by Glen | Jan 29, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Hard Money Lending, Housing Price Trends / Information

Anytime you turn on the news you hear about high house prices and that the culprit is that supply has not kept up with demand. Is supply really the main culprit of housing prices or did something else that occurred during Covid radically alter the market? ...

by Glen | Jan 22, 2024 | 2024 mortgage rates, 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, Commercial Loan Servicing, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money loans, Housing Price Trends / Information

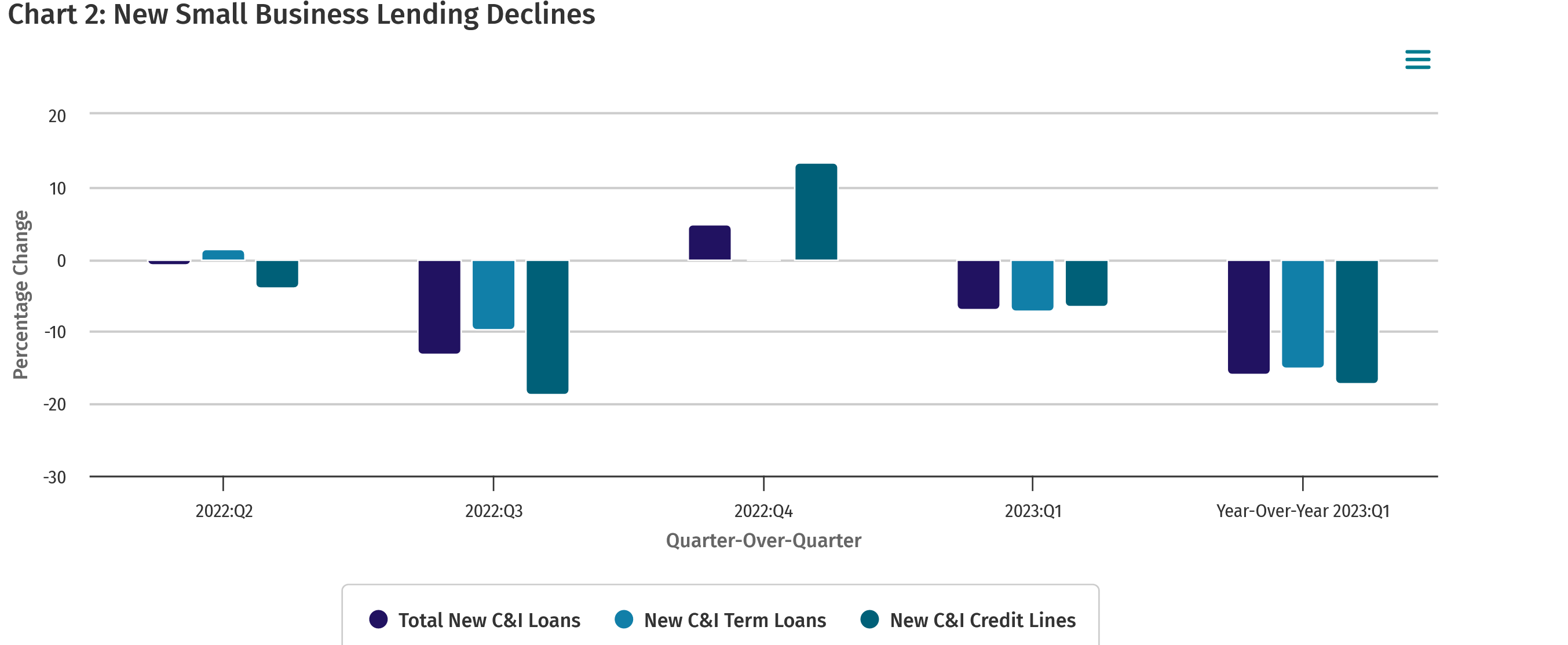

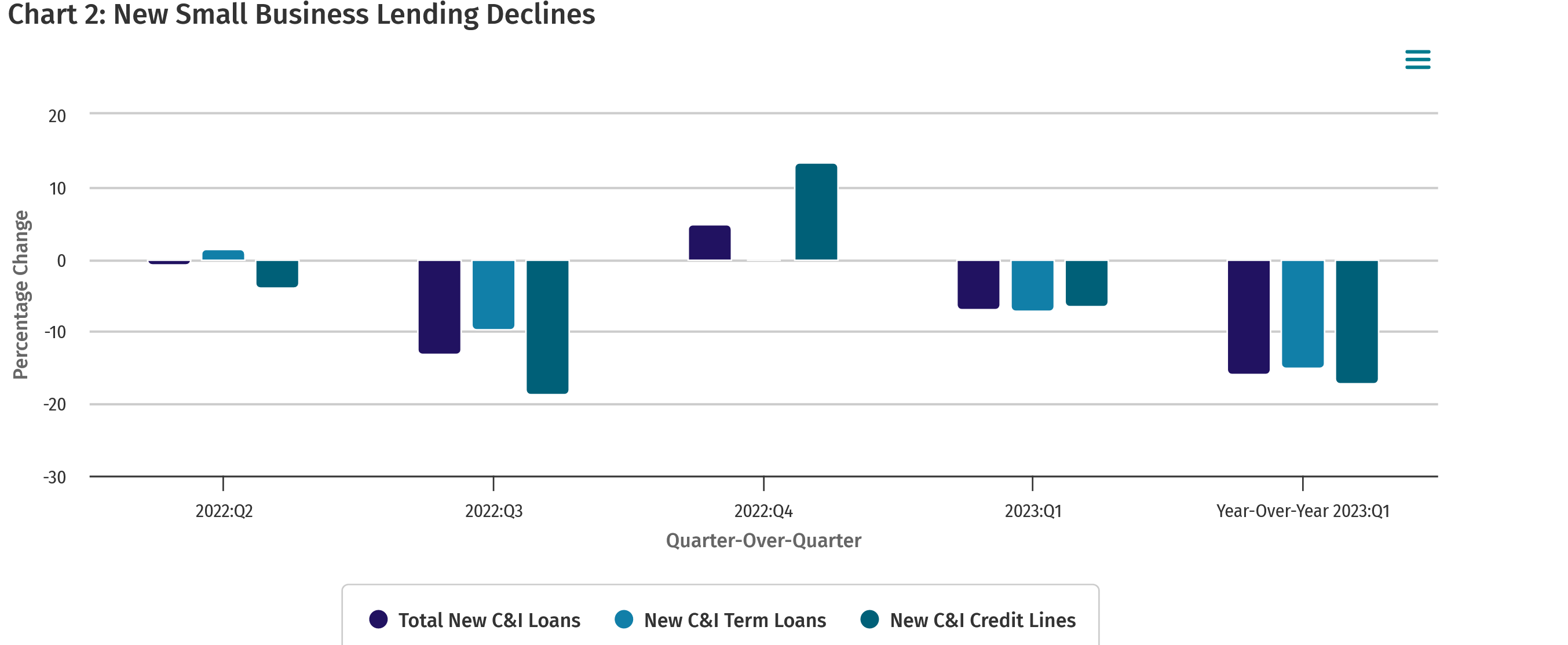

It is interesting that the market continues to focus on interest rates and employment as the barometer for the economy while totally ignoring one metric. As a lender I just did a year end analysis on our portfolio and one metric jumped off the page increasing...

by Glen | Dec 4, 2023 | Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, Commercial Loan Servicing, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money

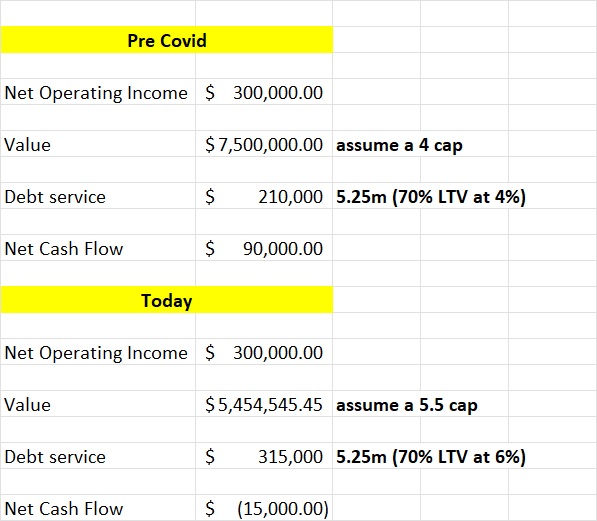

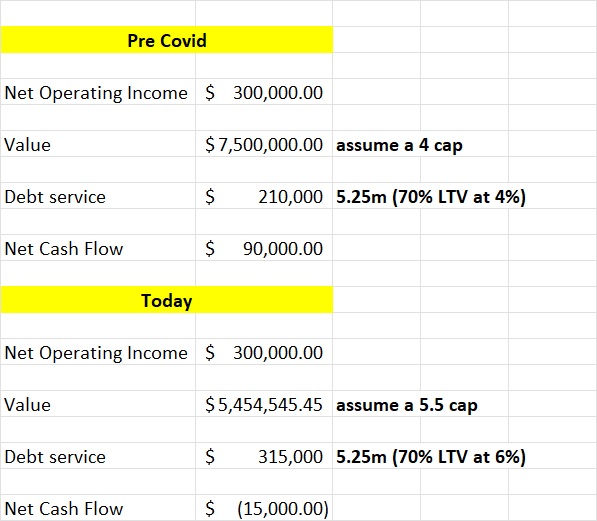

US commercial real estate prices have fallen this year for the first time in more than a decade, according to Moody’s Analytics, heightening the risk of more financial stress in the banking industry. What property types are declining? (hint not just office...

by Glen | Oct 9, 2023 | 2023 real estate prediction, 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, hard money loans, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

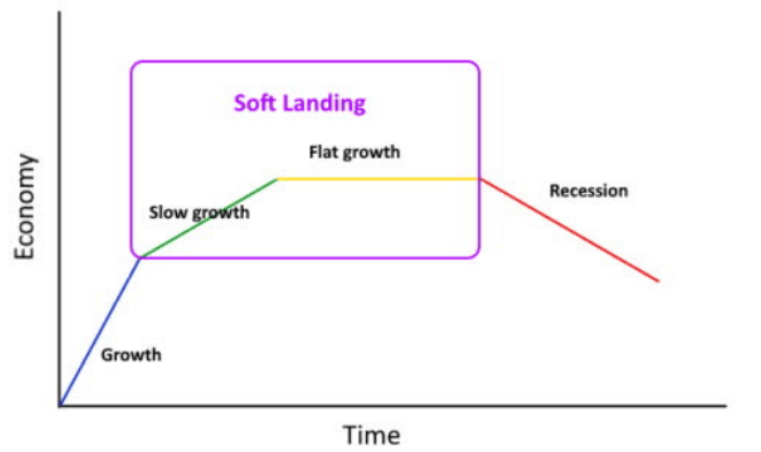

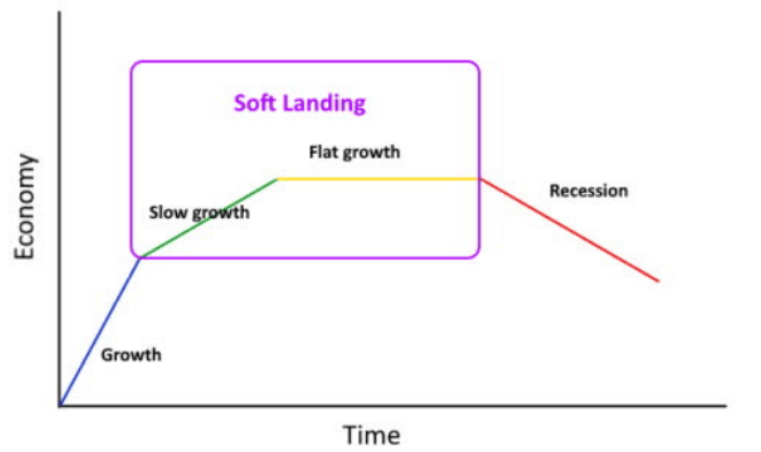

Earlier in the year most economists and myself predicted a recession by now, but the cards have changed with most now predicting the opposite, a soft landing. What is a soft landing? Is a soft or hard landing better for real estate? Does it really matter which...

by Glen | Sep 18, 2023 | 2023 real estate prediction, 2023 real estate predictions, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Biden tax plan, Colorado Hard Money, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money

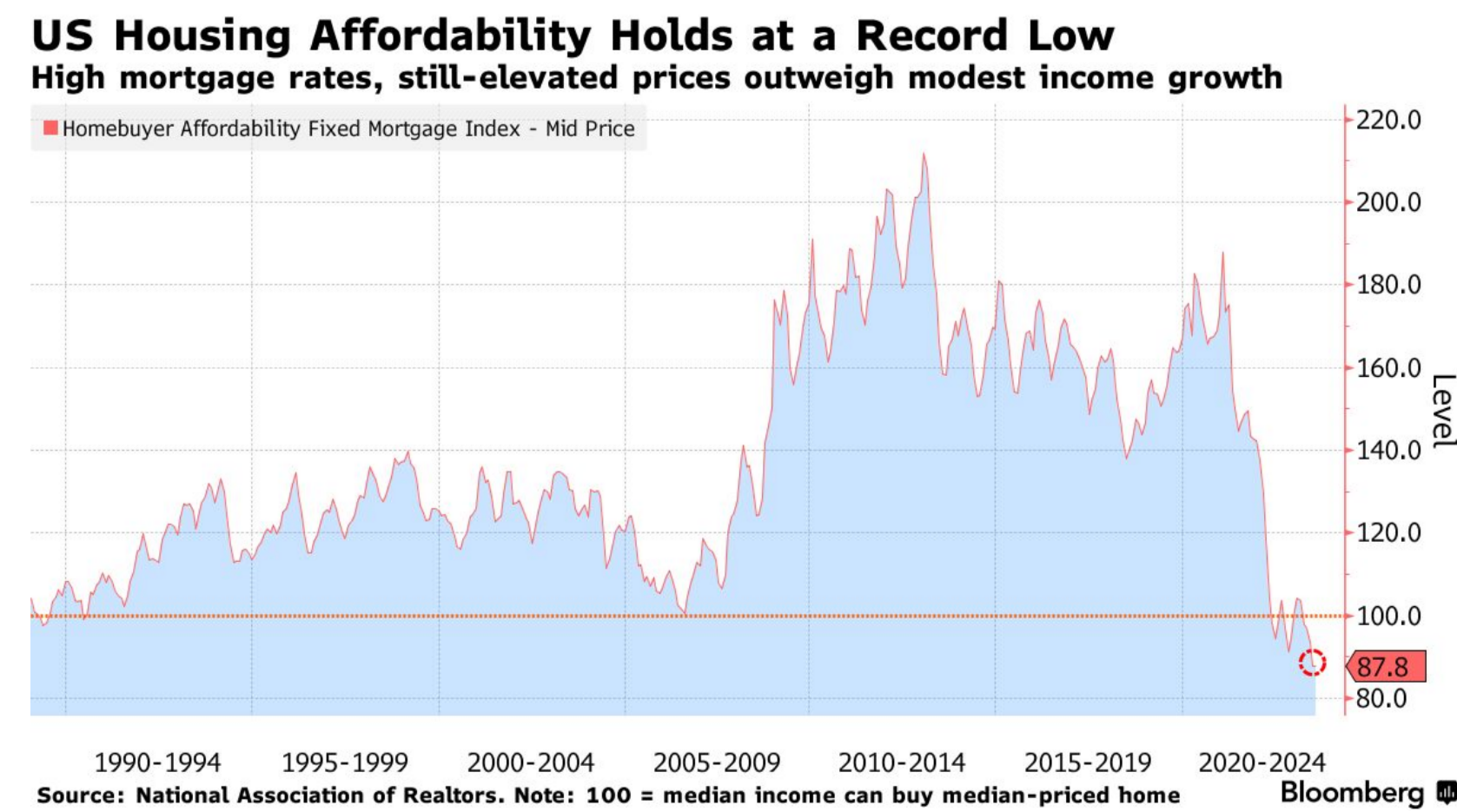

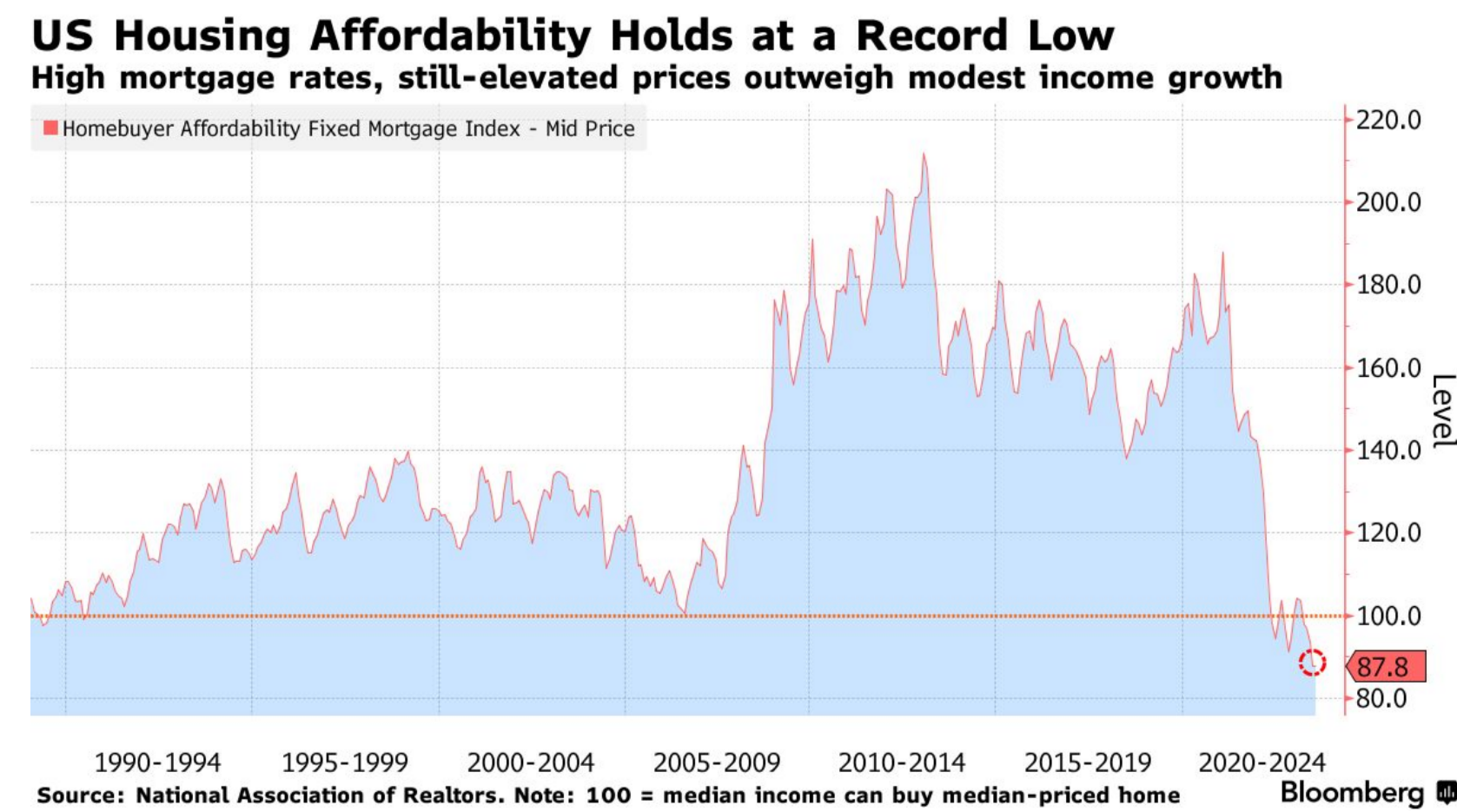

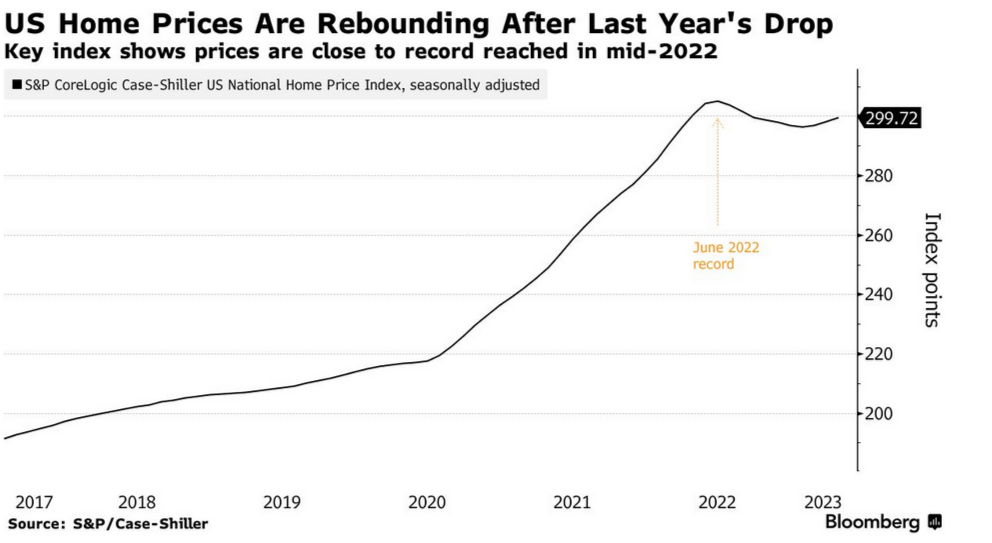

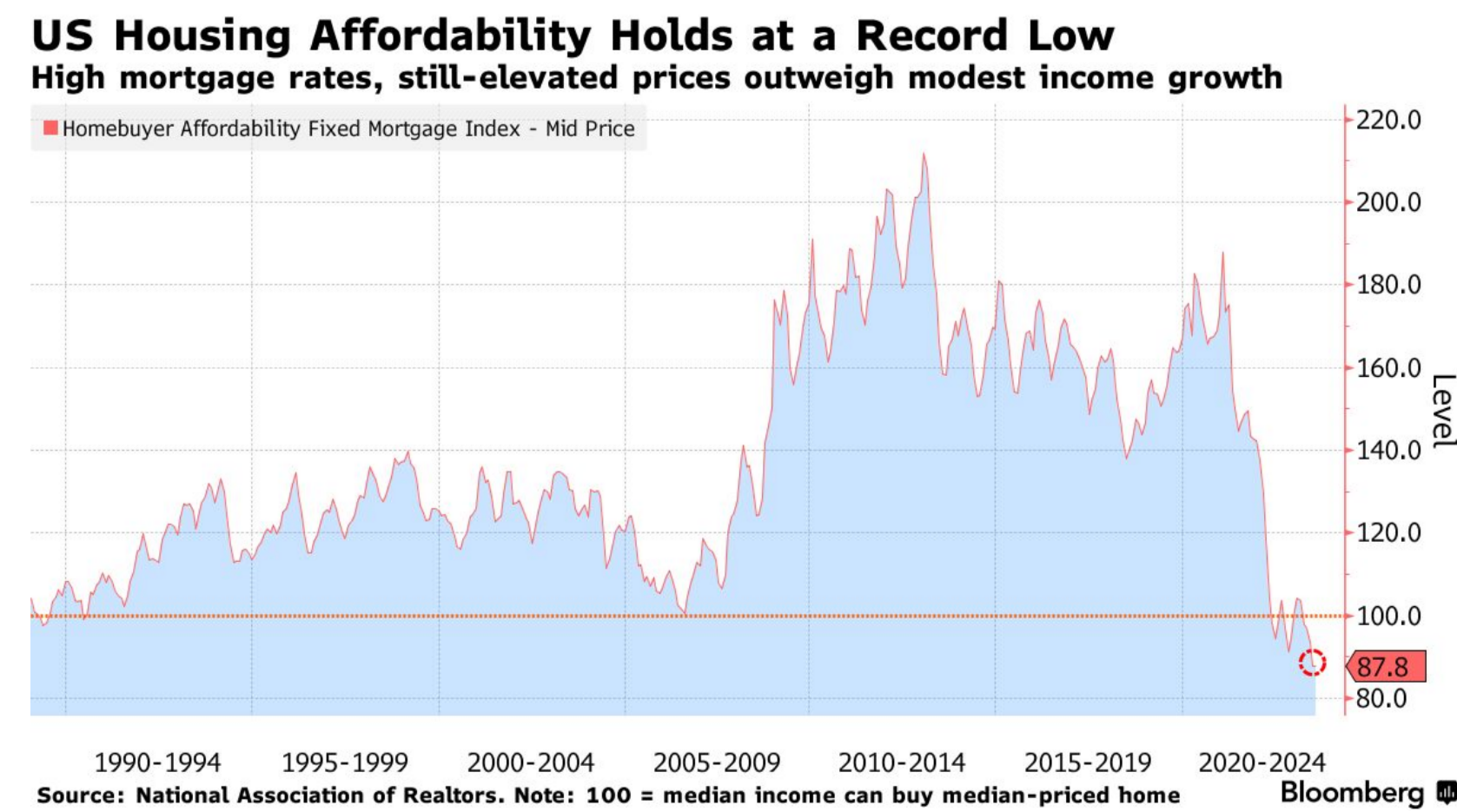

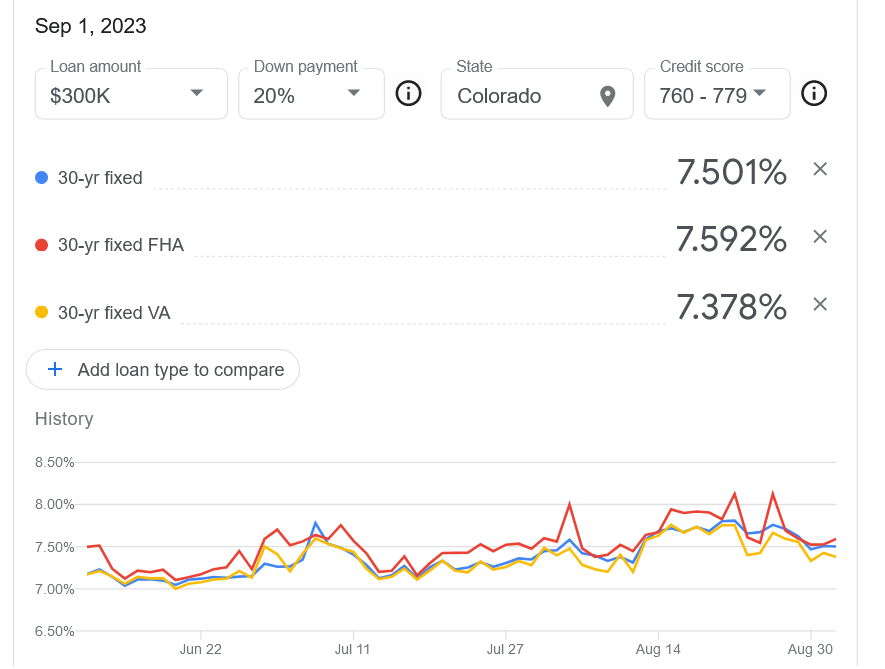

For years interest rates were the number one indicator for real estate prices. In this cycle interest rates have more than doubled yet real estate prices have barely budged. If we look back at 2008, the impetus for the large real estate crash was rising interest...

by Glen | Aug 21, 2023 | 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, interest rates, mortgage rates

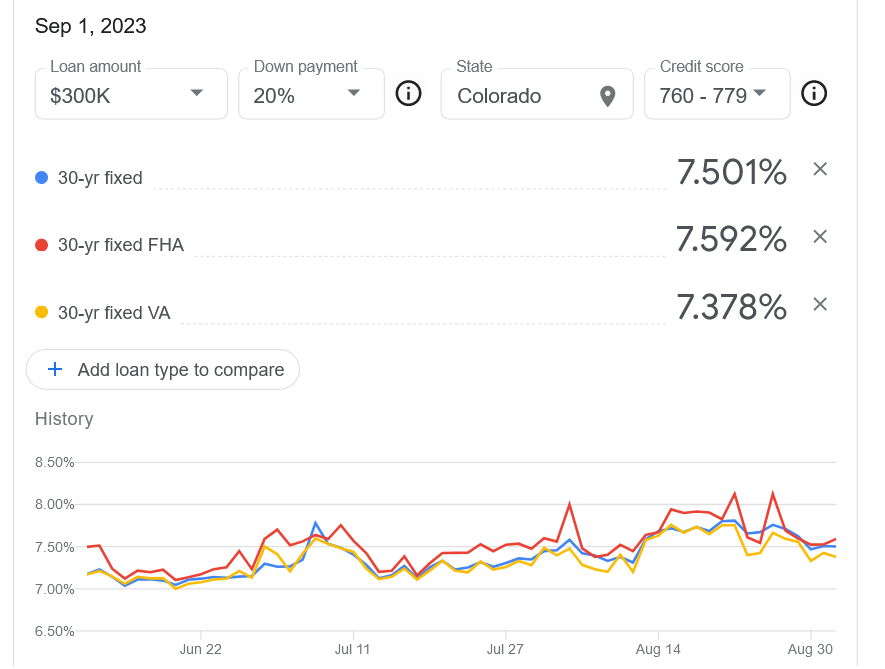

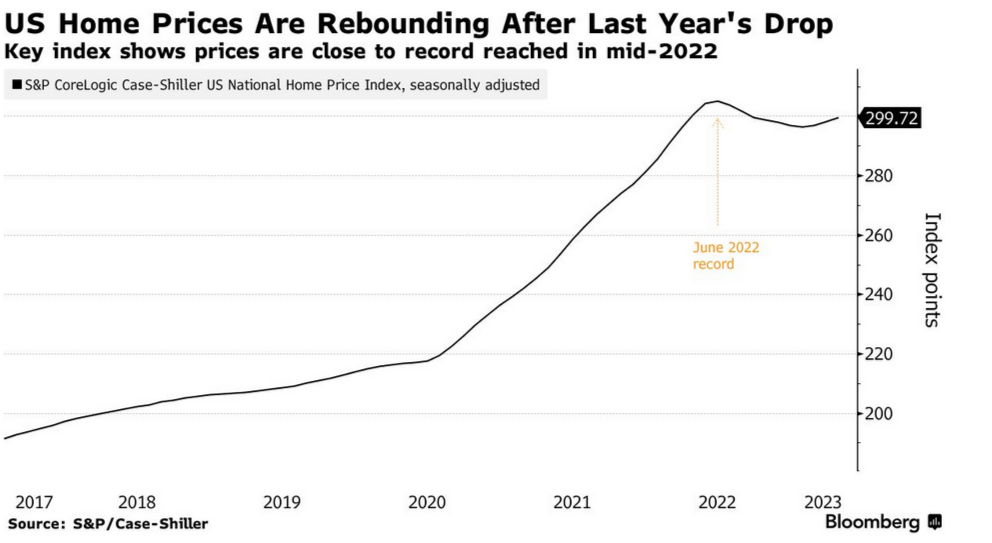

Like most, I have been surprised at the recent upward movement in prices. Did we just experience the shortest housing cycle ever? Are housing prices going to continue their recent upward swing? Why are housing prices now moving higher after a very shallow decline...