by Glen | Feb 19, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Commercial Lending valuation, Commercial Loan Servicing, commercial property trends, Consumer price index and inflation, Denver Hard Money, Denver private Lending, Hard Money Commercial Lending, Hard Money Lending, hard money loans

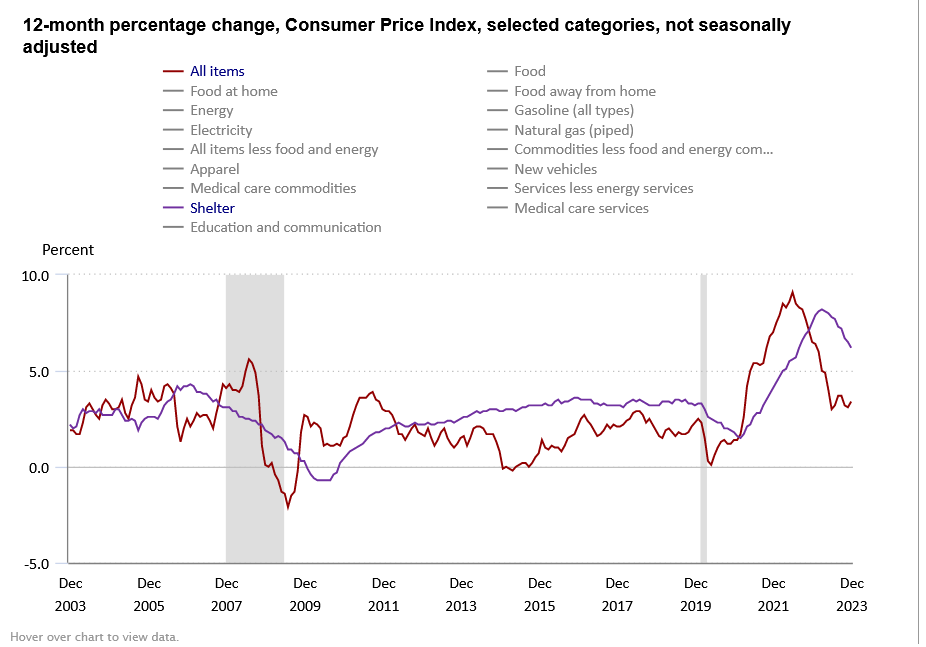

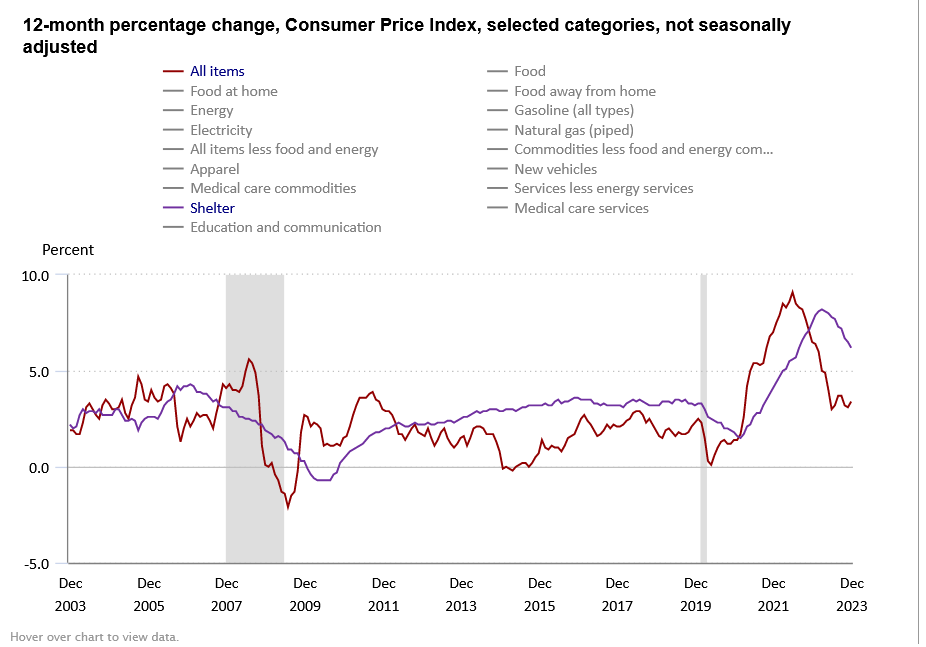

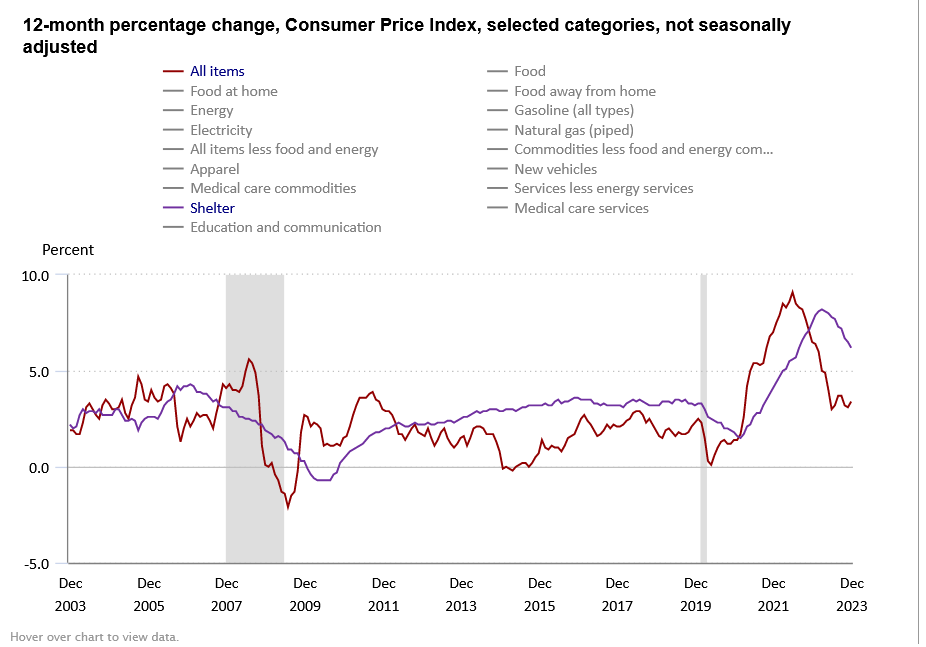

We have heard a ton of good news recently regarding inflation. Inflation has come down dramatically from its peak and the market is pricing in almost a 100% probability of an elusive soft landing. Is inflation really coming down as fast as the consumer price index...

by Glen | Feb 12, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money

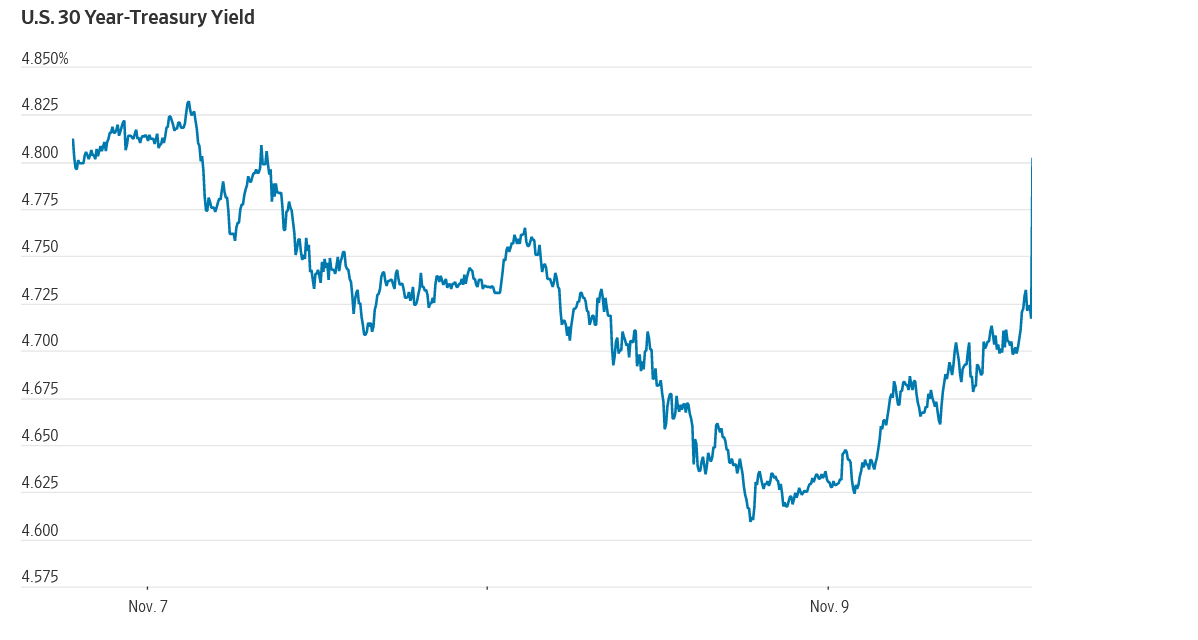

Soft Landing base case, impact on real estate Every realtor newsletter I have received predicts an increase in sales and a great real estate market is 2024 due to lower mortgage rates. Will this come to fruition? Will we have a “soft landing” in 2024 and which will...

by Glen | Jan 29, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Hard Money Lending, Housing Price Trends / Information

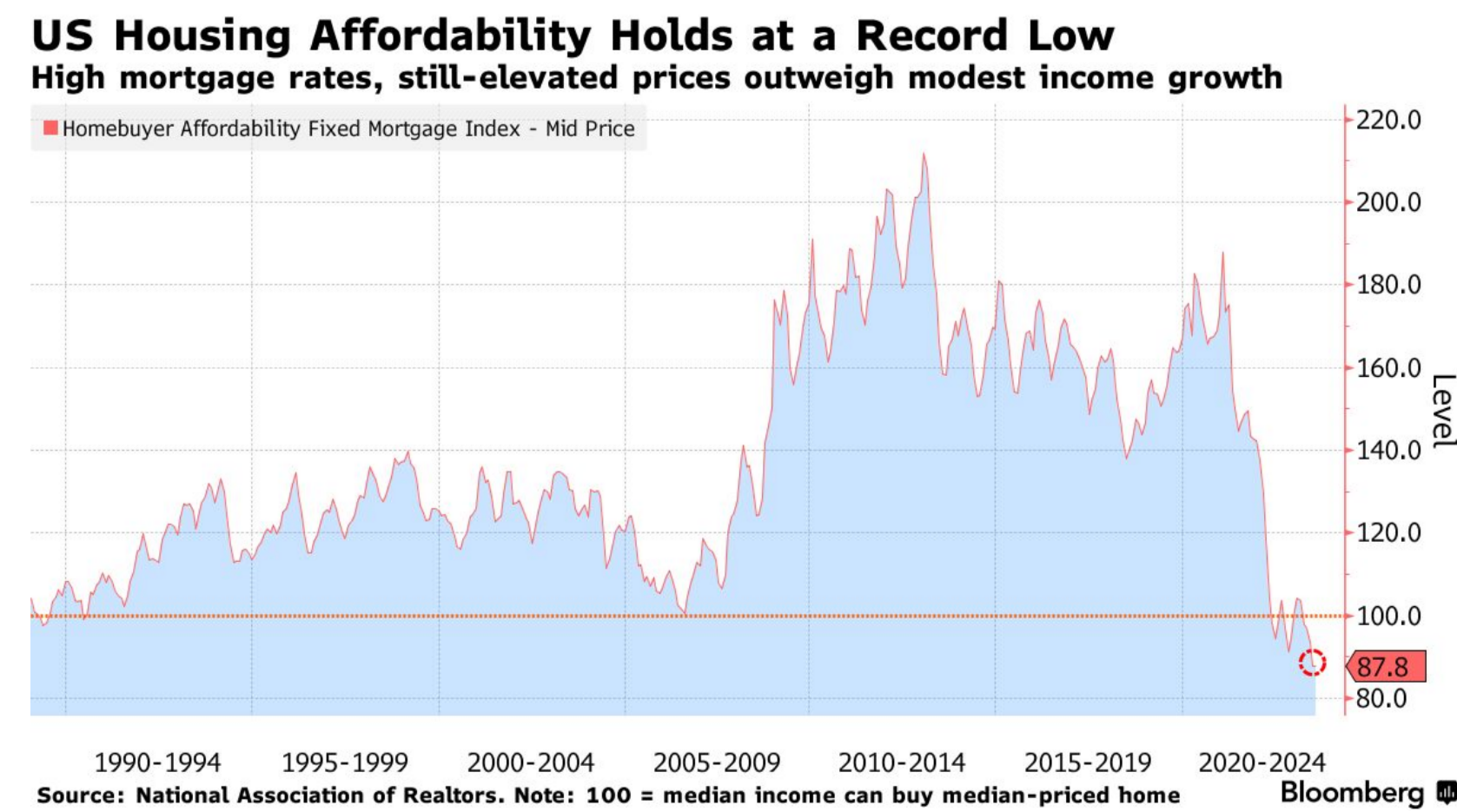

Anytime you turn on the news you hear about high house prices and that the culprit is that supply has not kept up with demand. Is supply really the main culprit of housing prices or did something else that occurred during Covid radically alter the market? ...

by Glen | Jan 22, 2024 | 2024 mortgage rates, 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, Commercial Loan Servicing, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money loans, Housing Price Trends / Information

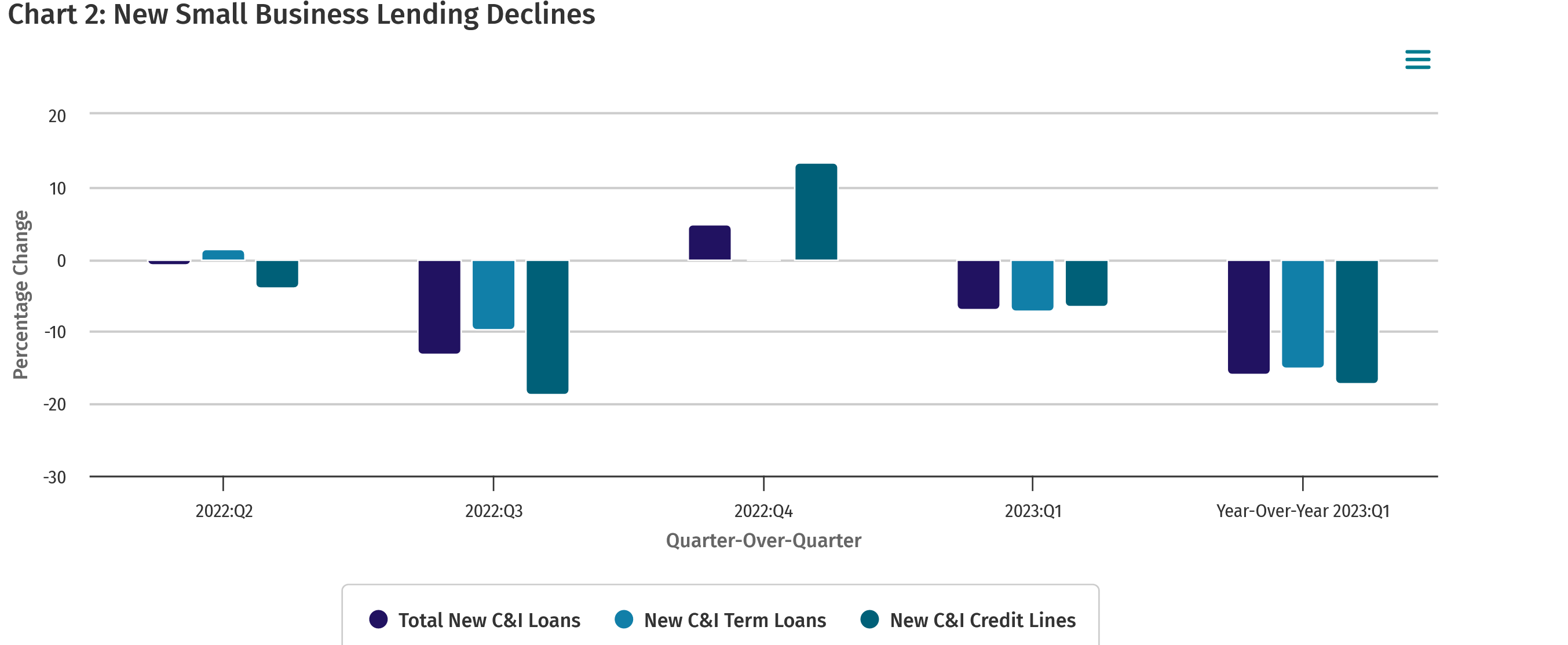

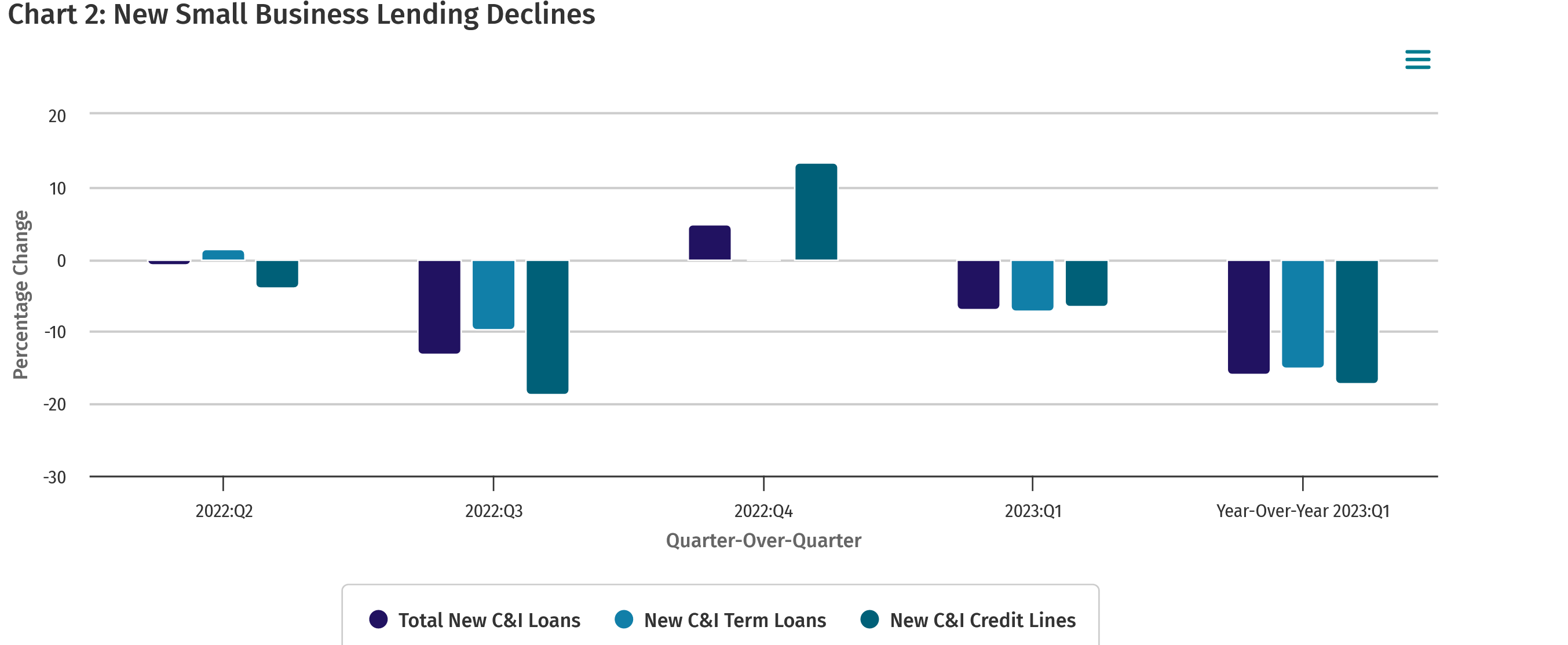

It is interesting that the market continues to focus on interest rates and employment as the barometer for the economy while totally ignoring one metric. As a lender I just did a year end analysis on our portfolio and one metric jumped off the page increasing...

by Glen | Jan 15, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, hard money, Housing Price Trends / Information

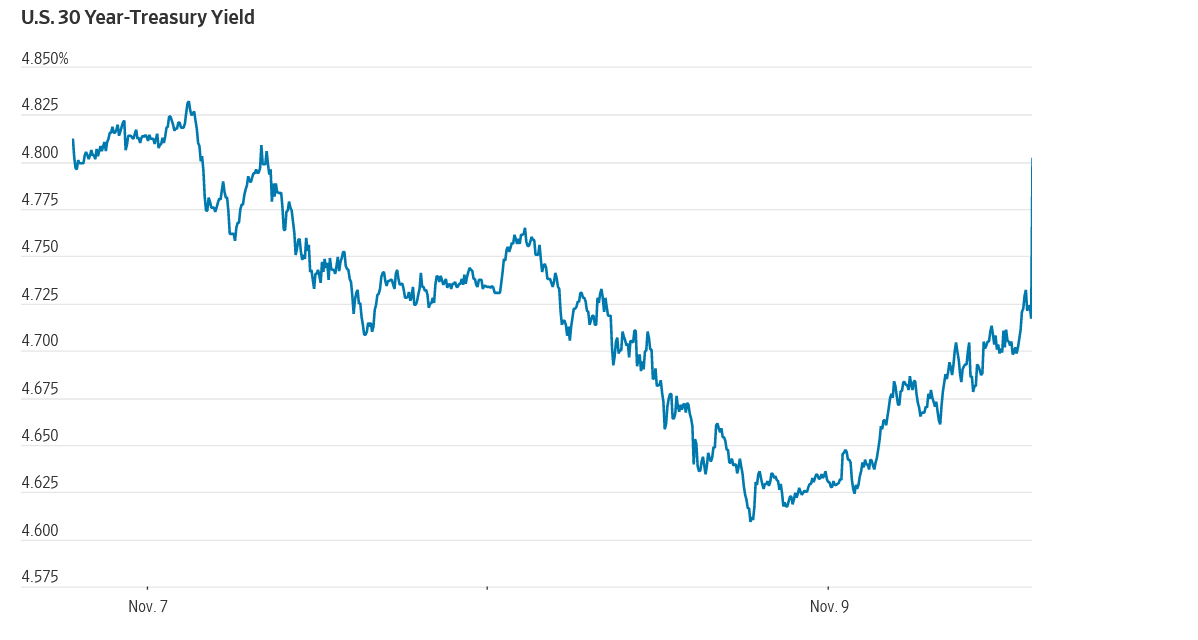

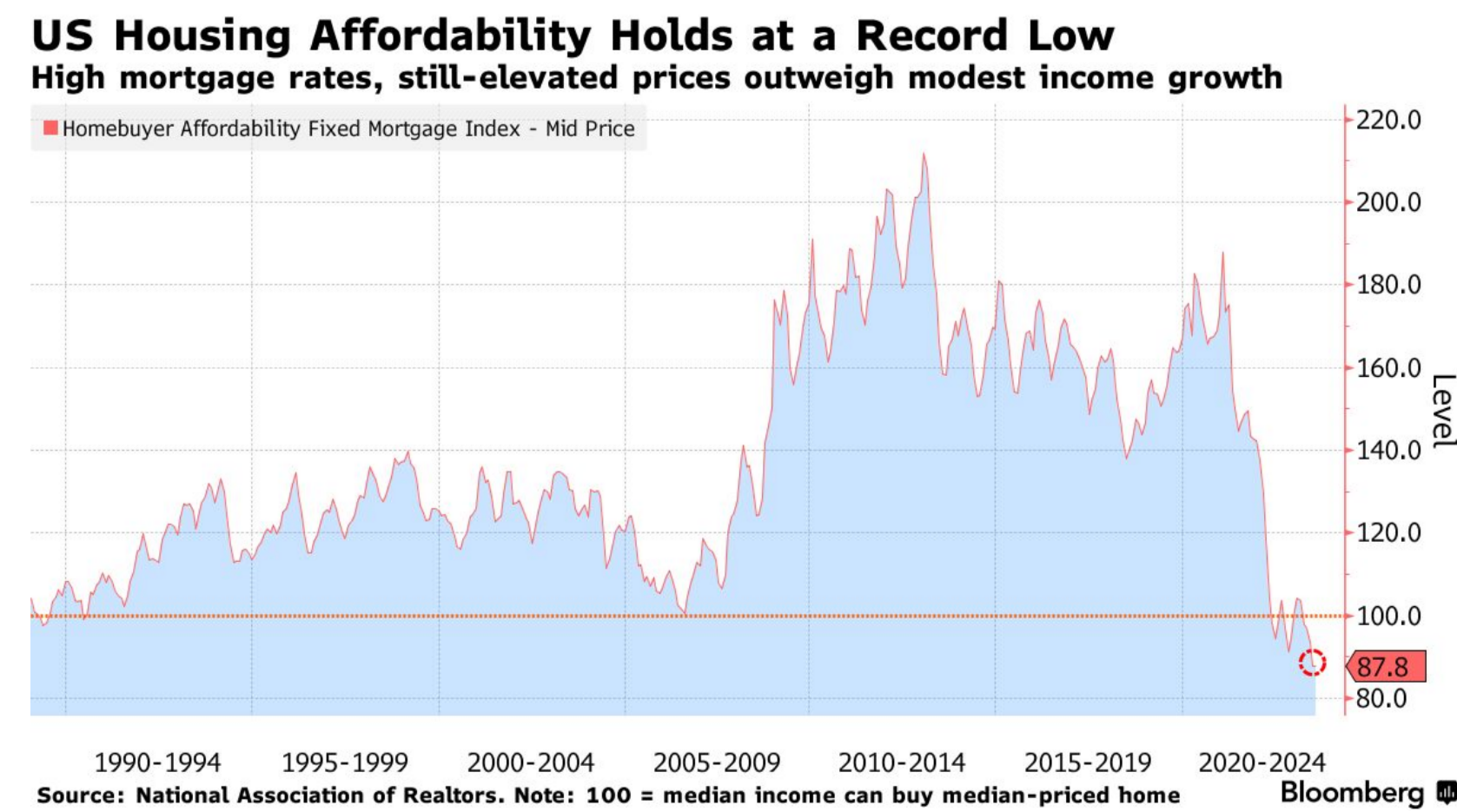

The market keeps predicting a goldilocks scenario with 100% certainty where inflation falls without much if any impact on residential real estate. The “soft landing” will occur at the same time interest rates have skyrocketed and supposedly the consumer...

by Glen | Jan 8, 2024 | 2024 real estate predictions, Atlanta Hard Money, Colorado Hard Money, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, Realtor, Realtor commision lawsuits

There has been a ton of talk regarding the lawsuits against the National Association of realtors, but from a practical perspective what does this mean for the market? Will buyer’s agent commissions be eliminated? One realtor association is not waiting for more...