by Glen | Jul 24, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, Housing Price Trends / Information, interest rates, mortgage rates

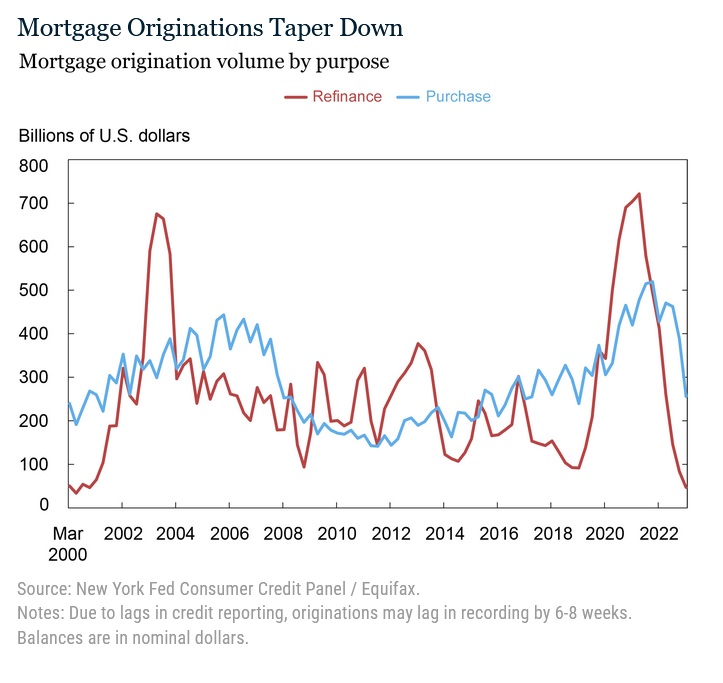

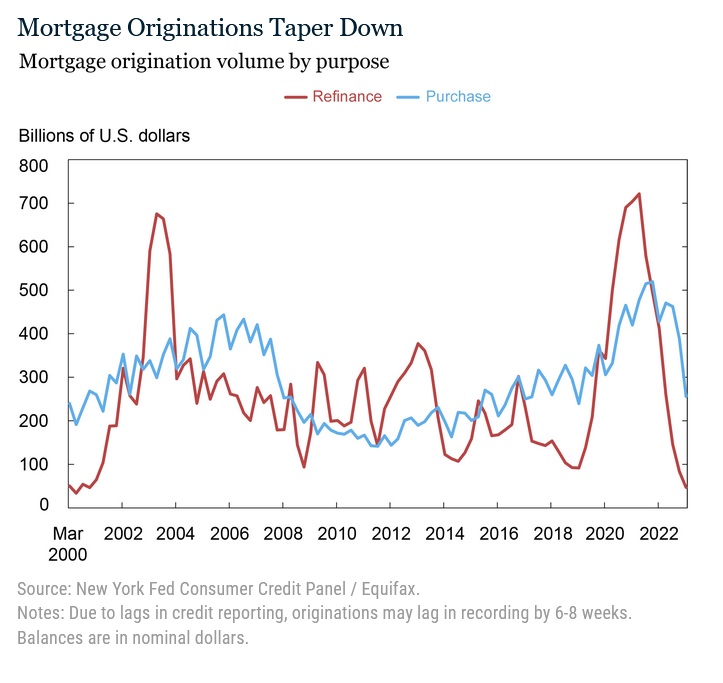

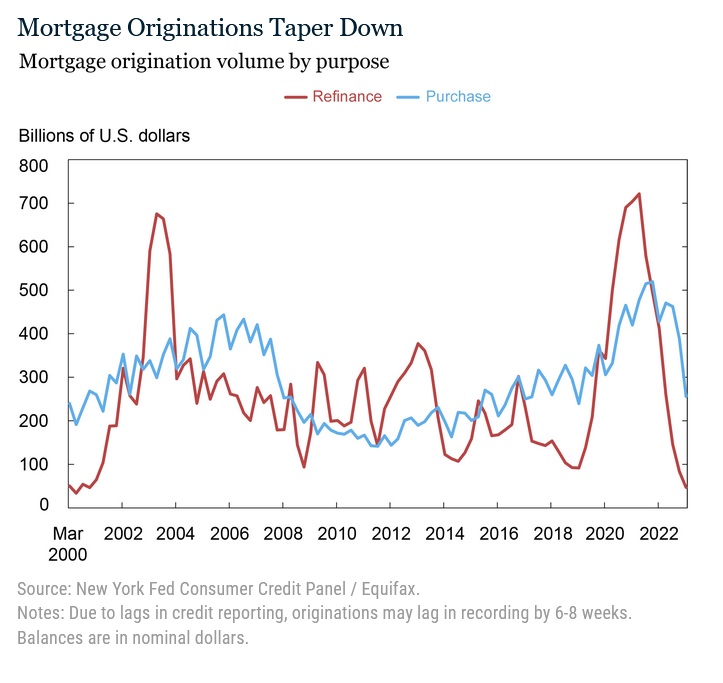

According to a recent Federal Reserve Report, fourteen million mortgages were refinanced during the COVID refinance boom, and these refinances will have effects on the mortgage market, real estate, and the general economy for years to come. An astonishing 430 billion...

by Glen | May 29, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending

A lot has changed since my year end update, four major banks have collapsed, and the market is now signaling a recession with interest rates beginning to fall. What does this mean for real estate in the second half of the year? Are there any big changes to my...

by Glen | Mar 6, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation, Realtor, recession, recession impact on real estate

In only a couple of months, the world has changed substantially. In December, inflation was supposedly decreasing rapidly and the odds of a soft landing were non existent. Fast forward a few months and inflation is running hot, consumers are spending like crazy,...

by Glen | Feb 27, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, commercial hard money, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, Private Lending, real estate investing, real estate taxes, Real Estate Trends, Real estate Valuation, recession impact on real estate, Residential hard money

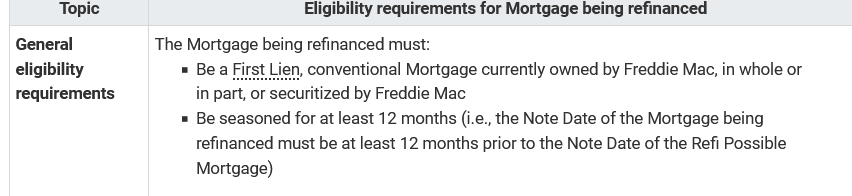

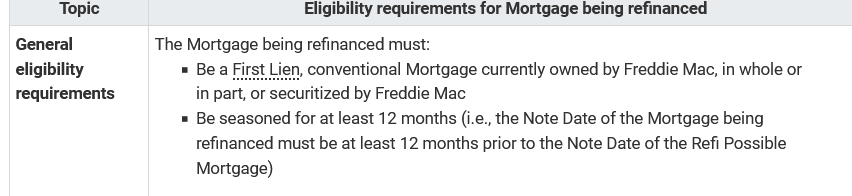

Beginning in March of 2023, Freddie Mac, the largest buyer of mortgages is drastically changing the seasoning requirements for any loans it purchases which basically means any new conventional conforming loan will have to follow the new rules. What big changes are...

by Glen | Feb 20, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks

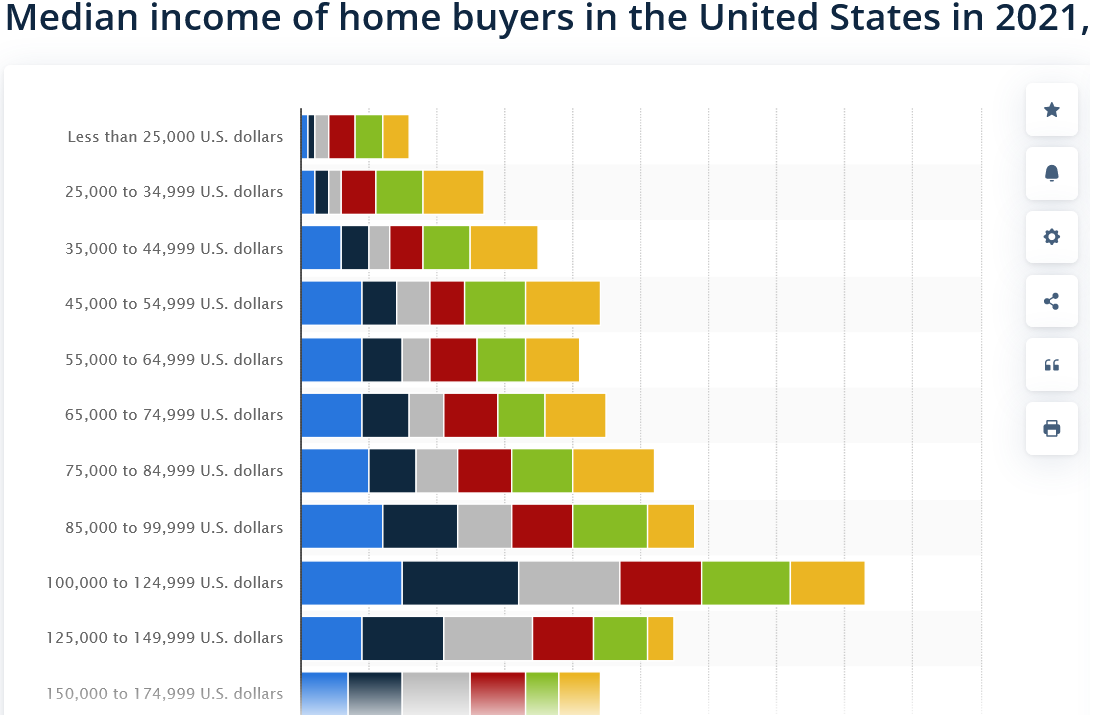

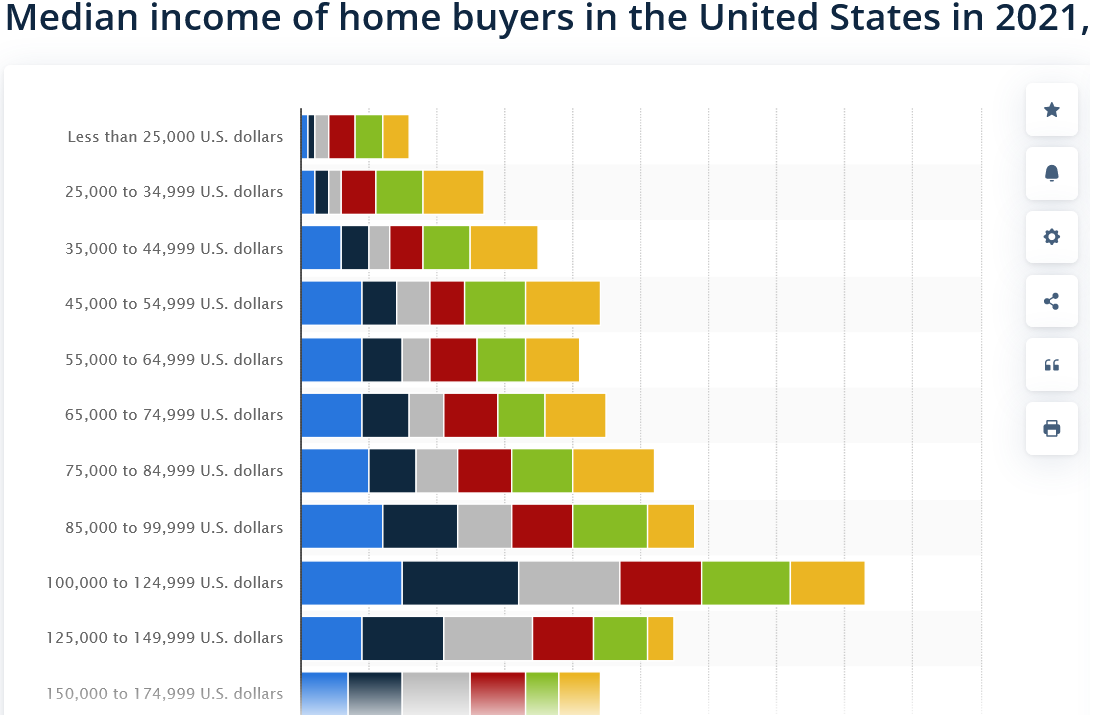

Purchasing power from paychecks fell 2.9% for middle-income households in 2022 compared with 2021, while rising 1.5% for the bottom fifth of households and 1.1% for the top, according to the Congressional Budget Office study. Furthermore, nearly 40 percent of...

by Glen | Feb 13, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates

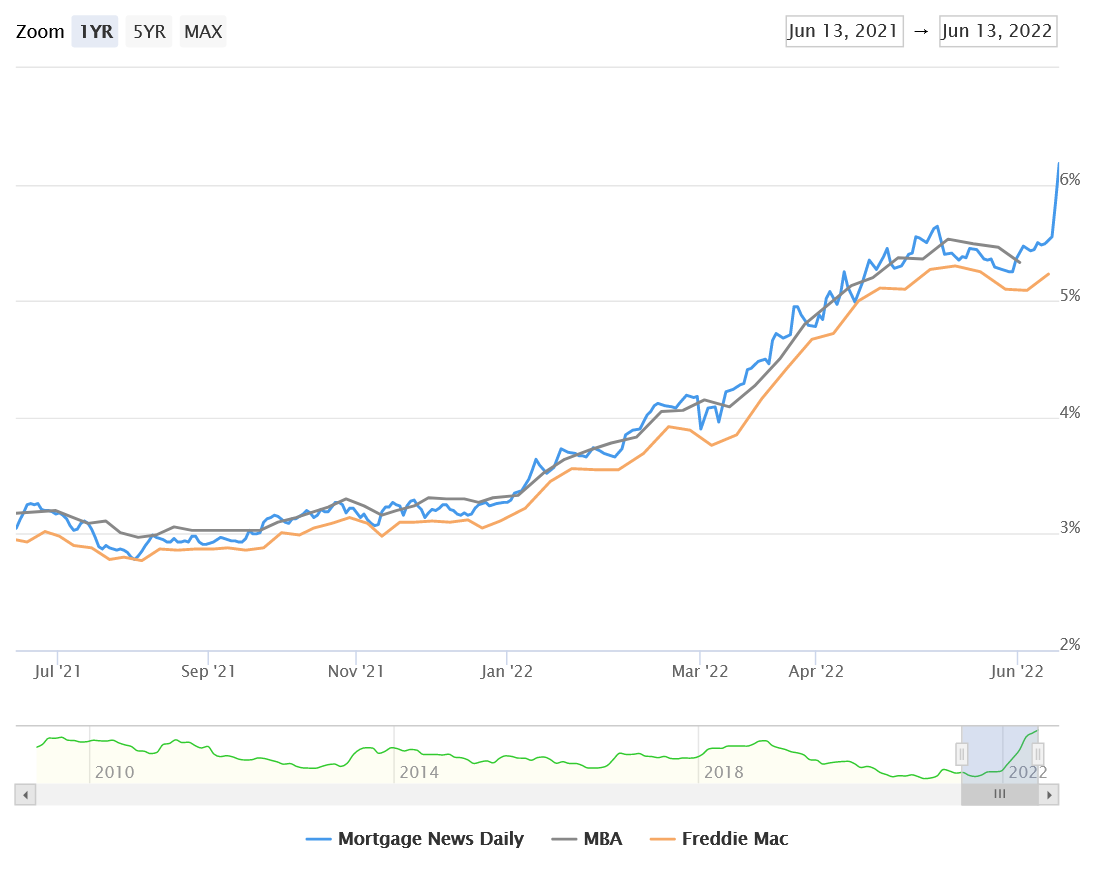

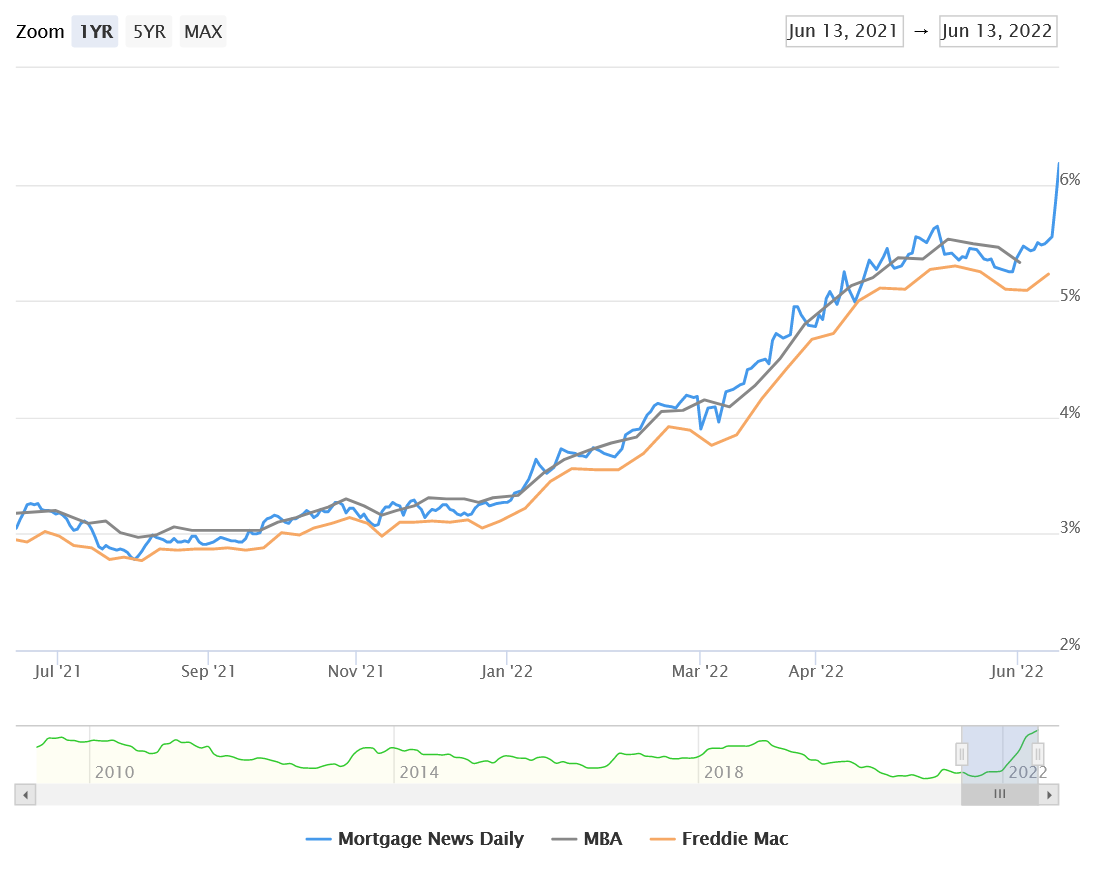

The market currently has a fixation on interest rates. Essentially whatever interest rates do the market reacts accordingly. For example if rates rise, sales fall and vice versa. Are rates really the driver of the slow down in real estate sales? If rates...