by Glen | May 20, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Biden tax plan, CO hard money, Colorado Hard Money, Colorado private lender, credit scoring, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Government Bailout

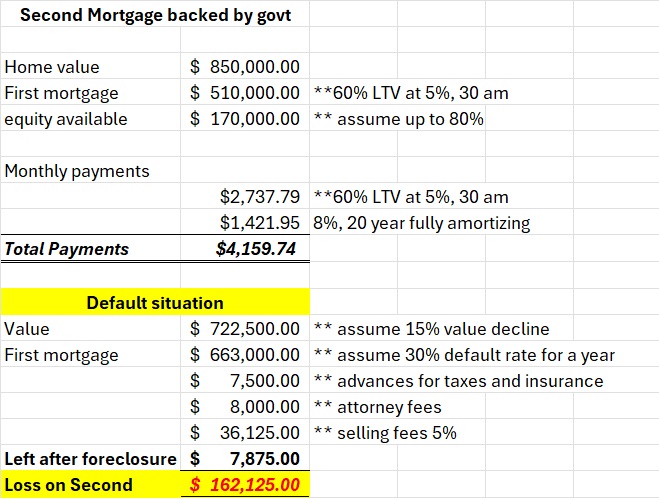

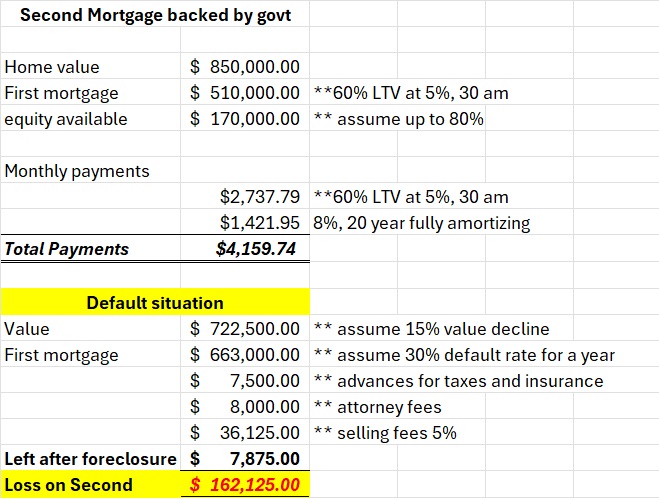

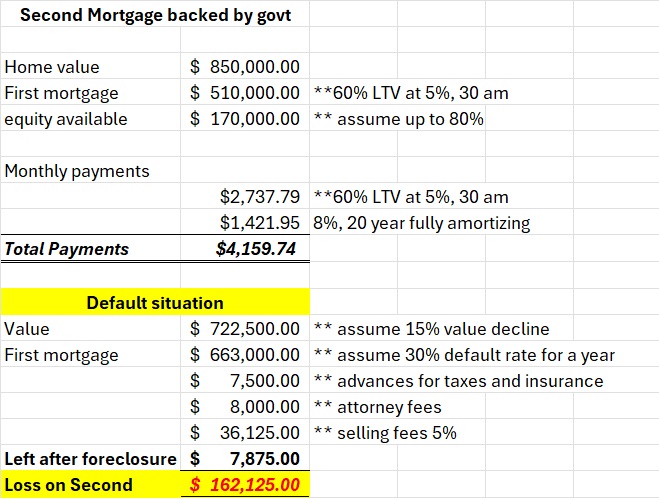

You have to hand it to the Federal government, they are always working to solve problems that do not exist. Currently there is a new proposal from the federal government (via Freddie Mac) to insure second mortgages/home equity lines of credit similar to first...

by Glen | Apr 8, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, commercial property trends, Consumer price index and inflation, credit scoring, Denver Hard Money, Denver private Lending

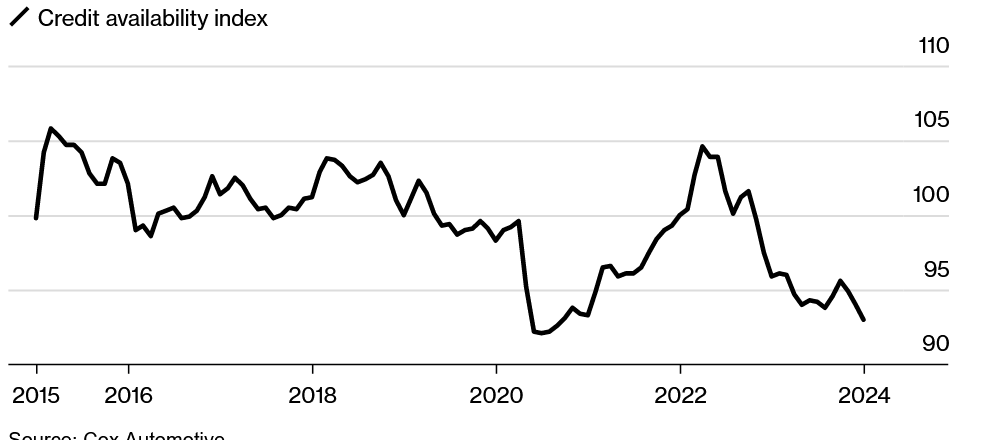

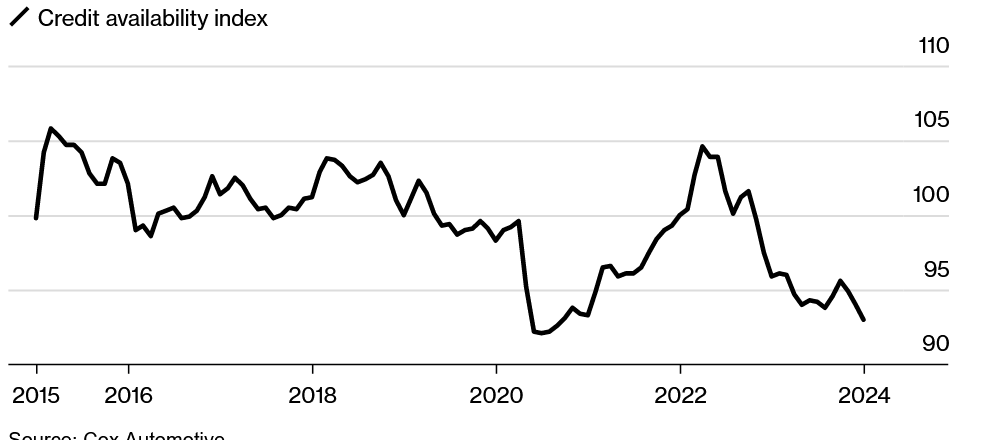

According to everything I’ve read, the economy is humming along. Economic growth is good, the labor market is healthy, and a soft landing is all but inevitable. At the same time lenders are acting polar opposite of what we should expect. Why are lenders all the...

by Glen | May 8, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Biden tax plan, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, credit scoring, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending, interest rates, mortgage rates

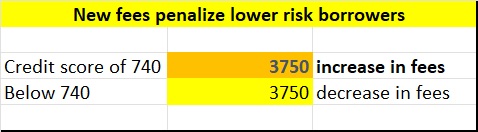

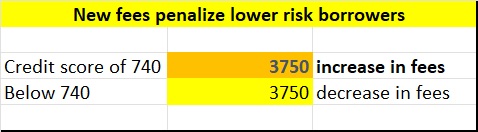

No this is not a joke, I had to read the recent Fannie Mae press release multiple times to actually believe what I was reading. Who would have ever thought that someone with a high credit score above 740 would be penalized for having a high score. Under a new rule...

by Glen | Apr 3, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, credit scoring, Denver Hard Money, General real estate financing information, Georgia hard money

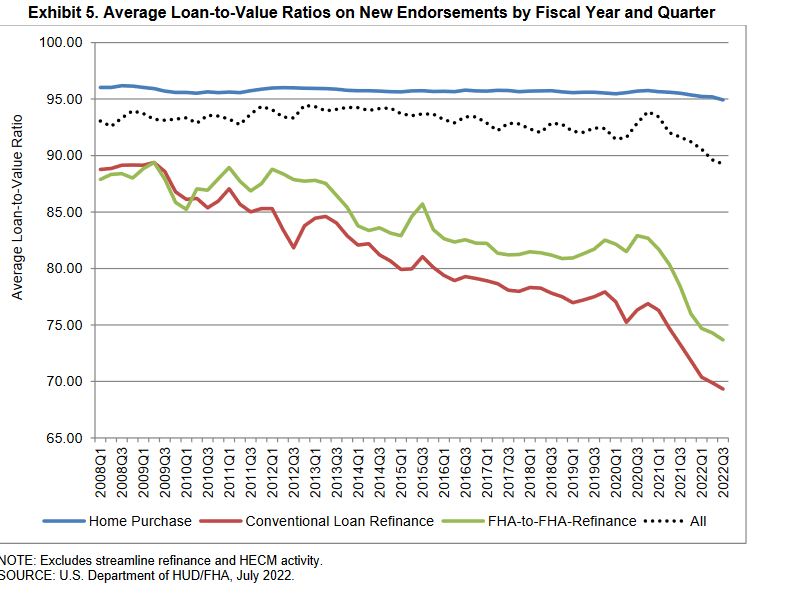

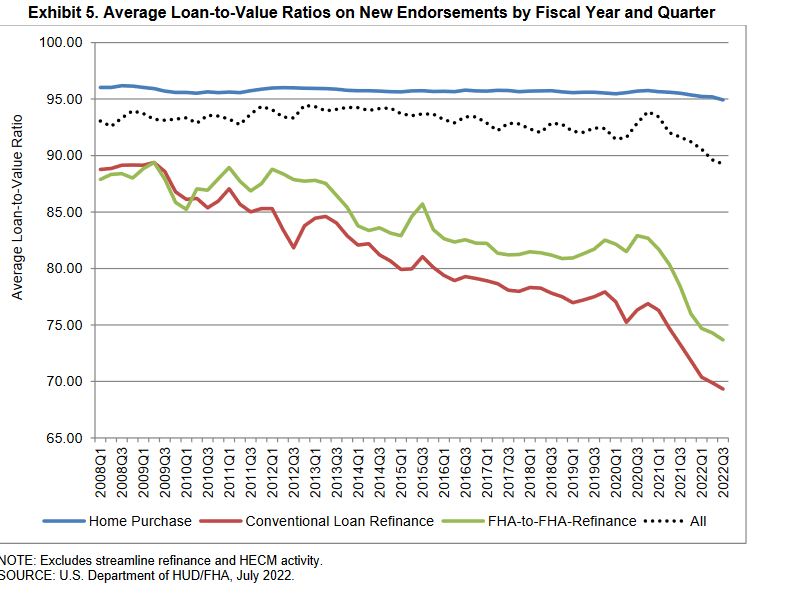

Last week, the president announced an action that will save homebuyers and homeowners with new FHA-insured mortgages $1500 per year (assuming a 500k home), lowering housing costs for an estimated 850,000 home buyers and homeowners in 2023. On the surface, the change...

by Glen | Nov 21, 2022 | 2023 real estate prediction, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Commercial Lending valuation, credit scoring, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, real estate investing, Real Estate Trends, Residential hard money, residential lending valuation

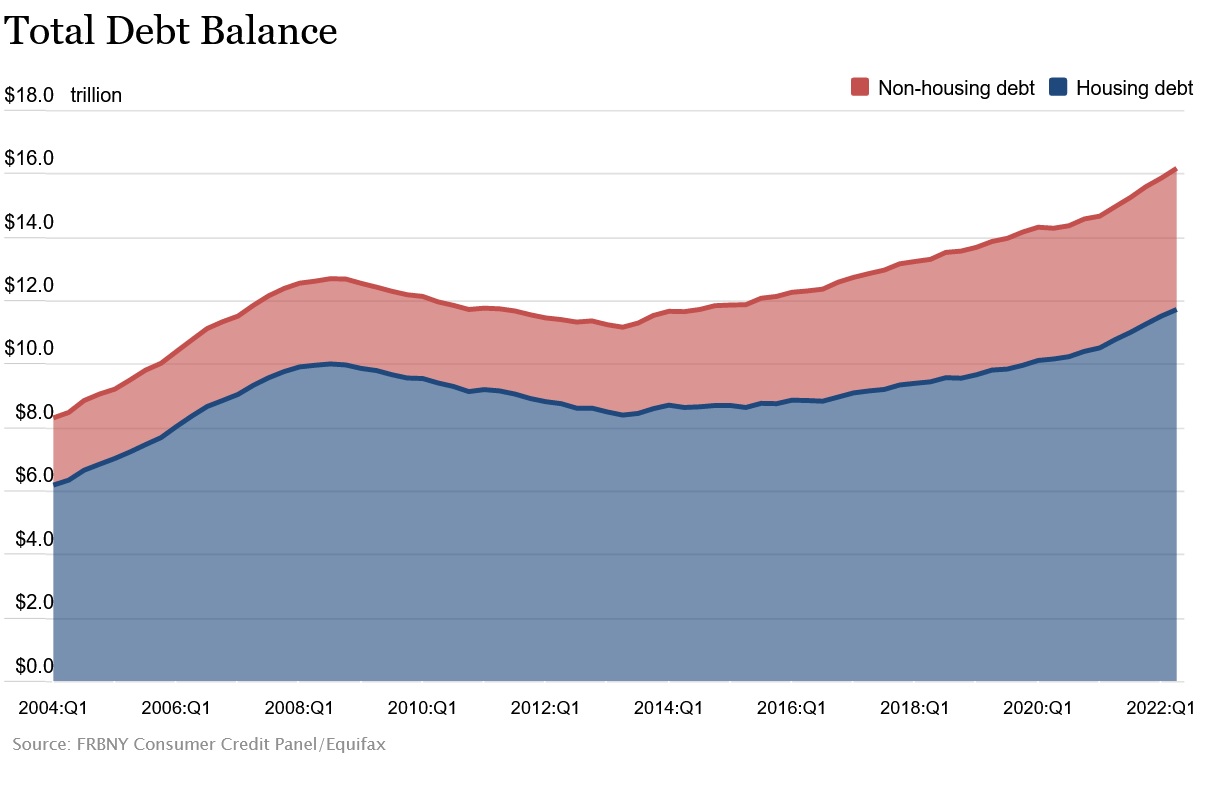

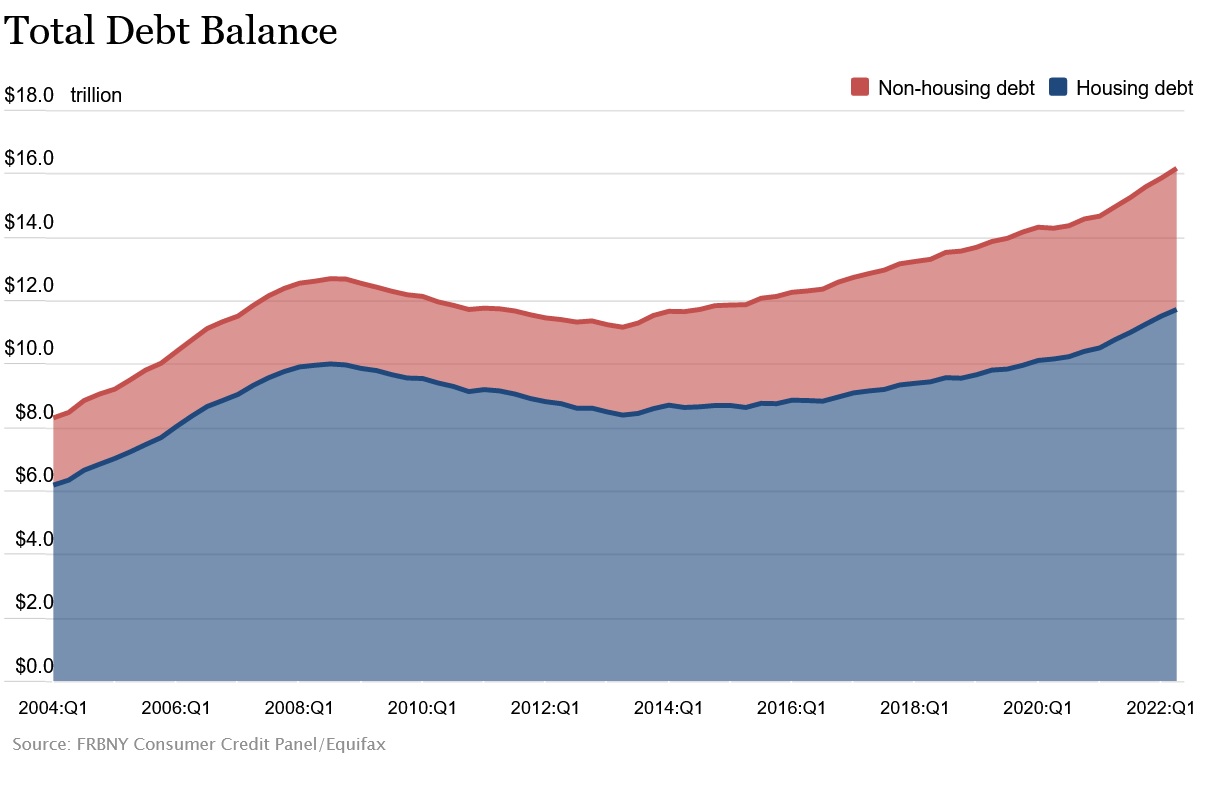

The federal reserve bank of NY recently published a report showing consumer debt jumping to the highest levels ever recorded with every category growing from mortgages, autos, credit cards, lines of credit, etc… Is some consumer debt better/worse than others for the...

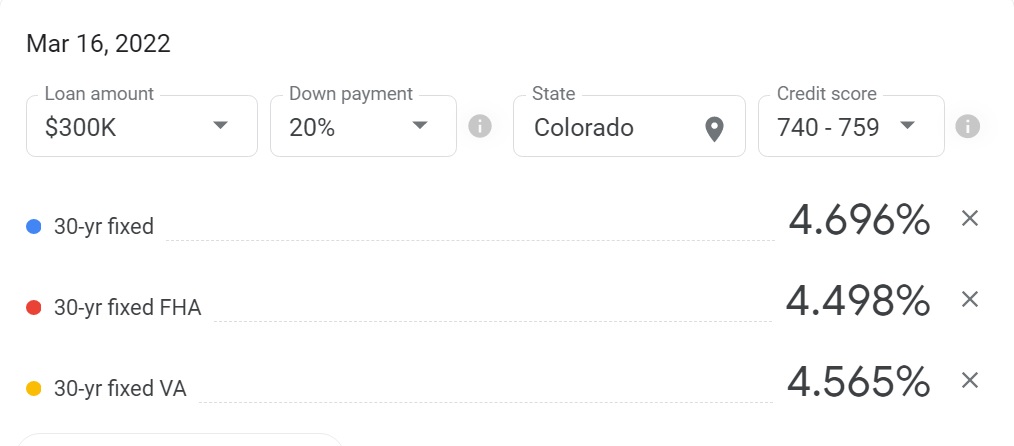

by Glen | Apr 4, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Atlanta Hard Money, Colorado Hard Money, credit scoring, Denver Hard Money, Georgia hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

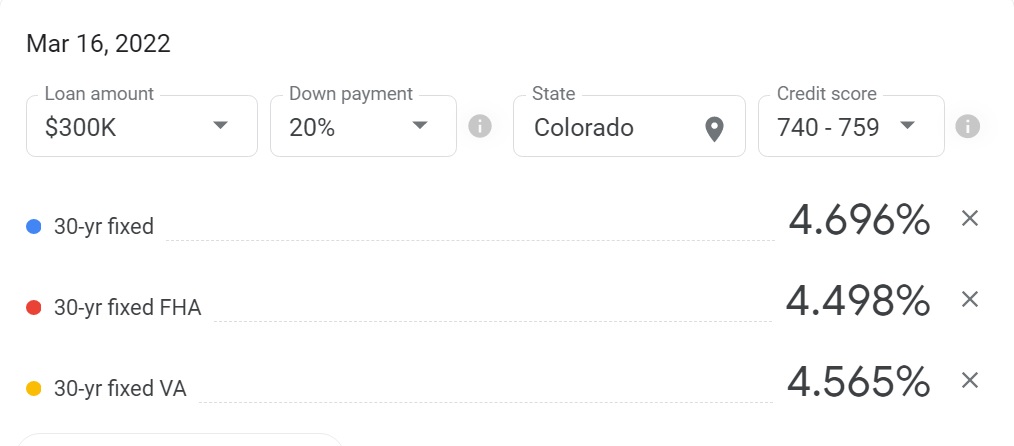

The swiftness of the changes in the real estate market are astonishing, yet not unexpected. I predicted last year mortgage rates would top 5% and they already have come close. This has led to a 60% drop in refinances and a sharp reduction in sales. What do these...