by Glen | May 21, 2018 | commercial hard money, Commercial Lending in the news, Commercial Lending valuation, Housing Price Trends / Information

No I’m not crazy and I don’t subscribe to conspiracy theories. But, as we speak the value of your commercial real estate is being “changed” by the federal government. This is not a joke; the federal government is making your real estate value decrease. How is this...

by Glen | Mar 21, 2018 | commercial hard money, Commercial Lending in the news, Uncategorized

Last week an Uber driverless/ autonomous car struck and killed a pedestrian. This is the first fatality from a fully autonomous vehicle that was using sensors and artificial intelligence to drive itself. Why is this incident so important? How does this...

by Glen | Feb 18, 2018 | Commercial Lending in the news, Commercial Lending valuation, Hard Money Commercial Lending

Reagonomics, Clintonomics, Obamanomics, Bushonomics (1 and 2), Trumponomics, and the new Moronomics which has been embraced by both political parties. It seems like every party has their own economics plan whether is it trickle down or trickle up; economists...

by Glen | Jan 10, 2018 | Commercial Lending in the news

A year ago, most of the world had never heard of bitcoin or cryptocurrency. All of the sudden bitcoin and other cryptocurrencies are the new rage stealing the headlines. What does this mean for real estate? Should buyer/sellers/lenders/loan servicers utilize this...

by Glen | Nov 26, 2017 | commercial hard money, Commercial Lending in the news, Housing Price Trends / Information

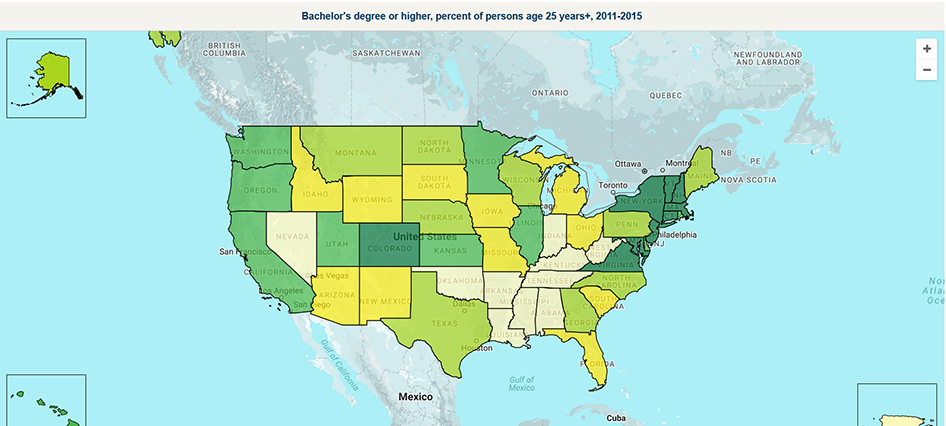

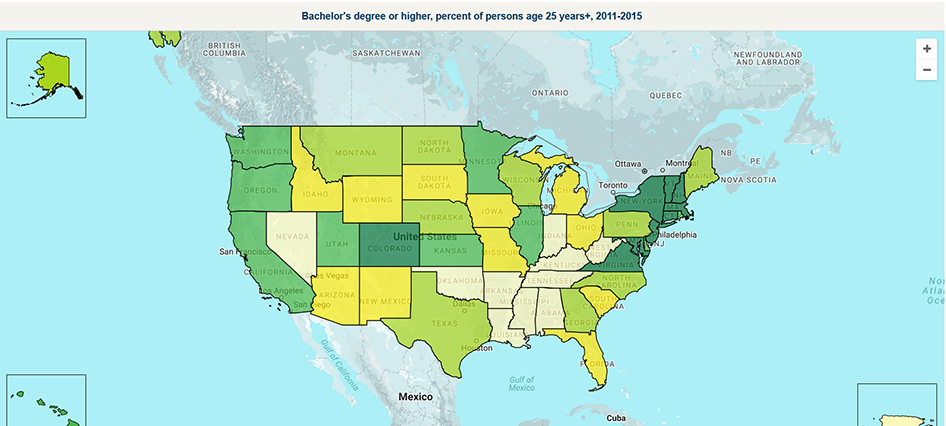

The map above is the most important picture for Real Estate Profitability. What does it signify? What do the dark green areas mean? A recent article in the Wall Street Journal stated 19 million jobs will be eliminated in the next 15 years, but 21 million new jobs...

by Glen | Nov 2, 2017 | Commercial Lending in the news

The new republican tax plan came out today. This could have sweeping consequences for the entire real estate industry. Mark Zandi, chief economist at Moody’s Analytics, said the tax changes could initially cut prices by 10 percent in expensive markets and 3 percent...