by Glen | Apr 10, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, commercial property trends, Denver Hard Money, Georgia hard money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, if there is a recession what happens to real estate

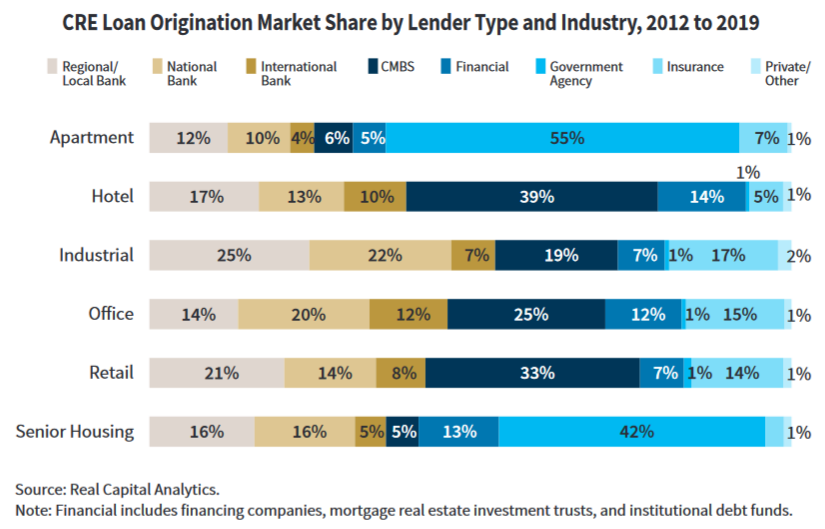

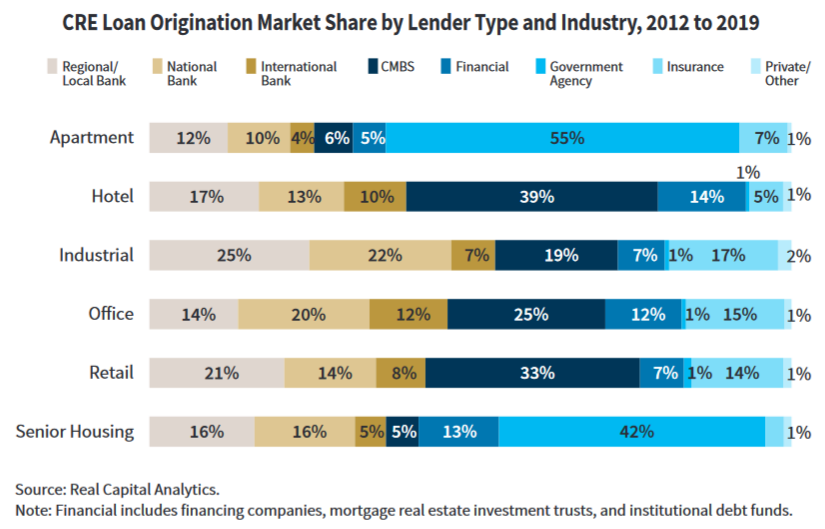

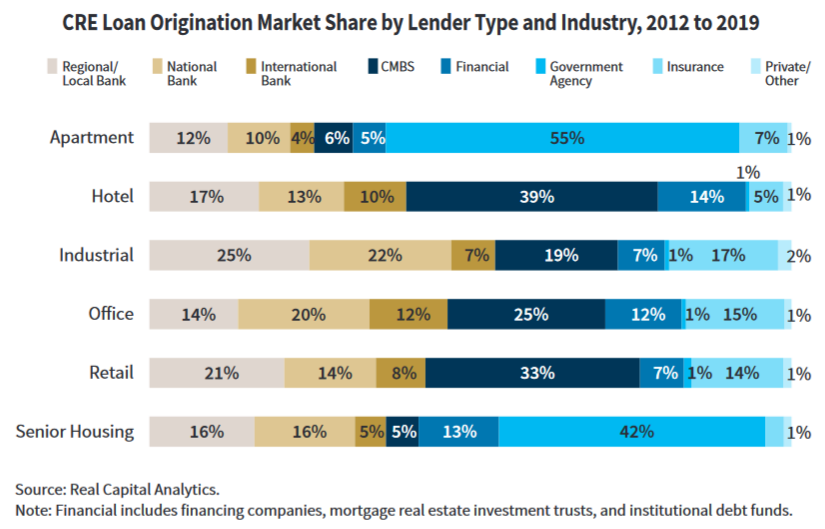

As the banking crisis unfolds, the media continues to focus on depositors and shareholders. Although both are important, there is an even bigger issue that is not being discussed. According to the FDIC, community banks made 67% of all commercial real estate loans in...

by Glen | Apr 3, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, credit scoring, Denver Hard Money, General real estate financing information, Georgia hard money

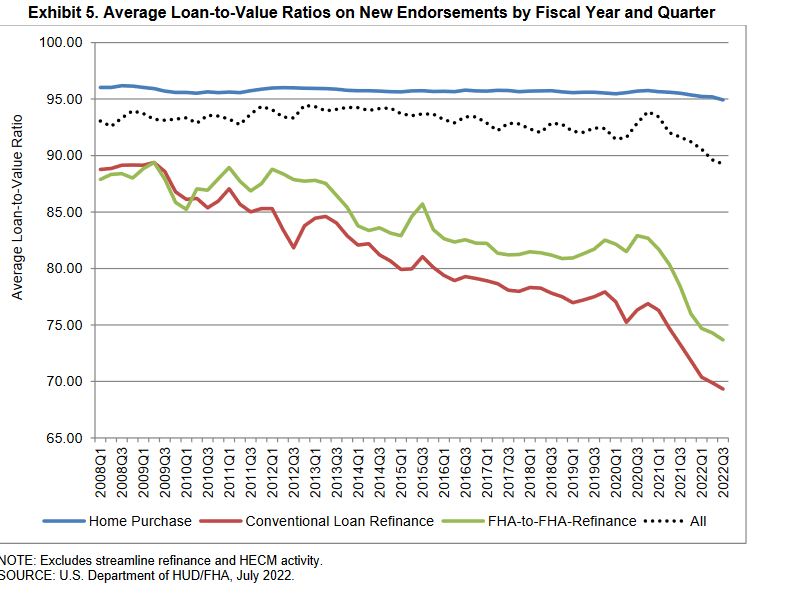

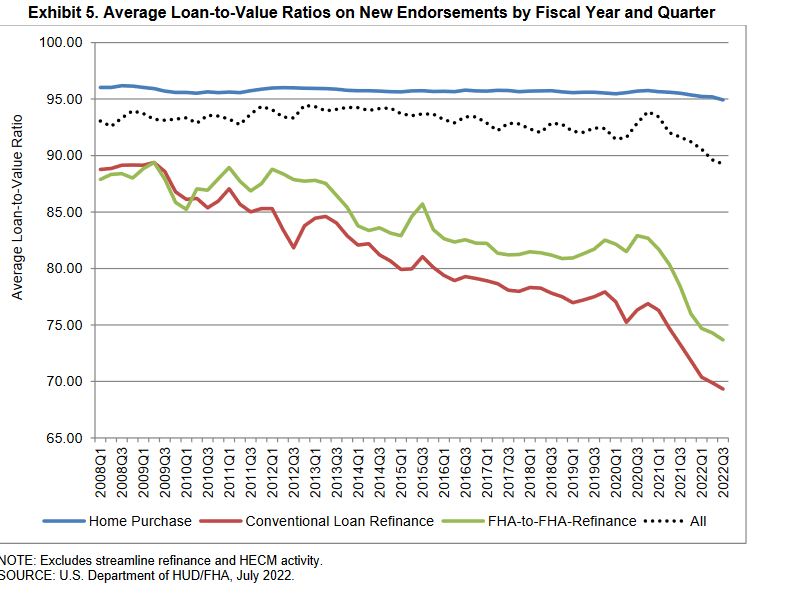

Last week, the president announced an action that will save homebuyers and homeowners with new FHA-insured mortgages $1500 per year (assuming a 500k home), lowering housing costs for an estimated 850,000 home buyers and homeowners in 2023. On the surface, the change...

by Glen | Mar 27, 2023 | Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, if there is a recession what happens to real estate, interest rates, mortgage rates

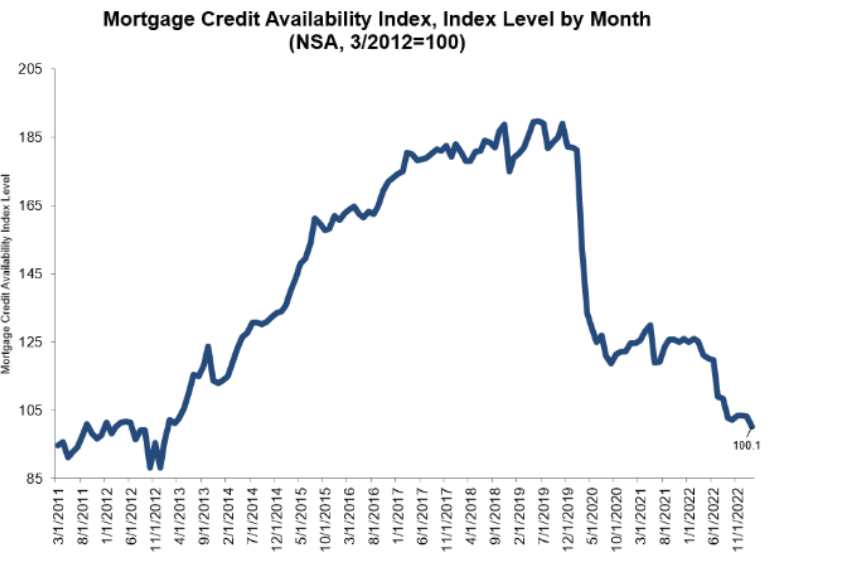

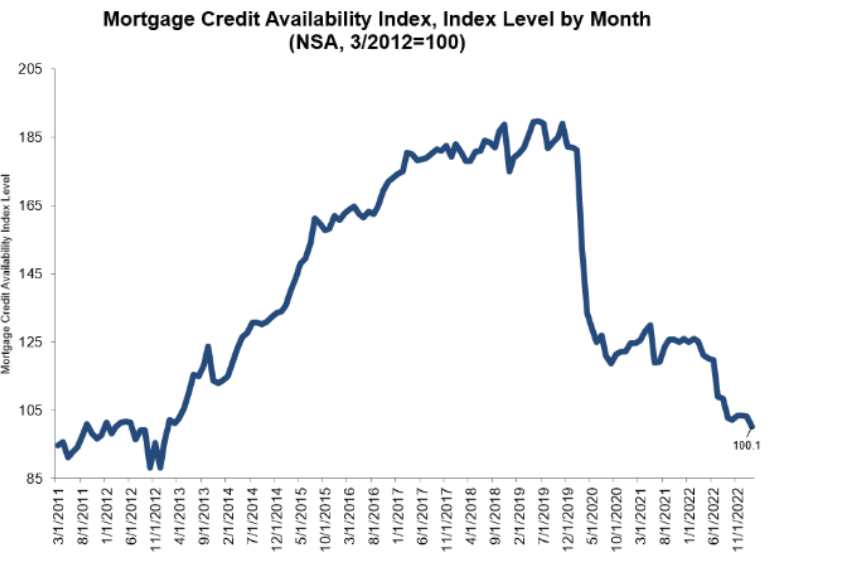

As a private lender, my call volume and closings the first quarter have been off the charts as borrowers fall out of more conventional products. This trend is now playing out with the Mortgage Credit Availability Index showing substantial tightening of credit for all...

by Glen | Mar 20, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, if there is a recession what happens to real estate, interest rates, mortgage rates, private lender, Private Lending

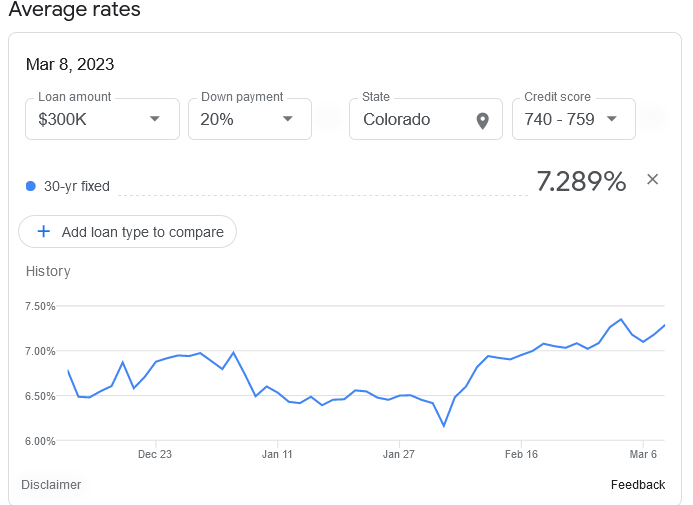

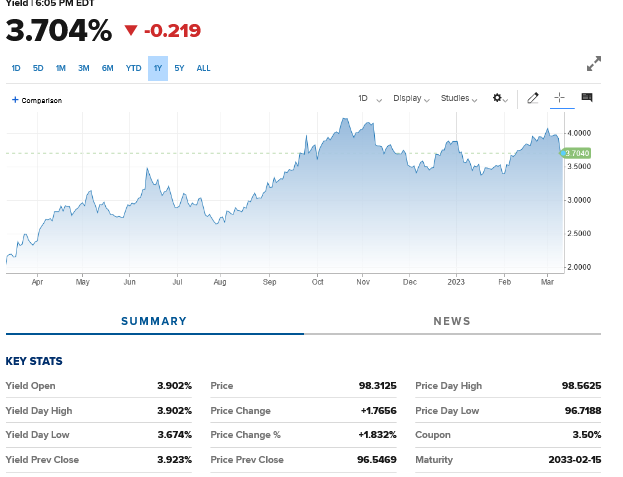

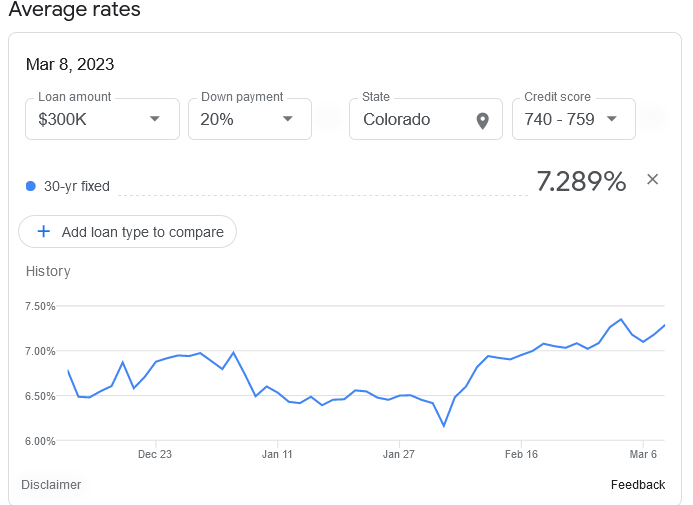

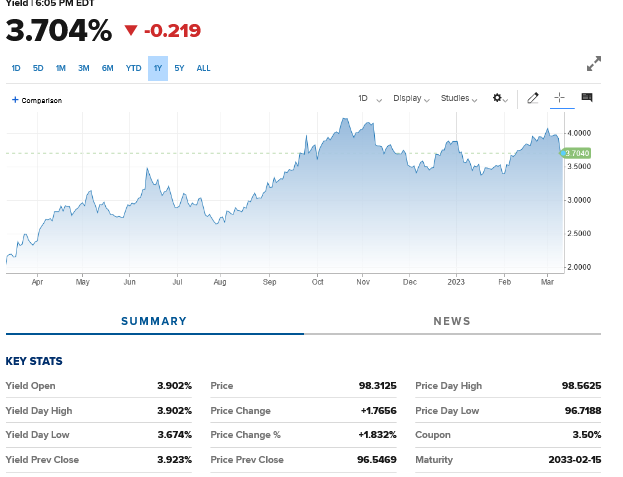

Wow, a few weeks ago rates had fallen from a peak of over 7% to almost 6%. Unfortunately the party was short lived as rates are now heading much higher. The recent jobs report was another blow out upping the odds of another half point increase at the next Fed...

by Glen | Mar 13, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, Hard Money Lending, Housing Price Trends / Information

Over 48 hours two banks failed for very different reasons. There is a saying in banking that when rates rise and easy money runs out, we will find the skeletons that have been lurking in plain sight. Are we in for a 2008 rerun? What caused the sudden...

by Glen | Mar 6, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation, Realtor, recession, recession impact on real estate

In only a couple of months, the world has changed substantially. In December, inflation was supposedly decreasing rapidly and the odds of a soft landing were non existent. Fast forward a few months and inflation is running hot, consumers are spending like crazy,...