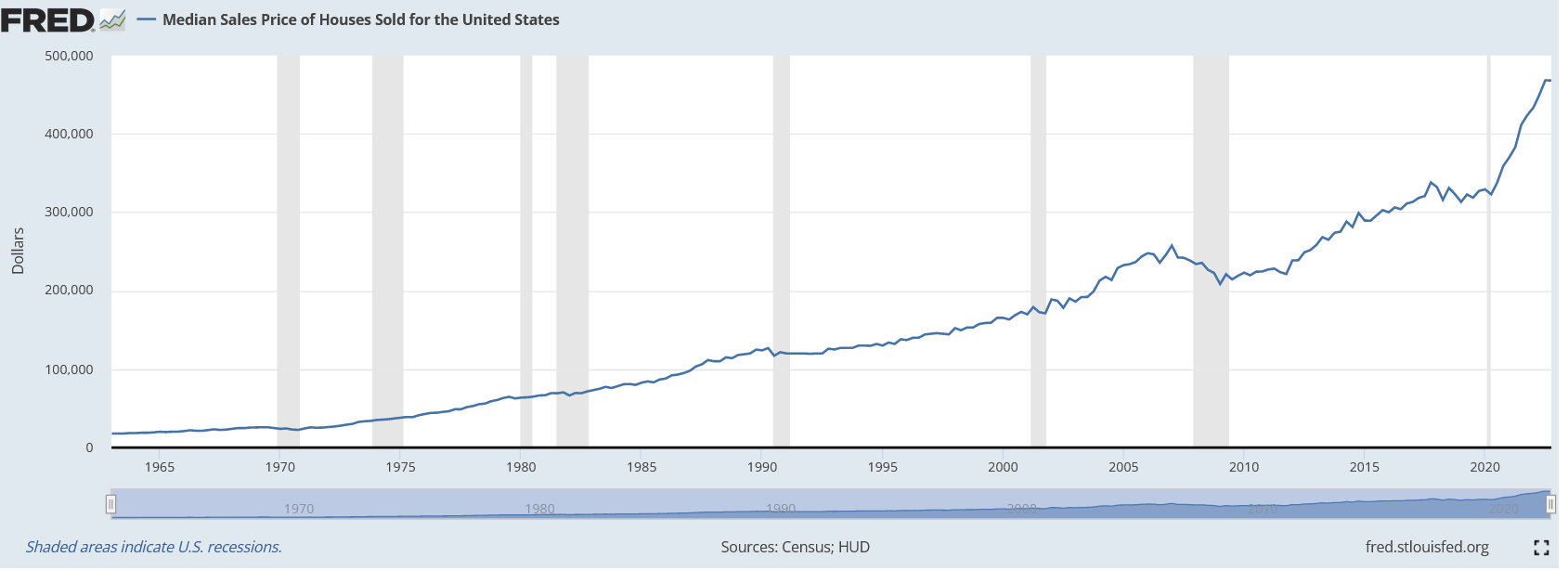

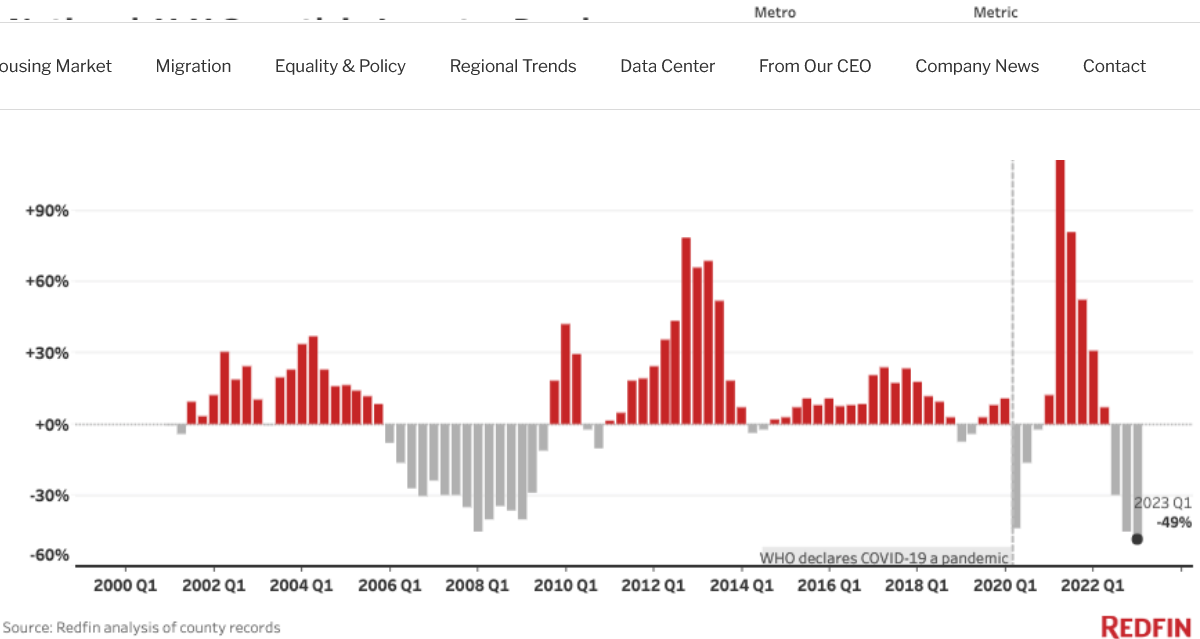

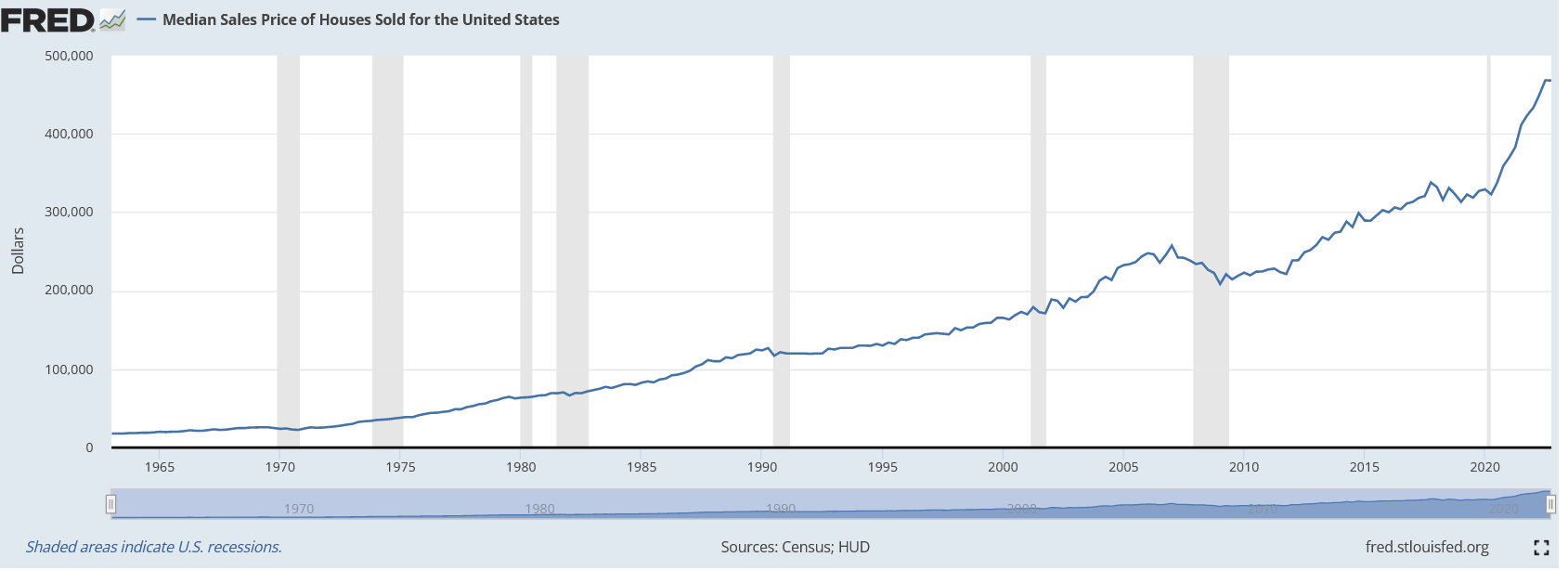

Although the spring real estate market has slowed drastically from the pandemic days, the bottom has not fallen out. Quite the opposite has occurred, in suburban markets and sunbelt cities, real estate keeps charging higher. A good example is Boulder, CO, a...

by Glen | Apr 3, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, credit scoring, Denver Hard Money, General real estate financing information, Georgia hard money

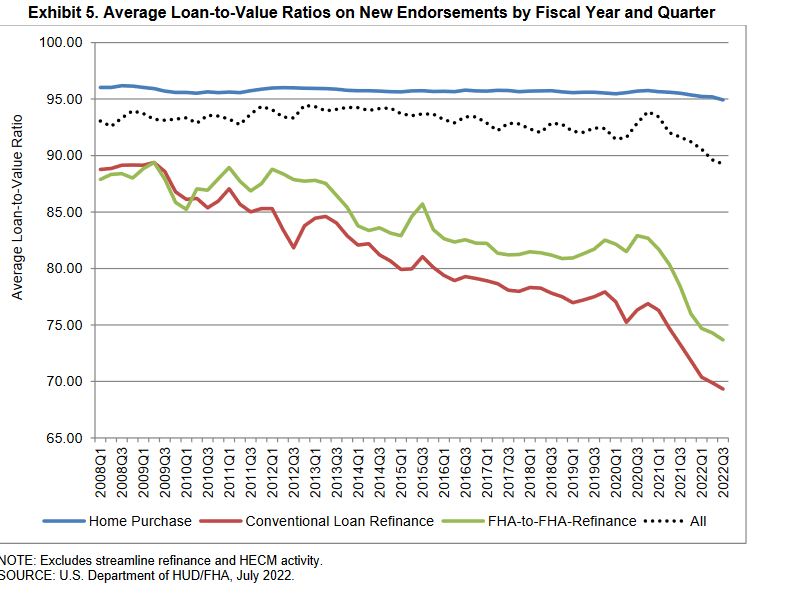

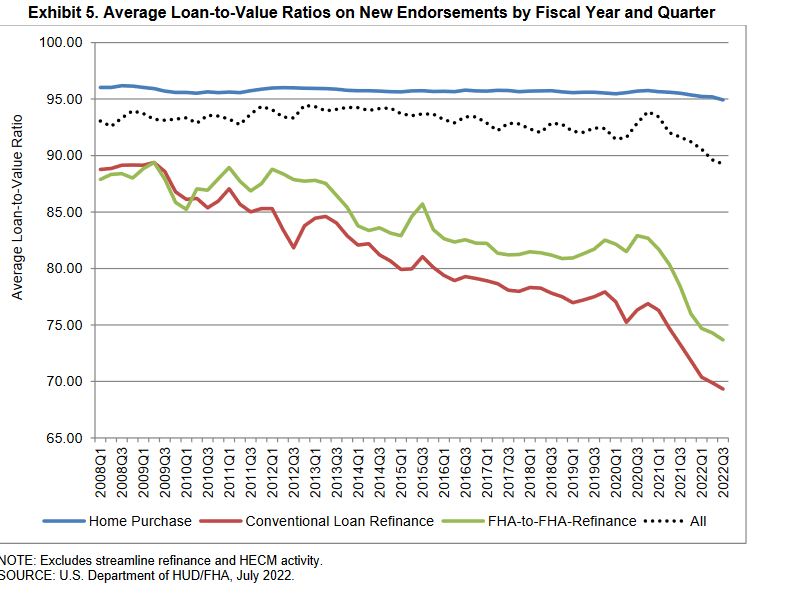

Last week, the president announced an action that will save homebuyers and homeowners with new FHA-insured mortgages $1500 per year (assuming a 500k home), lowering housing costs for an estimated 850,000 home buyers and homeowners in 2023. On the surface, the change...

by Glen | Mar 27, 2023 | Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, if there is a recession what happens to real estate, interest rates, mortgage rates

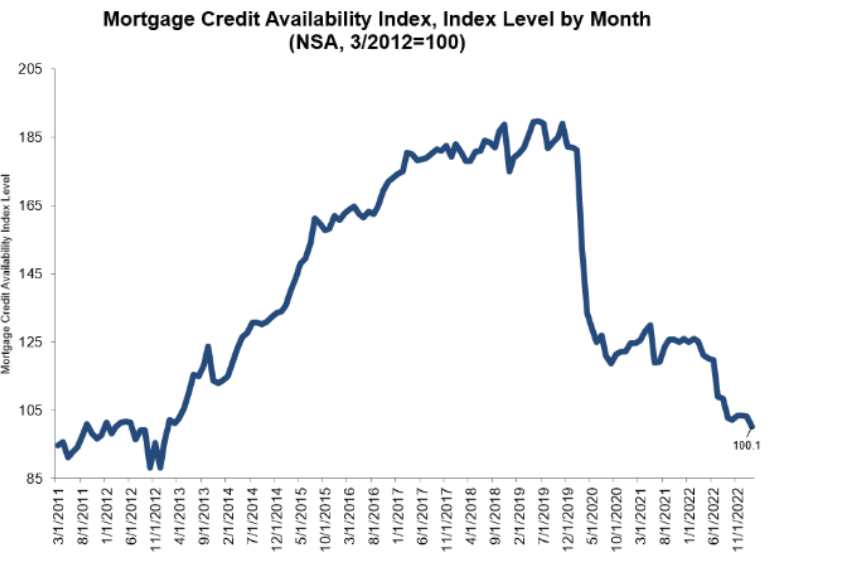

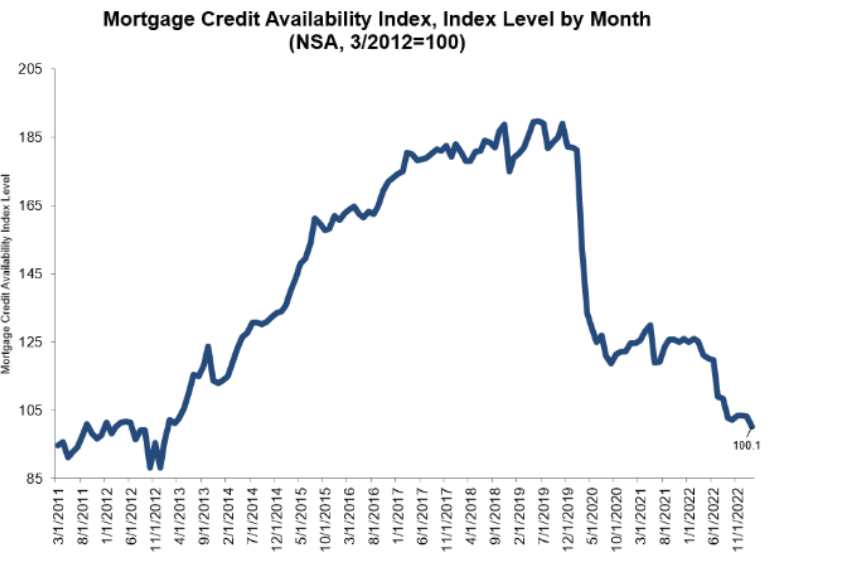

As a private lender, my call volume and closings the first quarter have been off the charts as borrowers fall out of more conventional products. This trend is now playing out with the Mortgage Credit Availability Index showing substantial tightening of credit for all...

by Glen | Mar 6, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation, Realtor, recession, recession impact on real estate

In only a couple of months, the world has changed substantially. In December, inflation was supposedly decreasing rapidly and the odds of a soft landing were non existent. Fast forward a few months and inflation is running hot, consumers are spending like crazy,...