by Glen | Dec 4, 2023 | Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, Commercial Loan Servicing, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money

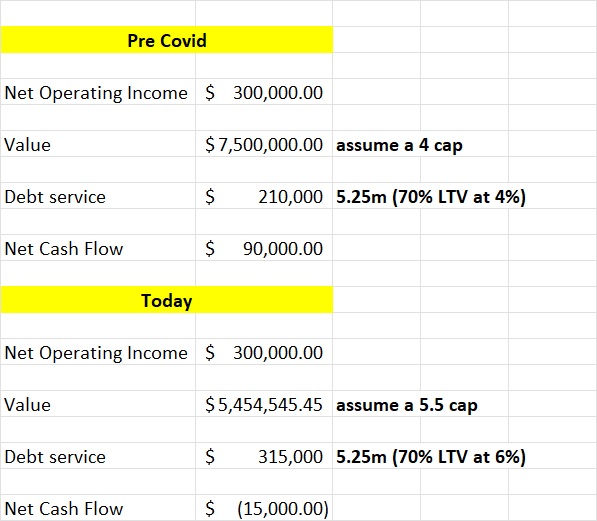

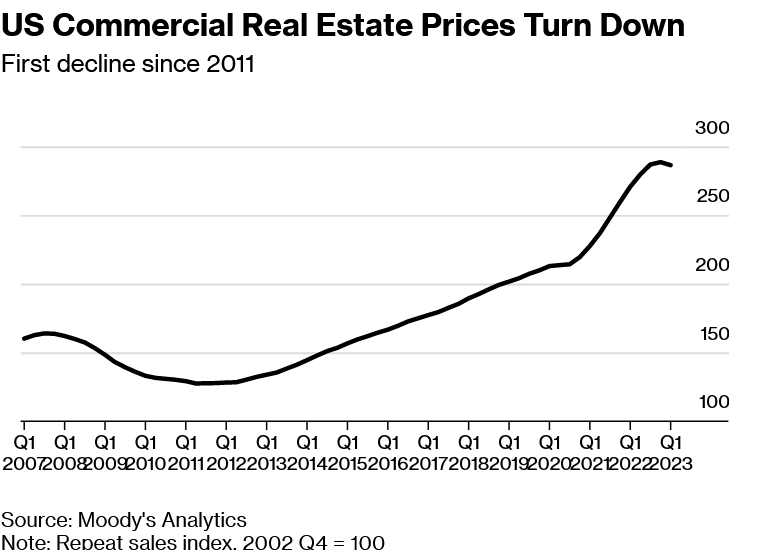

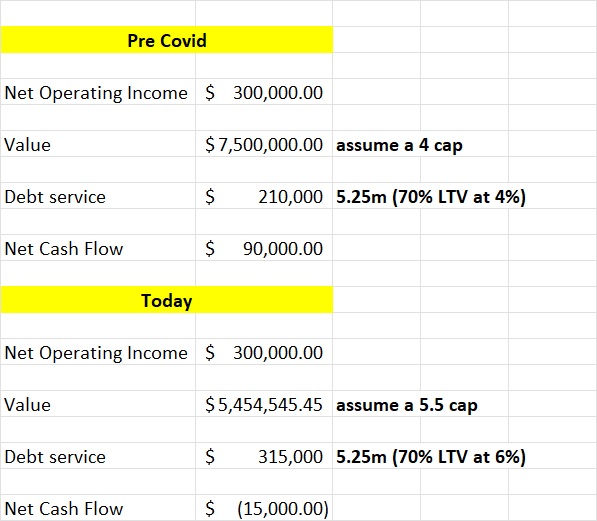

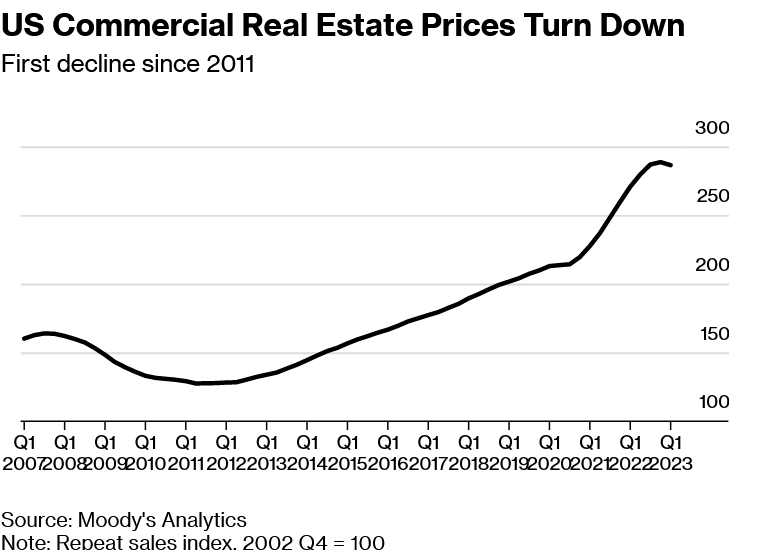

US commercial real estate prices have fallen this year for the first time in more than a decade, according to Moody’s Analytics, heightening the risk of more financial stress in the banking industry. What property types are declining? (hint not just office...

by Glen | Aug 21, 2023 | 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, interest rates, mortgage rates

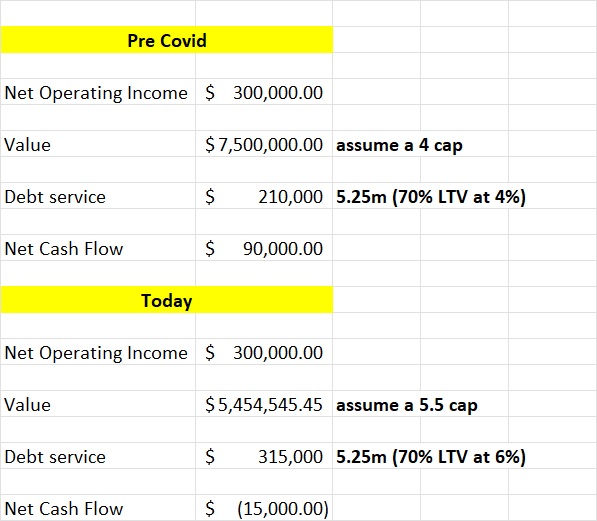

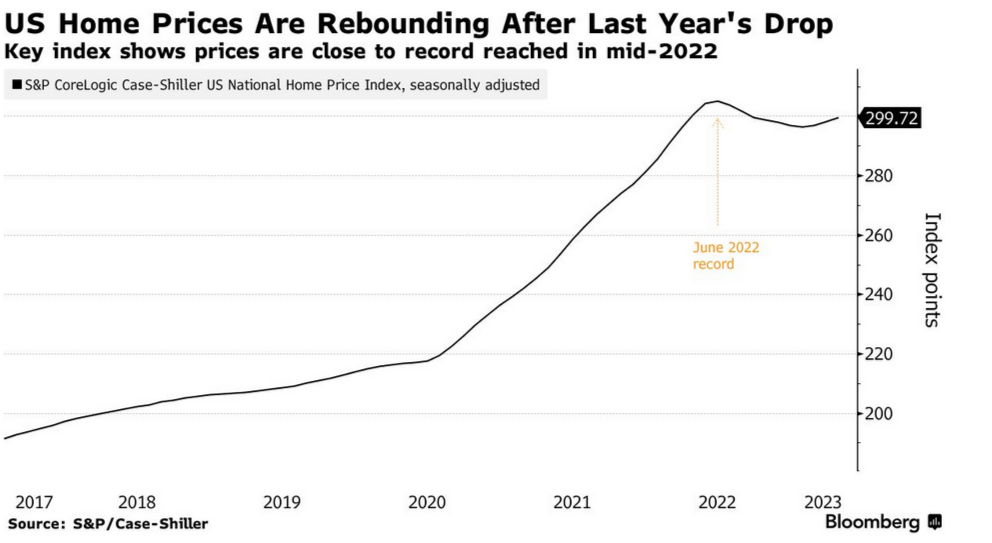

Like most, I have been surprised at the recent upward movement in prices. Did we just experience the shortest housing cycle ever? Are housing prices going to continue their recent upward swing? Why are housing prices now moving higher after a very shallow decline...

by Glen | Jul 24, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, Housing Price Trends / Information, interest rates, mortgage rates

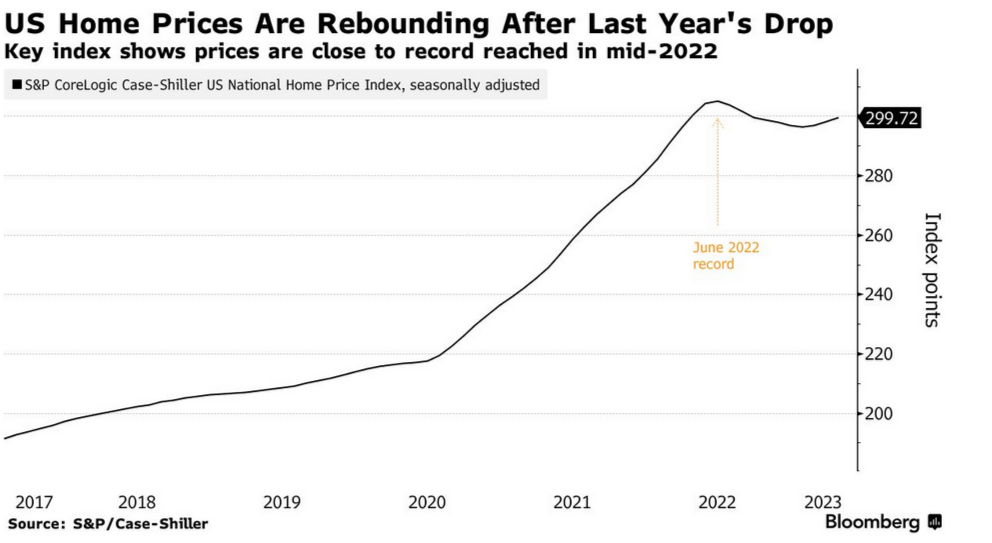

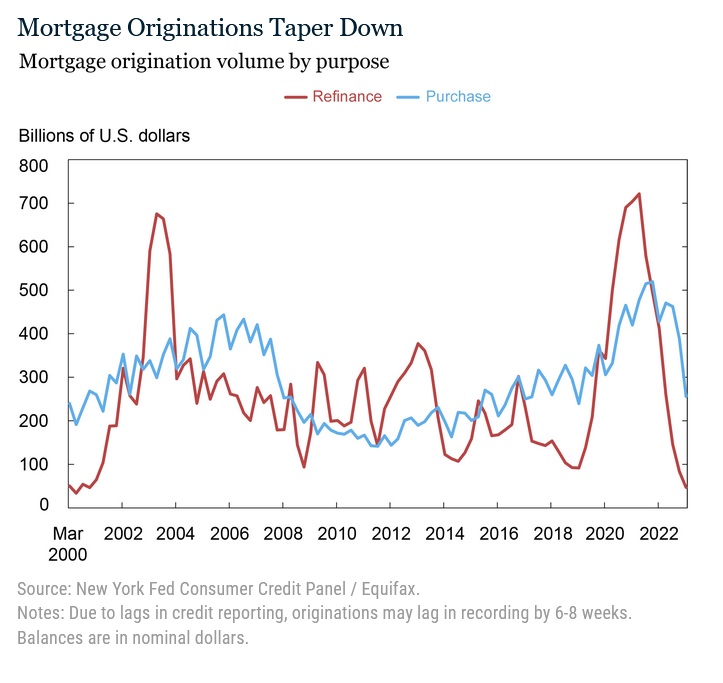

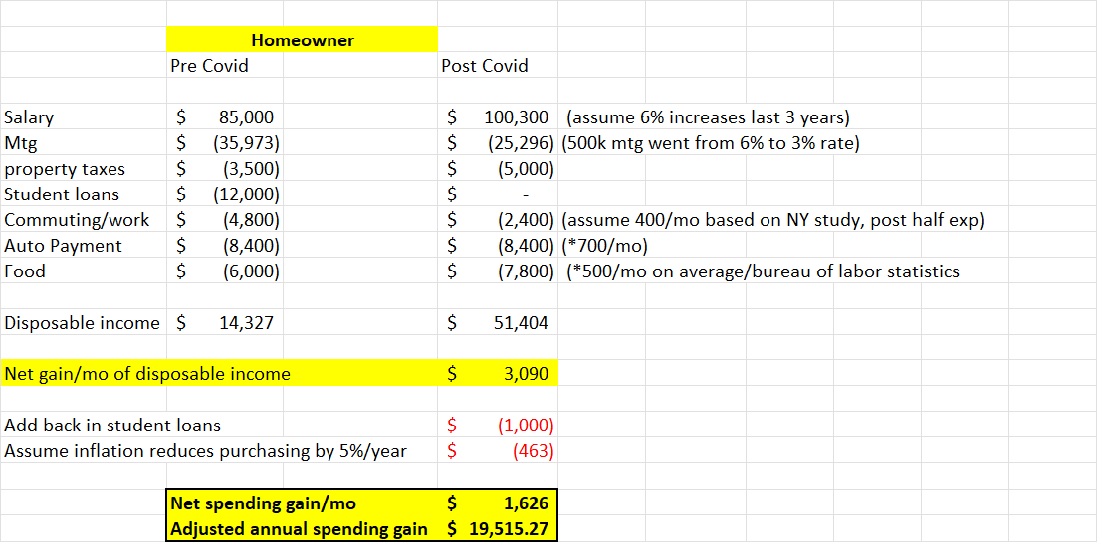

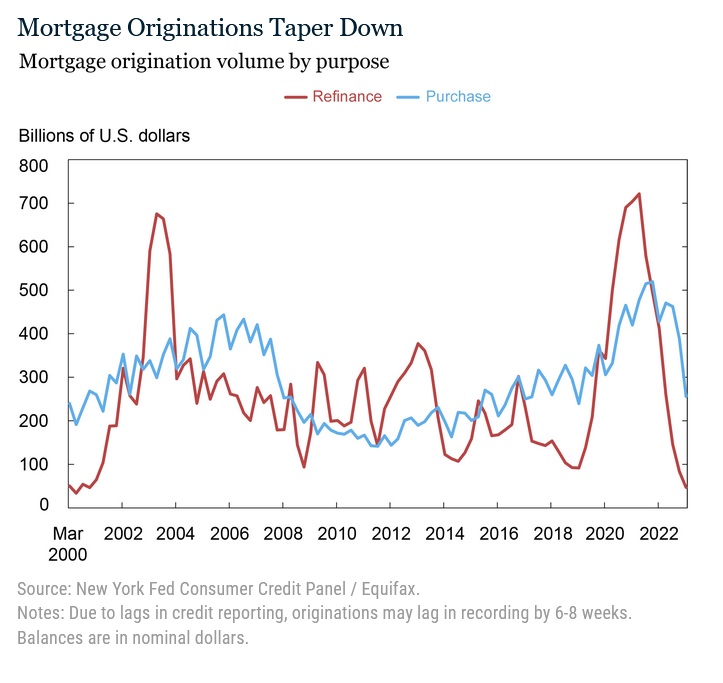

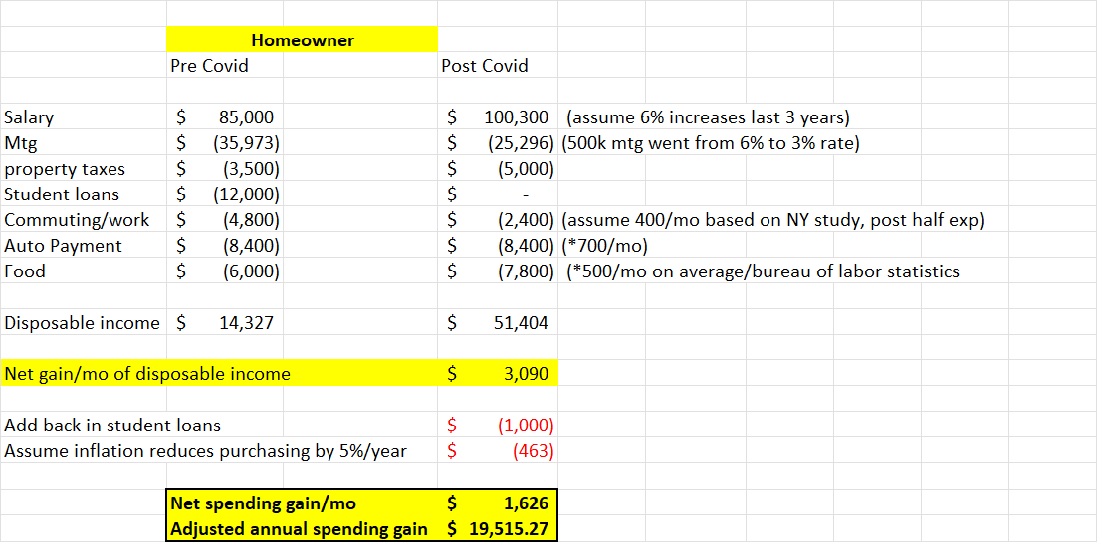

According to a recent Federal Reserve Report, fourteen million mortgages were refinanced during the COVID refinance boom, and these refinances will have effects on the mortgage market, real estate, and the general economy for years to come. An astonishing 430 billion...

by Glen | Jun 19, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, hard money, Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

Interesting times we are in. Consumers keep spending big on services like travel and eating out, but on the flip side Home Depot just reported its first drop since the pandemic. On the other hand Target tops earnings estimates. What is driving the continued...

by Glen | Jun 12, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Lending

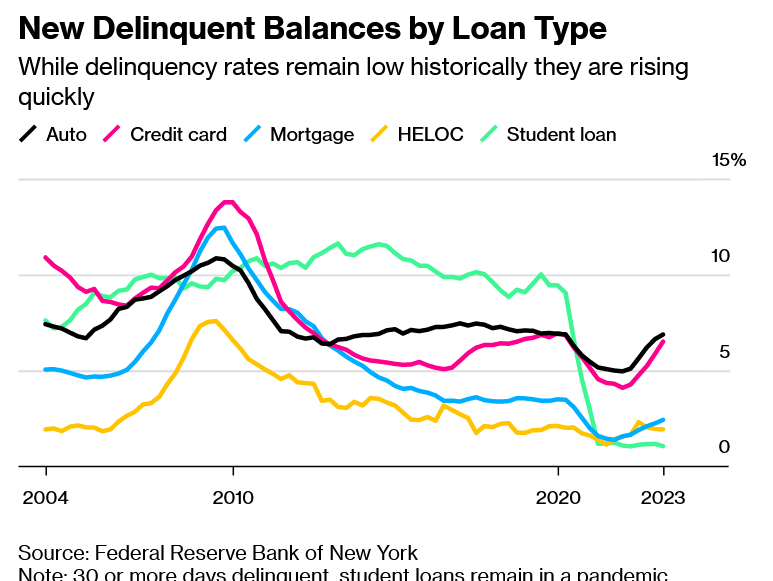

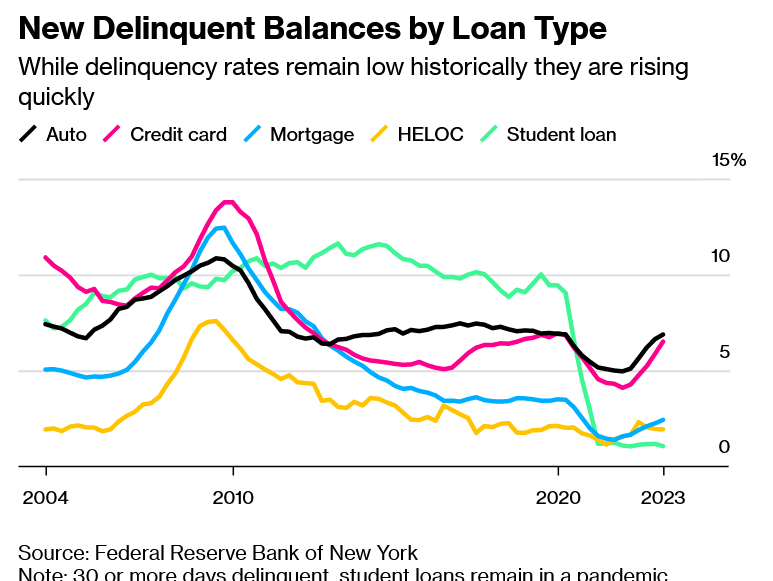

Households added $148 billion in overall debt, bringing the total to $17.05 trillion, according to a report released by the Federal Reserve Bank of New York on Monday. Balances are now $2.9 trillion higher than just before the pandemic. What categories are...

by Glen | Jun 5, 2023 | 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending

US commercial real estate prices fell in the first quarter for the first time in more than a decade, according to Moody’s Analytics, heightening the risk of more financial stress in the banking industry. What property types are declining? (hint not just office...