by Glen | Jan 13, 2025 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Brokering Loans to Fairview, Closing, CO hard money, Colorado Hard Money, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, Georgia hard money, nightly rental real estate, Process/Loan Submittal, Program Details, Questions Regarding Fairview, Realtor, Underwriting/Valuation

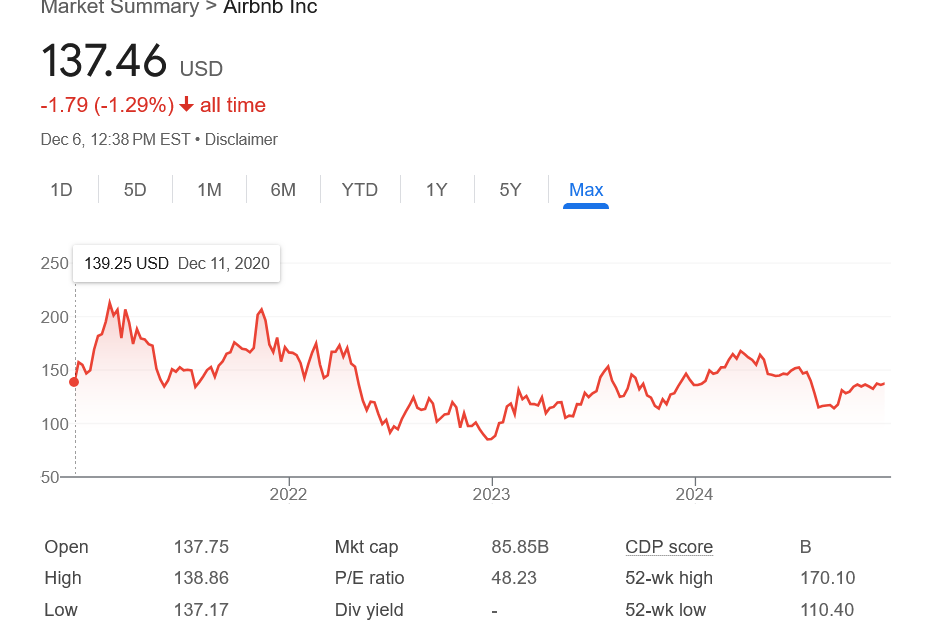

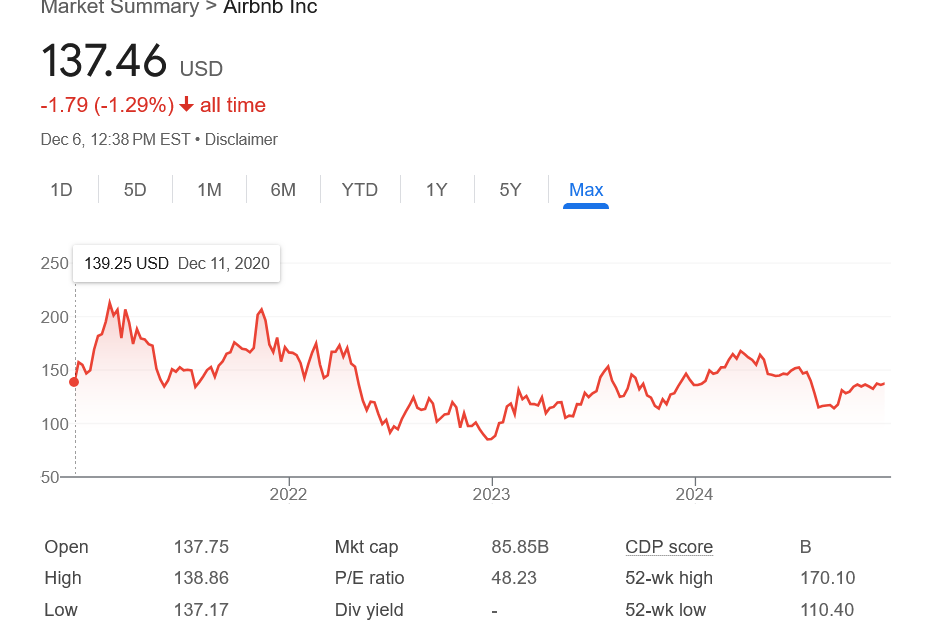

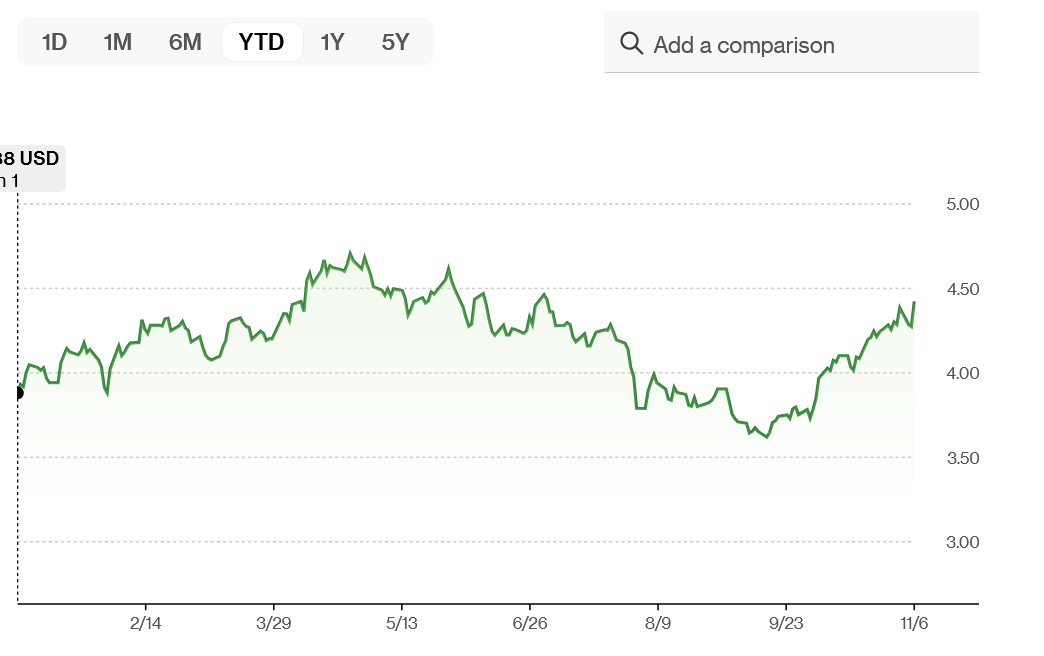

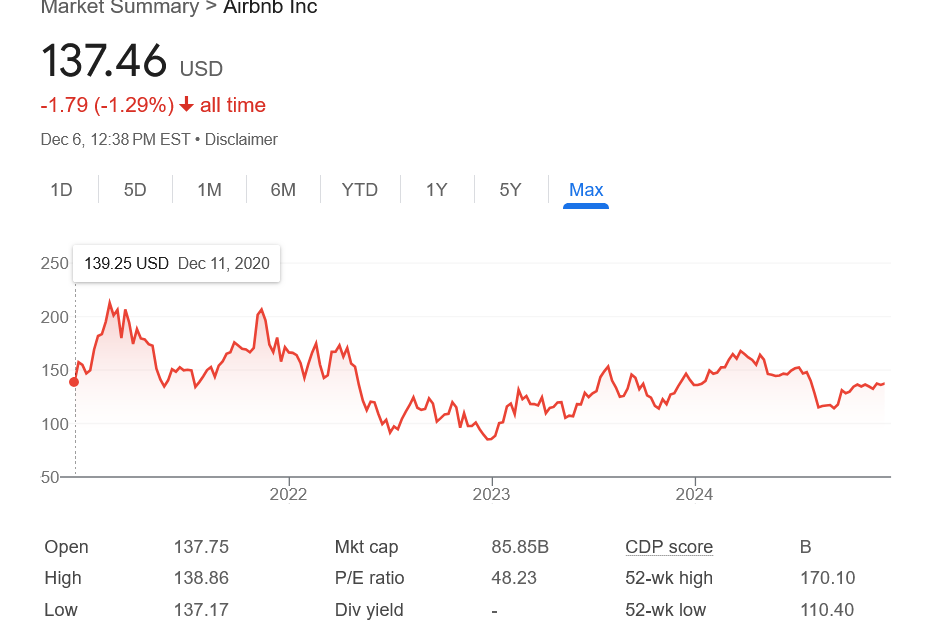

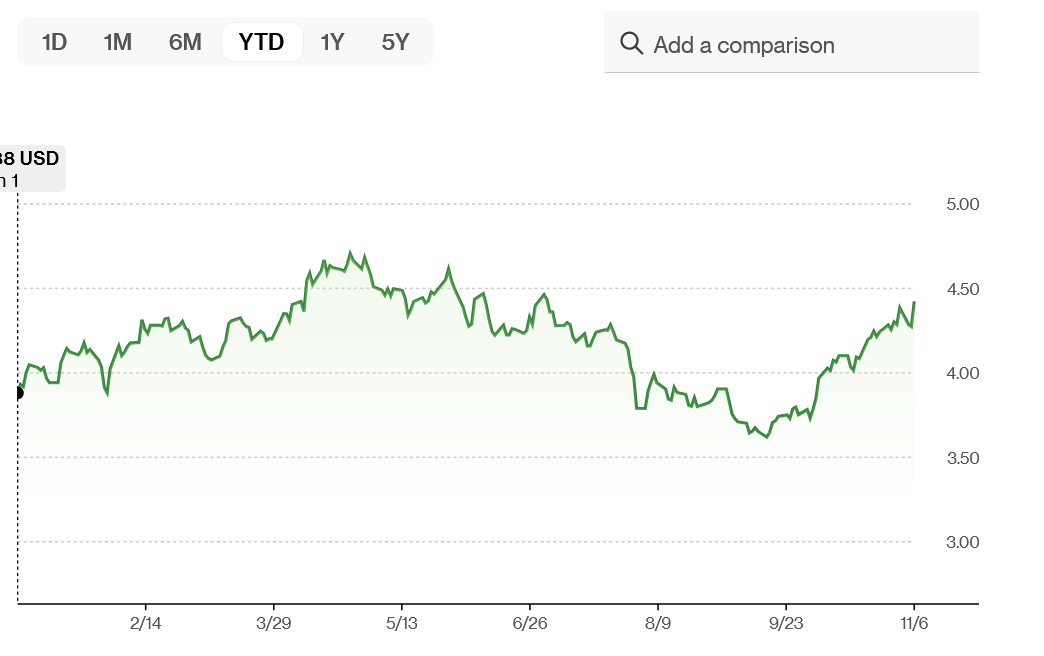

After peaking around 215 dollars, Airbnb stock has taken a tumble of almost 40%. At the same time occupancy of nightly rentals has plummeted from its peak while available listings continue to grow. What does this mean for real estate prices? The two...

by Glen | Nov 8, 2024 | 2024 election impact on real estate, 2024 election real estate impacts, 2024 mortgage rates, 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Lending, hard money loans

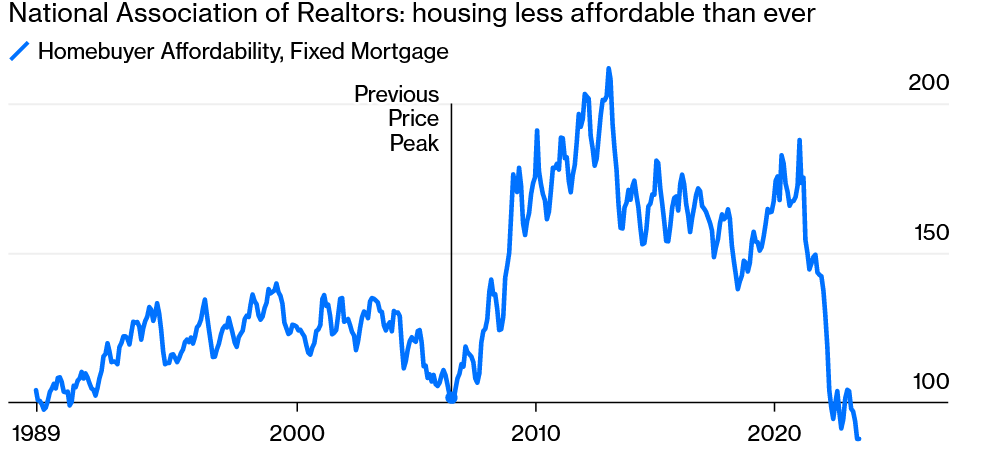

Regardless of how you voted, at the end of the day for real estate in particular, does the election of President Trump radically change the trajectory of real estate? What happens to real estate volumes? Will interest rates rise or fall? What happens to values? Why...

by Glen | Apr 22, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money

The big premise of the commission lawsuit against the national association of realtors is that high commission fees were one of the leading drivers of real estate prices. How true is this statement? Will the new commission structure for realtors lead to a reduction...

by Glen | Feb 19, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Commercial Lending valuation, Commercial Loan Servicing, commercial property trends, Consumer price index and inflation, Denver Hard Money, Denver private Lending, Hard Money Commercial Lending, Hard Money Lending, hard money loans

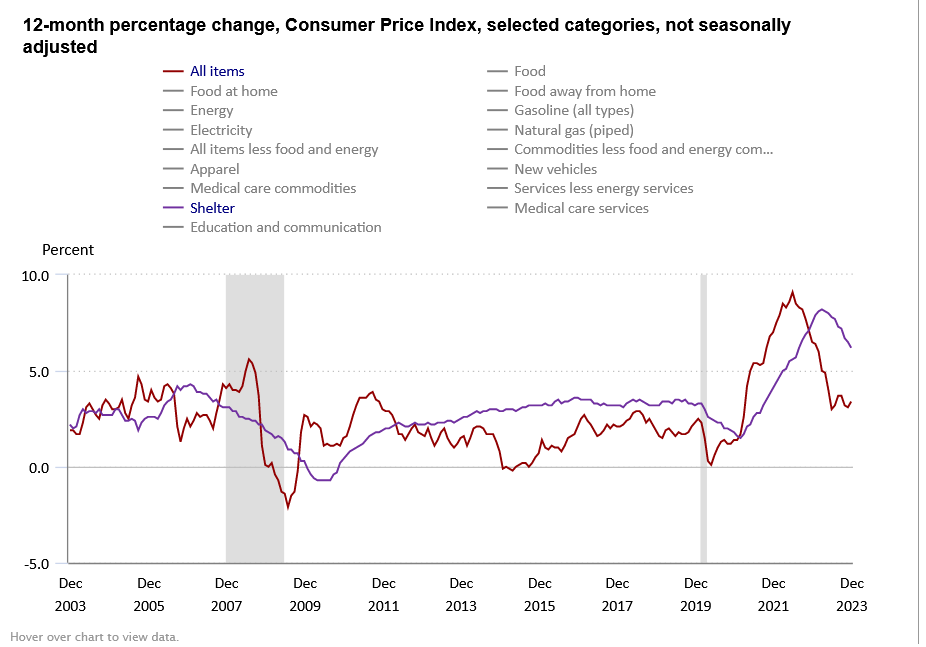

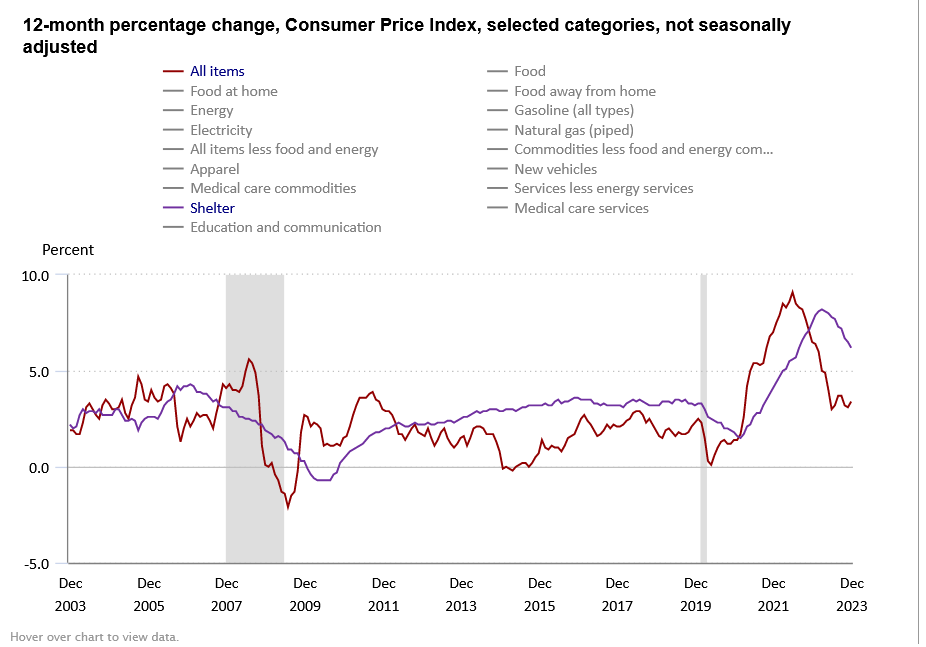

We have heard a ton of good news recently regarding inflation. Inflation has come down dramatically from its peak and the market is pricing in almost a 100% probability of an elusive soft landing. Is inflation really coming down as fast as the consumer price index...

by Glen | Dec 18, 2023 | 2023 real estate predictions, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, Georgia hard money, private lender, Private Lending

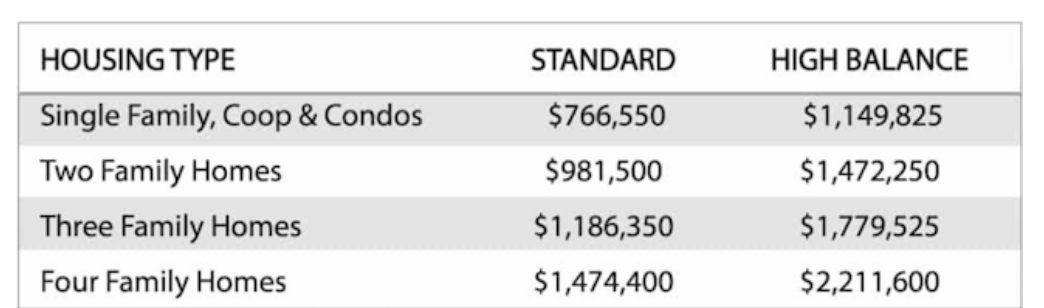

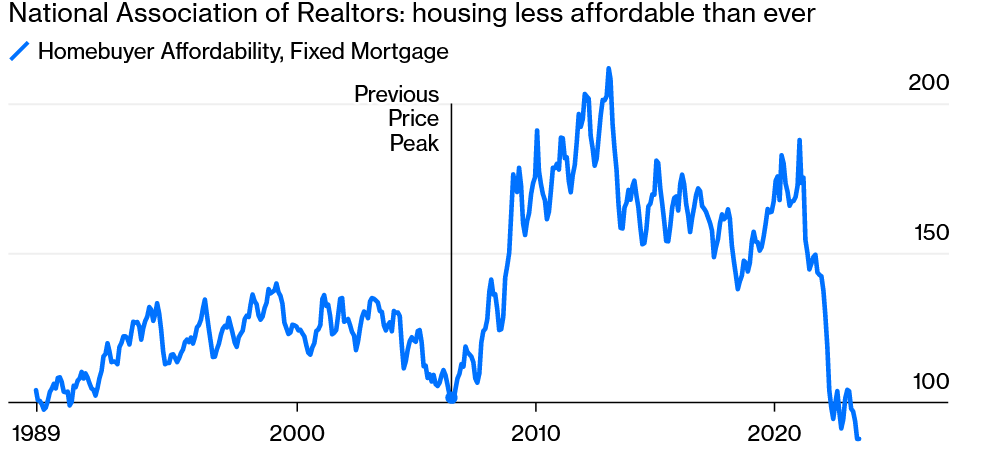

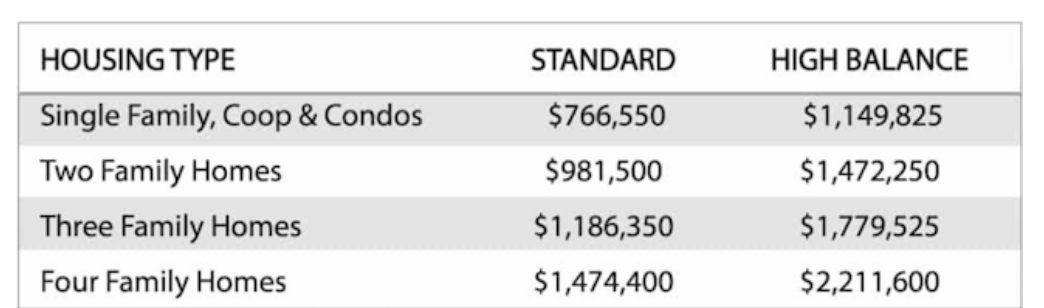

What do the increased conforming loan limits mean for real estate? The federal government (aka you the taxpayer) now backs mortgages up to 1.15m. The maximum size of home-mortgage loans eligible for backing by Fannie Mae and Freddie Mac has jumped sharply over the...

by Glen | Aug 14, 2023 | 2023 real estate prediction, 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Hard Money Lending, interest rates, mortgage rates

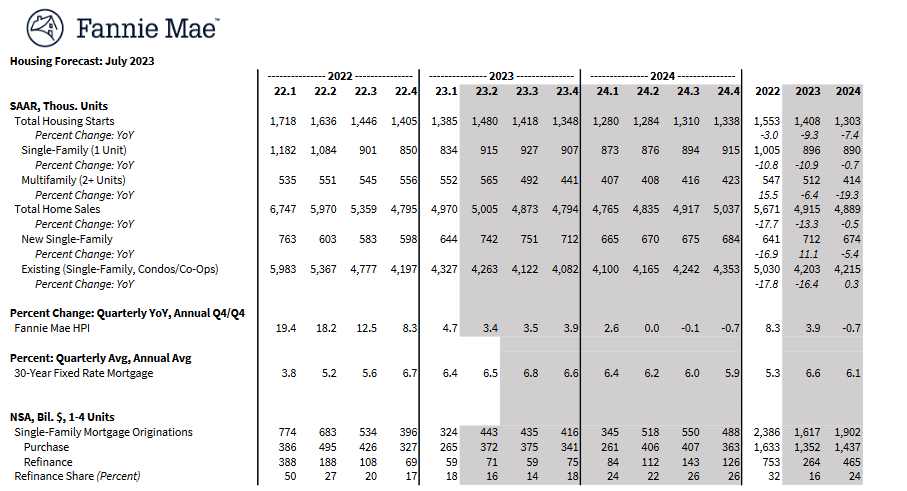

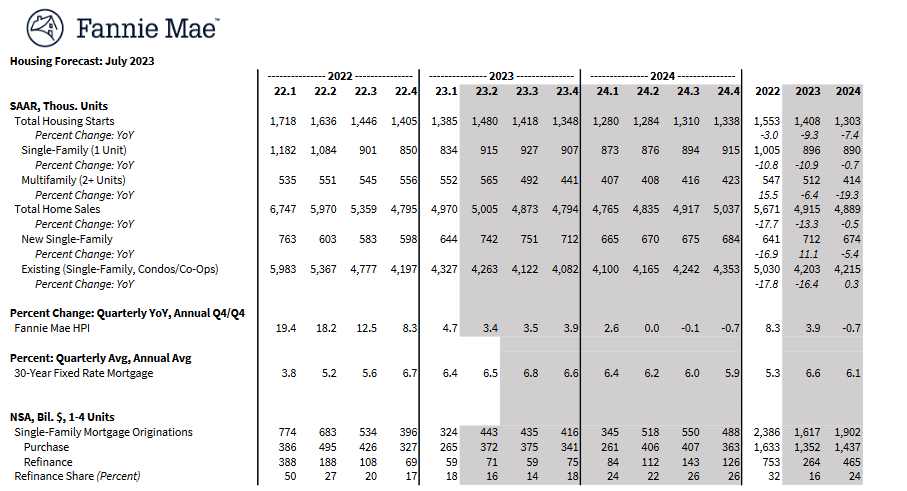

Both the stock and bond markets are partying like its 99 again. Fannie Mae, the largest buyer of US mortgages, is not buying into the theory that a soft landing is the base case for the economy. What is Fannie Mae predicting for inflation and in turn interest rates? ...