by Glen | Aug 1, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, commercial hard money, Commercial Lending valuation, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

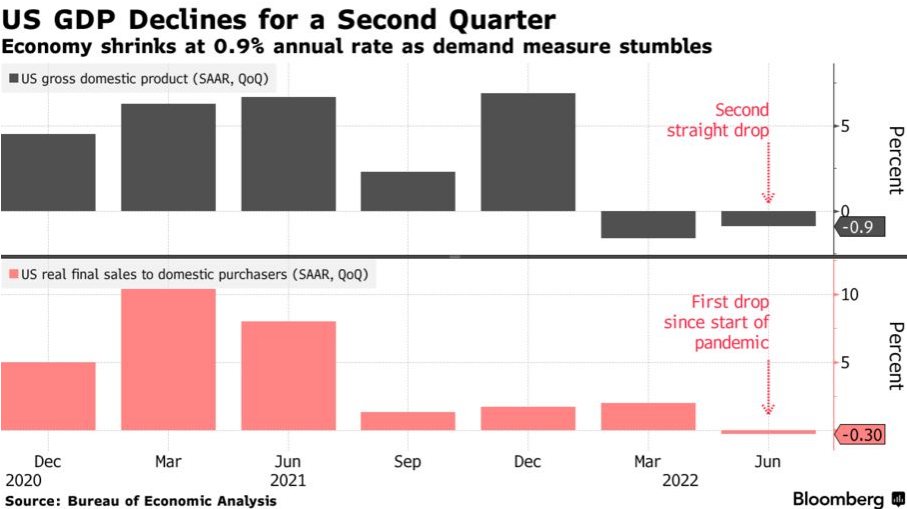

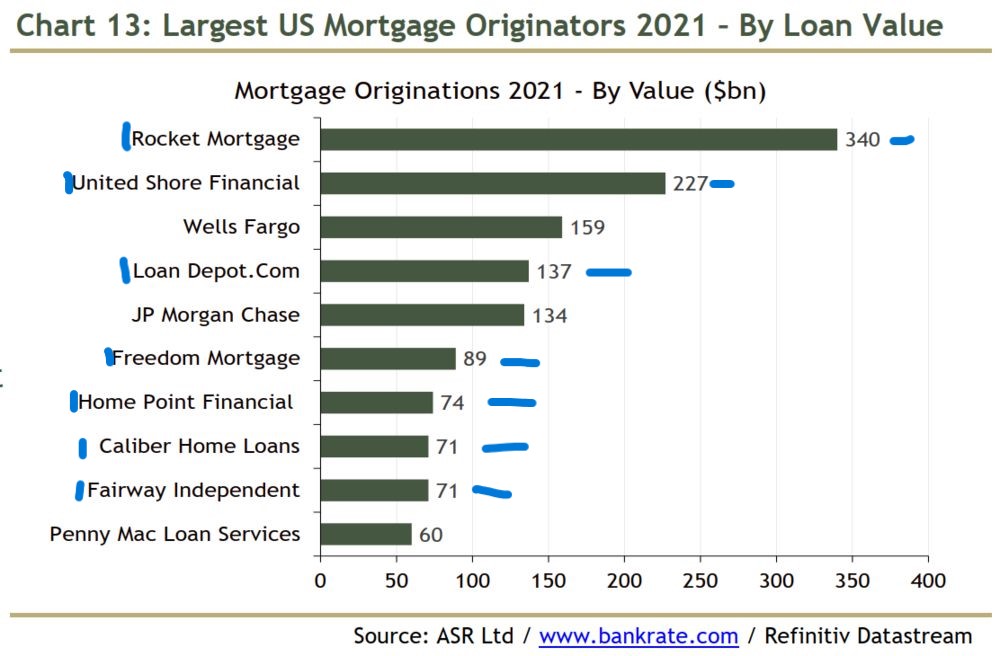

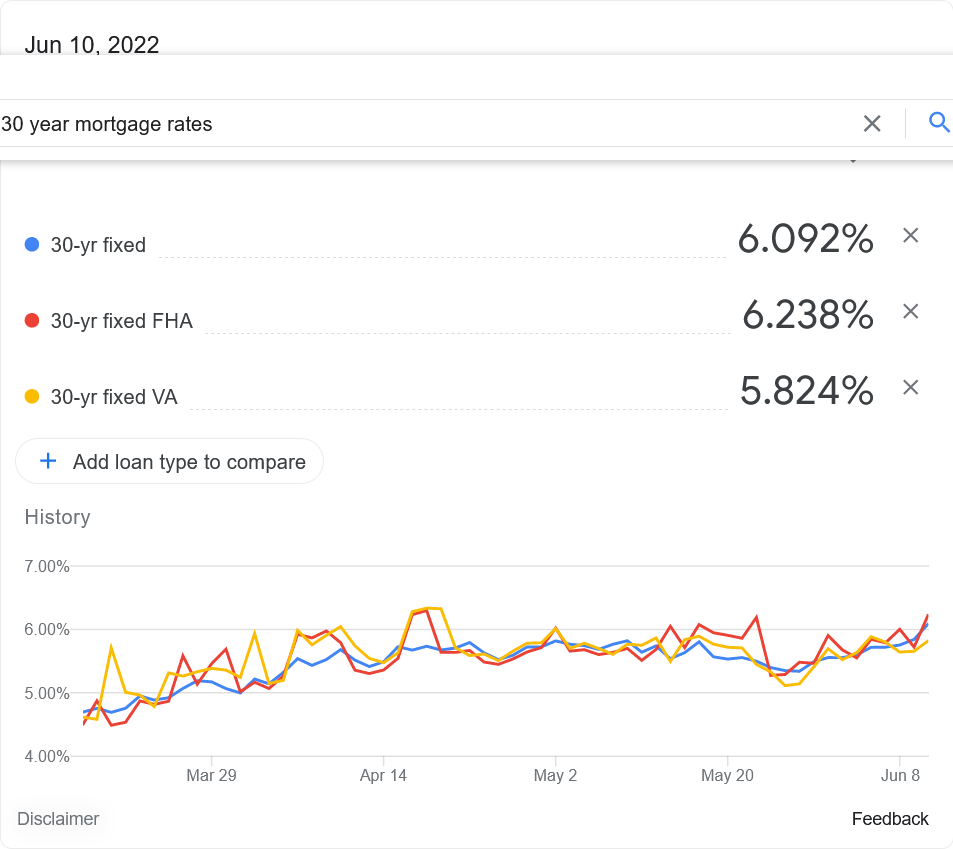

What a week it has been in the economy. The federal reserve is still struggling to contain inflation and as a result increased the fed funds rate .75%. After the announcement stocks roared back in a huge “relief” rally and mortgage rates plummeted. Shortly after,...

by Glen | Jul 25, 2022 | 2022 real estate predictions, 2022 stock market correction, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, Property Valuation, real estate investing, Real Estate Trends, Real estate Valuation, recession, recession impact on real estate, Residential hard money, residential lending valuation

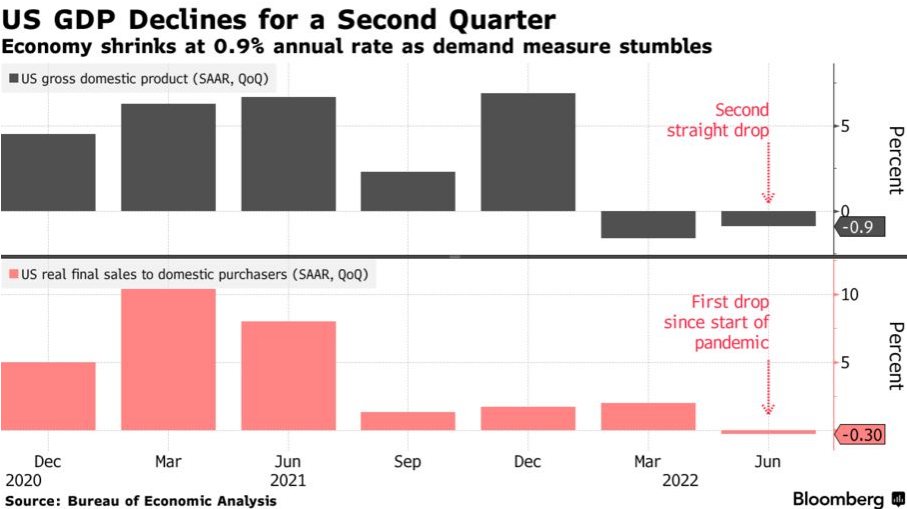

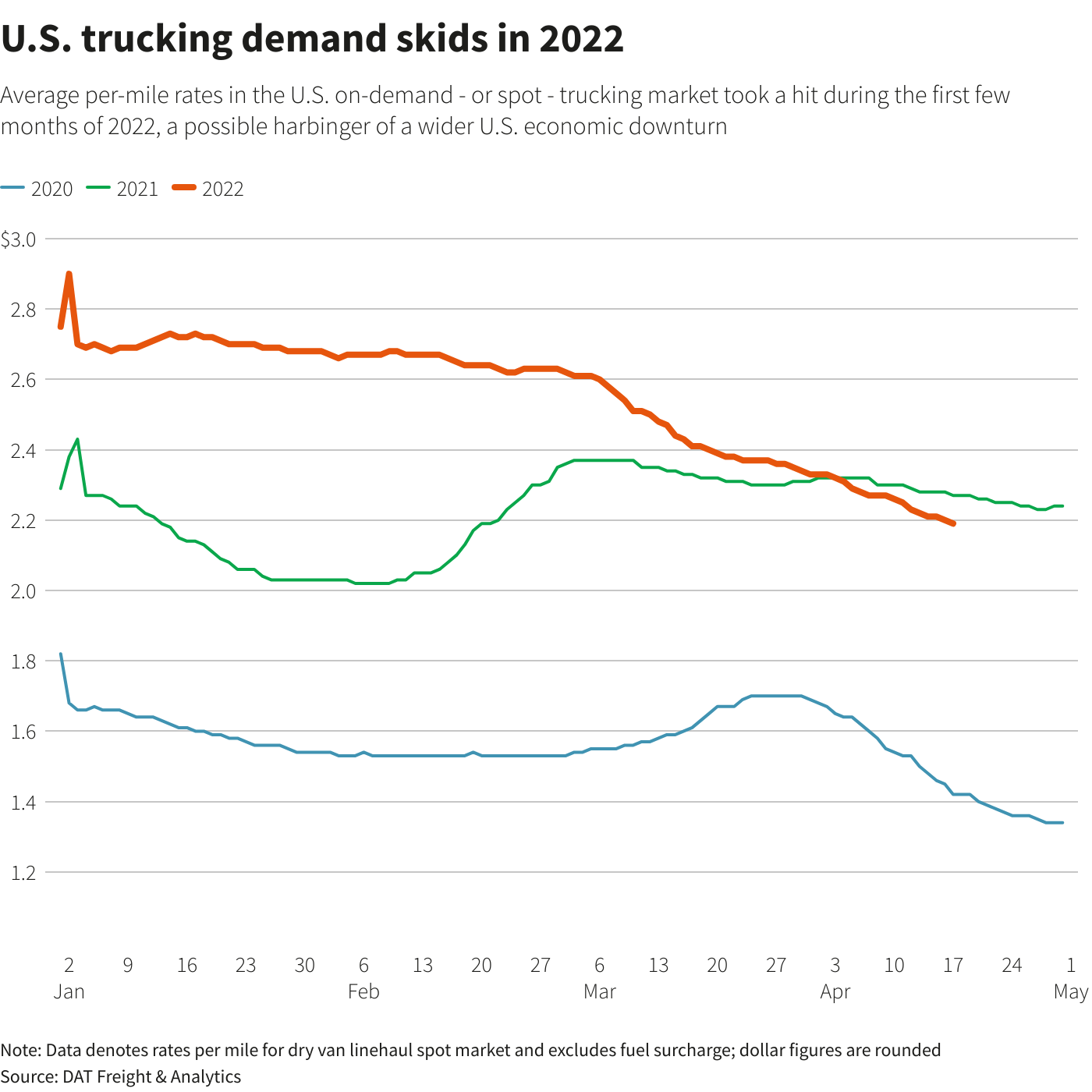

There has been an unexpectedly sharp downturn in demand to truck everything from food to furniture since the beginning of March and rates in the overheated segment that deals in on-demand trucking jobs – known as the spot market – are skidding. Why are...

by Glen | Jul 18, 2022 | 2022 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, commercial hard money, Denver Hard Money, General real estate financing information, Georgia hard money, Government Bailout, Hard Money Commercial Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

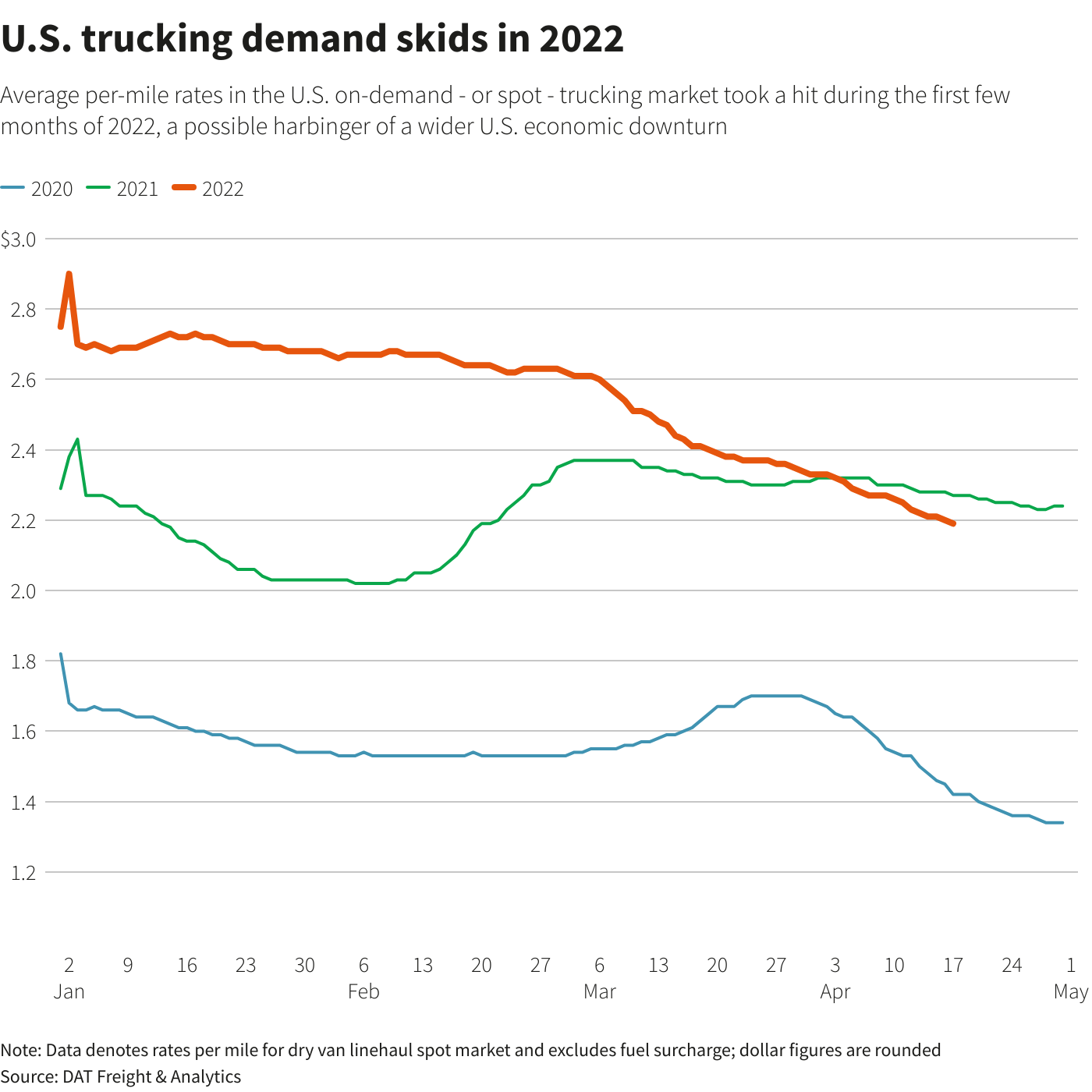

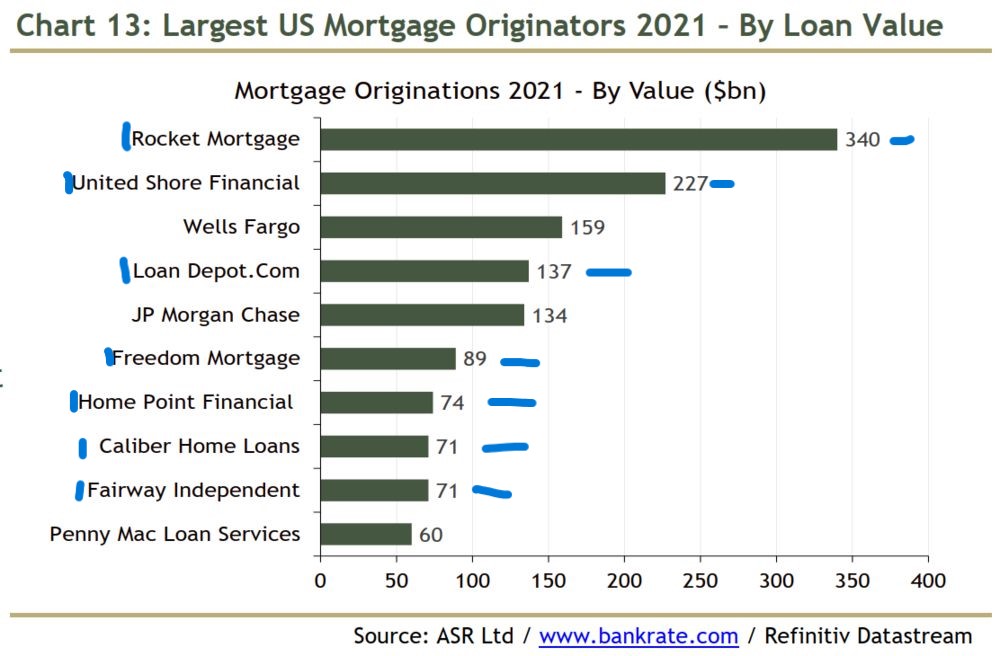

The federal government in their quest to shore up the mortgage market in 2008 has created some new risks to the housing market. Non bank lenders now make up 74% of the origination volume with only 3 banks even making the list. What does this mean for the mortgage...

by Glen | Jul 11, 2022 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Realtor

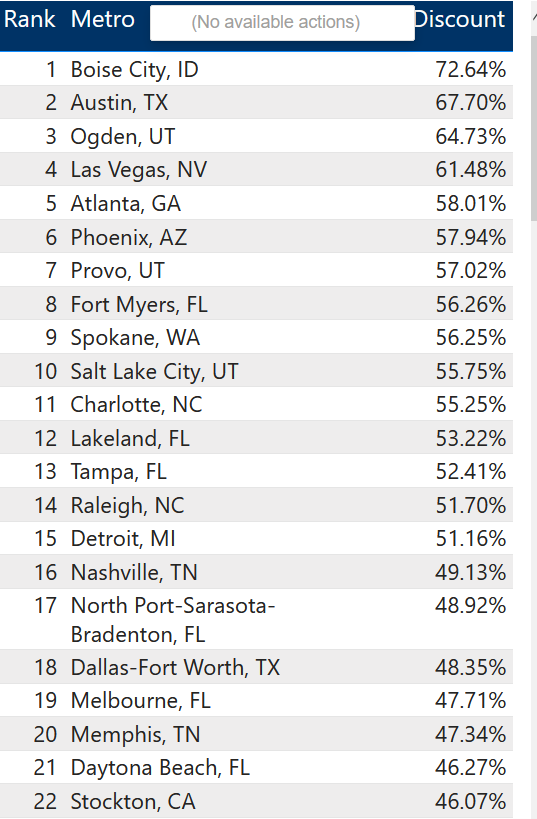

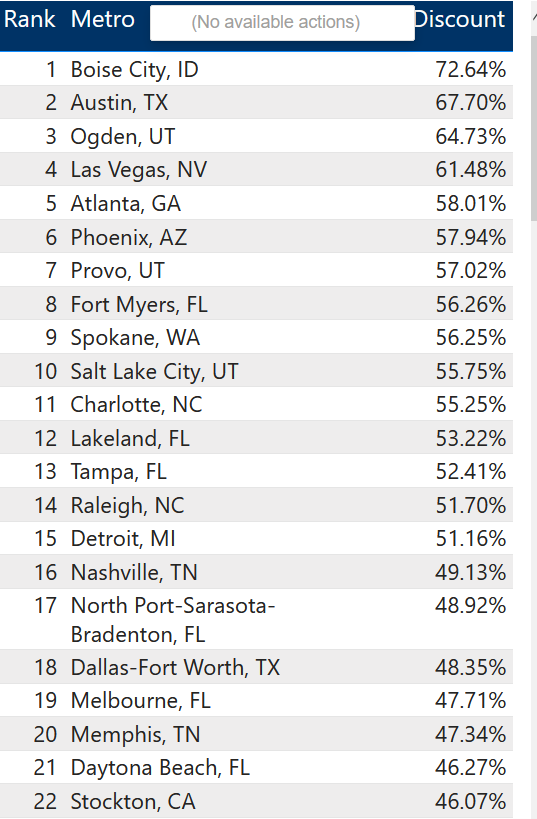

“A reckoning is due. Home prices and rents can’t separate as significantly as they have from their long-term fundamental trends without major issues arising in the marketplace,” said Ken Johnson, an economist at Florida Atlantic University, in an analysis. “Few...

by Glen | Jul 4, 2022 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado ski lending, Colorado ski real estate, commercial hard money, Commercial Lending valuation, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, hard money loans, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

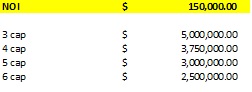

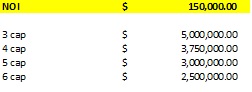

Commercial real estate is showing the first signs of cooling in more than a year, disrupted by rising interest rates that are already causing some deals to collapse. What is causing the quick change in fortunes in commercial real estate? How will the recent fed...

by Glen | Jun 27, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Atlanta Private Lending, Atlanta real estate trends, Denver Hard Money, Denver private Lending, General real estate financing information, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, Property Valuation, Real Estate economic trends, recession, recession impact on real estate

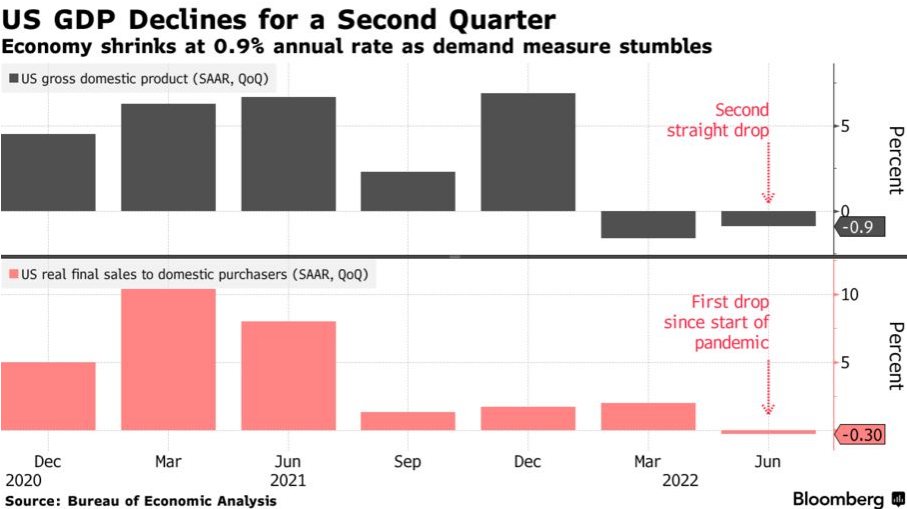

Most economists are convinced that there will be a recession soon, although nobody knows whether it is 3,6 or 12 months away. The good news is that this recession should not be a repeat of 2008. Which prior cycle will the next recession likely represent? Will it...