by Glen | May 8, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Biden tax plan, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, credit scoring, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending, interest rates, mortgage rates

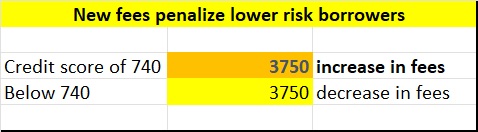

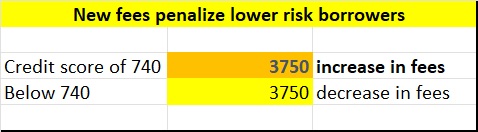

No this is not a joke, I had to read the recent Fannie Mae press release multiple times to actually believe what I was reading. Who would have ever thought that someone with a high credit score above 740 would be penalized for having a high score. Under a new rule...

by Glen | Mar 27, 2023 | Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, if there is a recession what happens to real estate, interest rates, mortgage rates

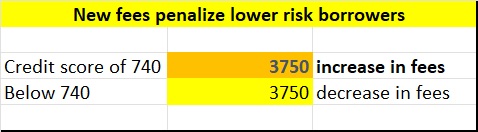

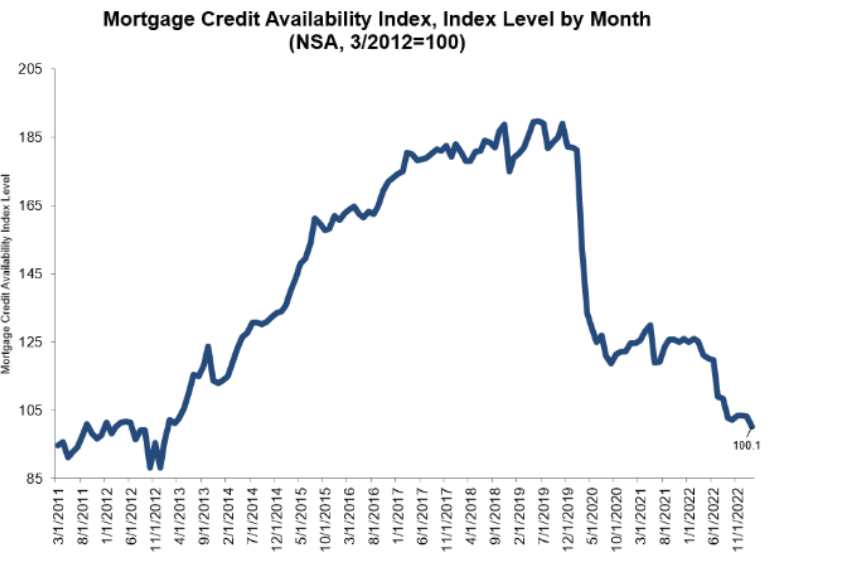

As a private lender, my call volume and closings the first quarter have been off the charts as borrowers fall out of more conventional products. This trend is now playing out with the Mortgage Credit Availability Index showing substantial tightening of credit for all...

by Glen | Feb 27, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, commercial hard money, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, Private Lending, real estate investing, real estate taxes, Real Estate Trends, Real estate Valuation, recession impact on real estate, Residential hard money

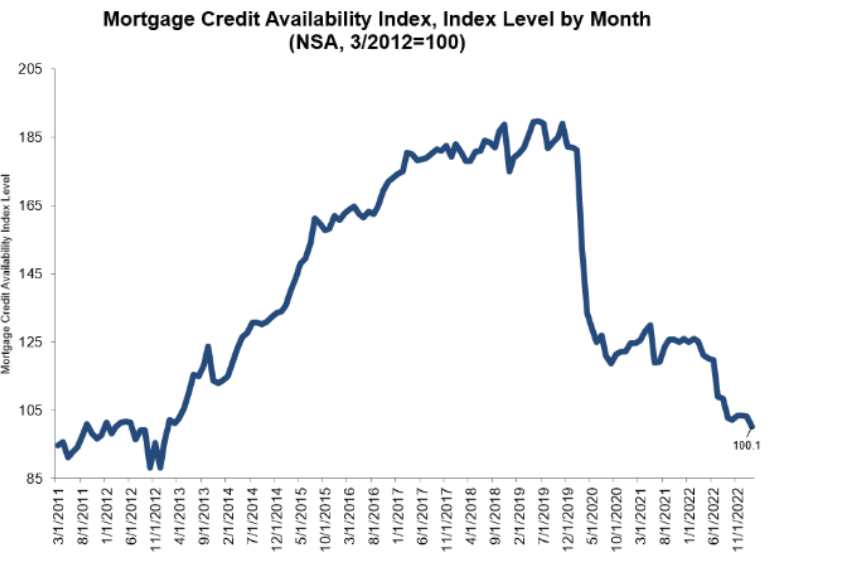

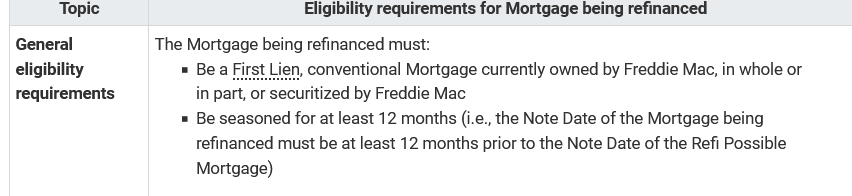

Beginning in March of 2023, Freddie Mac, the largest buyer of mortgages is drastically changing the seasoning requirements for any loans it purchases which basically means any new conventional conforming loan will have to follow the new rules. What big changes are...

by Glen | Feb 6, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Colorado Hard Money, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Georgia hard money, Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates

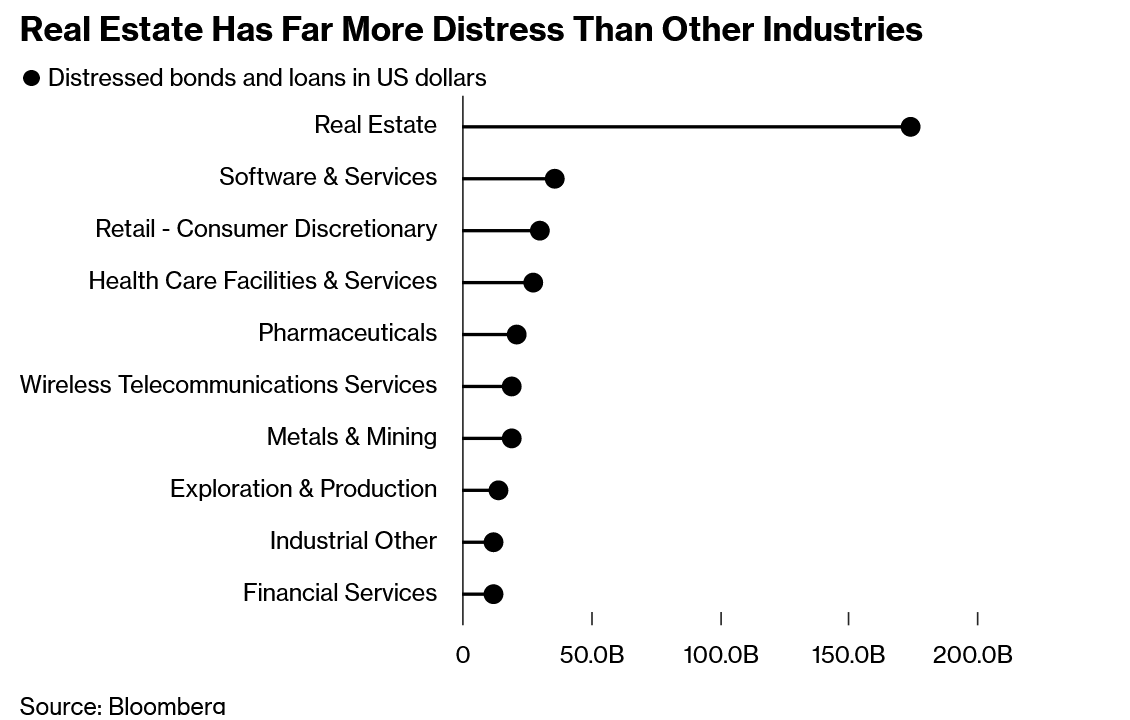

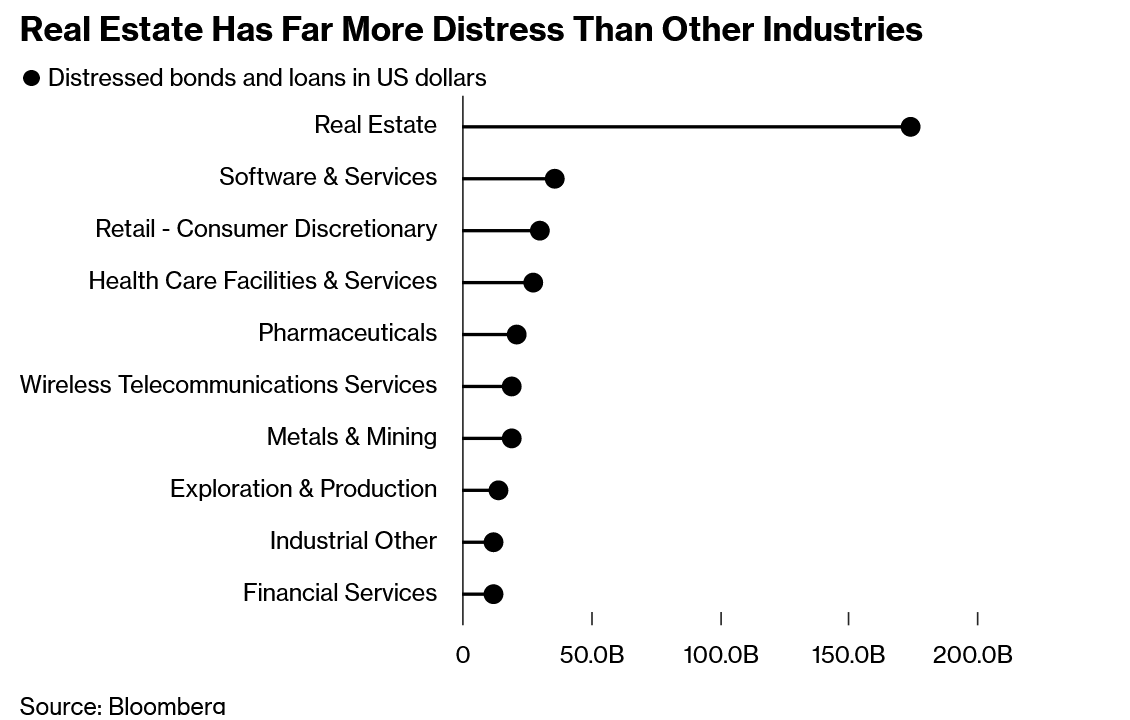

I rarely say that Covid caused radical changes in behavior but the commercial property sector is bucking this trend. This is not because of return to office or lack thereof, but leverage and the central bank. In every cycle in recent memory as the economy started to...

by Glen | Jan 16, 2023 | Colorado private lender, Colorado ski lending, Colorado ski real estate, commercial hard money, Georgia hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, nightly rental real estate

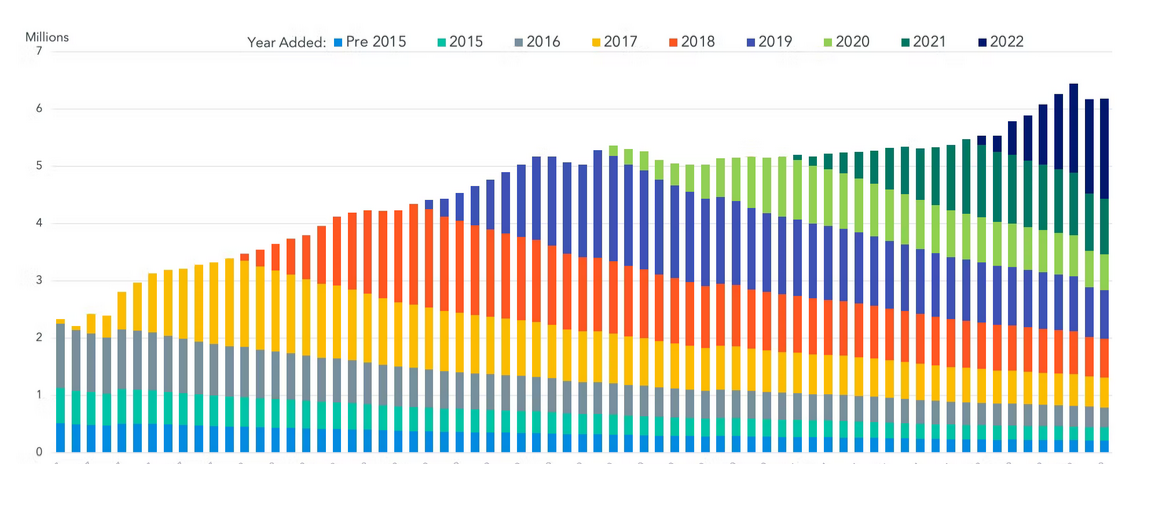

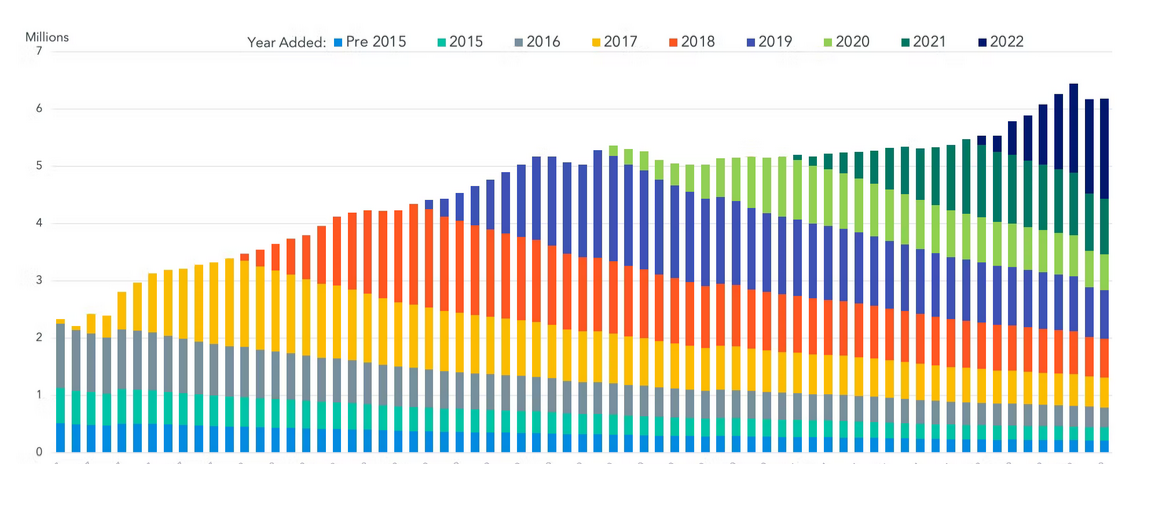

Data from AirDNA, a short-term rental analytics firm, show as of October 2022, the number of future nights booked—a real-time indicator of the health of the short-term rental industry—was up 15.8% year-over-year. At the same time, anyone in the short-term rental...

by Glen | Nov 7, 2022 | 2023 real estate prediction, Colorado Hard Money, commercial hard money, Real Estate economic trends, Residential hard money, Underwriting/Valuation, what does this real estate recession look like

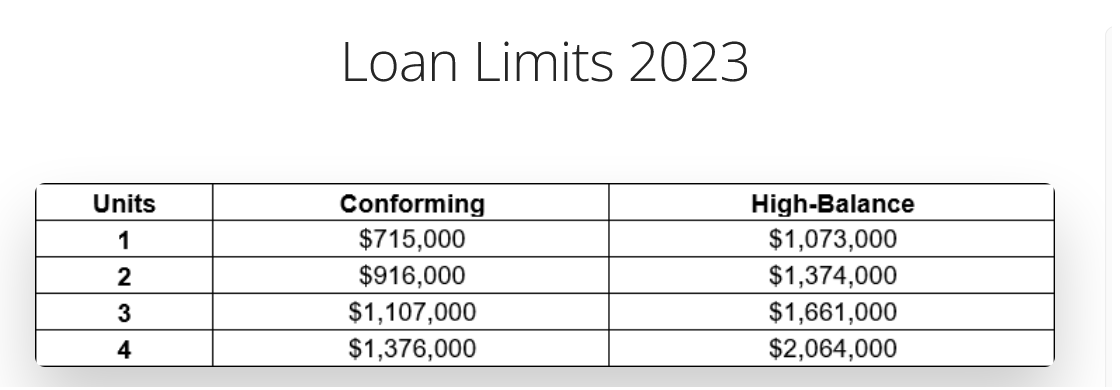

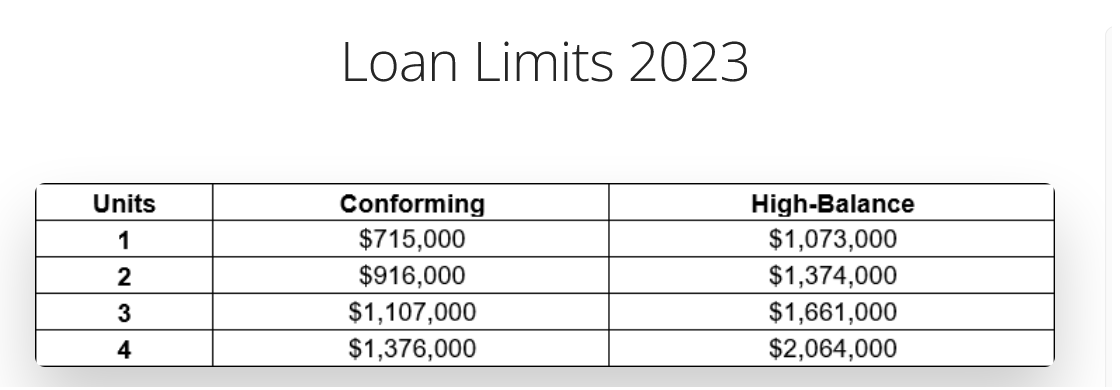

The federal government is about to back mortgages over one million for the first time. The maximum size of home-mortgage loans eligible for backing by Fannie Mae and Freddie Mac is expected to jump sharply in 2023, a reflection of the rapid appreciation in home prices...