by Glen | Feb 27, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, commercial hard money, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, Private Lending, real estate investing, real estate taxes, Real Estate Trends, Real estate Valuation, recession impact on real estate, Residential hard money

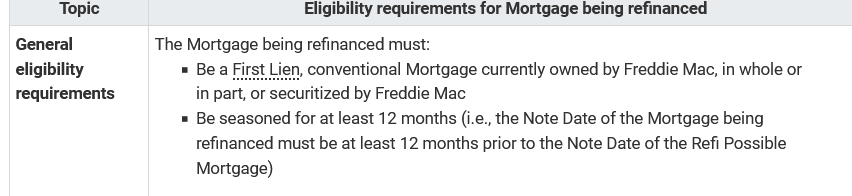

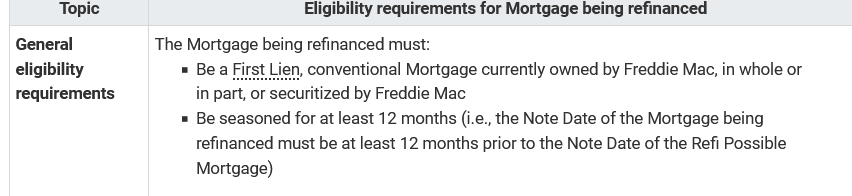

Beginning in March of 2023, Freddie Mac, the largest buyer of mortgages is drastically changing the seasoning requirements for any loans it purchases which basically means any new conventional conforming loan will have to follow the new rules. What big changes are...

by Glen | Feb 20, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks

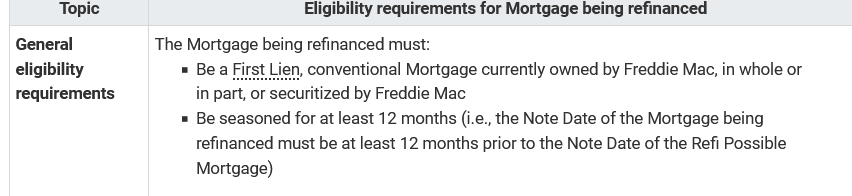

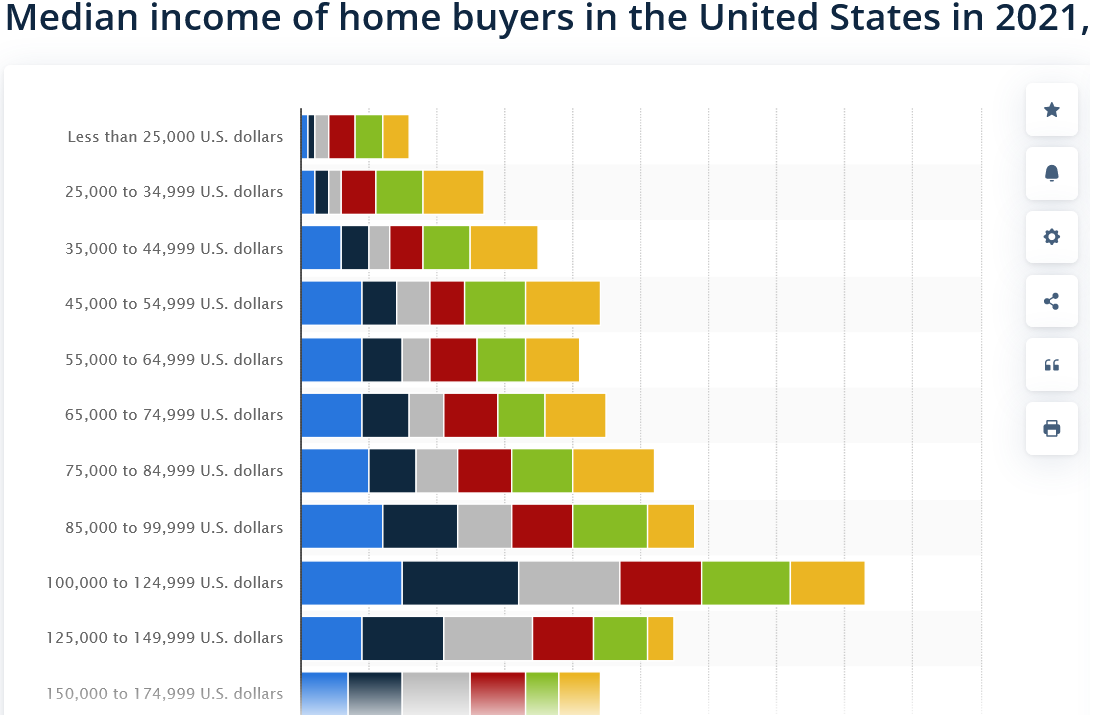

Purchasing power from paychecks fell 2.9% for middle-income households in 2022 compared with 2021, while rising 1.5% for the bottom fifth of households and 1.1% for the top, according to the Congressional Budget Office study. Furthermore, nearly 40 percent of...

by Glen | Feb 13, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates

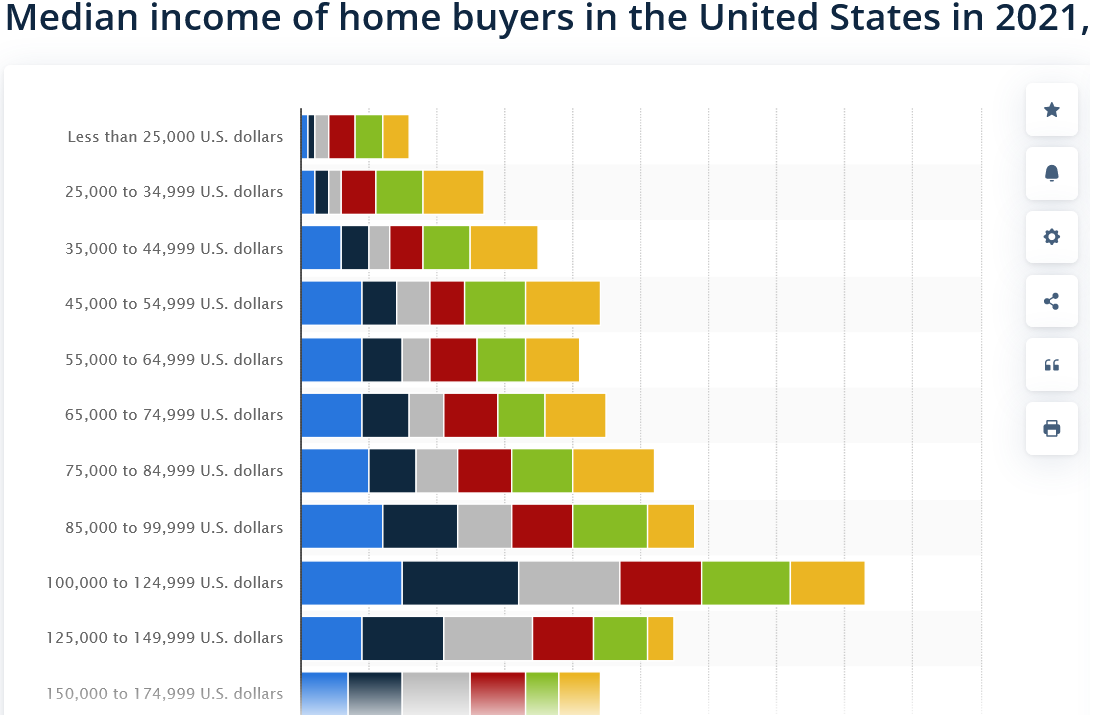

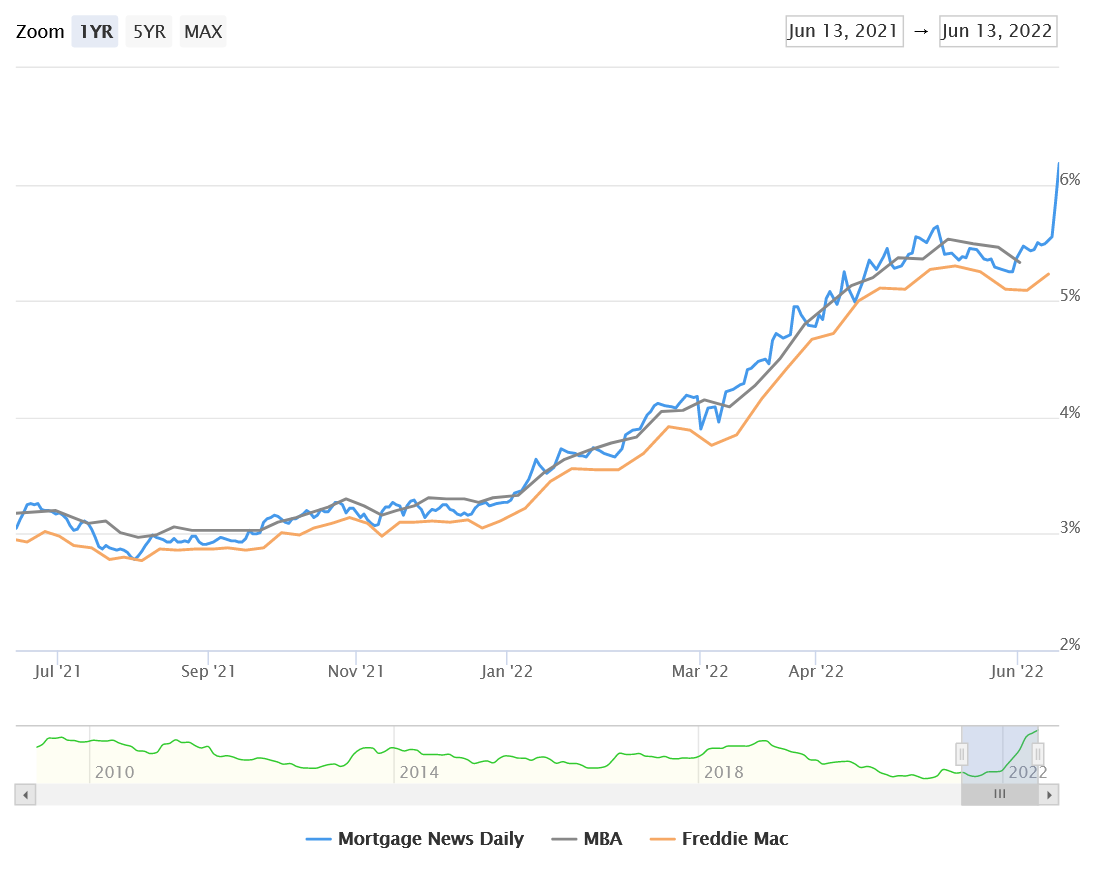

The market currently has a fixation on interest rates. Essentially whatever interest rates do the market reacts accordingly. For example if rates rise, sales fall and vice versa. Are rates really the driver of the slow down in real estate sales? If rates...

by Glen | Feb 6, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Colorado Hard Money, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Georgia hard money, Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates

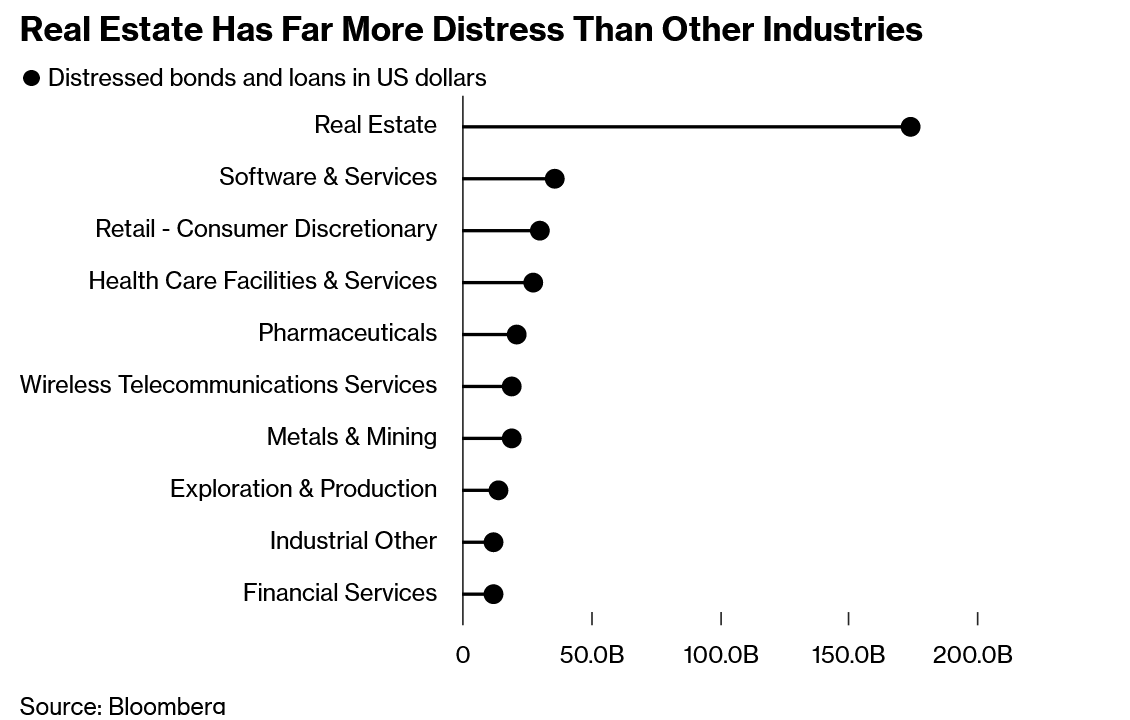

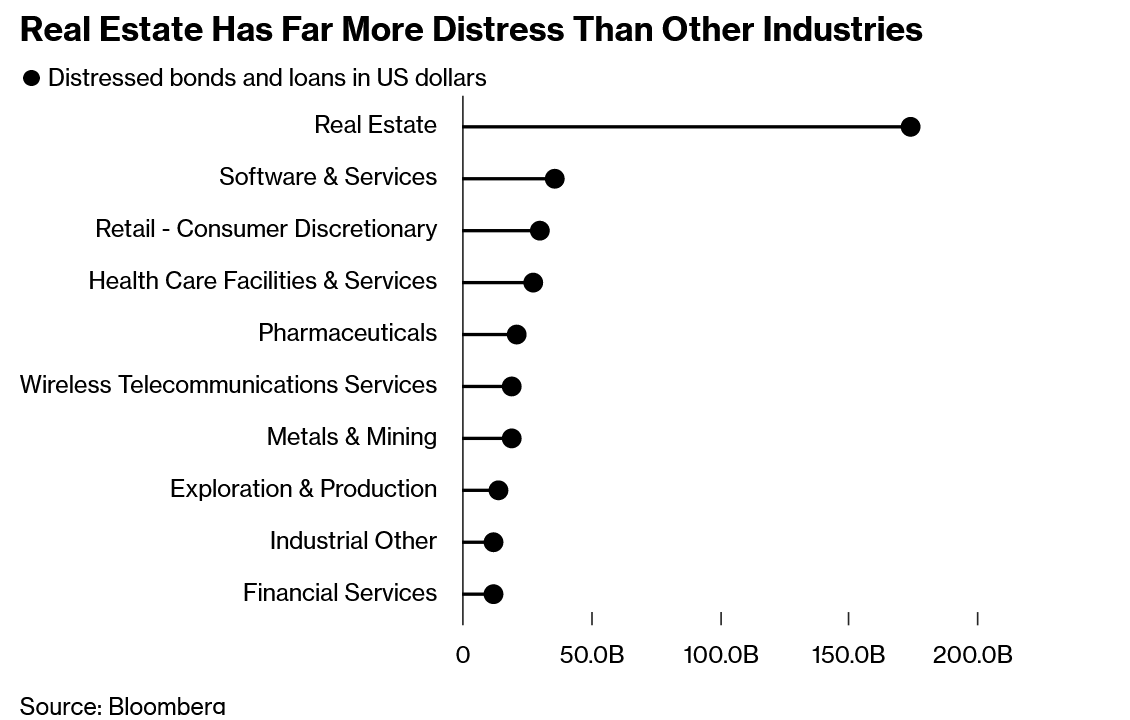

I rarely say that Covid caused radical changes in behavior but the commercial property sector is bucking this trend. This is not because of return to office or lack thereof, but leverage and the central bank. In every cycle in recent memory as the economy started to...

by Glen | Jan 30, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Government Bailout, Housing Price Trends / Information, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, rent control

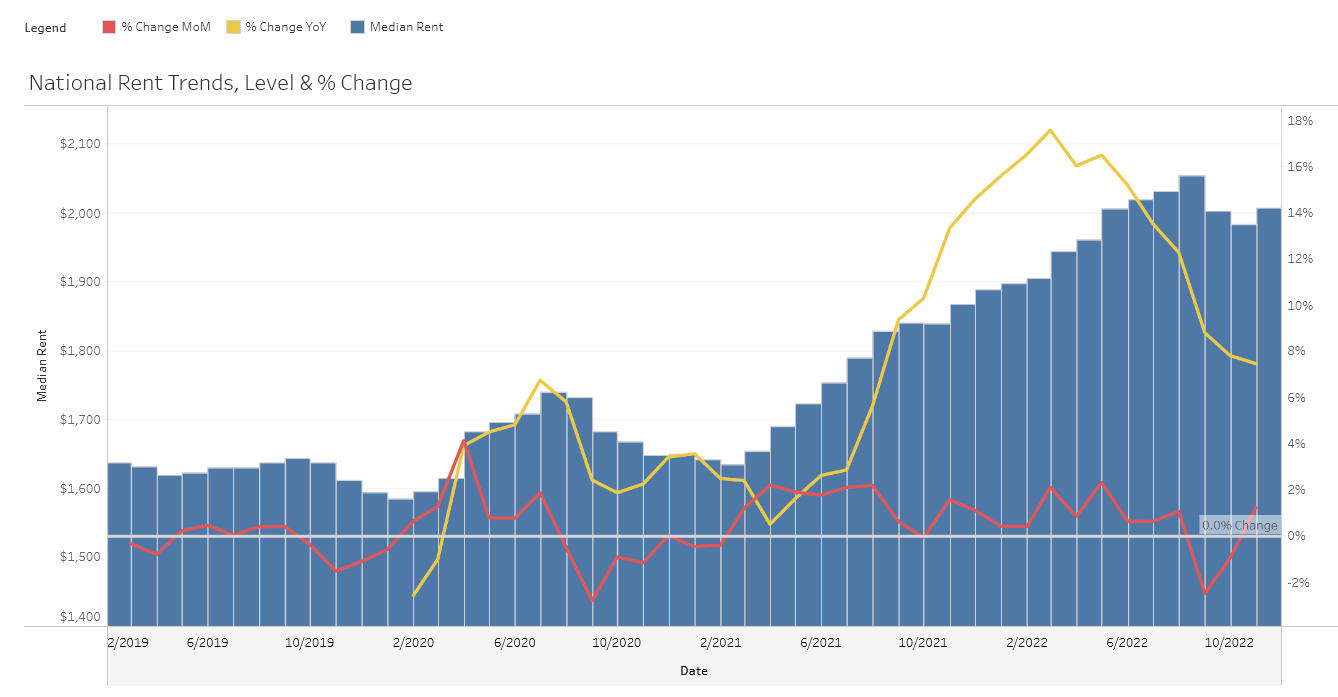

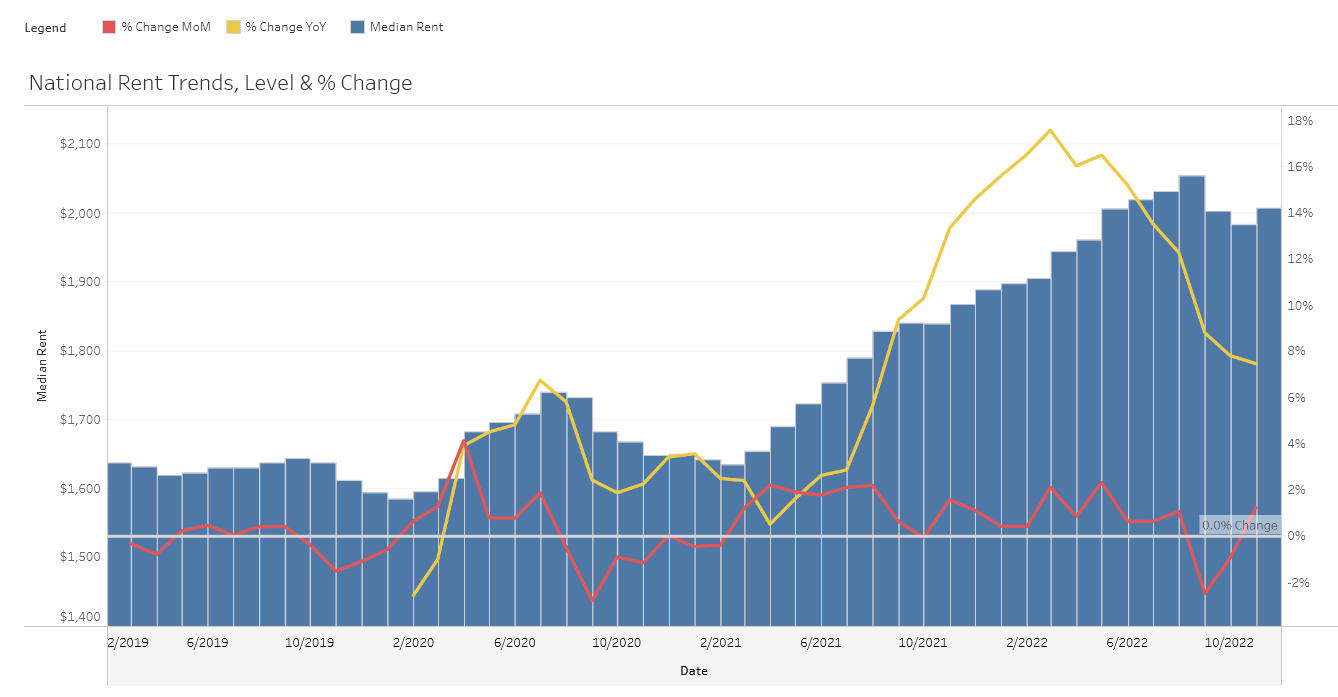

It is no secret that rent has skyrocketed throughout the country. Nationally rental growth peaked at 17.45% year over year in March of 2022. Some markets like NY and FL have exceeded over 31% rent growth annually. What are the three causes of huge jumps in rents?...

by Glen | Jan 23, 2023 | 2023 real estate predictions, Colorado Hard Money, Colorado private lender, real estate investing, Real Estate Trends, Realtor

I’m usually skeptical that lawsuits will totally alter an industry but the recent suit against the National Association of realtors, various multiple listing services, and many large real estate brokerages could be a bombshell. The U.S. Supreme Court on Monday...