by Glen | Jun 19, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, hard money, Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

Interesting times we are in. Consumers keep spending big on services like travel and eating out, but on the flip side Home Depot just reported its first drop since the pandemic. On the other hand Target tops earnings estimates. What is driving the continued...

by Glen | Jun 12, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Lending

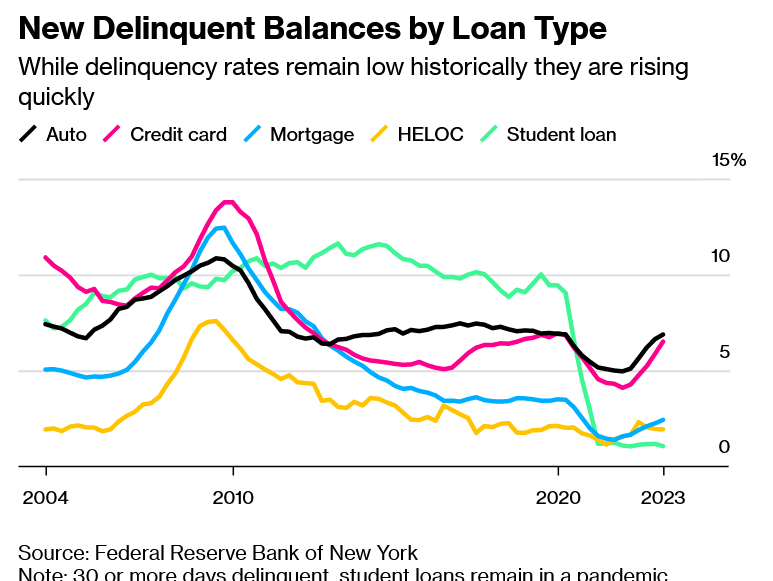

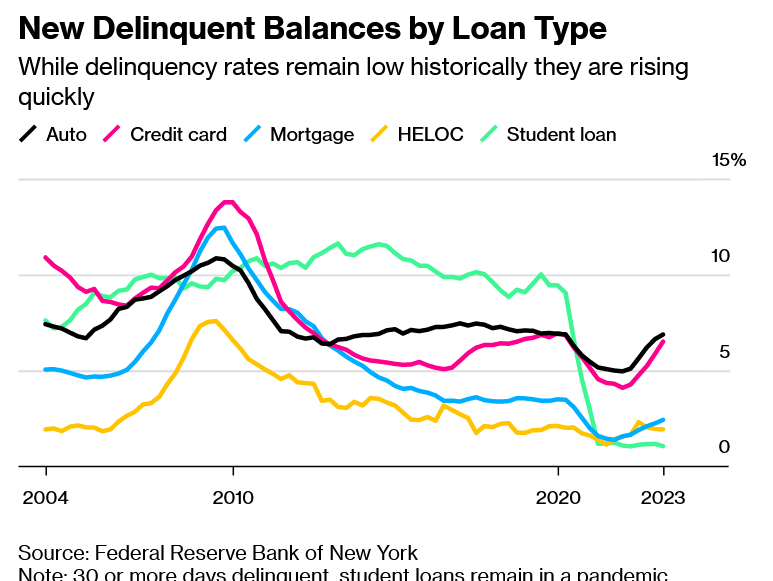

Households added $148 billion in overall debt, bringing the total to $17.05 trillion, according to a report released by the Federal Reserve Bank of New York on Monday. Balances are now $2.9 trillion higher than just before the pandemic. What categories are...

by Glen | Jun 5, 2023 | 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending

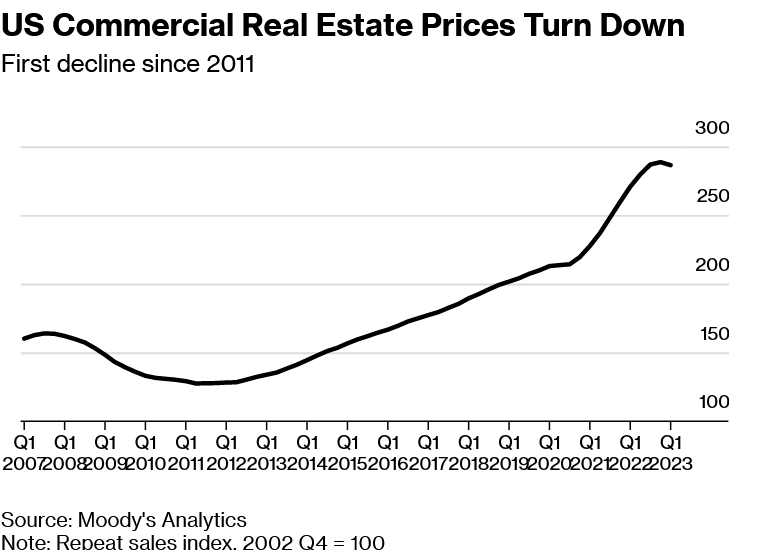

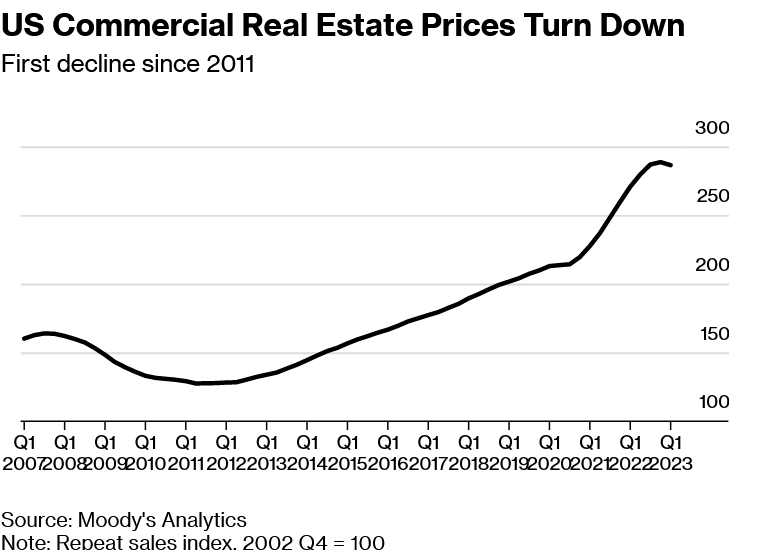

US commercial real estate prices fell in the first quarter for the first time in more than a decade, according to Moody’s Analytics, heightening the risk of more financial stress in the banking industry. What property types are declining? (hint not just office...

by Glen | May 29, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending

A lot has changed since my year end update, four major banks have collapsed, and the market is now signaling a recession with interest rates beginning to fall. What does this mean for real estate in the second half of the year? Are there any big changes to my...

by Glen | May 15, 2023 | 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, commercial property trends, Denver Hard Money, Denver private Lending, Hard Money Lending, hard money loans, Housing Price Trends / Information

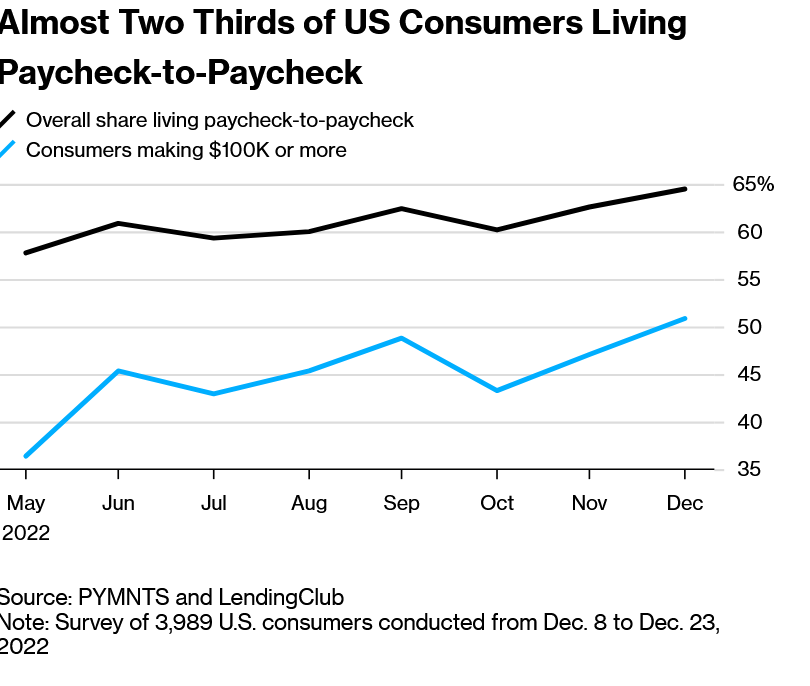

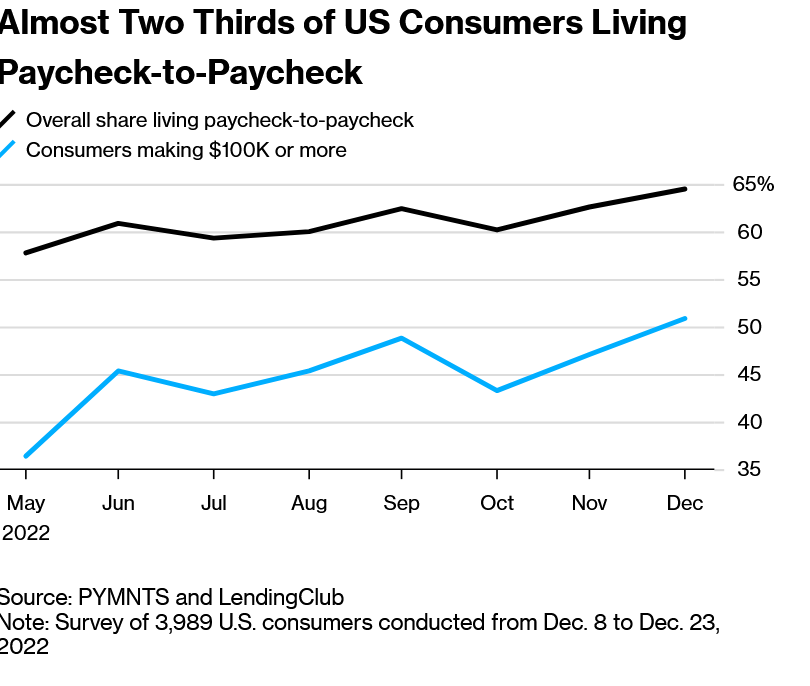

The share of Americans who say they live paycheck-to-paycheck climbed last year, and most of the new arrivals in that category were among the country’s higher earners (greater than 100k), a new study shows. Furthermore 24% had issues paying their bills in...

by Glen | May 8, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Biden tax plan, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, credit scoring, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending, interest rates, mortgage rates

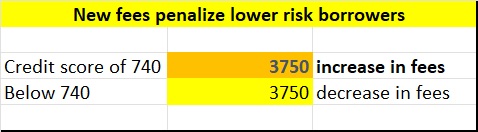

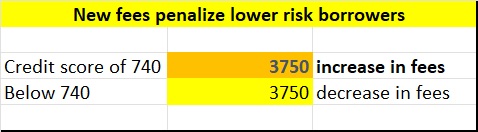

No this is not a joke, I had to read the recent Fannie Mae press release multiple times to actually believe what I was reading. Who would have ever thought that someone with a high credit score above 740 would be penalized for having a high score. Under a new rule...