by Glen | Sep 26, 2018 | Commercial Lending valuation, Housing Price Trends / Information, Private Lending, Property Valuation, residential lending valuation

It has been 10 years since Lehman Brothers collapsed and the mortgage market tanked with Fannie and Freddie taken over by the US government. Have we learned any lessons from the last collapse? Is the mortgage market substantially safer than before? Who will take it...

by Glen | Aug 28, 2018 | Commercial Lending valuation, Hard Money in the News, Housing Price Trends / Information, Private Lending, Property Valuation

President Donald Trump said he expected Jerome Powell to be a cheap-money Fed chairman and lamented to wealthy Republican donors at a Hamptons fundraiser on Friday that his nominee instead had raised interest rates, according to people present. This is his most...

by Glen | Aug 21, 2018 | Commercial Lending valuation, Housing Price Trends / Information, private lender, Private Lending, Property Valuation

Less relocation impacts real estate investments. About 3.5 million workers relocated for a new job last year, a 10% drop from 3.8 million in 2015. The current relocation rate of 10 percent is 72 percent lower than in the mid-to-late 1980s. The average annual...

by Glen | Jun 25, 2018 | Atlanta Hard Money, Colorado Hard Money, commercial hard money, Commercial Lending in the news, Commercial Lending Lawsuits, Commercial Lending valuation, Hard Money Commercial Lending, Housing Price Trends / Information

The markets tanked losing almost 2% with some companies down almost 10% due to the selloff. What caused the selloff? What does this mean for real estate? What should you do? Is it time to panic? What is the silver lining? What happened? The markets has in the...

by Glen | Jun 14, 2018 | Commercial Lending in the news, Commercial Lending valuation, Housing Price Trends / Information, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation

The economy is in for a bit of a ride! The federal reserve in their last meeting changed their tone signaling two more rate increases this year as opposed to one bringing the total rate increase to four. Why is this change in tone important? What does this have to...

by Glen | Jun 6, 2018 | Commercial Lending in the news, Commercial Lending valuation, Denver Hard Money, Hard Money Commercial Lending, Hard Money in the News, Hard Money Lending, Housing Price Trends / Information, Private Lending, Property Valuation, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation, Small Balance Commercial Lending

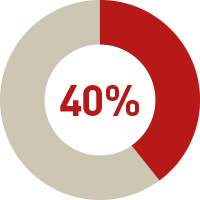

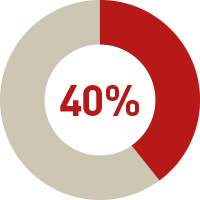

The Federal reserve in their recent Report on Economic Well being made two very concerning discoveries: 1) 40% of all adults if faced with an unexpected expense of $400 would not be able to cover it 2) 25% of all adults are not able to pay all of their current...