by Glen | Dec 16, 2024 | 2025 mortgage rates, 2025 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, if there is a recession what happens to real estate, mortgage rates, Private Lending, real estate investing, Real Estate Trends, Real estate Valuation

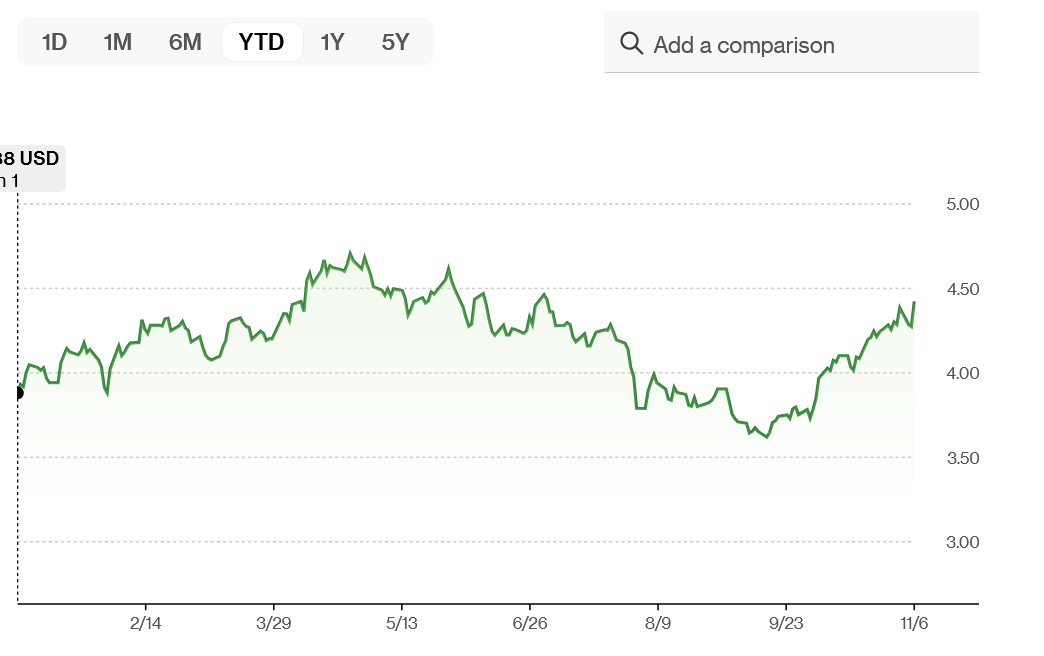

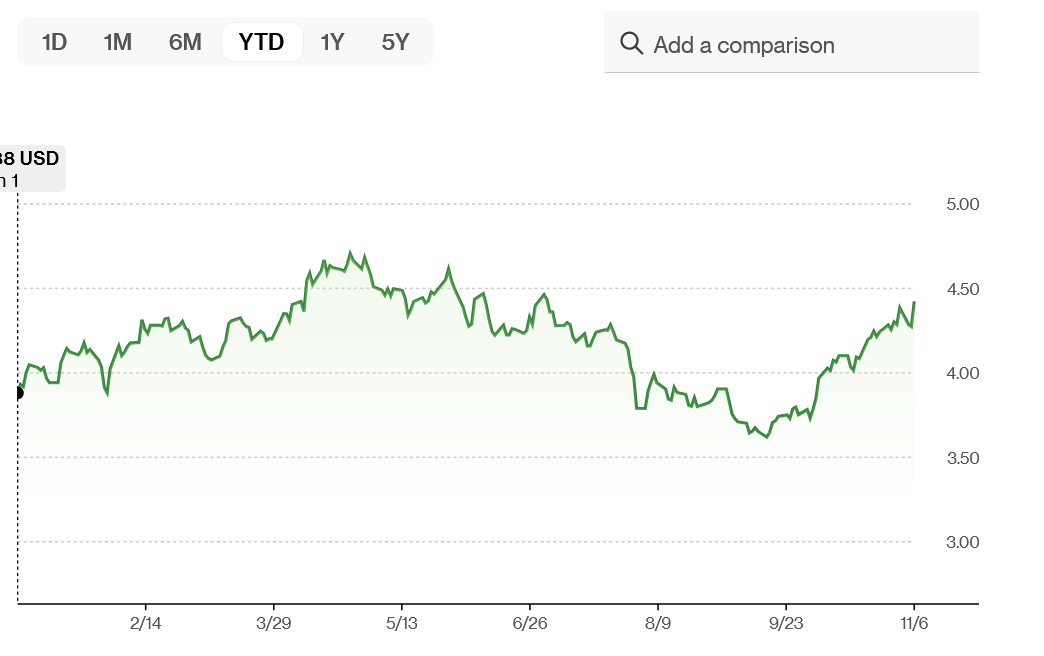

When I was writing this article mortgage rates were hovering right around 7%. At the same time economists had been predicting a sharp decline in mortgage rates and a booming 2024 real estate market as the fed has cut rates. On the other hand, the chart above...

by Glen | Nov 8, 2024 | 2024 election impact on real estate, 2024 election real estate impacts, 2024 mortgage rates, 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Lending, hard money loans

Regardless of how you voted, at the end of the day for real estate in particular, does the election of President Trump radically change the trajectory of real estate? What happens to real estate volumes? Will interest rates rise or fall? What happens to values? Why...

by Glen | Nov 4, 2024 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, hard money loans, private lender, Real estate Valuation, Residential hard money

Even with falling interest rates, inventory has quickly increased. We have gone from a supposed shortage of housing to an inventory surplus in many hot markets. Home sales in July were at the lowest recorded level. What is driving the increase in inventory? Will...

by Glen | Oct 14, 2024 | 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, General real estate financing information, Housing Price Trends / Information, Housing shortage

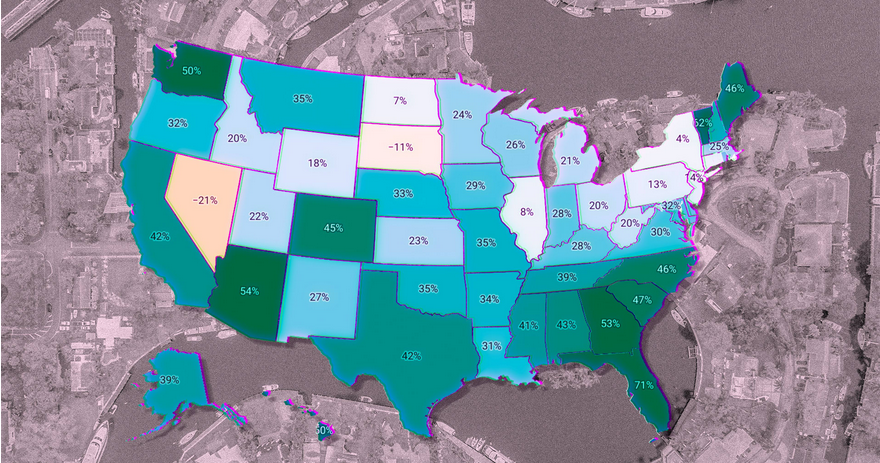

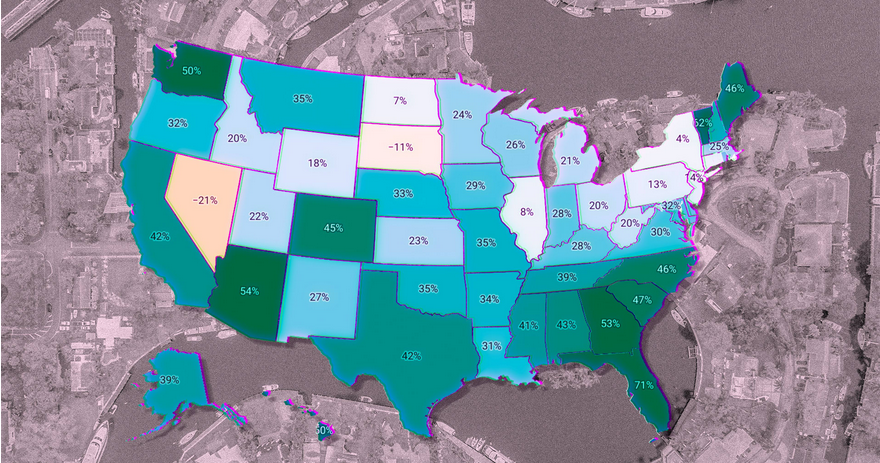

According to a new Realtor.com report, among America’s 50 biggest cities, 20 show annual price declines since last year, and the metro with the steepest drop might surprise you. What markets are dropping the fastest and why? How accurate is the data they are using? ...

by Glen | Oct 7, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Buy now Pay later impact on real estate, CO hard money, Colorado Hard Money, Denver Hard Money, Georgia hard money, Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, mortgage rates, Private Lending, Property Valuation

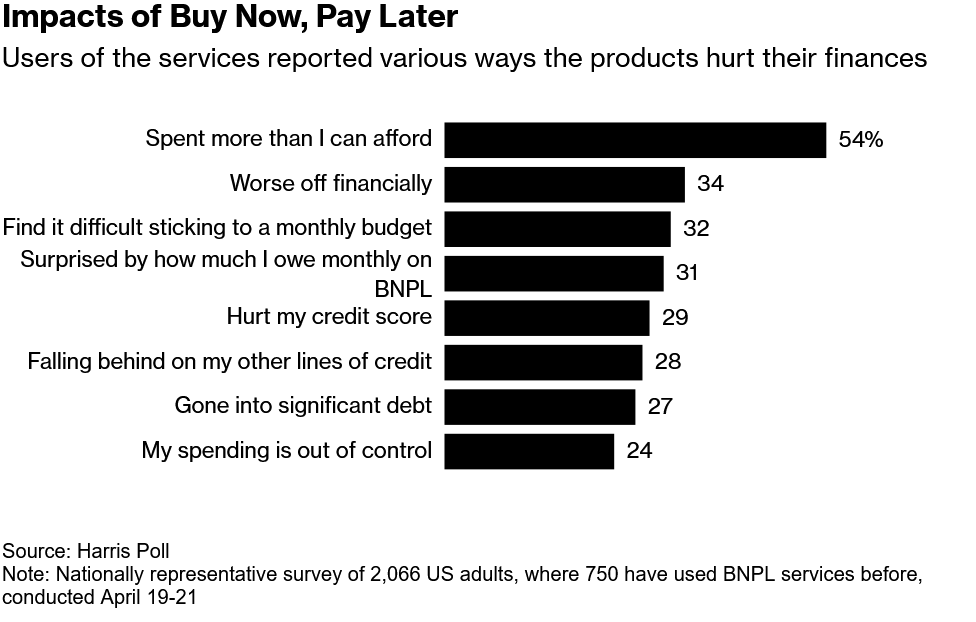

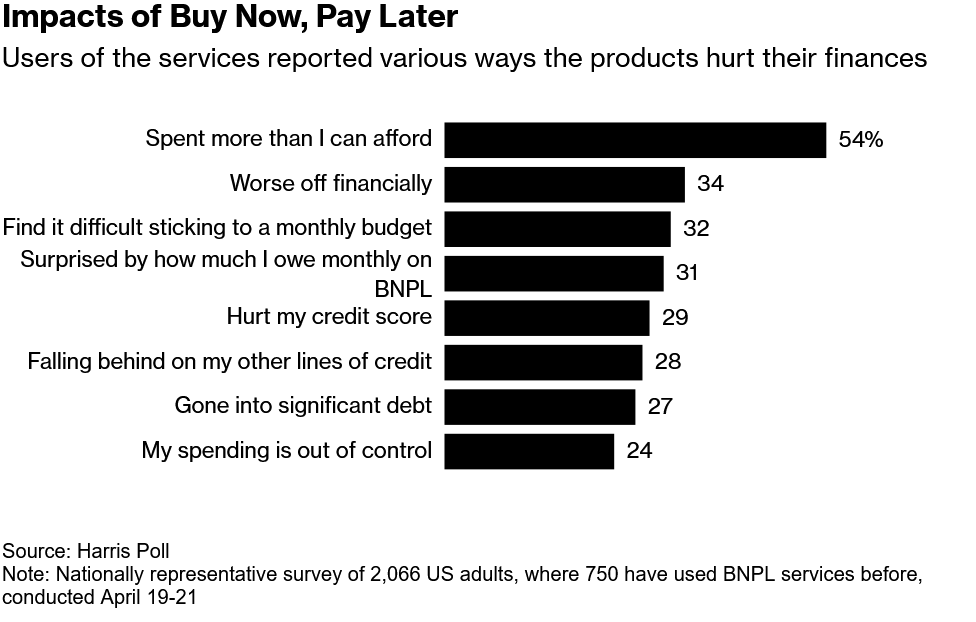

Consumer spending in the world’s largest economy has been so resilient in the face of stubbornly high inflation that economists and traders have had to repeatedly rip up their forecasts for slowing growth and interest-rate cuts. Is Phantom Debt driving consumer...

by Glen | Jul 22, 2024 | 2024 election real estate impacts, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Commercial Lending, mortgage rates, Property Valuation, Real Estate economic trends, Real Estate Trends, Real estate Valuation, recession impact on real estate

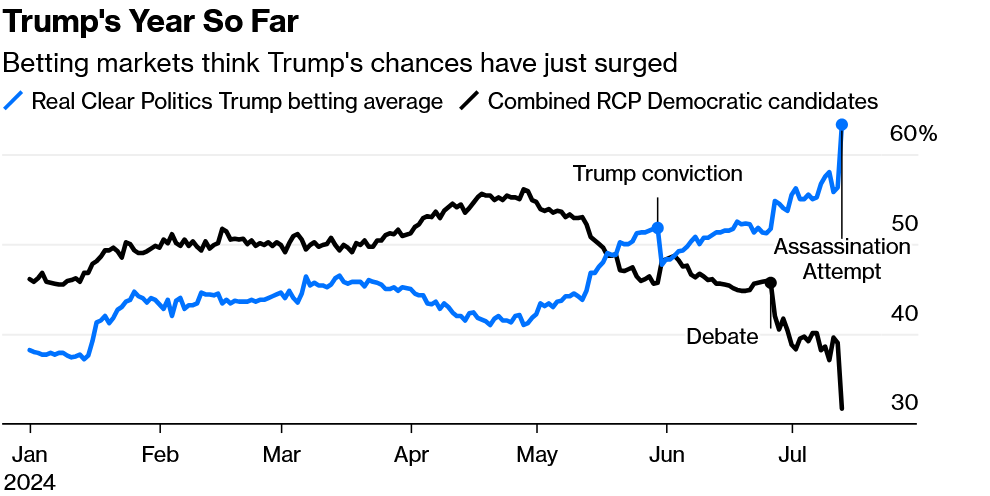

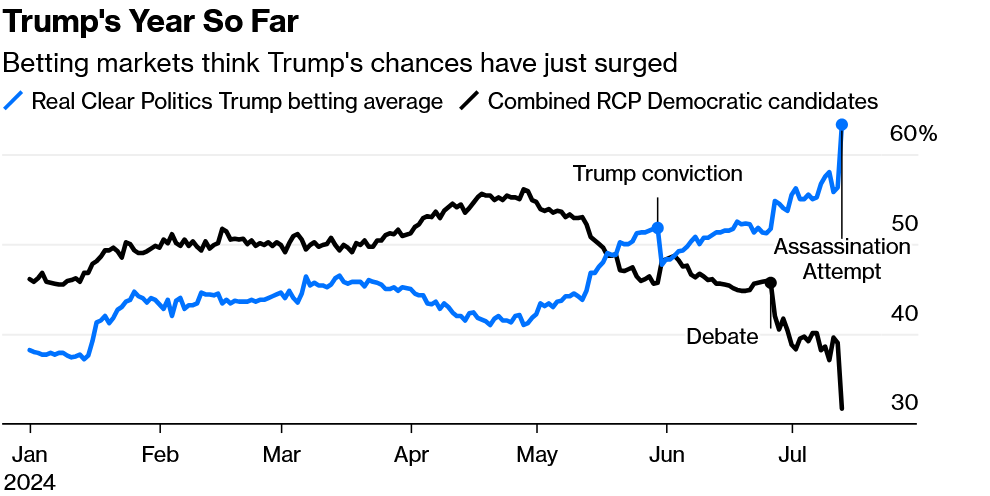

Wow, it is amazing how quickly tides have changed. Look at the chart above of the betting market on the next presidential election right after the assassination attempt. Fast forward and another twist happened over the weekend with President Biden stepping...