by Glen | Jun 6, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, Government Bailout, hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

One of the world’s bubbliest real estate housing markets is tilting from sellers to buyers with dizzying speed. Canadian home prices fell for the first time in two years as a rapid rise in interest rates looks set to threaten one of the world’s hottest housing...

by Glen | May 30, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Atlanta Hard Money, CO hard money, Colorado Hard Money, Commercial Lending valuation, commercial private lending, commercial property trends, coronavirus 2021 real estate impacts, Denver Hard Money, Denver private Lending, Hard Money Lending, hard money loans, Housing Price Trends / Information

ATTOM’s just released January 2022 U.S. Foreclosure Market Report shows there were a total of 23,204 U.S. properties with foreclosure filings reported in January 2022. That figure is up 29 percent from December 2021 and 139 percent from January 2021. Will we see a...

by Glen | May 23, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Atlanta Hard Money, Atlanta real estate trends, CO hard money, Colorado Hard Money, commercial private lending, commercial property trends, Denver Hard Money, General real estate financing information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates, Private Lending

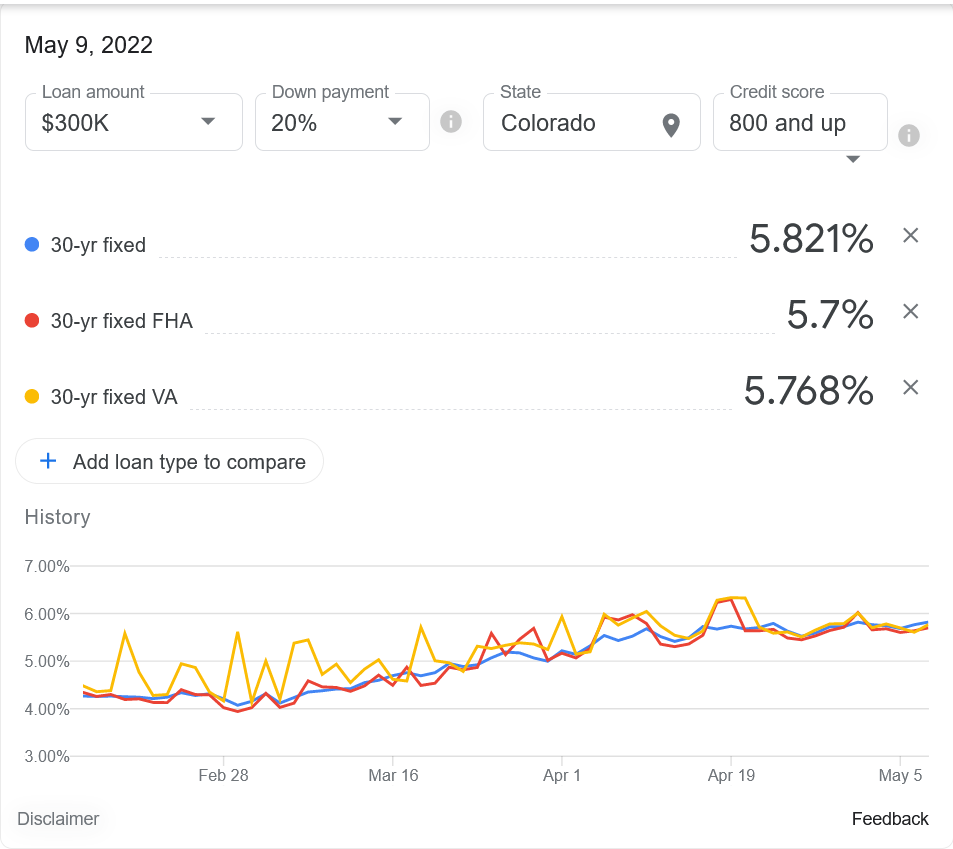

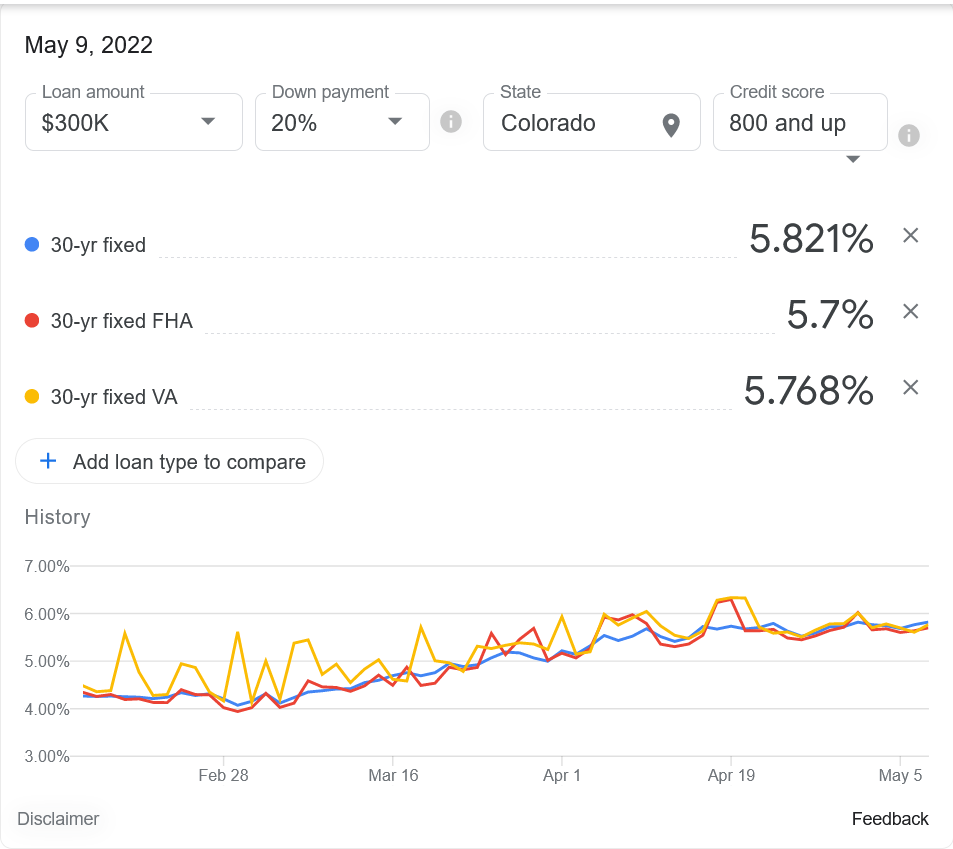

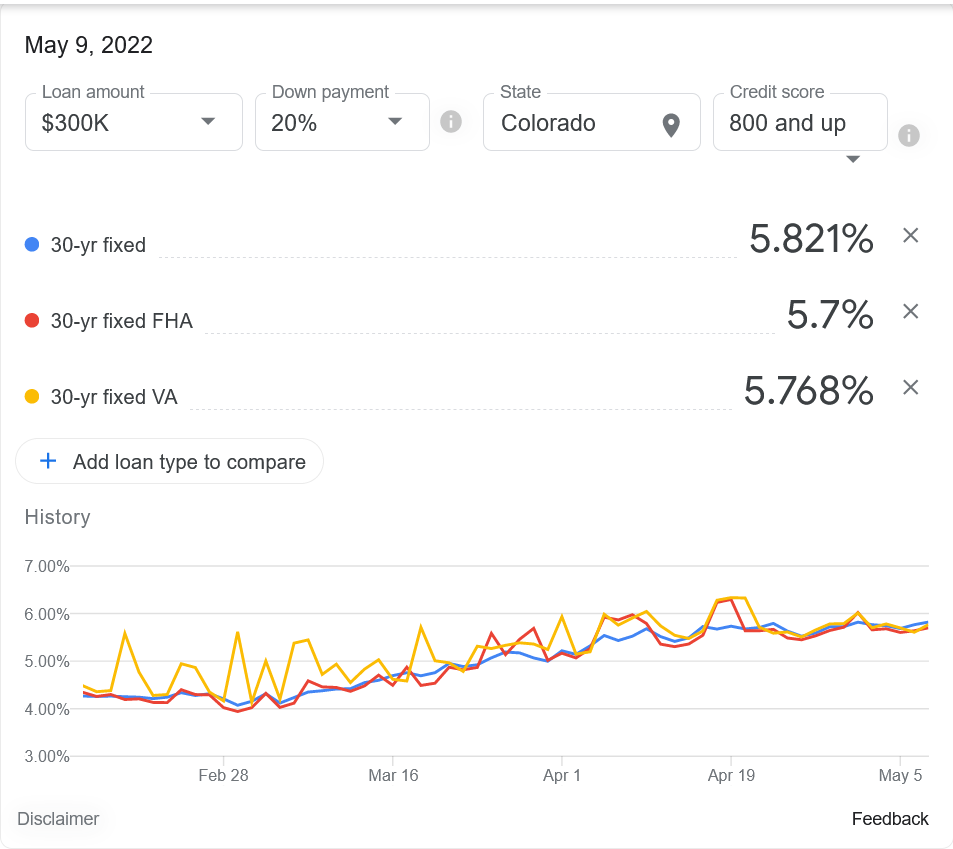

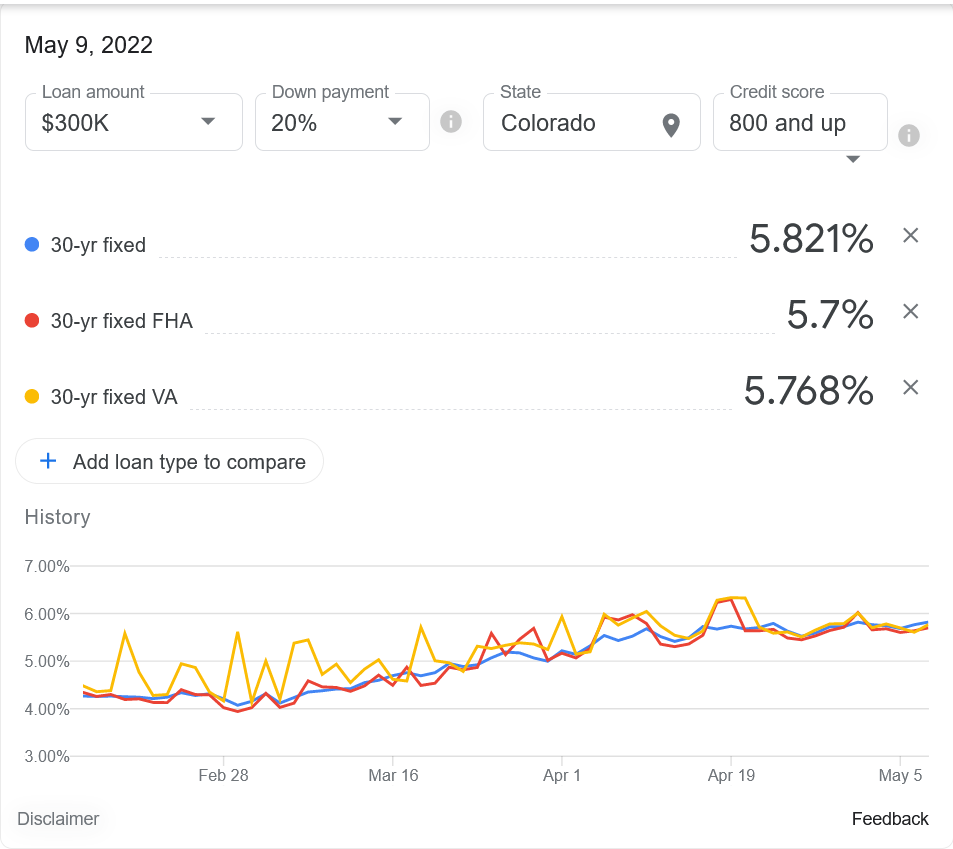

Where mortgage rates are heading seems to be the biggest question on everyone’s mind in real estate. As of this writing rates were around 5.821% which is substantially higher than any economists had predicted even a few months ago. What is causing the jump in...

by Glen | May 2, 2022 | 2022 real estate predictions, Atlanta real estate trends, Colorado Hard Money, Colorado ski real estate, commercial property trends, Denver Hard Money, General real estate financing information, Hard Money in the News, Hard Money Lending, hard money loans, Housing Price Trends / Information

As mortgage rates have easily breached 5% (last I checked they were at 5.25%), there is a drastic change in real estate that is just beginning to rear its head. At the same time inventory is starting to increase and loan volumes have plummeted. What is the big...

by Glen | Apr 25, 2022 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado ski real estate, Denver Hard Money, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation, Underwriting/Valuation, what happens to real estate in a correction

The average time someone spends in a home has increased from 8.7 years in 2010 to over 13 years in 2020; a whopping 50% increase. How is this impacting house prices? What caused the “break” in the game of musical chairs leading to the inventory shortage? How are...

by Glen | Apr 18, 2022 | 2022 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Denver Hard Money, Denver private Lending, General real estate financing information, Government Bailout, hard money, Housing Price Trends / Information, interest rates, mortgage rates, Other Questions, Private Lending

The federal housing finance agency (FHFA), the largest buyer of mortgages through Fannie Mae and Freddie Mac (Fannie/Freddie), announced huge changes to there fee structure. In particular they are targeting high cost loans with big jumps for second...