by Glen | Feb 17, 2025 | Atlanta Hard Money, Brokering Loans to Fairview, Closing, Colorado Hard Money, commercial hard money, commercial private lending, commercial property trends, Denver Hard Money, Georgia hard money, Other Questions, Process/Loan Submittal, Program Details, Questions Regarding Fairview, Realtor, Underwriting/Valuation

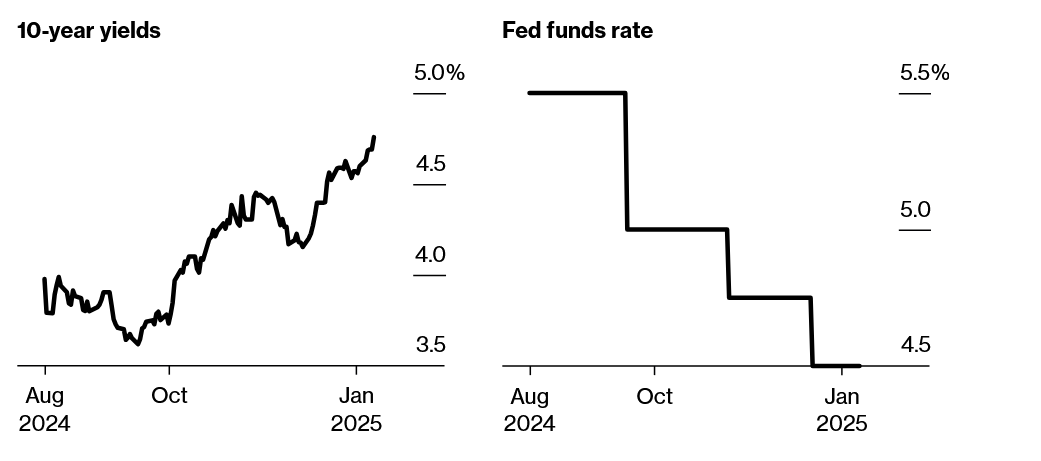

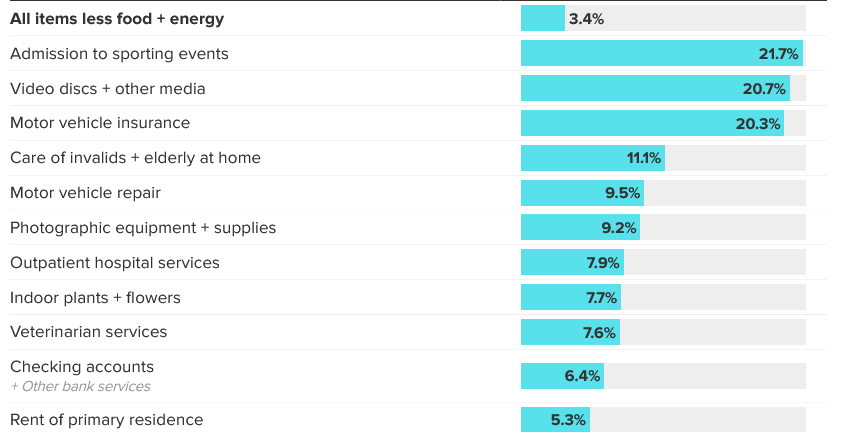

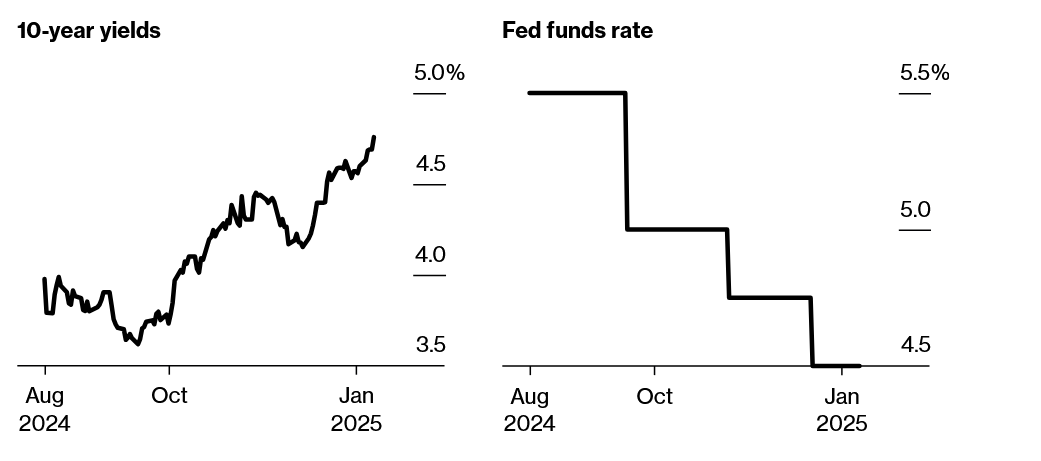

The bank mantra over the last 3 years has been survive until 2025. 2025 is when bankers were predicting a sharp decline in rates that would ultimately bail out the beleaguered commercial property market. Here we are at the dawn of 2025 and 10 year treasuries and...

by Glen | Dec 2, 2024 | 2024 election real estate impacts, 2024 mortgage rates, 2025 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money

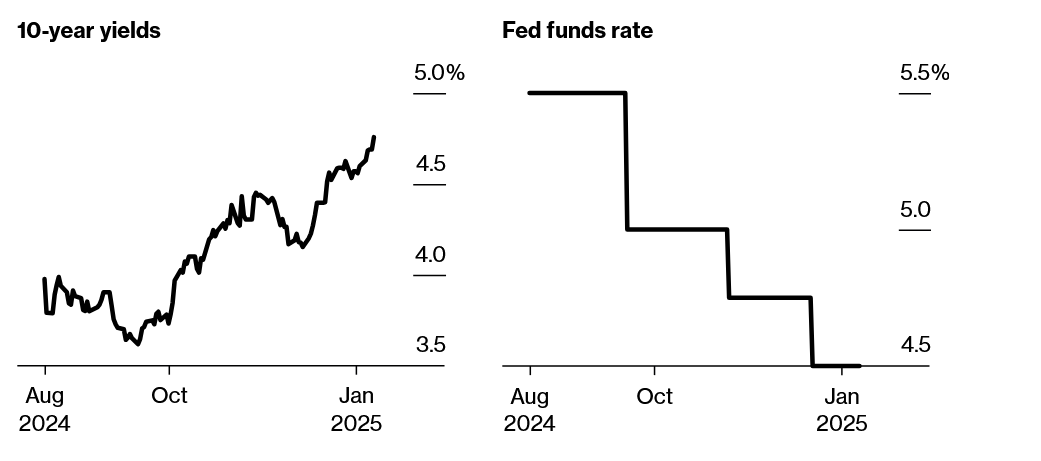

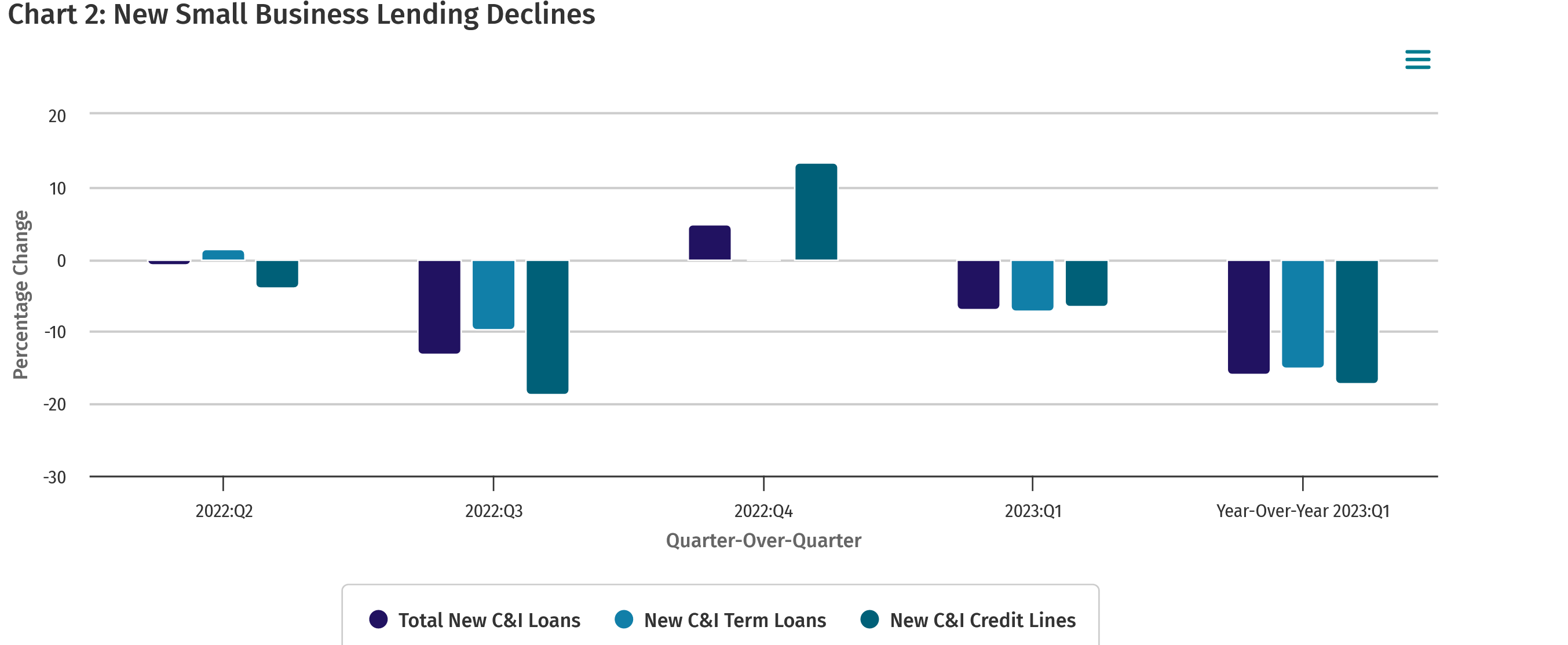

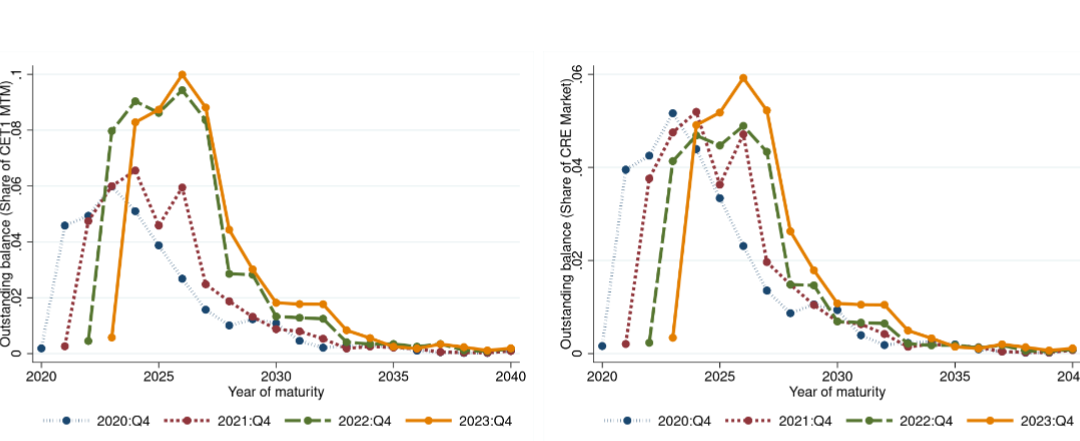

There is a mantra being used in small/regional banks that is “survive until 2025”. In essence the theory is that rates will drop precipitously and basically “bail out” many banks’ portfolios. Banks are in turn pushing out maturity dates hoping for a market bail out....

by Glen | Jul 8, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money

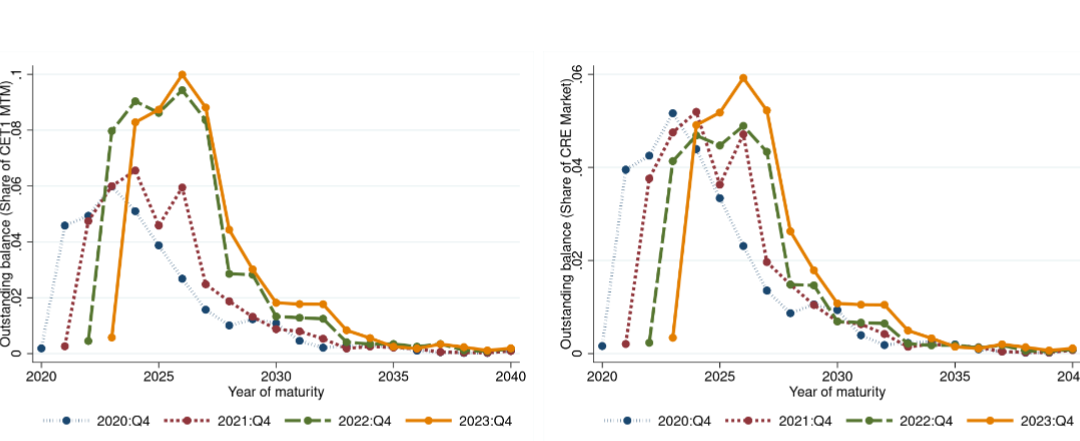

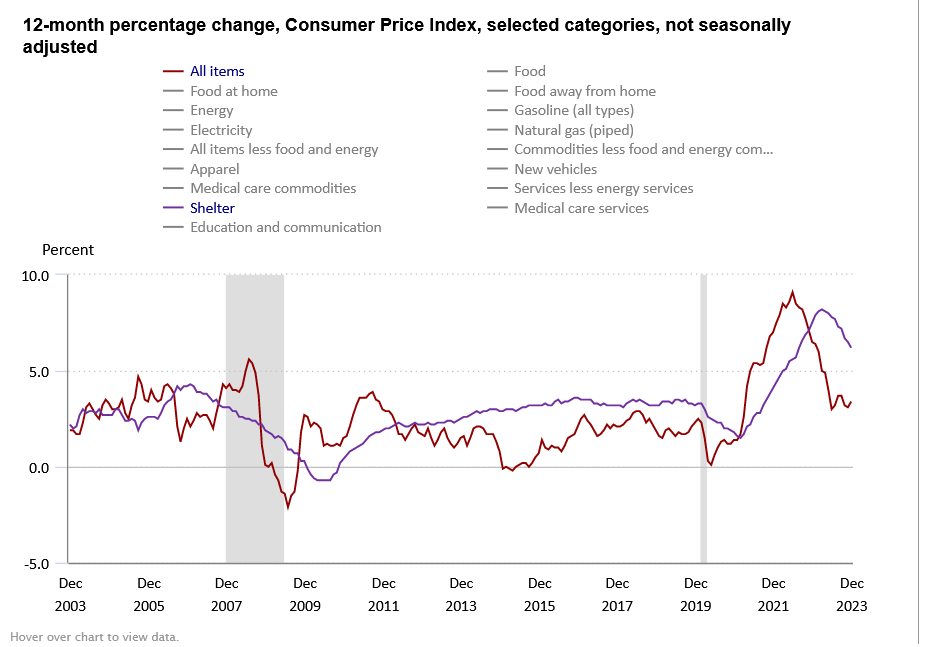

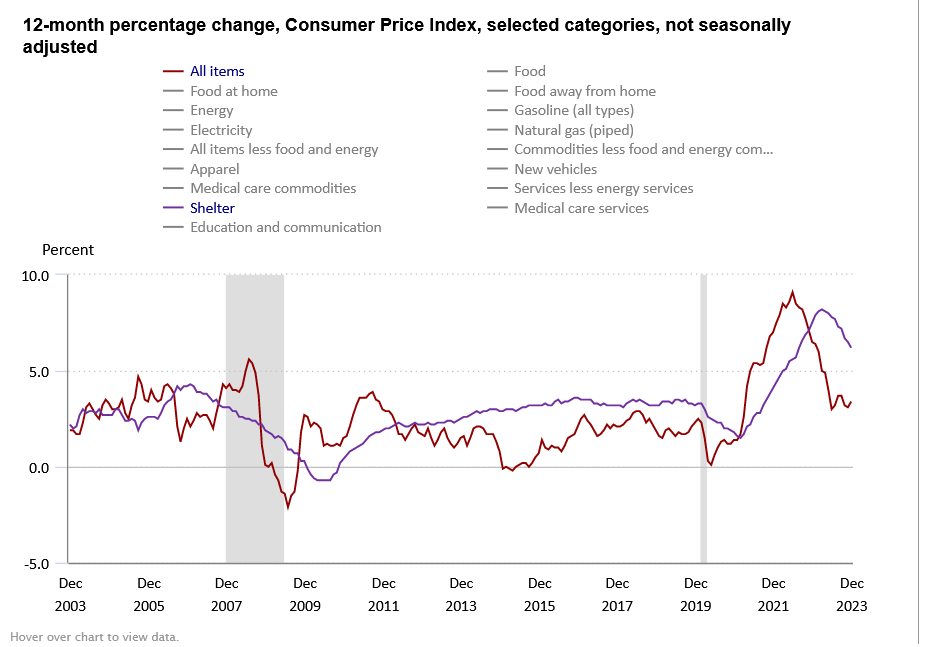

When I was writing this article mortgage rates were hovering right around 7%. At the same time June showed the first real slowdown in inflation in the last year. The stock market soared on the slowdown in inflation while the federal reserve took a much more...

by Glen | Apr 1, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski real estate, Commercial Lending valuation, commercial private lending, commercial property trends, Consumer price index and inflation, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout

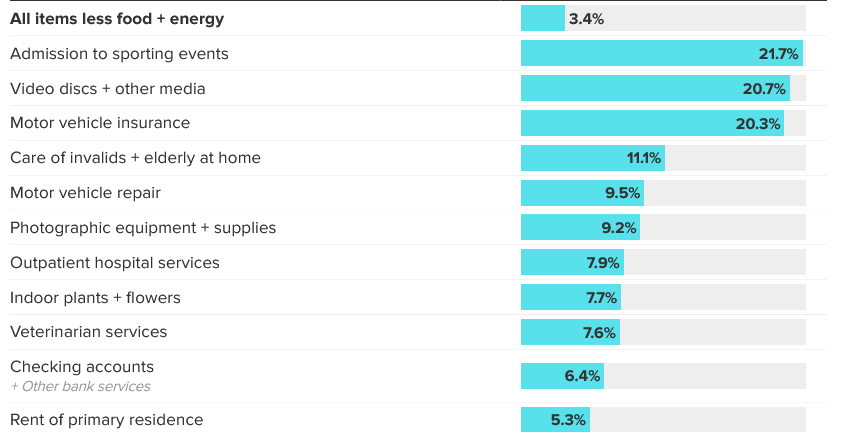

The market currently has a fixation on interest rates. Senators are now jumping on the bandwagon pushing the federal reserve to “immediately” cut rates to help the real estate market and affordability. Unfortunately, the senators do not fully grasp how...

by Glen | Mar 25, 2024 | 2024 mortgage rates, 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta real estate trends, Bank failures, Bankruptcy, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending in the news, Commercial Lending valuation, Commercial Loan Servicing, commercial private lending, commercial property trends, Georgia hard money, Hard Money Lending

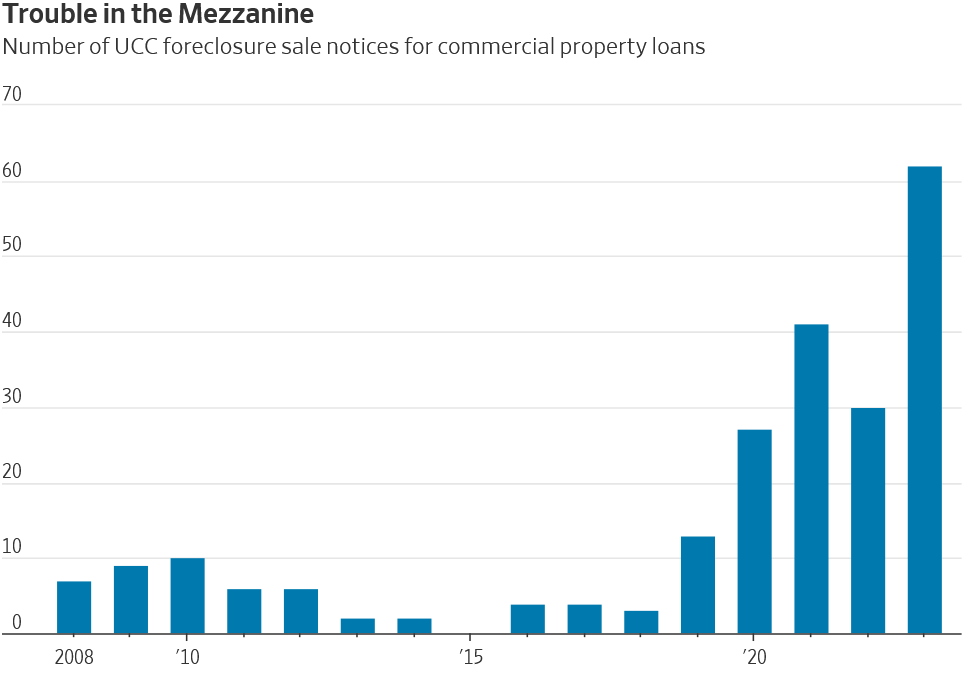

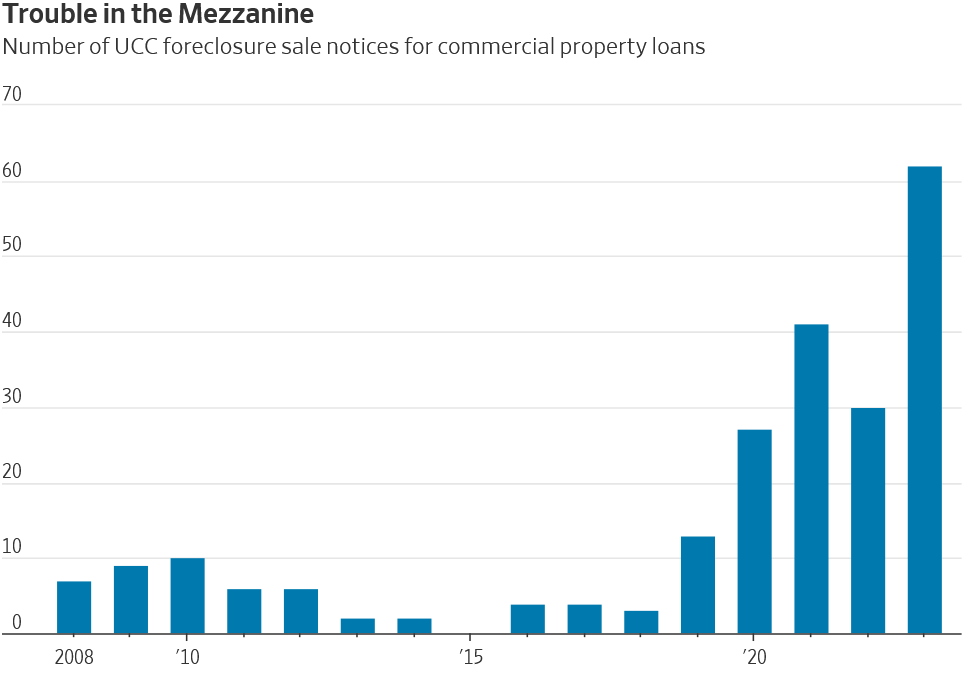

Foreclosures are surging in a risky corner of commercial real-estate finance, offering one of the most profound signs yet that turmoil in the commercial property market is just beginning. Lenders this year have issued a record number of foreclosure notices for...

by Glen | Jan 22, 2024 | 2024 mortgage rates, 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, Commercial Loan Servicing, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money loans, Housing Price Trends / Information

It is interesting that the market continues to focus on interest rates and employment as the barometer for the economy while totally ignoring one metric. As a lender I just did a year end analysis on our portfolio and one metric jumped off the page increasing...