by Glen | Apr 14, 2025 | 2025 mortgage rates, 2025 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, Georgia hard money, Government Bailout, hard money, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, private lender, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, recession, recession impact on real estate

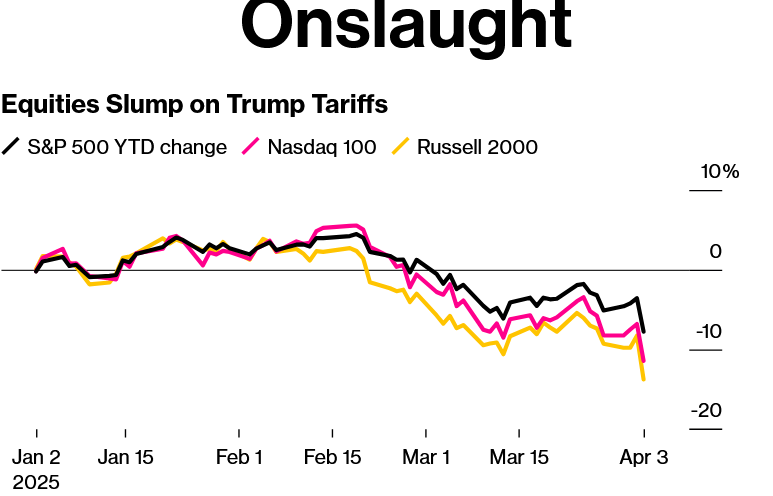

Are the bulls running or are the bears coming? Any business media you pick up is harping on the idea of a “recession watch” and the economy is basically coming to an end! On the flip side my proprietary lending data is giving me a radically different answer. What...

by Glen | Apr 7, 2025 | Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, Denver Hard Money, Georgia hard money, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Realtor, Residential hard money

For years, myself, and many others have thought that interest rates were the predictor of housing prices. Fast forward to post COVID where interest rates have doubled and yet housing prices remain high and are still trending higher in many markets. What other...

by Glen | Mar 31, 2025 | 2025 mortgage rates, 2025 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, General real estate financing information, Georgia hard money, hard money, Tariff impact on Real Estate

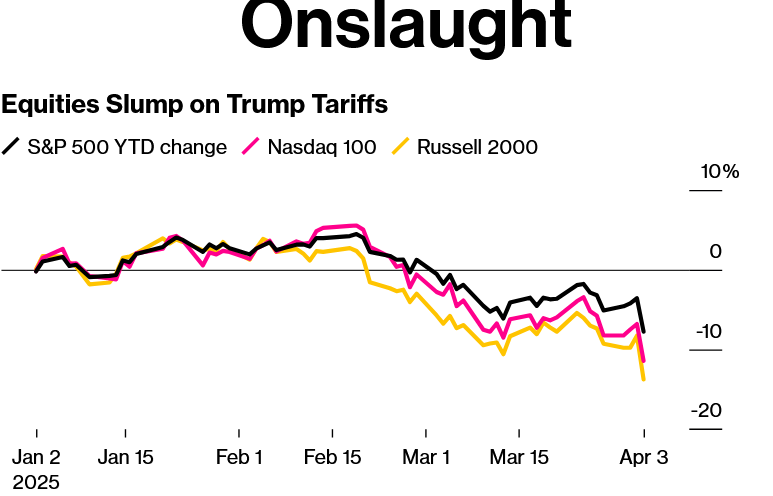

70% of lumber and 30% of drywall comes from Canada which could be subject to tariffs, what does this mean for the average build cost of a house? What does the chart above have to do with Tariffs? Will tariffs meaningfully impact real estate build costs and...

by Glen | Mar 24, 2025 | 2025 mortgage rates, 2025 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates

In almost every real estate advertisement I receive, there is a common theme that prospective buyers should not focus on the rate as they will be able to refinance relatively soon at a much lower rate. How true is this theory? (hint anyone who bought into...

by Glen | Mar 17, 2025 | 2025 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, interest rates, mortgage rates

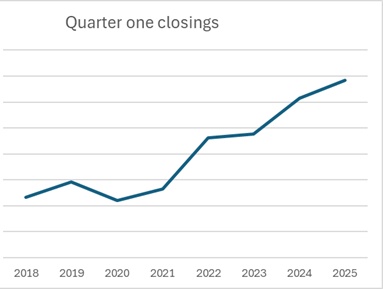

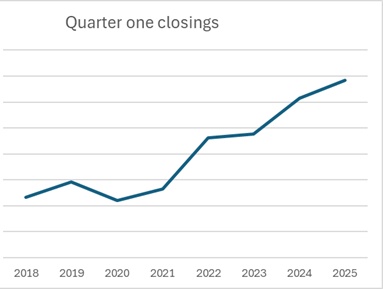

Look at the graph above, what has caused my closing to surge in 2025 while overall real estate closing volumes have plummeted? What does this mean for real estate? Don’t get me wrong, I like to think the surge in closings is because I’m an amazing lender and a great...

by Glen | Mar 10, 2025 | 2024 mortgage rates, 2025 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, credit score, Denver Hard Money, Georgia hard money

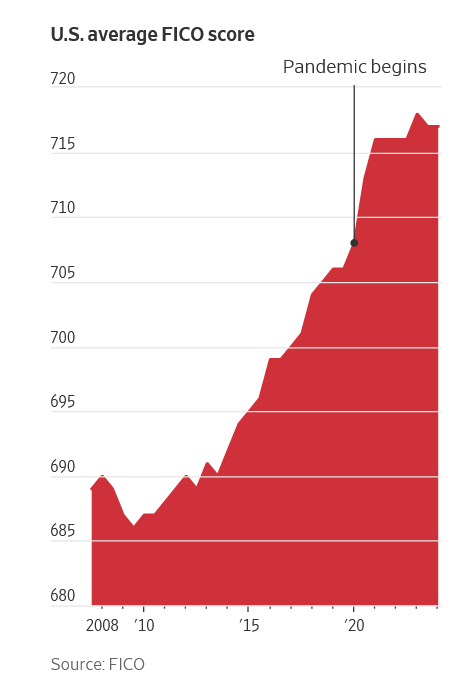

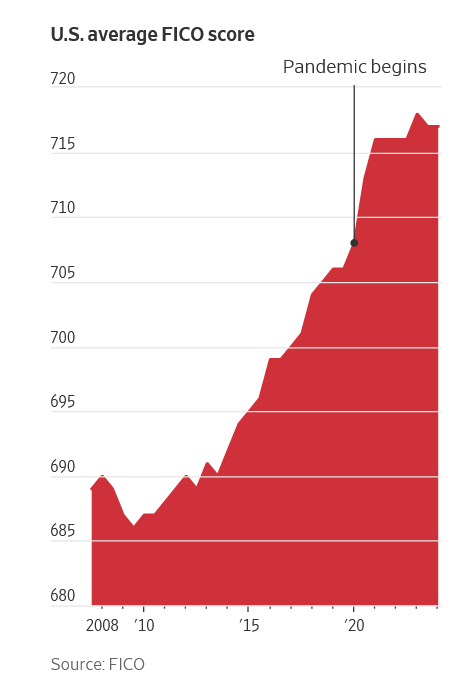

Wow, look at the huge increases in credit scores over the last 15 years. This has occurred even as student debt, auto debt, and credit card debt have all surged. Has the US all the sudden become much more credit worthy or has something else changed? What does this...